New US Energy Policy: Uncertainty And The Impact On Energy Prices

Table of Contents

The Shifting Sands of US Energy Independence

For decades, US energy policy has aimed towards energy independence, reducing reliance on foreign oil and securing domestic energy sources. However, the path to this goal has been anything but straightforward, characterized by shifts in priorities and technological advancements. This ongoing evolution significantly influences the price of energy for American consumers and businesses.

The Role of Fossil Fuels

Despite growing concerns about climate change and the push towards renewable energy, fossil fuels – oil, natural gas, and coal – continue to play a dominant role in the US energy mix.

- Impact of oil production policies: Fluctuations in domestic oil production, influenced by government regulations and technological advancements in fracking, directly impact gasoline prices and overall energy costs.

- Natural gas exports: The rise of US natural gas exports has impacted global energy markets, influencing both domestic and international prices. However, this increase in exports can also lead to higher prices domestically if not managed effectively.

- Coal plant closures: The phasing out of coal-fired power plants, driven by environmental regulations, has led to shifts in electricity generation and potential price increases in some regions. The transition away from coal is a complex issue affecting both employment and energy prices. For example, the closure of certain coal plants in Appalachia has resulted in job losses and higher electricity costs for consumers in the surrounding areas.

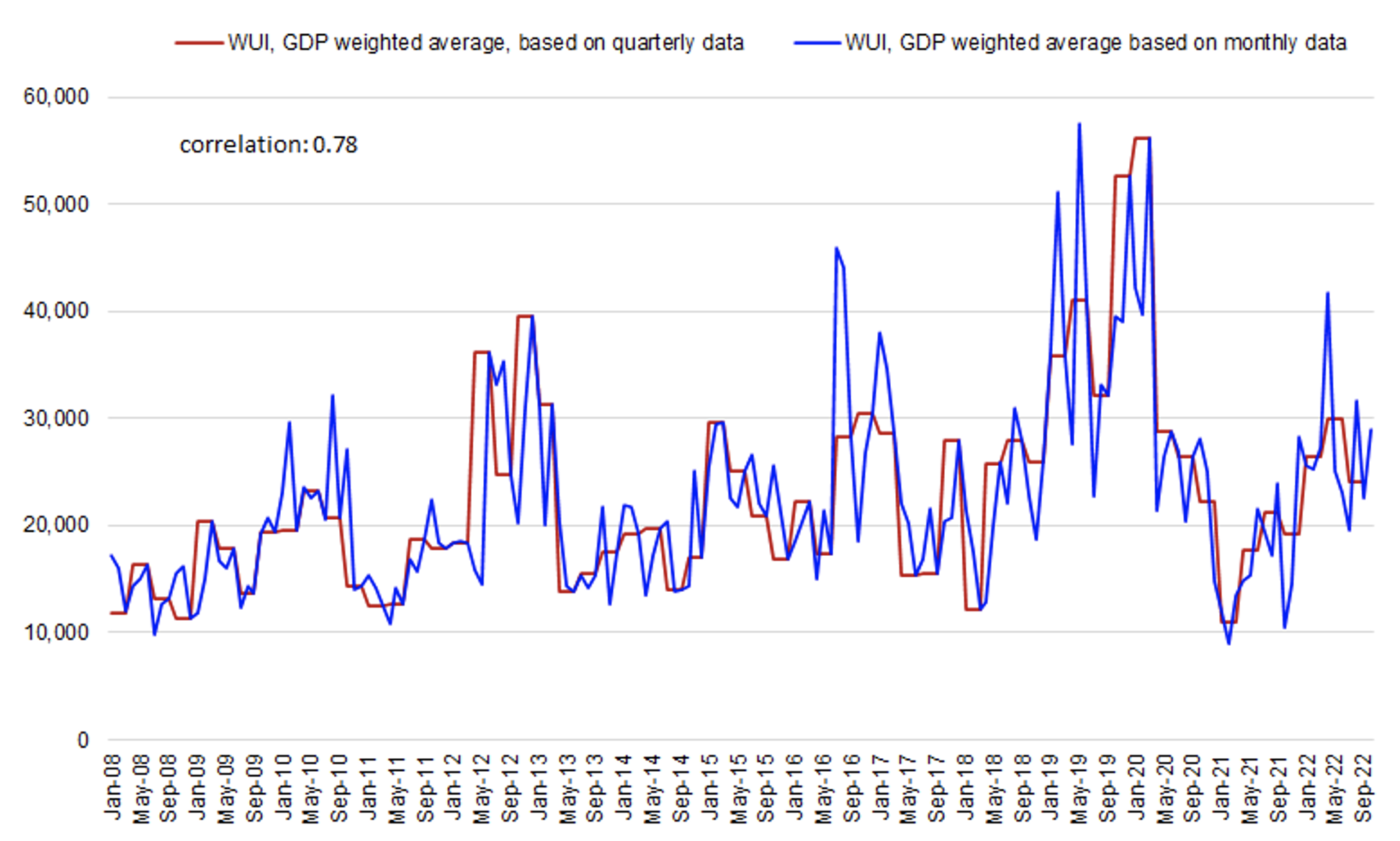

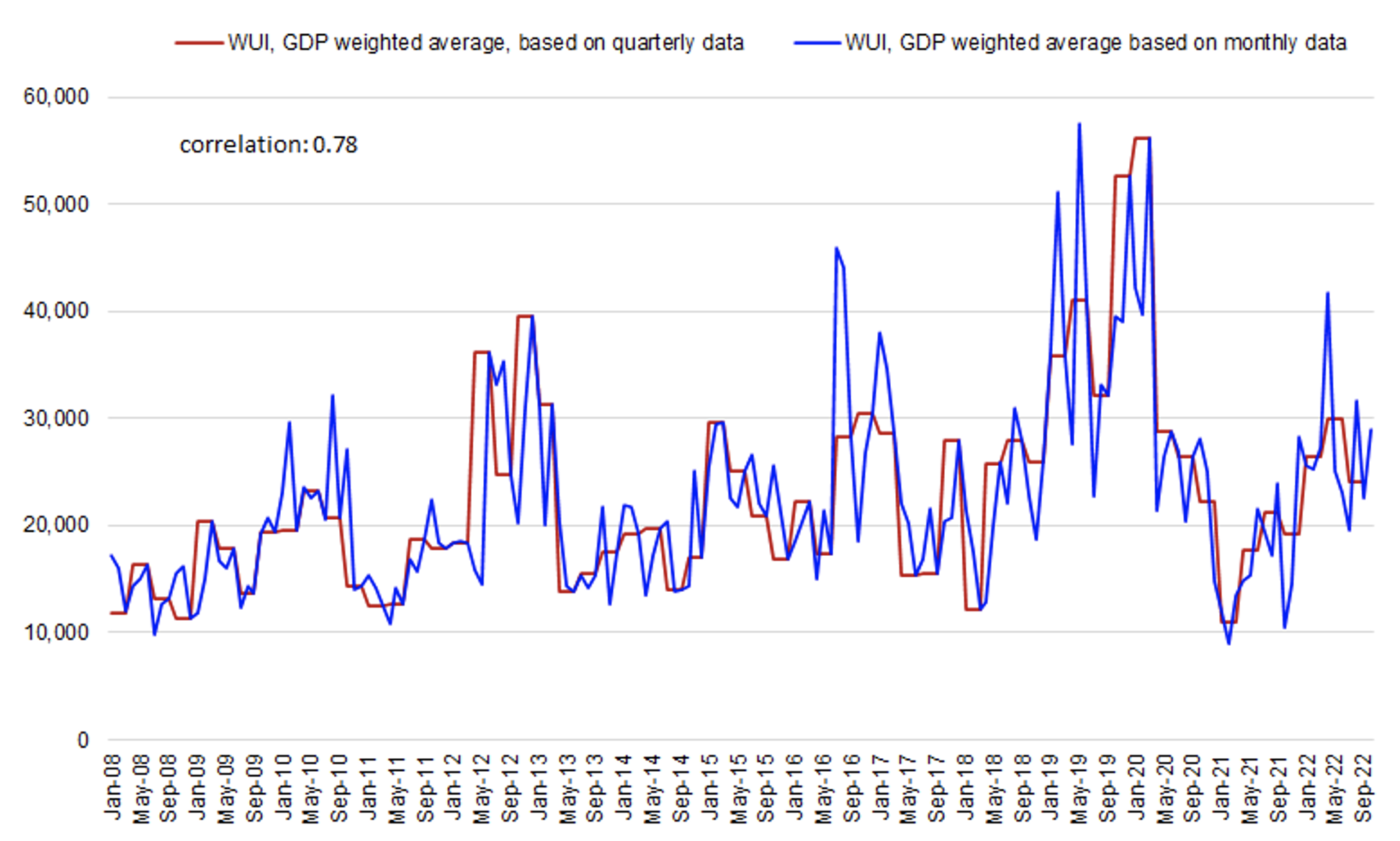

Data from the Energy Information Administration (EIA) shows significant fluctuations in fossil fuel production and consumption, directly correlating with price changes. These price changes have wide-ranging effects on the US economy.

The Rise of Renewable Energy

Simultaneously, there's a significant push towards renewable energy sources like solar, wind, and geothermal. This transition, however, is not without its challenges.

- Challenges of renewable energy integration: Intermittency (sunlight and wind availability) presents a challenge for grid stability, necessitating substantial investment in smart grid technologies and energy storage solutions.

- Subsidies and tax credits: Government incentives such as subsidies and tax credits play a crucial role in supporting the growth of renewable energy, influencing its competitiveness with fossil fuels. These incentives are often debated in terms of their effectiveness and long-term economic impact.

