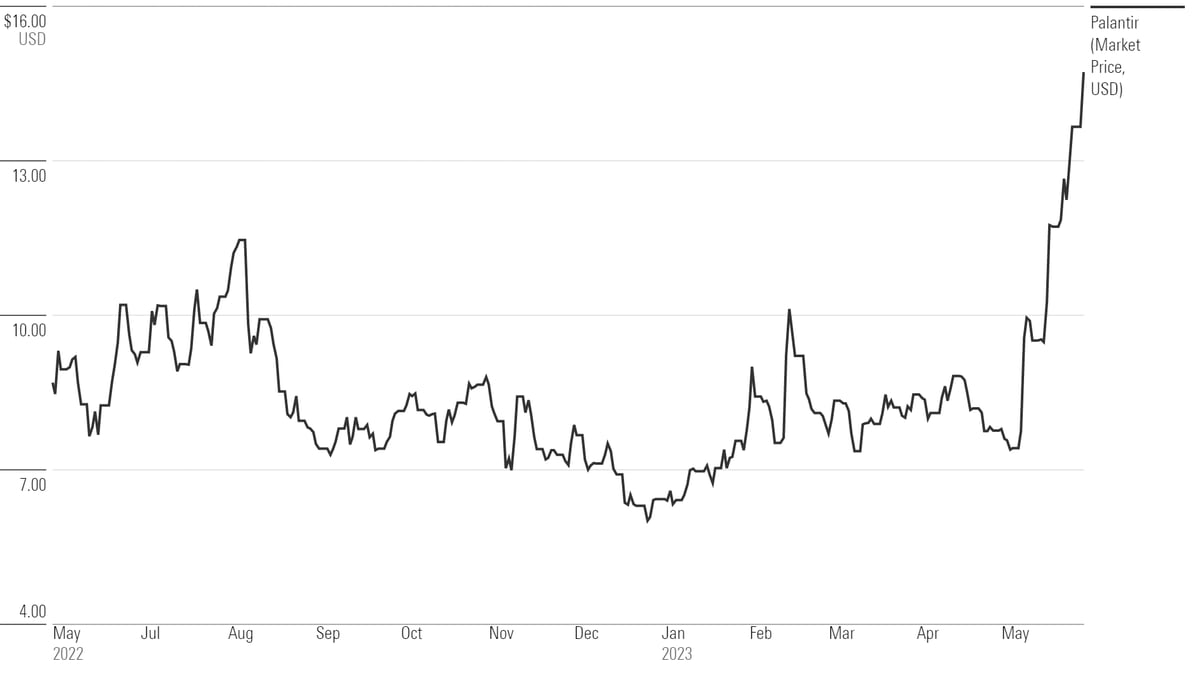

Late To The Game? Evaluating Palantir Stock's Projected 40% Growth In 2025

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir's core offerings, Gotham and Foundry, are sophisticated data analytics platforms catering to diverse sectors. Gotham primarily targets government agencies, assisting them in counterterrorism, intelligence gathering, and crime prevention. Foundry, on the other hand, focuses on commercial clients, empowering them with data-driven insights to improve operational efficiency and decision-making.

Palantir employs a primarily subscription-based revenue model, offering tiered access to its platforms. This SaaS (Software as a Service) approach generates recurring revenue streams, increasing predictability and stability. Consulting services complement the subscription model, offering tailored solutions and expertise to clients.

The growth potential within both sectors is substantial. Government contracts remain a significant source of revenue, with increasing demand for advanced data analytics solutions worldwide. The commercial sector holds even greater untapped potential, as businesses across various industries are increasingly recognizing the value of data-driven decision making.

- Successful Government Deployments: The FBI's use of Palantir's platform for criminal investigations and the UK's adoption of Gotham for national security purposes highlight the platform's impact.

- Successful Commercial Deployments: Companies like Airbus are using Foundry to optimize their supply chains, demonstrating the platform's commercial versatility and potential for widespread adoption.

Assessing the 40% Growth Projection

The projected 40% growth for Palantir in 2025 is based on a confluence of factors. Analyst estimates, company guidance, and overall market trends point toward significant expansion. This growth is fueled by several key drivers:

- New Product Launches: Continuous innovation and the release of new features and functionalities within Gotham and Foundry attract new customers and enhance existing contracts.

- Increased Adoption Rates: As awareness of Palantir's capabilities grows, the adoption rate across both the government and commercial sectors is projected to accelerate.

- Expansion into New Markets: Palantir is strategically expanding into new geographic regions and industries, further diversifying its revenue streams and fueling growth.

However, potential risks and challenges exist:

- Competition: The big data and analytics market is competitive, with established players and emerging startups vying for market share.

- Economic Downturn: A global economic downturn could affect government spending and commercial investment in data analytics solutions.

- Regulatory Hurdles: Navigating complex regulatory environments, particularly in the government sector, can pose challenges.

Key Factors Supporting the 40% Growth Projection: Strong product offerings, increasing demand for data analytics, strategic expansion. Key Factors Challenging the 40% Growth Projection: Intense competition, economic uncertainty, regulatory complexities.

