New X Financials: Musk's Debt Sale And The Company's Evolution

Table of Contents

Musk's Debt Sale: A Deep Dive

The massive debt incurred during the acquisition of X has significantly shaped its financial landscape. Let's examine the details of Musk's debt sale and its consequences.

The Rationale Behind the Debt Offering:

Musk's need to raise capital stemmed primarily from the high cost of the Twitter acquisition, which was largely financed through debt. The funds raised through the debt sale were likely used for several key purposes:

- Debt Repayment: Reducing existing high-interest debt to improve the company's financial stability.

- Platform Improvements: Investing in infrastructure, technology upgrades, and new features to enhance user experience and attract more users and advertisers.

- Operational Expenses: Covering the ongoing costs of running a large social media platform, including salaries, marketing, and maintenance.

The terms of the debt sale – including interest rates, maturity dates, and covenants – significantly impact X's financial health. High-interest rates increase the debt burden, while shorter maturity dates create pressure for timely repayments.

- High-interest rates: The cost of borrowing has been significant, impacting profitability.

- Leveraging existing assets: Musk may have leveraged existing X assets as collateral for the loans.

- Restructuring existing debt: The sale may have involved restructuring existing debt obligations to more manageable terms.

Impact on X's Financial Health:

The debt sale has undoubtedly increased X's leverage, creating both opportunities and risks. While the injection of capital can fund growth initiatives, the increased debt burden also increases the risk of default if the company fails to meet its financial obligations.