- Influence on price stability: The increasing share of renewables in the energy mix can contribute to price stability in the long run, but the initial investments and infrastructure development can lead to short-term price fluctuations.

The rapid growth of renewable energy capacity, as documented by the EIA, is gradually altering the energy landscape and influencing price trends, albeit with some short-term volatility.

Geopolitical Factors and Global Energy Markets

US energy prices are not solely determined by domestic policies. Global events and international relations exert a significant influence.

International Conflicts and Supply Chain Disruptions

Geopolitical instability, such as wars and sanctions, can disrupt global energy supply chains, leading to sharp price increases.

- Examples of specific events: The ongoing war in Ukraine has significantly impacted global oil and natural gas prices, illustrating the vulnerability of the US energy market to international crises.

- Role of OPEC and other global energy organizations: The Organization of the Petroleum Exporting Countries (OPEC) and other international energy organizations play a significant role in influencing global oil supply and prices, impacting the US energy market.

These disruptions often trigger ripple effects throughout the global economy, impacting inflation and the overall cost of living.

Global Demand and Economic Growth

Global economic growth is directly linked to energy demand. Rapid growth in developing economies increases global demand, putting upward pressure on prices.

- Role of developing economies: The rising energy consumption in countries like China and India significantly impacts global energy markets and ultimately affects US energy prices.

Understanding these global dynamics is vital for accurately forecasting future price trends and implementing effective energy strategies.

The Impact on Consumers and Businesses

Fluctuating energy prices have far-reaching consequences for households and businesses.

Residential Energy Costs

Increased energy prices directly impact household budgets, leaving less disposable income for other necessities.

- Increased energy poverty: High energy costs disproportionately affect low-income households, leading to increased energy poverty and reduced quality of life.

- Energy conservation strategies: Consumers are increasingly adopting energy conservation strategies to mitigate the impact of high prices, such as improving home insulation and switching to energy-efficient appliances.

Industrial and Commercial Energy Costs

Businesses face significant challenges as energy costs become a larger percentage of their operating expenses.

- Impact on production costs and competitiveness: Rising energy prices increase production costs, potentially reducing competitiveness in the global marketplace.

- Switching to renewable energy sources: Businesses are increasingly exploring renewable energy options to hedge against price volatility and reduce their environmental footprint.

Predicting Future Trends and Mitigating Risk

Predicting future energy prices under the current policy environment is challenging.

Policy Uncertainty and Investment Decisions

Unpredictable energy policies create uncertainty for investors, hindering investment in both fossil fuel and renewable energy infrastructure.

- Need for long-term, stable energy policies: Long-term, stable policies are crucial for attracting the substantial investments needed to modernize the energy grid and transition to a more sustainable energy future.

Strategies for Price Stability and Energy Security

Several strategies can help mitigate the impact of price volatility.

- Diversification of energy sources: A diversified energy portfolio reduces dependence on any single source, improving resilience to supply disruptions.

- Energy efficiency measures: Investing in energy efficiency technologies reduces overall energy consumption, mitigating the impact of price increases.

- Strategic energy reserves: Maintaining strategic energy reserves provides a buffer against unexpected supply shocks, stabilizing prices during crises.

Conclusion

The new US energy policy landscape presents significant challenges and opportunities. The interplay of fossil fuels, renewable energy, geopolitical factors, and global markets creates an environment of uncertainty, directly affecting energy prices. Understanding these factors and implementing effective mitigation strategies are critical for ensuring energy security and affordability. Stay informed about developments in the new US energy policy and its implications for your household or business. By actively monitoring the evolving situation and adapting accordingly, you can better navigate the complexities of the US energy market and mitigate the risks associated with price volatility. Learning about and adapting to changes in the new US energy policy will allow for smarter and more sustainable choices in the future.

Featured Posts

-

Ray Epps Sues Fox News For Defamation Over Jan 6 Coverage

May 30, 2025

Ray Epps Sues Fox News For Defamation Over Jan 6 Coverage

May 30, 2025 -

Oi Tileoptikes Metadoseis Toy Megaloy Savvatoy 19 Aprilioy

May 30, 2025

Oi Tileoptikes Metadoseis Toy Megaloy Savvatoy 19 Aprilioy

May 30, 2025 -

Meeting Between Finance Minister And Deutsche Bank Implications For The Economy

May 30, 2025

Meeting Between Finance Minister And Deutsche Bank Implications For The Economy

May 30, 2025 -

Cd Projekt Reds Cyberpunk 2 Development Update And Future Plans

May 30, 2025

Cd Projekt Reds Cyberpunk 2 Development Update And Future Plans

May 30, 2025 -

Se Cayo Ticketmaster El 8 De Abril Noticias Y Analisis Grupo Milenio

May 30, 2025

Se Cayo Ticketmaster El 8 De Abril Noticias Y Analisis Grupo Milenio

May 30, 2025