Nigel Farage And NatWest Settle Debanking Dispute

Table of Contents

The Background of the NatWest-Farage Dispute

The dispute between Nigel Farage and NatWest began in 2021 when NatWest, one of the UK's largest banks, closed several of Mr. Farage's personal and business accounts. This decision followed a series of public statements made by Mr. Farage on various political issues, sparking immediate controversy. The timeline of events is crucial to understanding the context of the case:

- Account Closure: NatWest closed Farage's accounts in July 2021, citing concerns relating to his public statements and perceived risk.

- Farage's Claims: Mr. Farage publicly accused NatWest of acting on politically motivated grounds, alleging a breach of his rights to freedom of speech and financial services. He argued that the decision was politically motivated and unfairly targeted him due to his outspoken political views.

- Public Outcry and Media Coverage: The closure generated widespread public discussion and intense media coverage, with many questioning the bank's actions and raising concerns about potential censorship and the impact on freedom of expression. Numerous commentators and organizations weighed in on the debate, highlighting the potential implications for other politically active individuals.

- Initial Legal Proceedings: Mr. Farage initiated legal proceedings against NatWest, arguing that the bank's decision was unlawful and discriminatory. The initial stages of these proceedings involved detailed scrutiny of NatWest's justifications for account closure. The case garnered significant attention in the UK Parliament as well.

- Similar Experiences: It's important to note that several other high-profile individuals and political figures have reported facing similar challenges with banks closing their accounts, further fueling the debate about de-banking and its potential misuse.

Key Terms of the Settlement

While the exact details of the settlement remain partially confidential to protect both parties' interests, some key aspects have emerged:

- Financial Compensation: While the specific amount remains undisclosed, reports indicate that Mr. Farage received a substantial financial settlement from NatWest as compensation for the inconvenience and damage caused.

- Public Apology: NatWest issued a public apology acknowledging that their communication with Mr. Farage could have been handled better. This apology aimed to address concerns about the bank's handling of the situation and acknowledge the distress caused.

- Policy Changes: Although the specific details are confidential, the settlement likely led to internal policy reviews at NatWest regarding its de-banking procedures. While the bank hasn't publicly announced sweeping changes, the pressure from the case and potential regulatory scrutiny likely influenced their internal risk assessment and account closure processes.

- Future Relations: The settlement explicitly indicates a cessation of hostilities between Mr. Farage and NatWest, bringing an end to the legal battle and the public controversy that surrounded it.

Implications of the Settlement

The Nigel Farage and NatWest settlement has significant implications for the banking sector and political discourse in the UK and beyond:

- Precedent for De-banking: This settlement sets a crucial precedent for future de-banking cases, potentially making banks more cautious about closing accounts based solely on a customer's political views.

- Freedom of Speech: The case highlights the delicate balance between a bank's right to manage risk and an individual's right to freedom of speech and political expression. The outcome emphasizes the need for clear guidelines and robust oversight to prevent the misuse of de-banking powers.

- Regulatory Changes: The controversy surrounding this case might lead to regulatory changes aimed at clarifying the rules around bank account closures and improving transparency in the de-banking process. Expect increased scrutiny from regulatory bodies.

- Public Trust: The settlement's impact on public trust in financial institutions remains to be seen. Many are likely to view the settlement as a victory for freedom of speech, while others may remain concerned about the potential for banks to use their power to silence dissenting voices.

- Risk Management vs. Customer Rights: The case forces a closer look at how banks balance their responsibility to manage risk with their obligation to provide services to all customers, regardless of their political affiliations.

The Role of Regulation and Oversight

Regulatory bodies play a crucial role in overseeing bank de-banking practices:

- Responsibilities of Regulators: Financial regulators are responsible for ensuring that banks comply with relevant legislation, act fairly, and do not discriminate against customers based on their political beliefs.

- Existing Regulations: While some regulations exist concerning account closures, they might lack sufficient clarity concerning politically motivated de-banking.

- Potential for Reform: The Farage case might lead to a review of existing regulations and potentially result in new laws providing greater protection for customers against politically motivated account closures.

Public Reaction and Media Coverage

The settlement has generated mixed reactions across the public and in the media:

- Public Opinion: Public opinion polls show a wide range of views on the matter, with some supporting NatWest's right to manage risk, while others highlight concerns regarding freedom of expression.

- Media Coverage: Media outlets presented diverse perspectives, reflecting the complexity of the issue and the various interpretations of the settlement's implications.

