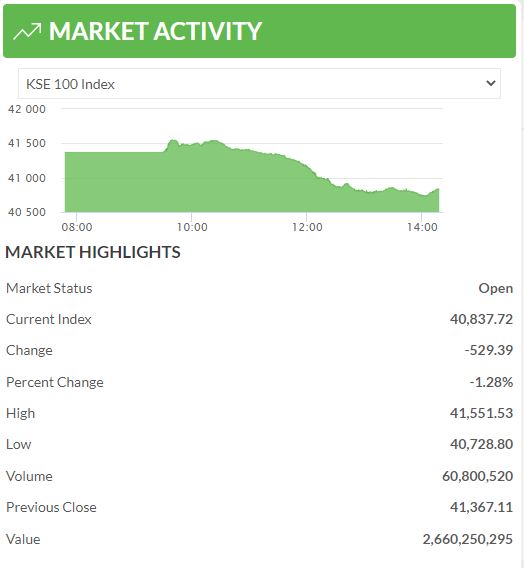

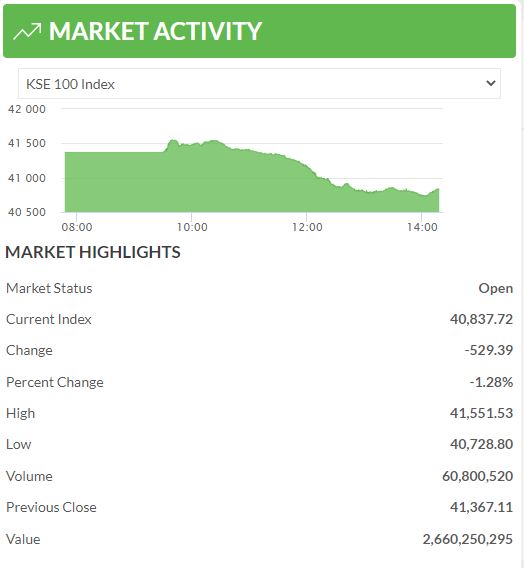

Operation Sindoor: Pakistan Stock Market Plunges, KSE 100 Halted

Table of Contents

The Causes of the "Operation Sindoor" Market Plunge

The sudden and sharp decline in the Pakistan Stock Market, leading to the suspension of the KSE 100, wasn't a singular event but a confluence of factors. Understanding these contributing elements is crucial to comprehending the severity of the "Operation Sindoor" crisis.

Political Instability and Uncertainty

Political instability played a significant role in triggering the market downturn. Investor confidence is highly sensitive to political developments, and Pakistan's recent political landscape has been characterized by significant uncertainty.

- Specific political events: [Insert specific recent political events, e.g., changes in government, policy disagreements, etc.]. These events created a climate of uncertainty, discouraging both domestic and foreign investment.

- Policy changes: [Insert details on any sudden or unexpected policy changes that negatively impacted investor confidence]. These abrupt shifts created confusion and fueled speculation.

- Impact on investor sentiment: The resulting uncertainty led to a significant decrease in investor confidence, prompting many to withdraw their investments, leading to capital flight.

- Foreign investment outflow: [Insert data or statistics about foreign investment outflow during this period, citing credible sources]. This outflow further exacerbated the pressure on the market.

Economic Factors Fueling the Crisis

Beyond political factors, a range of economic indicators contributed to the market crash. The Pakistani economy was already grappling with several challenges before the "Operation Sindoor" event.

- Inflation rates: [Insert current inflation data and its impact on the economy and investor confidence]. High inflation erodes purchasing power and discourages investment.

- Currency devaluation: [Insert details about the devaluation of the Pakistani Rupee and its impact on import costs and investor sentiment]. A weakening currency increases the cost of imports and reduces investor confidence.

- Rising interest rates: [Insert details about interest rate hikes and their impact on borrowing costs and business investments]. Higher interest rates increase borrowing costs, hindering economic growth.

- Balance of payments issues: [Insert details about Pakistan's balance of payments situation and its impact on market stability]. A widening current account deficit further weakens the economy and investor confidence.

Speculation and Panic Selling

Market speculation and subsequent panic selling played a crucial role in exacerbating the "Operation Sindoor" crash. Fear and uncertainty fueled a rapid sell-off.

- Speculative trading: [Give examples of speculative trading activities that contributed to the market volatility]. This amplified the downturn.

- Herd behavior: [Explain how herd behavior among investors contributed to the rapid sell-off]. Investors often mimic each other's actions, leading to amplified market movements.

- Market contagion: [Explain how negative news spread rapidly, creating a contagion effect]. The rapid spread of negative news through social media and traditional channels fueled panic.