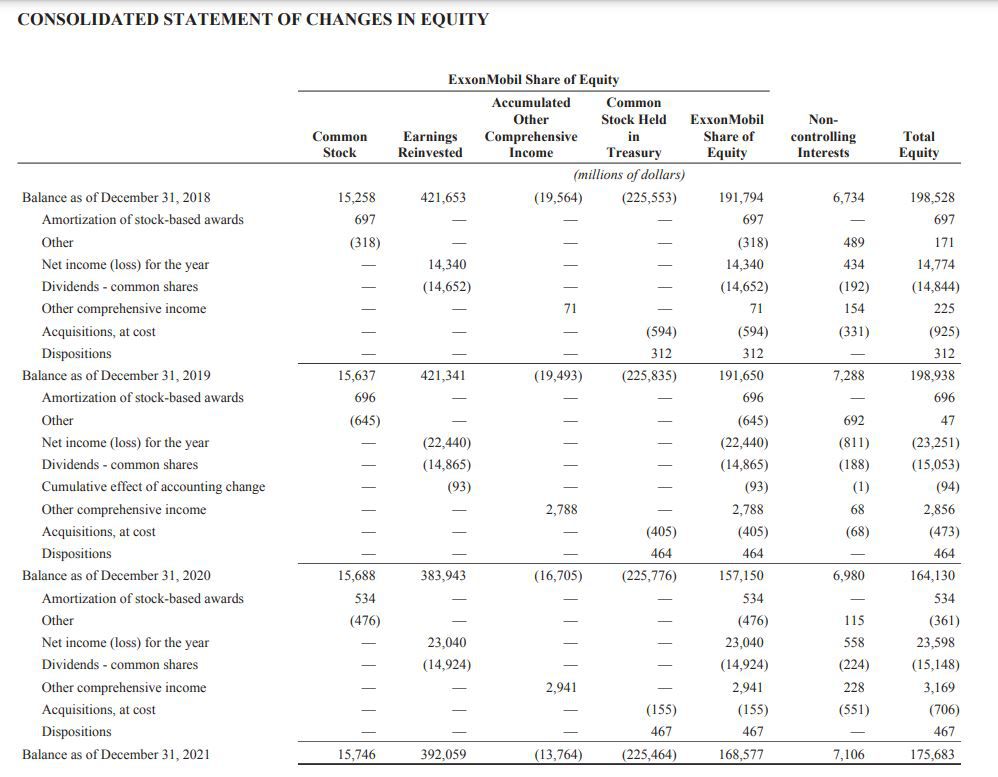

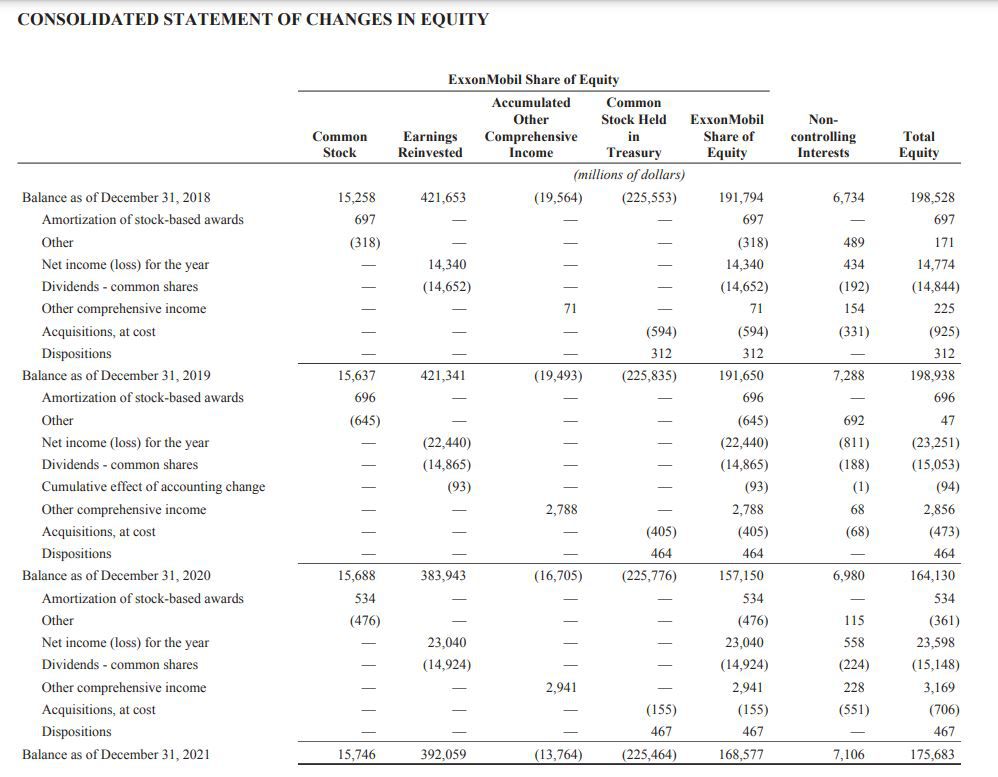

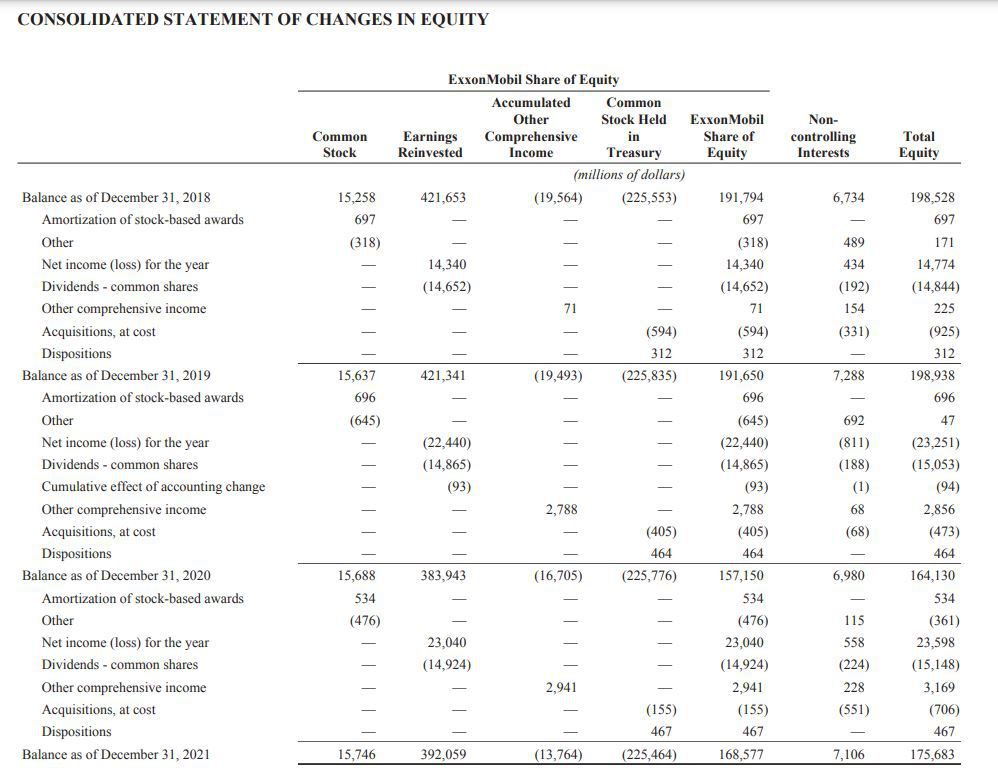

- Increased debt burden: A higher debt-to-equity ratio increases the financial risk for X.

- Potential for future defaults: Failure to generate sufficient revenue could lead to difficulties in servicing the debt.

- Impact on shareholder value: The increased financial risk could negatively impact the perceived value of X for shareholders. The fluctuations in X's stock price reflect this uncertainty.

Investor Reactions and Market Response:

The market reacted to the news of the debt sale with a mix of caution and concern. The impact on X's stock price (if applicable) has reflected this uncertainty, showcasing the volatility associated with such significant financial decisions.

- Stock price fluctuations: News of the debt sale likely contributed to significant price swings in X's stock.

- Investor confidence: The debt sale impacted investor confidence in X's long-term financial sustainability.

- Credit rating agencies' assessments: Credit rating agencies carefully assessed the impact of the debt on X's creditworthiness.

X's Evolution Under Musk's Leadership:

Musk's acquisition has led to significant changes in X's strategy, impacting its business model, user engagement, and future direction.

Strategic Shifts and Business Model Changes:

Since the acquisition, Musk has implemented numerous changes aimed at reshaping X's business model and revenue streams. These include:

- Subscription model changes: The introduction and changes to X Blue (formerly Twitter Blue) demonstrate a focus on subscription revenue.

- Advertising revenue strategies: Musk's approach to advertising and monetization remains a significant area of focus and change.

- Algorithm adjustments: Changes to the platform's algorithms have aimed to increase user engagement and retention.

Impact on User Engagement and Growth:

