Nicki Chapman's Smart Property Investment: A £700,000 Return On Her Escape To The Country

Table of Contents

Nicki Chapman's Investment Strategy: A Case Study in Smart Property Buying

Nicki Chapman's approach to property investment showcases a blend of strategic planning and market awareness. While the specifics of her strategy remain partially private, analyzing her success reveals several key elements of a smart property investment approach.

- Strategic Location: A key component of any successful property investment is location. Smart investors prioritize areas with high rental demand or strong potential for capital appreciation. While the exact location of Nicki's property isn't publicly available for privacy reasons, its success suggests a strategic choice in a desirable and potentially undersupplied market.

- Property Type Selection: The type of property itself played a crucial role. Was it a buy-to-let property generating rental income, or a renovation project that saw significant value increase post-improvement? This decision highlights the importance of understanding different property investment avenues and their inherent risks and rewards.

- Market Research & Due Diligence: Thorough market research is essential before making any property investment. Nicki's success implies a deep understanding of local market trends, property values, and potential rental yields. This extensive due diligence minimizes risks and maximizes potential returns.

The Property Itself: Location, Features, and Market Value

While details about Nicki's specific property remain confidential to protect her privacy, we can infer several characteristics contributing to its impressive value.

- Desirable Location: The property's location undoubtedly played a crucial role in its success. A desirable area, perhaps with excellent schools, amenities, or transport links, would command higher prices and attract strong rental demand.

- Key Features: The property likely possessed desirable features that increased its market value. This might include size, number of bedrooms and bathrooms, garden space, parking, or unique architectural details.

- Renovations and Improvements (if any): Any renovations or improvements undertaken likely added significantly to the property's value. Smart investors often identify undervalued properties with potential for enhancement, thereby maximizing their return on investment (ROI).

Financial Analysis: Breaking Down the £700,000 Return

The £700,000 return on Nicki Chapman's property investment is a testament to a well-executed strategy. Let's examine the potential financial aspects:

- Initial Investment: The initial purchase price of the property formed the base cost of the investment.

- Renovation Expenses (if any): If renovations were undertaken, these costs would need to be factored into the overall expenditure.

- Sale Price: The final sale price, significantly higher than the initial investment and renovation costs (if any), generated the substantial £700,000 profit.

- Return on Investment (ROI): Calculating the ROI provides a clear picture of the investment's success. A high ROI, as demonstrated by Nicki's venture, indicates a highly profitable investment. Understanding the ROI is crucial for evaluating the success of any property investment strategy.

Lessons Learned: Key Takeaways for Aspiring Property Investors

Nicki Chapman's success provides several valuable lessons for aspiring property investors:

- Thorough Market Research: Understand the local market, rental yields, and potential for capital appreciation.

- Strategic Location: Prioritize properties in desirable areas with strong rental demand or potential for value growth.

- Due Diligence: Conduct thorough research on the property itself, including its condition, potential for improvement, and any legal or financial implications.

- Financial Planning: Develop a detailed financial plan, including budgeting for potential expenses, and understanding the tax implications of property investment. This financial analysis is critical for long-term success.

Conclusion: Unlocking Your Property Investment Potential with Nicki Chapman's Success

Nicki Chapman's impressive £700,000 return on her smart property investment serves as an inspiring example of the potential rewards of shrewd property investment. By carefully considering location, property type, and undertaking thorough due diligence, she achieved exceptional success. The key takeaways – strategic location selection, thorough market research, and careful financial planning – are crucial for anyone looking to embark on their own successful property investment journey. Learn from Nicki Chapman's example and start your own journey towards smart property investment today!

