Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF Dist: A Detailed Explanation

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the intrinsic value of a fund's assets. For the Amundi MSCI World II UCITS ETF Dist, and any other ETF, the NAV is calculated by taking the total market value of all the assets held in the fund's portfolio, subtracting any liabilities (such as fees and expenses), and then dividing the result by the total number of outstanding shares. This gives you a per-share value representing the fund's net worth. It's a fundamental metric reflecting the true underlying value of your investment, distinct from the market price you see quoted on exchanges.

- NAV reflects the true underlying value of the ETF's holdings. It's a snapshot of the current worth of the assets the fund owns.

- NAV is calculated daily at the close of market trading. This ensures the valuation reflects the most up-to-date market prices.

- The NAV is different from the ETF's market price. While ideally, the market price should closely track the NAV, short-term fluctuations in supply and demand can cause divergence.

How is the NAV of Amundi MSCI World II UCITS ETF Dist Calculated?

Calculating the NAV of the Amundi MSCI World II UCITS ETF Dist involves a precise daily process. Amundi, the fund manager, values each asset within the ETF's portfolio at its closing market price. This portfolio typically includes a diversified range of global equities, mirroring the MSCI World Index. The process involves:

- The ETF's holdings are valued at their closing market prices. This ensures accuracy reflecting the day's market conditions.

- Any accrued income (dividends) is included. Dividends received by the fund are added to the total asset value before calculating the NAV per share.

- Expenses and management fees are deducted. These costs are subtracted from the total asset value to arrive at the net asset value.

- The result is divided by the total number of outstanding shares. This final step gives the NAV per share, a crucial figure for investors.

This rigorous daily valuation ensures transparency and accuracy in reflecting the fund's underlying worth.

The Significance of NAV for Amundi MSCI World II UCITS ETF Dist Investors

Monitoring the NAV of the Amundi MSCI World II UCITS ETF Dist is crucial for several reasons. It's a powerful tool for:

- Tracking your investment's growth. By comparing the NAV over time, you can see how your investment is performing.

- Assessing the fund manager's performance. Consistent positive NAV growth indicates effective portfolio management.

- Comparing with similar ETFs to make informed investment decisions. NAV allows you to benchmark the Amundi MSCI World II UCITS ETF Dist against competitors.

- Understanding the fund's risk profile. Significant NAV fluctuations might point to higher risk associated with the fund's holdings.

Where to Find the NAV of Amundi MSCI World II UCITS ETF Dist

Finding the daily NAV for the Amundi MSCI World II UCITS ETF Dist is straightforward. Reliable sources include:

- Amundi's official website. The fund manager's website is the primary source for accurate and up-to-date NAV data.

- Major financial news websites (e.g., Bloomberg, Yahoo Finance). These sites often provide real-time or delayed NAV information for various ETFs.

- Your brokerage account platform. Most brokerage accounts display the current NAV of your holdings, offering convenient access.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF Dist is essential for any investor seeking to make informed decisions. Regularly monitoring the NAV allows you to track performance, assess risk, and compare your investment against market benchmarks. By understanding how the NAV is calculated and where to find this crucial data, you're better equipped to manage your investment and achieve your financial goals. We strongly recommend checking the NAV of your Amundi MSCI World II UCITS ETF Dist holdings daily or at least weekly to maintain a clear picture of your investment's performance. Mastering the Net Asset Value will significantly improve your long-term investment strategy.

Featured Posts

-

Mia Farrow Demands Trump Be Jailed For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrow Demands Trump Be Jailed For Deporting Venezuelan Gang Members

