Operation Sindoor And Its Fallout: Analyzing The KSE 100 Crash

Table of Contents

Understanding Operation Sindoor

Operation Sindoor, a [briefly describe the nature of the operation, e.g., crackdown on alleged financial crimes], sparked significant controversy due to its [mention the controversial aspects, e.g., methods, targets, lack of transparency]. Its aims were ostensibly to [state the official aims of the operation], but the operation's execution and the lack of clear communication fueled widespread speculation and uncertainty.

- Key players involved: [List key individuals and organizations involved]

- Alleged targets: [Describe the alleged targets of the operation]

- Methods employed: [Detail the methods used during the operation, highlighting controversial aspects]

- Initial reactions and media coverage: [Describe the immediate public and media response, focusing on the uncertainty and speculation it created.]

The Immediate Impact on the KSE 100

The immediate aftermath of Operation Sindoor witnessed a sharp decline in the KSE 100 index. The market reacted swiftly and negatively to the uncertainty and perceived risk associated with the operation.

- Percentage drop in the KSE 100 index: [State the exact percentage drop]

- Volatility and trading volume: [Describe the heightened volatility and trading activity during the crash]

- Specific sectors most affected: [Identify the sectors most severely impacted, e.g., banking, energy, technology, explaining why.]

- Investor sentiment and panic selling: [Analyze the prevailing investor sentiment and the extent of panic selling]

- Government response to the market crash: [Outline the government's immediate response and any measures taken to stabilize the market.]

Long-Term Effects and Economic Fallout

The KSE 100 crash resulting from Operation Sindoor had far-reaching and long-lasting consequences for the Pakistani economy. The initial shockwaves rippled through various sectors, impacting investor confidence and foreign investment.

- Impact on foreign investment: [Analyze the decrease in foreign direct investment (FDI) following the crash]

- Changes in investor confidence: [Discuss the decline in investor confidence and its effect on future investment decisions]

- Effect on overall economic growth: [Assess the impact on GDP growth and overall economic performance]

- Government policies implemented: [Describe any long-term economic policies implemented by the government in response to the crisis]

- Long-term recovery of the KSE 100: [Analyze the timeline and extent of the KSE 100's recovery after the crash]

Analyzing the Contributing Factors

While Operation Sindoor was a major catalyst for the KSE 100 crash, other factors contributed to the severity of the downturn. Understanding these contributing factors provides a more comprehensive picture of the crisis.

- Pre-existing economic vulnerabilities: [Identify existing weaknesses in the Pakistani economy that exacerbated the impact of Operation Sindoor]

- Geopolitical factors: [Discuss any relevant geopolitical events that influenced investor sentiment and market stability]

- Regulatory issues and market oversight: [Analyze potential regulatory failures or shortcomings that contributed to the market instability]

- Speculation and market manipulation: [Examine the role of speculation and potential market manipulation in amplifying the crash]

Lessons Learned and Future Implications

The Operation Sindoor and KSE 100 crash offer valuable lessons for Pakistan's financial markets and policymakers. Addressing the vulnerabilities exposed by this crisis is crucial for preventing similar events in the future.

- Importance of market transparency and regulation: [Emphasize the need for greater transparency and robust market regulations]

- Strengthening investor protection mechanisms: [Discuss improvements needed to protect investors from future market shocks]

- Improving macroeconomic stability: [Highlight the need for sound macroeconomic policies to mitigate future crises]

- The need for better risk management: [Stress the importance of effective risk management strategies for investors and financial institutions]

- Preventing similar crises in the future: [Offer suggestions for preventative measures and proactive strategies to avoid future market crashes]

Conclusion

The connection between Operation Sindoor and the subsequent KSE 100 crash is undeniable, highlighting the significant economic repercussions of politically charged actions on market stability. The long-term consequences, including decreased foreign investment and reduced investor confidence, underscore the need for better risk management and regulatory oversight. Understanding the intricacies of the "Operation Sindoor" and its impact on the KSE 100 crash is crucial for navigating future market volatility in Pakistan. Further research into this event and similar market crises is essential for investors and policymakers alike. Continue learning about the impact of significant events on the Pakistani stock market and effectively mitigate future risks associated with events like "Operation Sindoor," ensuring a more resilient and stable financial future.

Featured Posts

-

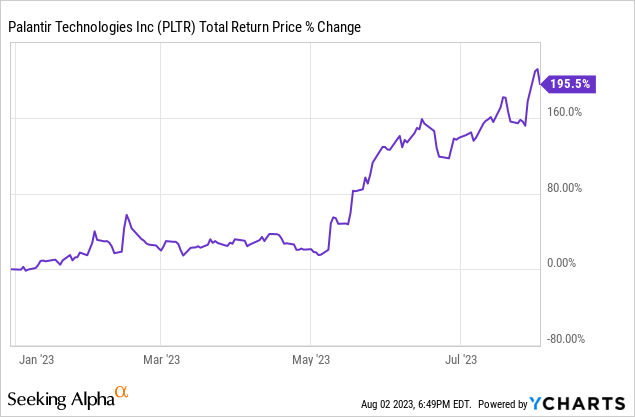

Should You Invest In Palantir Stock Before May 5th A Detailed Look

May 10, 2025

Should You Invest In Palantir Stock Before May 5th A Detailed Look

May 10, 2025 -

The Bangkok Post And The Ongoing Struggle For Transgender Equality

May 10, 2025

The Bangkok Post And The Ongoing Struggle For Transgender Equality

May 10, 2025 -

Palantirs 30 Price Drop A Deeper Look

May 10, 2025

Palantirs 30 Price Drop A Deeper Look

May 10, 2025 -

Hollywoods Biggest Strike In Decades Actors And Writers Demand Fair Treatment

May 10, 2025

Hollywoods Biggest Strike In Decades Actors And Writers Demand Fair Treatment

May 10, 2025 -

Chinas Canola Imports A Diversification Strategy

May 10, 2025

Chinas Canola Imports A Diversification Strategy

May 10, 2025