The changes implemented by Musk have had a mixed impact on user engagement and growth. Some users have left the platform while others have joined, leading to an ongoing flux in the user base.

- Changes in user demographics: The shifts in the user base have potential implications for advertiser targeting and revenue generation.

- Impact on advertiser reach: Changes to the platform and user base have significantly altered advertiser reach.

- User satisfaction levels: User satisfaction with X has become a key indicator of its future success.

The Future Direction of X:

The future trajectory of X depends on several factors, including its ability to manage its debt, attract and retain users, and successfully monetize its platform.

- Long-term growth prospects: Sustained growth requires consistent user acquisition, engagement, and revenue generation.

- Expansion into new technologies: X's future may involve leveraging AI, payments, or other technologies.

- Competitive landscape analysis: The competitive landscape of social media continues to evolve, posing challenges and opportunities for X.

Conclusion:

This analysis of New X Financials reveals a company undergoing significant transformation under Elon Musk's leadership. The recent debt sale highlights the financial challenges and strategic shifts undertaken to secure the platform's future. The impact on user engagement, investor sentiment, and long-term sustainability remains to be seen.

Call to Action: Stay informed about the evolving landscape of New X Financials and the ongoing impact of Musk's decisions on the platform. Follow our updates for further analysis of X's financial performance and its future trajectory. Continue to explore relevant news and commentary related to X (formerly Twitter) financials and Elon Musk's business strategies. Understanding X's financial health is crucial for navigating the evolving social media landscape.