Featured Posts

-

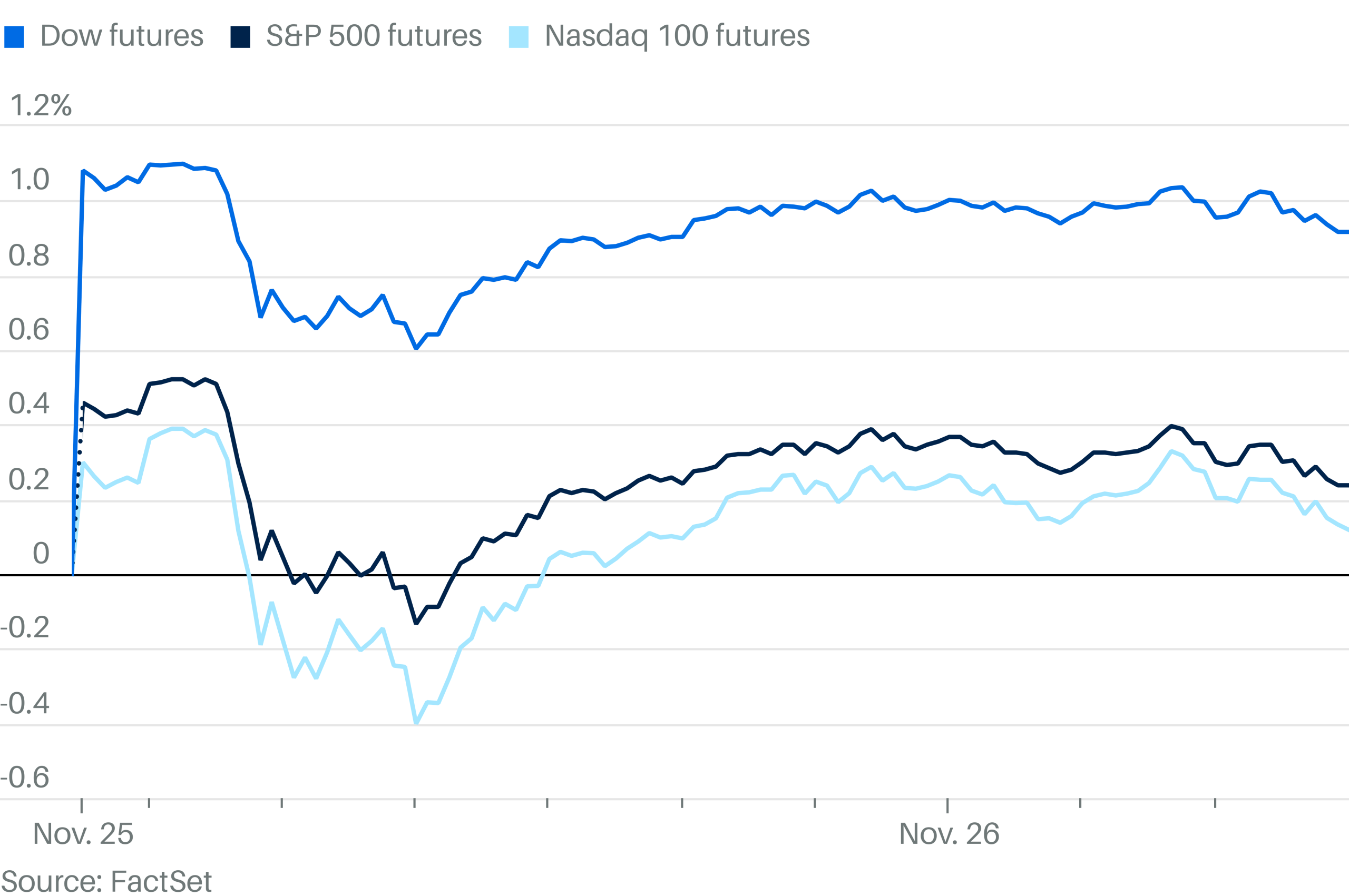

Amsterdam Stock Exchange Plunges 2 After Trumps Tariff Increase

May 24, 2025

Amsterdam Stock Exchange Plunges 2 After Trumps Tariff Increase

May 24, 2025 -

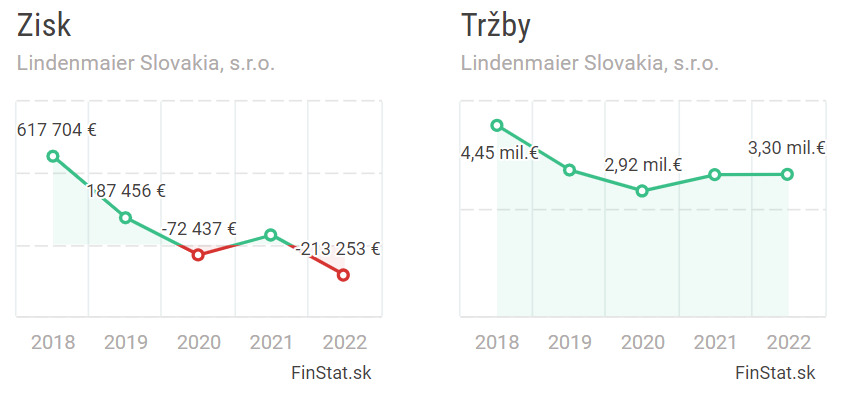

Nemecke Firmy A Prepustanie Dosledky Hospodarskeho Spomalenia Na H Nonline Sk

May 24, 2025

Nemecke Firmy A Prepustanie Dosledky Hospodarskeho Spomalenia Na H Nonline Sk

May 24, 2025 -

Erkek Burclari Ve Babalik Guevenilirlik Calkanti Ve Sadakat

May 24, 2025

Erkek Burclari Ve Babalik Guevenilirlik Calkanti Ve Sadakat

May 24, 2025 -

Southwest Airlines Changes To Carry On Portable Charger Restrictions

May 24, 2025

Southwest Airlines Changes To Carry On Portable Charger Restrictions

May 24, 2025 -

University Of Maryland Chooses Kermit The Frog For 2025 Commencement Speaker

May 24, 2025

University Of Maryland Chooses Kermit The Frog For 2025 Commencement Speaker

May 24, 2025