Navigate The Private Credit Boom: 5 Essential Dos And Don'ts

Table of Contents

Do Your Due Diligence: Understanding Private Credit Investments

Investing in private credit requires meticulous due diligence. Before committing your capital, thorough research is paramount. This involves several key steps:

Thoroughly Research Fund Managers and Their Track Records:

- Analyze their investment strategies: Understand their approach to identifying and evaluating opportunities within the private credit space. Do they specialize in specific sectors, asset classes (e.g., direct lending, mezzanine financing), or geographies?

- Scrutinize historical performance: Examine their past performance data, focusing on both returns and risk-adjusted returns. Look for consistency in performance over various market cycles. Consider using metrics like Sharpe ratios and Sortino ratios to assess risk-adjusted returns.

- Investigate key personnel: Assess the experience, expertise, and track record of the fund managers and their investment team. A strong team with a proven history of success is crucial.

- Check for regulatory compliance: Ensure the fund manager is compliant with all relevant regulations and has a clean regulatory history. This includes reviewing any potential sanctions, penalties, or legal actions.

- Transparency in fees and reporting: Understand the fee structure clearly. Look for transparency in reporting, including regular updates on portfolio performance and investment activity.

Assess the Risk Profile of Private Credit Investments:

Private credit investments carry inherent risks. Understanding these risks is vital for making informed decisions.

- Credit risk: The risk that the borrower will default on their loan obligations. This is a fundamental risk in private credit.

- Liquidity risk: Private credit investments are generally illiquid, meaning they can't be easily sold quickly. This needs to be factored into your overall investment strategy.

- Market risk: The risk of adverse movements in the broader financial markets impacting the value of your private credit investments.

- Diversification: Diversify your private credit portfolio across different borrowers, industries, and geographies to mitigate risk.

- Time horizon: Consider the investment time horizon. Private credit investments often require a long-term commitment.

Seek Professional Advice:

Navigating the complexities of private credit requires expert guidance.

- Financial advisors: Consult with experienced financial advisors specializing in alternative investments, such as private credit.

- Legal professionals: Engage legal counsel to review all legal documentation and ensure compliance with relevant regulations.

- Tax professionals: Consult tax professionals to understand the tax implications of your private credit investments.

Don't Overlook the Importance of Liquidity:

Liquidity is a critical consideration in private credit investing.

Understand Liquidity Constraints:

- Illiquidity: Private credit investments are typically illiquid, meaning they cannot be easily bought or sold on secondary markets. Be prepared for the lack of immediate access to your invested capital.

- Cash reserves: Ensure you have sufficient cash reserves to meet your short-term financial needs, as you might not be able to readily access your private credit investments.

- Long-term horizon: Private credit investments are generally suited for long-term investors with a longer time horizon. Short-term needs could be problematic.

Diversify Your Asset Allocation:

To mitigate the impact of illiquidity in private credit, diversify your overall investment portfolio.

- Asset classes: Allocate a portion of your assets to more liquid asset classes, such as publicly traded equities or bonds.

- Private credit strategies: Diversify across different private credit strategies, such as direct lending, mezzanine finance, and distressed debt.

Do Understand the Legal and Regulatory Landscape:

The legal and regulatory environment surrounding private credit is complex and constantly evolving.

Stay Informed About Regulations:

- Regulatory changes: Keep abreast of changes in regulations impacting private credit investments. These regulations can significantly impact investment strategies and returns.

- Compliance: Ensure that all your private credit investments comply with all applicable laws and regulations.

Seek Legal Counsel:

- Legal review: It's crucial to engage legal professionals to review all legal documents related to your private credit investments. This includes loan agreements, security documents, and other relevant legal instruments.

Don't Neglect Due Diligence on Borrowers:

Due diligence on the borrowers is equally critical as due diligence on the fund managers.

Assess Borrower Creditworthiness:

- Financial health: Conduct a thorough assessment of the borrower's financial health. Analyze their financial statements, cash flow projections, and credit ratings.

- Management team: Evaluate the experience, expertise, and track record of the borrower's management team.

- Collateral: Review the collateral or security offered by the borrower to secure the loan.

Evaluate the Borrower's Business Plan:

- Business viability: Carefully evaluate the viability and potential risks associated with the borrower’s business plan. Assess the market opportunity, competitive landscape, and management’s ability to execute the plan.

Do Develop a Clear Investment Strategy:

A well-defined investment strategy is essential for success in the private credit market.

