One Crypto Winner Amidst The Trade War Chaos

Table of Contents

The Impact of Trade Wars on Traditional Markets

Trade wars, characterized by escalating tariffs and protectionist measures, create significant negative impacts on traditional markets. The resulting global uncertainty leads to decreased investor confidence, hindering economic growth and potentially triggering a stock market downturn. This uncertainty stems from several key factors:

- Increased tariffs: Higher tariffs translate directly into higher prices for consumers, reducing purchasing power and dampening demand.

- Supply chain disruptions: Trade restrictions lead to disruptions in global supply chains, causing shortages and delays that impact businesses and consumers alike.

- Geopolitical risks: The escalating tensions associated with trade wars increase geopolitical risks, making investors hesitant to commit capital to traditional assets. This results in economic volatility and a flight to safety.

Why Cryptocurrency Remains a Safe Haven Asset

Amidst this instability, cryptocurrencies, particularly Bitcoin, are increasingly viewed as safe haven assets. This is due largely to their decentralized nature and independence from traditional financial systems. Unlike stocks or bonds which are susceptible to government regulations and trade war impacts, cryptocurrencies offer a degree of insulation:

- Decentralization: Bitcoin's decentralized nature minimizes its vulnerability to government policies and trade war fallout. Its operation isn't dependent on any single nation or authority.

- Diversification benefits: Cryptocurrencies often exhibit a low correlation with traditional markets, offering investors valuable portfolio diversification opportunities. This means that even when stock markets decline, cryptocurrencies may not follow suit, reducing overall portfolio risk.

- Increased adoption: The growing adoption of cryptocurrencies by institutional investors and everyday users further strengthens its position as a viable alternative asset class. This growing acceptance is solidifying its status in the global financial ecosystem.

Specific Advantages of Bitcoin During Trade Wars

Bitcoin, in particular, has demonstrated resilience during periods of trade war uncertainty. Several factors contribute to its relative strength:

- Limited supply: Bitcoin's fixed supply of 21 million coins acts as a deflationary mechanism. As demand increases, scarcity drives up value, offering protection against inflation often associated with trade war-induced economic instability.

- Growing institutional adoption: Major corporations and financial institutions are increasingly investing in Bitcoin, signifying growing acceptance and providing further market support.

- Proven track record: Bitcoin has weathered previous market downturns and periods of global uncertainty, demonstrating its resilience and long-term potential. Its proven history boosts investor confidence.

Future Outlook and Investment Considerations

The future performance of Bitcoin in the face of ongoing geopolitical uncertainty remains a complex topic. While its decentralized nature and growing adoption suggest continued growth, investors must also acknowledge potential risks:

- Regulatory uncertainty: Varying government regulations across different countries can affect the price and accessibility of Bitcoin.

- Market volatility: The cryptocurrency market remains highly volatile, and Bitcoin's price can fluctuate significantly in response to various factors.

Despite these risks, Bitcoin's potential for long-term growth remains significant. Careful consideration of a long-term investment strategy is essential:

- Thorough research: Before investing in Bitcoin or any cryptocurrency, conduct comprehensive research and understand the associated risks.

- Diversification: Diversification is crucial for mitigating risk. Don't put all your eggs in one basket, regardless of how promising it may seem.

- Long-term perspective: Bitcoin is a long-term investment, not a get-rich-quick scheme. Short-term price fluctuations should be viewed within the context of its long-term potential.

Conclusion: One Crypto Winner Amidst the Trade War Chaos – Key Takeaways and Call to Action

In conclusion, while trade wars create significant uncertainty in traditional markets, Bitcoin's decentralized nature, limited supply, and growing adoption have allowed it to emerge as a relative winner. Its resilience in the face of global uncertainty highlights the potential benefits of cryptocurrency as part of a diversified investment portfolio. Remember, responsible investing involves thorough research and a balanced approach to risk management. Navigating the complexities of trade wars and global uncertainty? Consider the benefits of including a Bitcoin strategy in your portfolio. Learn more about Bitcoin and its potential to weather economic storms by researching reputable sources and consulting with a financial advisor.

