Nine African Countries Affected By PwC's Departure

Table of Contents

The Nine Affected African Countries: A Detailed Overview

PwC's departure significantly impacts the following nine African countries:

-

South Africa: PwC South Africa was a major player in the country's auditing and consulting sector, employing thousands and servicing numerous large corporations. Their withdrawal represents a substantial loss of expertise and capacity.

-

Nigeria: PwC Nigeria held a similarly prominent position, advising key players in the Nigerian economy and contributing significantly to the nation’s financial infrastructure. The impact on "PwC Nigeria" operations is significant.

-

Kenya: PwC Kenya played a vital role in the country's development, supporting numerous businesses across various sectors. Their departure leaves a noticeable gap in the market.

-

Ghana: PwC Ghana's operations contributed significantly to the growth and stability of the Ghanaian economy.

-

Egypt: The impact of PwC's withdrawal on Egypt's large and diverse economy is a major concern.

-

Angola: PwC's presence in Angola supported the country's efforts toward economic diversification and sustainable development. Their departure adds another layer of complexity to the nation’s economic challenges.

-

Tanzania: PwC Tanzania's withdrawal could lead to challenges in various sectors reliant on PwC's expertise.

-

Morocco: The significant footprint of PwC Morocco in the country’s business landscape raises concerns about the ability of other firms to meet the growing demand for services.

-

Algeria: PwC Algeria’s expertise in various sectors will be sorely missed. The effect on businesses reliant on their services is a key concern.

Reasons Behind PwC's Withdrawal: Unpacking the Complexities

PwC's reasons for withdrawing from these nine African countries remain somewhat opaque, but several factors likely contributed:

-

Regulatory Changes: Increased scrutiny and evolving regulatory landscapes in some African nations may have increased compliance costs and operational complexities for PwC. "Africa regulatory changes" are impacting multiple sectors.

-

Economic Instability: Economic uncertainty and volatility in several of these countries might have prompted PwC to reassess its risk profile and operational strategy. "African economic challenges" are part of the wider global economic picture.

-

Operational Challenges: Difficulties in navigating complex bureaucratic processes and logistical hurdles within certain countries could have influenced the decision.

-

Strategic Realignment: PwC may be strategically realigning its global operations, focusing resources on markets deemed more profitable or less risky.

Impact on the African Business Landscape: Short-term and Long-term Consequences

PwC's departure has significant short-term and long-term consequences:

Short-term Consequences:

- Job losses among PwC employees in the affected countries.

- Disruption to ongoing projects and engagements with clients.

- Reduced investor confidence in the affected economies.

- Temporary difficulties in accessing high-quality auditing and consulting services.

Long-term Consequences:

- Potential hindrance to economic growth and development in the affected nations.

- Increased reliance on smaller, potentially less experienced firms, potentially impacting service quality.

- Need for regulatory reform to attract and retain international professional services firms.

- A potential increase in the cost of auditing and consulting services due to reduced competition. This impact on "African business impact" will be felt across many sectors.

Alternative Service Providers: Who Will Fill the Gap?

Several other international and local auditing and consulting firms operate in Africa. These include Deloitte, Ernst & Young (EY), KPMG, and numerous regional players. While these firms may be able to absorb some of the workload, they may struggle to fully compensate for PwC's departure. The long-term consequences for "Alternative auditing firms Africa" remain to be seen.

Conclusion

PwC's departure from nine African countries represents a significant event with potentially far-reaching consequences for the continent's economy. The reasons behind this withdrawal are complex, involving regulatory changes, economic instability, and operational challenges. The short-term impact includes job losses and service disruptions, while long-term consequences may include hindered economic growth and increased reliance on smaller firms. The void left by PwC needs to be addressed swiftly and effectively by alternative service providers and through regulatory reforms. What are your thoughts on PwC's departure from nine African countries? Share your opinions and perspectives in the comments section below. Let's discuss the future of auditing and consulting services in Africa in the wake of this significant development regarding "Nine African Countries Affected by PwC's Departure."

