Omada Health: Andreessen Horowitz Investment Fuels US IPO Bid

Table of Contents

Omada Health, a leading digital health company specializing in chronic disease management, is poised for a significant milestone: a US Initial Public Offering (IPO). Fueling this ambition is a substantial investment from the renowned venture capital firm, Andreessen Horowitz (a16z), which has significantly boosted Omada's growth and market position. This article delves into the details of this crucial investment and its implications for Omada's future in the competitive telehealth market.

Andreessen Horowitz's Investment in Omada Health

Andreessen Horowitz's investment in Omada Health represents a significant vote of confidence in the company's innovative approach to chronic disease management. While the exact investment amount hasn't been publicly disclosed in all instances, its impact is undeniable. a16z's strategic rationale likely stems from Omada's proven ability to improve patient outcomes and reduce healthcare costs through its digital therapeutic programs. This investment isn't just about capital; it also provides access to a16z's extensive network and expertise, further accelerating Omada's growth.

The funding has significantly impacted Omada's expansion plans. It's allowed the company to:

- Expand its reach into new markets and demographics.

- Develop new digital therapeutic programs targeting additional chronic conditions.

- Enhance its technology platform and improve user experience.

- Strengthen its sales and marketing efforts to reach a wider audience.

Omada Health's funding history shows a clear trajectory of growth. Previous funding rounds laid the foundation for the company's current success, with each investment enabling further development and expansion. This strategic layering of investments showcases the belief in Omada’s long-term potential.

- Key Financial Aspects (Illustrative): While precise figures may vary depending on undisclosed rounds, a potential scenario might involve a multi-million dollar investment representing a significant percentage ownership stake for a16z, substantially increasing Omada's valuation.

Omada Health's Business Model and Target Market

Omada Health's core business revolves around providing digital therapeutic programs for individuals with chronic conditions like type 2 diabetes, hypertension, and prediabetes. These programs combine remote patient monitoring, personalized coaching, and behavior change techniques delivered through a user-friendly mobile app and online platform.

Their target market primarily consists of adults aged 45-65, often with existing health conditions and commercial or Medicare Advantage insurance coverage. The market opportunity is substantial, given the growing prevalence of chronic diseases and the increasing demand for convenient, accessible healthcare solutions.

The technology behind Omada's platform is a key differentiator. Their programs leverage evidence-based interventions, integrating data from connected devices (like blood glucose meters and weight scales) to provide personalized feedback and support. Several studies have demonstrated the effectiveness of Omada's programs in improving patient outcomes, leading to increased engagement and better health management.

- Key Features of Omada's Digital Therapeutic Programs:

- Personalized health plans.

- Remote patient monitoring.

- Expert coaching and support.

- Interactive educational materials.

- Progress tracking and reporting.

The US IPO Bid and its Implications

Omada Health's US IPO is expected to take place [Insert projected timeframe if available], with a potential valuation reflecting the company's significant growth and market position. A successful IPO would provide Omada with substantial capital to further expand its operations, enhance its technology, and potentially acquire smaller competitors. For investors, this represents a chance to participate in the growth of a leading player in the rapidly expanding digital health market.

The digital health and telehealth market is highly competitive, with established players and numerous startups vying for market share. However, Omada's strong brand recognition, proven track record, and innovative approach to chronic disease management position it favorably. A successful IPO could significantly reshape the competitive landscape, attracting further investment and innovation within the telehealth sector.

- Expected Benefits for Omada Post-IPO:

- Increased funding for research and development.

- Expansion into new geographical markets.

- Strategic acquisitions to broaden service offerings.

- Enhanced brand awareness and market credibility.

Risks and Challenges Facing Omada Health

Despite its promising prospects, Omada Health faces several challenges. Competition in the digital health space is fierce, with numerous companies offering similar services. Regulatory hurdles and evolving healthcare policies could also impact Omada's operations. Market saturation in certain areas presents a potential threat, necessitating continued innovation and expansion into new markets.

