Navigate The Private Credit Boom: 5 Job-Landing Do's & Don'ts

Table of Contents

Do's for Landing Private Credit Jobs

1. Network Strategically

Networking is paramount in securing a private credit job. This isn't just about collecting business cards; it's about building genuine relationships.

- Attend industry events: Conferences like SuperReturn and Private Debt Investor are excellent places to meet professionals and learn about new opportunities. Smaller, regional events can also be highly effective.

- Leverage online platforms: LinkedIn is invaluable. Actively engage with posts, join relevant groups focused on private credit, alternative investments, or finance, and connect with people working in the field. Tailor your profile to highlight your skills and experience relevant to private credit roles.

- Join professional organizations: The Association for Corporate Growth (ACG) and the Alternative Credit Council (ACC) offer networking opportunities, educational resources, and access to industry leaders. Membership can significantly boost your visibility within the private credit community.

- Informational interviews: Don't be afraid to reach out to individuals working in private credit firms for informational interviews. These conversations can provide invaluable insights into the industry and potential job openings. Even if they don't have immediate openings, they may know someone who does.

2. Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. Generic applications rarely succeed in the competitive private credit market.

- Highlight relevant skills: Focus on your experience in financial modeling, credit analysis, deal structuring, and portfolio management. Quantify your achievements whenever possible; instead of saying "Improved efficiency," say "Improved efficiency by 15% through process optimization."

- Use keywords strategically: Carefully review job descriptions and incorporate relevant keywords into your resume and cover letter. This helps applicant tracking systems (ATS) identify your application as a strong match. Keywords might include: "leveraged lending," "distressed debt," "mezzanine financing," "underwriting," "due diligence," and specific software like Bloomberg Terminal or Argus.

- Tailor to each application: Each firm has a unique investment strategy and culture. Research the firm thoroughly and tailor your resume and cover letter to reflect your understanding of their approach. Show them you've done your homework.

- Showcase your personality: While highlighting skills is important, let some of your personality shine through. Private credit firms value people who are not only skilled but also a good cultural fit.

3. Showcase Your Financial Acumen

Private credit requires deep financial expertise. Demonstrate your proficiency in key areas.

- Master financial modeling: Be prepared to discuss your experience with discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and other valuation techniques.

- Credit analysis prowess: Demonstrate your understanding of credit risk assessment, covenant compliance, and financial statement analysis.

- Software proficiency: Highlight your experience with industry-standard software, such as Bloomberg Terminal, Capital IQ, and Argus.

- Case studies: Prepare compelling case studies that demonstrate your problem-solving abilities and financial expertise in real-world scenarios. This shows potential employers how you would approach challenges in a private credit environment.

Don'ts for Landing Private Credit Jobs

1. Neglect Networking

Don't underestimate the power of building relationships. The private credit industry thrives on connections.

- Don't rely solely on job boards: Many private credit opportunities aren't publicly advertised. Networking significantly increases your chances of uncovering hidden opportunities.

- Don't be passive: Actively engage with the private credit community. Attend events, reach out to professionals, and build your network proactively.

- Don't be afraid to reach out: Even if you don't have a direct connection, a well-crafted email expressing your interest can open doors.

2. Submit Generic Applications

Generic applications signal a lack of interest and effort. Private credit firms are looking for candidates who are genuinely passionate about the industry.

- Avoid generic templates: Each application should be tailored to the specific firm and role. Cut and paste applications are easily spotted.

- Research thoroughly: Understand the firm's investment strategy, recent transactions, and company culture before applying.

- Proofread carefully: Typos and grammatical errors reflect poorly on your attention to detail.