May 24, 2025 -

Mest Myagkovu Kak Brezhnev Spas Garazh Ryazanova Ot Tsenzury

May 24, 2025

Mest Myagkovu Kak Brezhnev Spas Garazh Ryazanova Ot Tsenzury

May 24, 2025 -

2025s Best Beaches Dr Beachs Top 10 Us Destinations

May 24, 2025

2025s Best Beaches Dr Beachs Top 10 Us Destinations

May 24, 2025 -

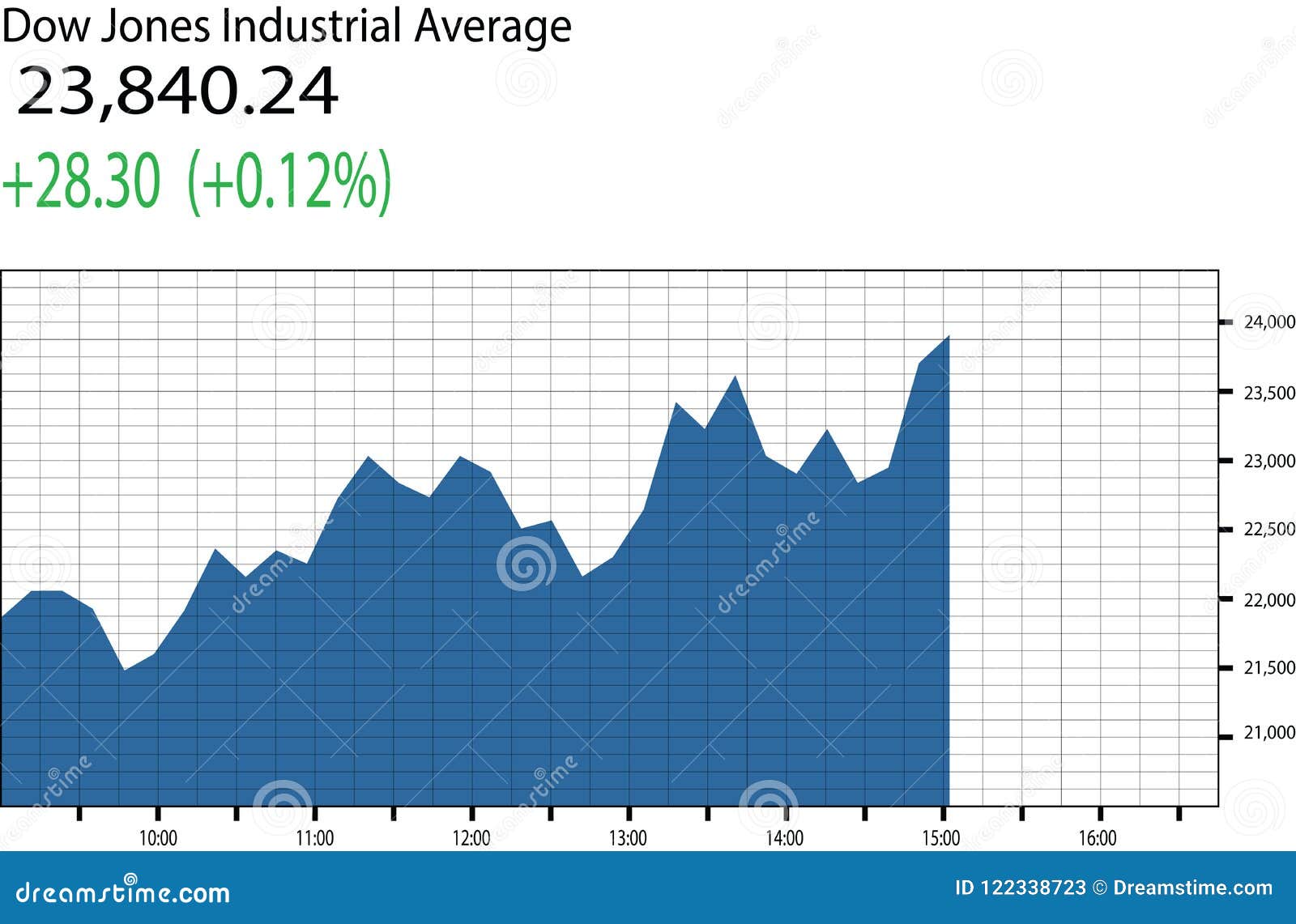

Analyzing The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Analyzing The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Kyle Walker Peters Crystal Palaces Free Transfer Pursuit

May 24, 2025

Kyle Walker Peters Crystal Palaces Free Transfer Pursuit

May 24, 2025