Featured Posts

-

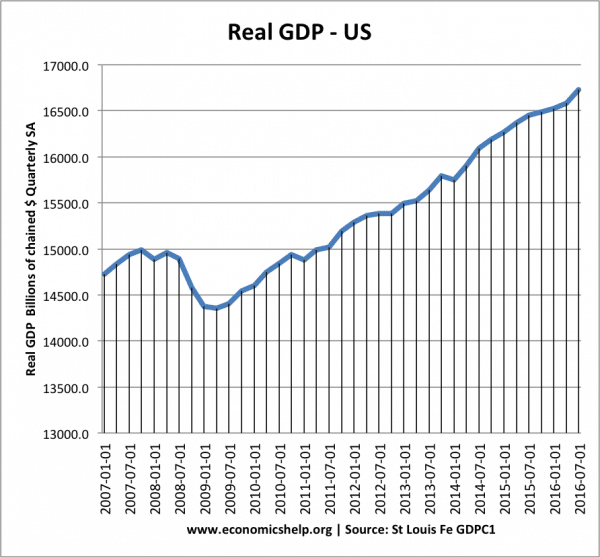

The Us Economy Under Pressure Examining The Impact Of The Canadian Travel Boycott

Apr 28, 2025

The Us Economy Under Pressure Examining The Impact Of The Canadian Travel Boycott