Define Your Investment Goals and Objectives:

- Clear goals: Clearly define your investment goals, including your target return, risk tolerance, and investment time horizon. Ensure that these goals align with your overall financial plan.

Develop a Diversified Portfolio:

- Diversification strategies: Diversify your private credit portfolio across different strategies, sectors, geographies, and borrower types. This helps reduce risk and potentially improve returns.

Conclusion:

Navigating the private credit boom requires careful planning, thorough due diligence, and a well-defined investment strategy. By following these five essential dos and don'ts, you can significantly increase your chances of success in this dynamic market. Remember to always conduct comprehensive research, seek professional advice, and diversify your portfolio to mitigate risks. Don't hesitate to leverage the expertise of experienced professionals to effectively navigate the complexities of the private credit market and achieve your financial objectives. Start making informed decisions in the exciting world of private credit investments today!

Featured Posts

-

A Conservative Harvard Professors Plan To Save Harvard University

Apr 26, 2025

A Conservative Harvard Professors Plan To Save Harvard University

Apr 26, 2025 -

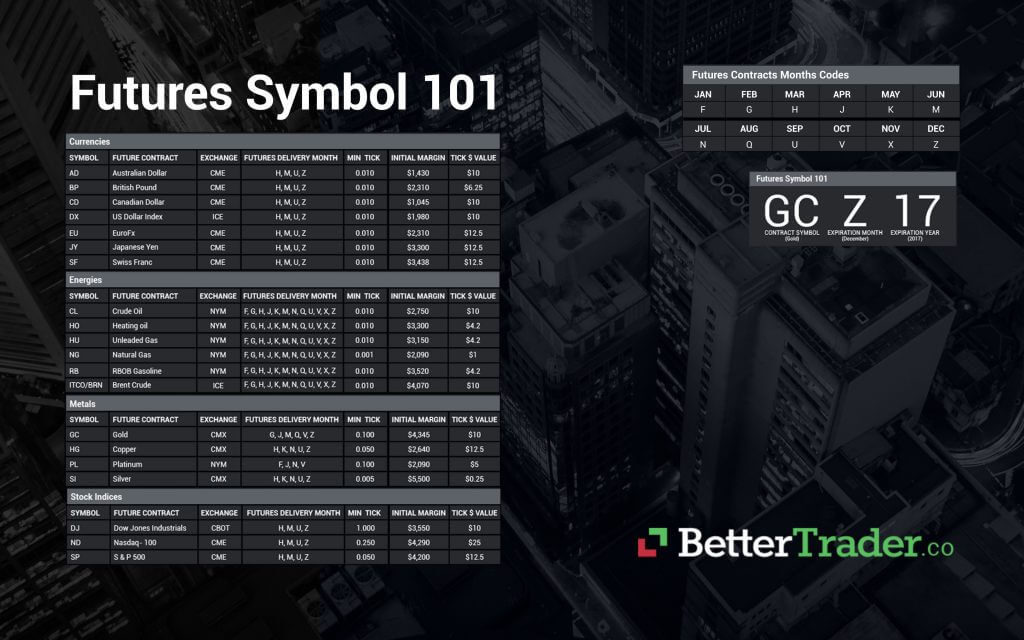

Stock Market Overview Dow Futures And The Implications Of Us China Trade Relations

Apr 26, 2025

Stock Market Overview Dow Futures And The Implications Of Us China Trade Relations

Apr 26, 2025 -

Double Trouble In Hollywood The Impact Of The Writers And Actors Strike

Apr 26, 2025

Double Trouble In Hollywood The Impact Of The Writers And Actors Strike

Apr 26, 2025 -

Bof As Argument Against Stock Market Valuation Concerns

Apr 26, 2025

Bof As Argument Against Stock Market Valuation Concerns

Apr 26, 2025 -

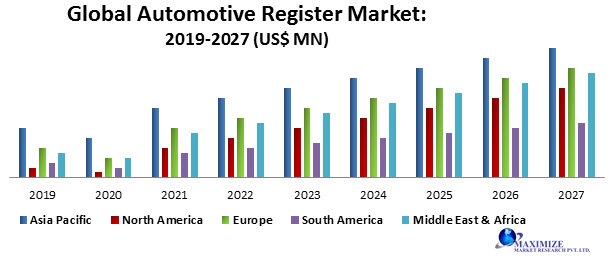

The China Factor Analyzing The Automotive Industrys Difficulties In The Chinese Market

Apr 26, 2025

The China Factor Analyzing The Automotive Industrys Difficulties In The Chinese Market

Apr 26, 2025