The IPO process itself carries inherent risks, including market volatility and investor sentiment. A downturn in the stock market could negatively impact Omada's valuation and its ability to raise capital. Scaling their digital therapeutic programs effectively will also be a critical challenge, requiring careful management of user engagement, data security, and operational efficiency.

- Key Risk Factors Associated with Omada's IPO Bid:

- Competition from established and emerging players.

- Regulatory changes and healthcare policy shifts.

- Market volatility and investor sentiment.

- Challenges in scaling operations and maintaining user engagement.

- Data security and privacy concerns.

Conclusion

Omada Health's journey towards a US IPO, fueled by significant investment from Andreessen Horowitz, highlights the burgeoning potential of the digital health sector. The company’s innovative approach to chronic disease management and strategic funding positions it for success. However, navigating the competitive landscape and mitigating inherent market risks will be vital for long-term growth. Success will depend on navigating these challenges while continuing to innovate within the dynamic digital health market.

Call to Action: Stay informed about Omada Health’s progress towards its US IPO and the evolving landscape of the digital health market. Follow Omada Health and Andreessen Horowitz for further updates on this exciting development in the telehealth and chronic disease management space. Learn more about Omada Health's innovative approach to digital therapeutics and the impact of venture capital investments in the burgeoning telehealth industry.

Featured Posts

-

Cassidy Hutchinson Jan 6th Testimony And Upcoming Memoir

May 10, 2025

Cassidy Hutchinson Jan 6th Testimony And Upcoming Memoir

May 10, 2025 -

Affordable Elizabeth Arden Skincare At Walmart

May 10, 2025

Affordable Elizabeth Arden Skincare At Walmart

May 10, 2025 -

Sensex And Nifty Live Updates Positive Trading Session Key Highlights

May 10, 2025

Sensex And Nifty Live Updates Positive Trading Session Key Highlights

May 10, 2025 -

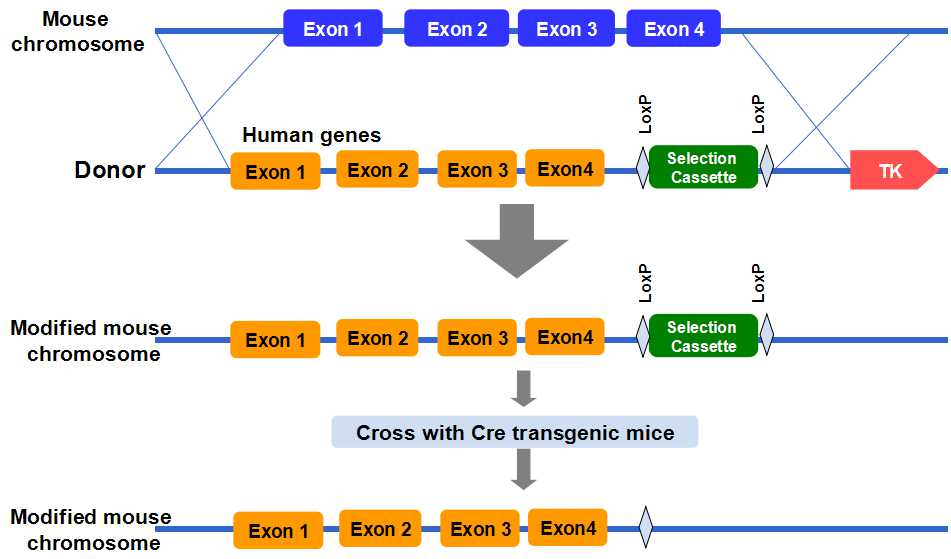

Does Us Government Funding Support Transgender Mouse Research

May 10, 2025

Does Us Government Funding Support Transgender Mouse Research

May 10, 2025 -

Lake Charles Easter Weekend Your Guide To Live Music And Events

May 10, 2025

Lake Charles Easter Weekend Your Guide To Live Music And Events

May 10, 2025