Apr 28, 2025 -

New X Financials Musks Debt Sale And The Companys Evolution

Apr 28, 2025

New X Financials Musks Debt Sale And The Companys Evolution

Apr 28, 2025 -

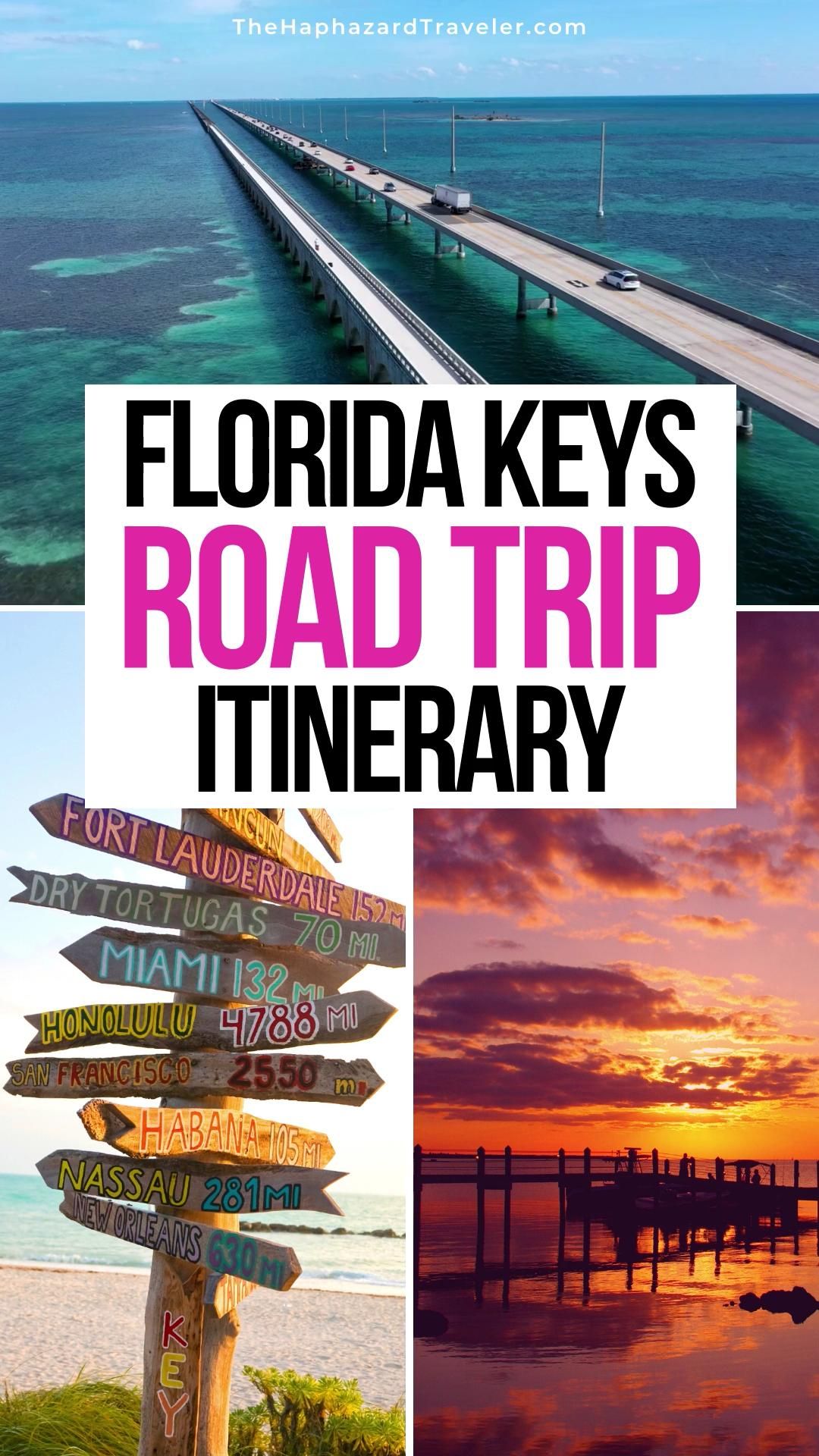

From Railroad To Overwater Highway A Florida Keys Road Trip

Apr 28, 2025

From Railroad To Overwater Highway A Florida Keys Road Trip

Apr 28, 2025 -

The China Factor Challenges And Opportunities For Luxury Car Brands

Apr 28, 2025

The China Factor Challenges And Opportunities For Luxury Car Brands

Apr 28, 2025 -

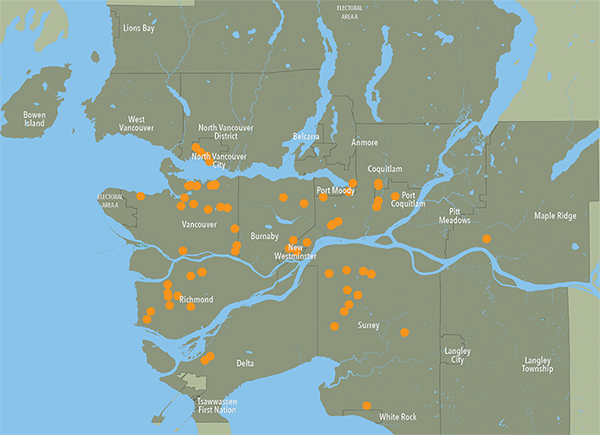

Metro Vancouver Housing Market Slower Rent Growth But Costs Still Climbing

Apr 28, 2025

Metro Vancouver Housing Market Slower Rent Growth But Costs Still Climbing

Apr 28, 2025

Latest Posts

-

Richard Jefferson And Shaquille O Neal Latest Feud Update

Apr 28, 2025

Richard Jefferson And Shaquille O Neal Latest Feud Update

Apr 28, 2025 -

Nba Analyst Jj Redick On Espns New Hire Richard Jefferson

Apr 28, 2025

Nba Analyst Jj Redick On Espns New Hire Richard Jefferson

Apr 28, 2025 -

Analysis Jj Redicks Comments On Richard Jefferson Joining Espn

Apr 28, 2025

Analysis Jj Redicks Comments On Richard Jefferson Joining Espn

Apr 28, 2025 -

Jj Redick Supports Espns Choice Of Richard Jefferson

Apr 28, 2025

Jj Redick Supports Espns Choice Of Richard Jefferson

Apr 28, 2025 -

Redick Praises Espn For Hiring Richard Jefferson

Apr 28, 2025

Redick Praises Espn For Hiring Richard Jefferson

Apr 28, 2025