Featured Posts

-

Posthumous Pardon Trumps Decision On Pete Roses Baseball Ban

Apr 29, 2025

Posthumous Pardon Trumps Decision On Pete Roses Baseball Ban

Apr 29, 2025 -

Abrz Mealm Fn Abwzby 2024 Bdayt Alerd 19 Nwfmbr

Apr 29, 2025

Abrz Mealm Fn Abwzby 2024 Bdayt Alerd 19 Nwfmbr

Apr 29, 2025 -

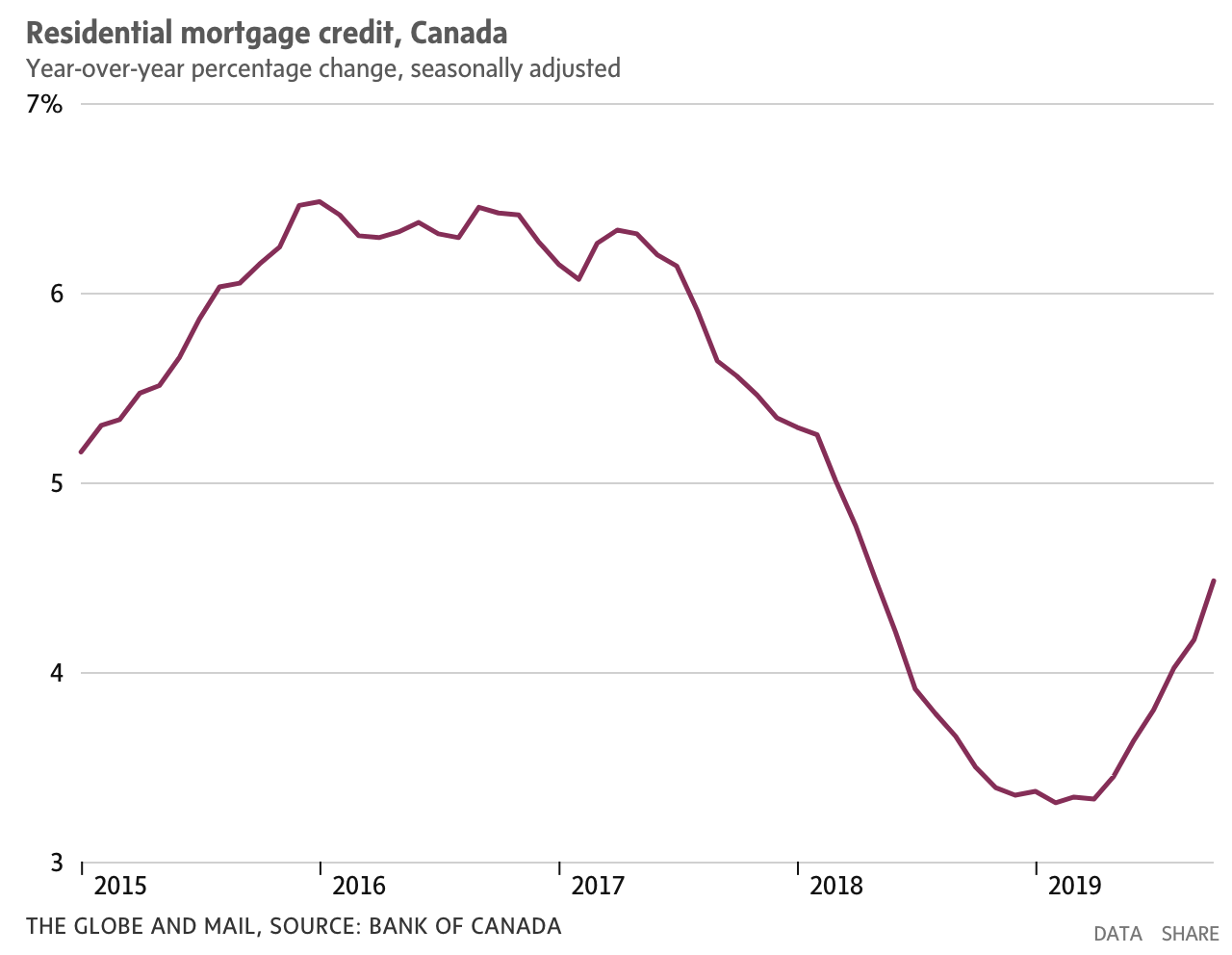

Falling Retail Sales Signal Potential Bank Of Canada Rate Cuts

Apr 29, 2025

Falling Retail Sales Signal Potential Bank Of Canada Rate Cuts

Apr 29, 2025 -

Willie Nelsons Outlaw Music Festival Bob Dylan And Billy Strings In Portland

Apr 29, 2025

Willie Nelsons Outlaw Music Festival Bob Dylan And Billy Strings In Portland

Apr 29, 2025 -

Kevin Bacons Tremor 2 Fact Or Fiction Netflix Series Update

Apr 29, 2025

Kevin Bacons Tremor 2 Fact Or Fiction Netflix Series Update

Apr 29, 2025

Latest Posts

-

Our Farm Next Door A Familys Story Of Farming And Community

Apr 30, 2025

Our Farm Next Door A Familys Story Of Farming And Community

Apr 30, 2025 -

Meet Amanda Clive And The Kids A Day In The Life Of Our Farm Next Door

Apr 30, 2025

Meet Amanda Clive And The Kids A Day In The Life Of Our Farm Next Door

Apr 30, 2025 -

Life On Our Farm Next Door Amanda Clive And Their Family

Apr 30, 2025

Life On Our Farm Next Door Amanda Clive And Their Family

Apr 30, 2025 -

Meet Amanda Clive And Kids A Day In The Life Of Our Farm Next Door

Apr 30, 2025

Meet Amanda Clive And Kids A Day In The Life Of Our Farm Next Door

Apr 30, 2025 -

Our Farm Next Door Amanda Clive And The Kids Country Life

Apr 30, 2025

Our Farm Next Door Amanda Clive And The Kids Country Life

Apr 30, 2025