- Expert Opinions: Legal experts and commentators are divided on the long-term impact, with some suggesting a more cautious approach by banks and others predicting limited change in practice.

Conclusion

The settlement between Nigel Farage and NatWest marks a significant turning point in the ongoing debate surrounding bank account closures and political expression. The terms of the agreement, while not fully disclosed, have implications for both financial institutions and political figures, potentially shaping future regulatory discussions and bank practices related to de-banking. The case underscores the importance of a balanced approach that respects both a bank’s responsibility to manage risk and the customer's right to financial services.

Call to Action: Stay informed about developments in this crucial area affecting financial services and freedom of speech. Continue following the story and related discussions regarding Nigel Farage and NatWest's settlement to understand the long-term impact on de-banking practices. Further research into the legal aspects of this landmark case is encouraged.

Featured Posts

-

Aid Ship To Gaza Under Attack Sos Issued Near Maltese Waters

May 03, 2025

Aid Ship To Gaza Under Attack Sos Issued Near Maltese Waters

May 03, 2025 -

1 T 50

May 03, 2025

1 T 50

May 03, 2025 -

Riot Fest 2025 Green Day Blink 182 And Weird Al Yankovic Lineup Announced

May 03, 2025

Riot Fest 2025 Green Day Blink 182 And Weird Al Yankovic Lineup Announced

May 03, 2025 -

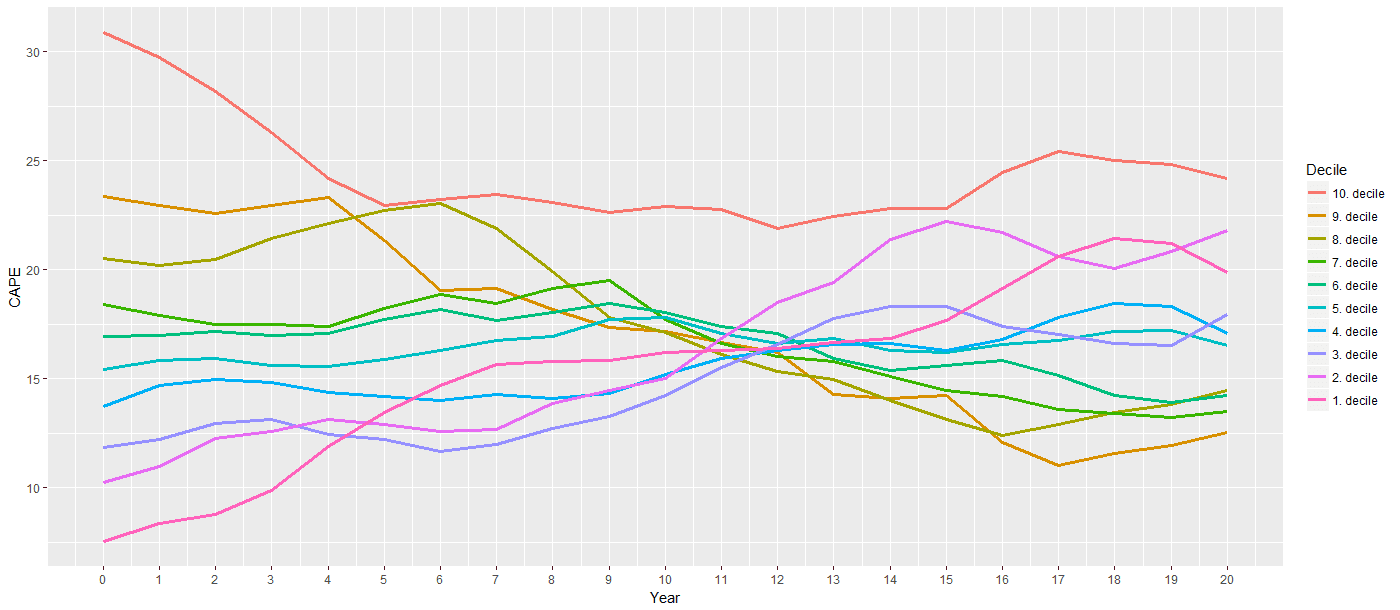

Addressing Investor Concerns About High Stock Market Valuations Bof A

May 03, 2025

Addressing Investor Concerns About High Stock Market Valuations Bof A

May 03, 2025 -

Une Rencontre Inattendue Au Vatican L Histoire Entre Trump Et Macron

May 03, 2025

Une Rencontre Inattendue Au Vatican L Histoire Entre Trump Et Macron

May 03, 2025