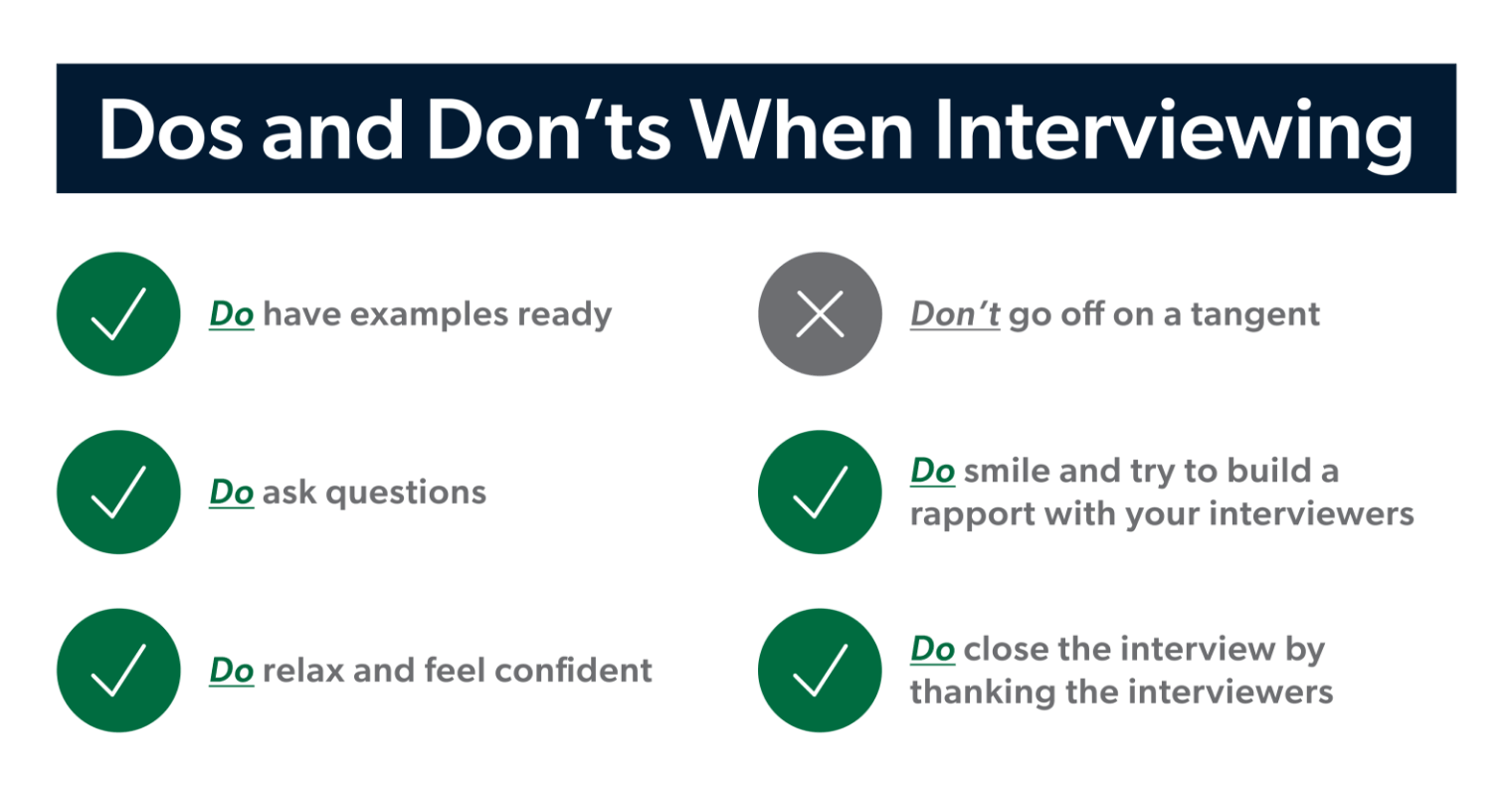

3. Underprepare for Interviews

Interviews are your chance to shine. Thorough preparation is essential.

- Research the firm and interviewers: Understand their investment philosophy, recent deals, and the individuals interviewing you. LinkedIn is a great resource for this.

- Prepare specific examples: Use the STAR method (Situation, Task, Action, Result) to answer behavioral questions with concrete examples that demonstrate your skills and accomplishments.

- Ask thoughtful questions: Prepare intelligent questions that showcase your genuine interest and understanding of the firm and role. This demonstrates initiative and engagement.

Conclusion

Securing a position in the booming private credit sector requires a proactive and strategic approach. By following these do's and don'ts, you'll significantly increase your chances of landing your dream job. Remember to network effectively, tailor your application materials, showcase your financial expertise, and prepare thoroughly for interviews. Don't neglect the importance of thorough preparation for interviews. Start building your network and refining your skills today to successfully navigate the competitive landscape of private credit jobs and related alternative investment jobs.

Featured Posts

-

Transgender Individuals And The Impact Of Trumps Executive Orders Your Stories Matter

May 10, 2025

Transgender Individuals And The Impact Of Trumps Executive Orders Your Stories Matter

May 10, 2025 -

Nyt Strands Game 366 Solution Tuesday March 4 Answers

May 10, 2025

Nyt Strands Game 366 Solution Tuesday March 4 Answers

May 10, 2025 -

Analysis Trumps Potential Trade Agreement With Britain

May 10, 2025

Analysis Trumps Potential Trade Agreement With Britain

May 10, 2025 -

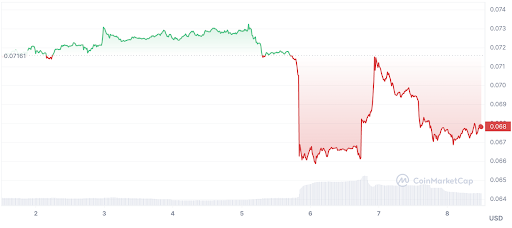

Wall Streets Resurgence How The Market Is Defying Bearish Predictions

May 10, 2025

Wall Streets Resurgence How The Market Is Defying Bearish Predictions

May 10, 2025 -

Don De Cheveux A Dijon Pour La Bonne Cause

May 10, 2025

Don De Cheveux A Dijon Pour La Bonne Cause

May 10, 2025