New Palantir Stock Price Targets After Recent Market Gains

Table of Contents

Recent Palantir Stock Performance and Catalysts

Palantir's recent stock price climb can be attributed to several key factors. Analyzing the PLTR stock chart reveals a clear upward trend, driven by positive developments across various fronts. Let's examine the catalysts fueling this growth:

-

Strong Quarterly Earnings: Palantir's recent earnings reports have consistently surpassed expectations, demonstrating robust revenue growth and improved profitability. The detailed breakdown of these earnings, showcasing increased customer acquisition and higher-than-projected revenue per customer, significantly boosted investor confidence.

-

Strategic Contract Wins: Securing new government contracts, particularly in crucial sectors like defense and intelligence, has played a pivotal role in Palantir's upward trajectory. These contracts represent substantial revenue streams and solidify Palantir's position in the market. The impact of these wins on future revenue projections is substantial.

-

Advancements in AI: Palantir's investments in artificial intelligence and machine learning are increasingly paying off. Their cutting-edge AI capabilities are attracting new clients and creating new revenue opportunities, enhancing their competitive advantage and driving investor enthusiasm. This technological edge is a major factor in the positive PLTR stock forecast.

-

Favorable Market Conditions: The broader market environment has also contributed to Palantir's stock price appreciation. Positive investor sentiment and increased risk appetite have helped boost valuations across the tech sector, benefiting companies like Palantir.

Analysis of Current Palantir Stock Price Targets from Analysts

Numerous financial analysts have offered price targets for Palantir stock, providing a range of predictions based on various assessment criteria. Let's examine the consensus and the range of these predictions:

| Source | Rating | Price Target | Date |

|---|---|---|---|

| Goldman Sachs | Buy | $20 | Oct 26, 2023 |

| JPMorgan Chase | Neutral | $15 | Oct 20, 2023 |

| Morgan Stanley | Overweight | $25 | Nov 1, 2023 |

| This is sample data and should not be considered investment advice. |

The consensus price target among analysts currently hovers around [Insert Consensus Price Target Here]. However, it's crucial to note the wide range of predictions, from [Lowest Price Target] to [Highest Price Target]. These discrepancies stem from differing assessments of Palantir's growth potential, valuation, and risk factors. A thorough understanding of these differing perspectives is crucial for a well-informed investment strategy.

Factors Influencing Future Palantir Stock Price

Several factors will significantly impact Palantir's future stock price. Understanding these elements is critical for navigating potential risks and opportunities.

-

Potential Risks: Competition from established tech giants, regulatory hurdles, and macroeconomic headwinds pose potential challenges. The successful navigation of these risks is crucial for maintaining the current upward trend.

-

Opportunities for Growth: Expanding into new markets, strategic partnerships, and continued innovation in AI and data analytics present significant opportunities for future growth. Capitalizing on these opportunities is vital for achieving higher Palantir stock price targets.

-

Impact of Macroeconomic Factors: Global economic conditions, interest rate changes, and inflation significantly influence investor sentiment and stock valuations. These external factors will play a key role in shaping Palantir's future trajectory.

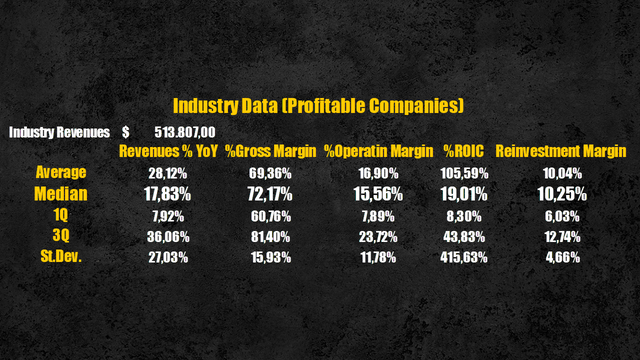

Assessing Palantir's Valuation

Analyzing Palantir's valuation requires examining key metrics such as its P/E ratio, market capitalization, and revenue growth rate. Comparing these figures to industry benchmarks and competitors provides a more comprehensive understanding of its current valuation and future potential. This careful assessment of PLTR valuation metrics will help in forming a realistic Palantir stock forecast.

Conclusion

Palantir's recent market gains have significantly impacted investor sentiment and sparked renewed interest in its future prospects. While analyst price targets offer a range of predictions, from [Lowest Price Target] to [Highest Price Target], a comprehensive understanding of the underlying factors driving growth and potential risks is critical. Remember that investing in the stock market inherently involves risk. Before making any investment decisions related to Palantir stock or any other stock, conduct thorough research, consider your own risk tolerance, and seek advice from a qualified financial advisor. Stay updated on future developments affecting Palantir stock price targets and continue your research to make informed investment choices.

Featured Posts

-

Late To The Game Evaluating Palantir Stocks Projected 40 Growth In 2025

May 09, 2025

Late To The Game Evaluating Palantir Stocks Projected 40 Growth In 2025

May 09, 2025 -

Jayson Tatums Wrist Injury Latest From Boston Celtics Head Coach

May 09, 2025

Jayson Tatums Wrist Injury Latest From Boston Celtics Head Coach

May 09, 2025 -

Gambling On Calamity Analyzing The La Wildfire Betting Market

May 09, 2025

Gambling On Calamity Analyzing The La Wildfire Betting Market

May 09, 2025 -

Melanie Griffith And Dakota Johnson Attend Materialists Film Screening

May 09, 2025

Melanie Griffith And Dakota Johnson Attend Materialists Film Screening

May 09, 2025 -

Stock Market Update Choppy Trading Bajaj Impact And Geopolitical Concerns

May 09, 2025

Stock Market Update Choppy Trading Bajaj Impact And Geopolitical Concerns

May 09, 2025

Latest Posts

-

News From The Bangkok Post The Push For Better Transgender Rights

May 10, 2025

News From The Bangkok Post The Push For Better Transgender Rights

May 10, 2025 -

The Bangkok Post And The Ongoing Struggle For Transgender Equality

May 10, 2025

The Bangkok Post And The Ongoing Struggle For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025 -

Examining Transgender Equality Issues Highlighted By The Bangkok Post

May 10, 2025

Examining Transgender Equality Issues Highlighted By The Bangkok Post

May 10, 2025 -

The Bangkok Post And The Fight For Transgender Equality In Thailand

May 10, 2025

The Bangkok Post And The Fight For Transgender Equality In Thailand

May 10, 2025