- Impact of fear: Fear and uncertainty are powerful drivers in market crashes. Investors, fearing further losses, rushed to sell their assets, creating a downward spiral.

Impact of the KSE 100 Halt and Market Volatility

The halting of the KSE 100 index had immediate and far-reaching consequences for the Pakistan Stock Market and the broader economy.

Immediate Consequences of the Halt

The immediate impact of the KSE 100 halt was significant and disruptive.

- Trading suspensions: The halt disrupted normal trading activities, leaving investors unable to buy or sell stocks.

- Investor losses: [Quantify the financial losses suffered by investors as a result of the market crash]. Many investors experienced substantial losses.

- Impact on listed businesses: The crash negatively affected businesses listed on the PSX, hindering their ability to raise capital.

- Disruption to market functioning: The halt significantly disrupted the smooth functioning of the stock market, creating uncertainty and anxiety.

Long-Term Implications for the Pakistani Economy

The "Operation Sindoor" crash has serious long-term implications for the Pakistani economy.

- Impact on foreign direct investment: The crash could deter foreign direct investment (FDI) in the future, hindering economic growth.

- Economic growth prospects: The market crash threatens to significantly slow down Pakistan's economic growth prospects.

- Government intervention measures: The government's response and its effectiveness will be crucial in determining the long-term recovery.

- Potential for prolonged downturn: There's a risk of a prolonged economic downturn if the underlying economic and political issues aren't addressed effectively.

Analyzing the Future of the Pakistan Stock Market Post "Operation Sindoor"

The future of the Pakistan Stock Market hinges on several factors, including government intervention and investor sentiment.

Government Intervention and Recovery Measures

The government's response to the "Operation Sindoor" crisis will play a crucial role in shaping the market's future.

- Policy changes: [Describe any policy changes implemented by the government to address the crisis]. These changes will influence investor confidence.

- Economic stimulus packages: [Detail any economic stimulus packages introduced to boost the economy]. The effectiveness of these measures will be crucial.

- Regulatory reforms: [Explain any regulatory reforms aimed at improving market stability and transparency]. These reforms are essential for rebuilding investor trust.

- Effectiveness of measures: The success of the government's response in restoring stability and confidence will determine the speed of market recovery.

Investor Sentiment and Confidence

Rebuilding investor confidence is paramount for the Pakistan Stock Market's recovery.

- Investor sentiment surveys: [Cite any relevant investor sentiment surveys or analyses]. These surveys will provide insights into the prevailing mood.

- Potential for market rebound: The potential for a market rebound depends on addressing the underlying economic and political challenges.

- Long-term investment strategies: Investors need to develop long-term strategies that account for the inherent risks in emerging markets.

- Investment opportunities/risks: While there might be potential opportunities in the long term, investors need to carefully assess the risks before committing funds.

Conclusion: Navigating the Aftermath of "Operation Sindoor" in the Pakistan Stock Market

The "Operation Sindoor" market crash highlights the fragility of the Pakistan Stock Market and its vulnerability to political instability and economic headwinds. The KSE 100 halt underscored the severity of the situation and its impact on investor confidence. Rebuilding the market requires addressing the underlying economic and political challenges, implementing effective government interventions, and restoring investor confidence. Navigating this period requires careful analysis, informed decision-making, and a thorough understanding of the risks involved. Stay informed about the evolving situation, conduct thorough research before making any investment decisions, and consider consulting a financial advisor before investing in the Pakistan Stock Market and KSE 100 during this period of heightened volatility. Remember, understanding the risks associated with investing in volatile markets is crucial for protecting your capital.

Featured Posts

-

10 Unmissable Film Noir Films A Critics Picks

May 10, 2025

10 Unmissable Film Noir Films A Critics Picks

May 10, 2025 -

Bbc Strictly Come Dancing Wynne Evans Statement On Potential Return

May 10, 2025

Bbc Strictly Come Dancing Wynne Evans Statement On Potential Return

May 10, 2025 -

How Luis Enrique Reshaped Paris Saint Germain A Winning Strategy

May 10, 2025

How Luis Enrique Reshaped Paris Saint Germain A Winning Strategy

May 10, 2025 -

The Pam Bondi Video A Deeper Look At Her Statements On American Citizens

May 10, 2025

The Pam Bondi Video A Deeper Look At Her Statements On American Citizens

May 10, 2025 -

Russian Gas Pipeline Elliotts Exclusive Investment Strategy Revealed

May 10, 2025

Russian Gas Pipeline Elliotts Exclusive Investment Strategy Revealed

May 10, 2025