Comparing Palantir to Competitors

Palantir's primary competitors in the big data analytics market include established players like Microsoft, Amazon Web Services (AWS), and Google Cloud Platform (GCP), as well as smaller, specialized firms. Palantir differentiates itself through its focus on highly secure, customizable solutions tailored to complex, sensitive data environments. While competitors offer broader, more general-purpose solutions, Palantir excels in handling highly sensitive data with robust security features, a crucial advantage in government and certain commercial sectors.

However, Palantir faces challenges in competing with the vast resources and market reach of tech giants like Microsoft, AWS, and GCP. The competitive landscape necessitates continued innovation and strategic expansion to maintain and grow market share.

| Company | Key Features | Market Share (Estimate) | Strengths | Weaknesses |

|---|---|---|---|---|

| Palantir | Highly secure, customizable data analytics platforms | Relatively small | Strong security, tailored solutions | Smaller market share compared to large players |

| Microsoft Azure | Comprehensive cloud services, including analytics | Large | Wide range of services, strong market presence | Less specialized for highly sensitive data |

| AWS | Extensive cloud infrastructure, data analytics tools | Large | Scalability, broad ecosystem | Less focus on highly customized solutions |

| Google Cloud Platform | Cloud services, machine learning, data analytics | Large | Advanced analytics capabilities, strong AI | Less focus on highly sensitive data handling |

Evaluating the Risk/Reward Ratio of Investing in Palantir Stock

Investing in tech stocks, especially high-growth companies like Palantir, involves inherent risks. Market volatility can significantly impact stock prices, creating both opportunities and potential losses. The competitive landscape and economic uncertainty add further layers of complexity.

However, the potential rewards are substantial. The projected 40% growth presents a compelling opportunity for significant returns on investment. The decision to invest in Palantir stock depends on your individual risk tolerance and investment strategy. A diversified portfolio can mitigate risk, while a long-term investment horizon can allow you to ride out market fluctuations.

Potential Upsides: Significant growth potential, strong technology, expanding market. Potential Downsides: High volatility, intense competition, economic sensitivity.

Conclusion: Is Now the Time to Invest in Palantir Stock?

Our analysis reveals that Palantir Technologies presents a compelling investment opportunity, with a projected 40% growth in 2025 fueled by strong product offerings, expanding markets, and increasing adoption rates. However, investors must acknowledge the associated risks, including intense competition, economic uncertainty, and regulatory complexities. The decision to invest in Palantir stock hinges on your individual risk tolerance and investment strategy. A thorough understanding of the company's business model, competitive landscape, and financial performance is crucial. Remember to conduct your own due diligence before making any investment decisions.

Learn more about Palantir stock and make informed decisions about your investment strategy. [Link to Palantir Investor Relations] [Link to Financial News Source]

Featured Posts

-

Palantir Stock In 2025 Potential Growth And Investment Risks

May 09, 2025

Palantir Stock In 2025 Potential Growth And Investment Risks

May 09, 2025 -

Palantir Technologies Stock Buy Before May 5th Wall Streets View

May 09, 2025

Palantir Technologies Stock Buy Before May 5th Wall Streets View

May 09, 2025 -

Thousands Return To Anchorage Streets To Protest Trump Administration Policies

May 09, 2025

Thousands Return To Anchorage Streets To Protest Trump Administration Policies

May 09, 2025 -

Spac Stock Frenzy Is This Micro Strategy Competitor Worth The Hype

May 09, 2025

Spac Stock Frenzy Is This Micro Strategy Competitor Worth The Hype

May 09, 2025 -

Pakistan Stock Exchange Portal Down Volatility And Geopolitical Tensions

May 09, 2025

Pakistan Stock Exchange Portal Down Volatility And Geopolitical Tensions

May 09, 2025

Latest Posts

-

Mezhdunarodnaya Izolyatsiya Zelenskogo On Odin Na 9 Maya

May 09, 2025

Mezhdunarodnaya Izolyatsiya Zelenskogo On Odin Na 9 Maya

May 09, 2025 -

Pakistan Awaits Imf Decision On Crucial 1 3 Billion Loan Amidst Regional Tensions

May 09, 2025

Pakistan Awaits Imf Decision On Crucial 1 3 Billion Loan Amidst Regional Tensions

May 09, 2025 -

9 Maya Vladimir Zelenskiy Ostalsya Bez Podderzhki

May 09, 2025

9 Maya Vladimir Zelenskiy Ostalsya Bez Podderzhki

May 09, 2025 -

Dogovor Makrona I Tuska Novaya Glava Vo Franko Polskikh Otnosheniyakh

May 09, 2025

Dogovor Makrona I Tuska Novaya Glava Vo Franko Polskikh Otnosheniyakh

May 09, 2025 -

Oboronnoe Soglashenie Makron Tusk 9 Maya Analiz I Prognozy

May 09, 2025

Oboronnoe Soglashenie Makron Tusk 9 Maya Analiz I Prognozy

May 09, 2025