Featured Posts

-

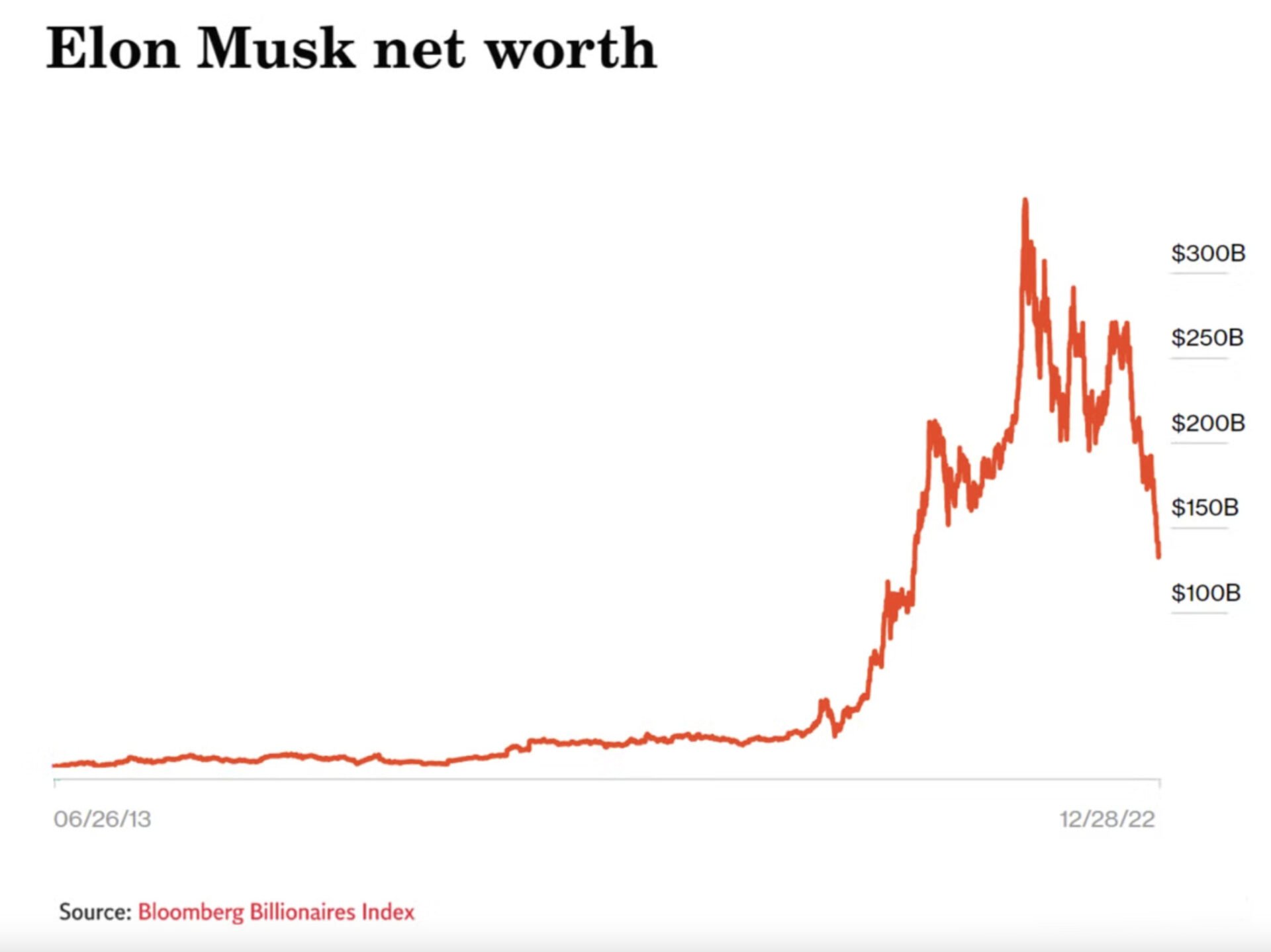

Market Downturn Impacts Elon Musks Net Worth Falling Below 300 Billion

May 09, 2025

Market Downturn Impacts Elon Musks Net Worth Falling Below 300 Billion

May 09, 2025 -

Daycare Costs Skyrocket After Man Pays 3 000 For Babysitting Services

May 09, 2025

Daycare Costs Skyrocket After Man Pays 3 000 For Babysitting Services

May 09, 2025 -

Indonesia Reserve Holdings Fall Impact Of Rupiah Depreciation

May 09, 2025

Indonesia Reserve Holdings Fall Impact Of Rupiah Depreciation

May 09, 2025 -

High Potential Episode 13 Exploring The Role Of David And Its Casting

May 09, 2025

High Potential Episode 13 Exploring The Role Of David And Its Casting

May 09, 2025 -

Man Learns Costly Lesson After 3 000 Babysitting Bill Results In Higher Daycare Fees

May 09, 2025

Man Learns Costly Lesson After 3 000 Babysitting Bill Results In Higher Daycare Fees

May 09, 2025

Latest Posts

-

Summer Walker Opens Up About Life Threatening Delivery

May 09, 2025

Summer Walker Opens Up About Life Threatening Delivery

May 09, 2025 -

Young Thugs Reaction To Not Like U Name Drop After Prison Release

May 09, 2025

Young Thugs Reaction To Not Like U Name Drop After Prison Release

May 09, 2025 -

Is Young Thugs Back Outside Album Finally Coming Soon A Look At The Rollout

May 09, 2025

Is Young Thugs Back Outside Album Finally Coming Soon A Look At The Rollout

May 09, 2025 -

Summer Walker Reveals Near Death Experience During Childbirth

May 09, 2025

Summer Walker Reveals Near Death Experience During Childbirth

May 09, 2025 -

Young Thugs Back Outside Anticipation Builds For Upcoming Album

May 09, 2025

Young Thugs Back Outside Anticipation Builds For Upcoming Album

May 09, 2025