Pakistan's IMF Bailout: $1.3 Billion Review Amidst Regional Tensions

Table of Contents

The Current Economic Climate in Pakistan

Pakistan's economy is facing a multitude of challenges that significantly impact the IMF review process. These challenges are deeply interconnected, creating a complex and precarious situation. Key issues include:

-

High Inflation Rates: Soaring inflation rates are eroding purchasing power, leading to widespread social unrest and impacting the stability of the Pakistani Rupee. This makes it difficult for the government to implement austerity measures required by the IMF.

-

Shrinking Foreign Exchange Reserves: Pakistan's dwindling foreign exchange reserves are a major source of concern. This has led to a significant devaluation of the Pakistani Rupee, further exacerbating inflation and increasing the cost of imports. The dwindling reserves directly threaten the country's ability to service its debt and import essential goods.

-

Mounting Public Debt: Pakistan's public debt is unsustainable, requiring urgent debt restructuring negotiations with both domestic and international creditors. The burden of debt servicing diverts funds from crucial social programs and development initiatives.

-

Climate Change Impacts: Pakistan is highly vulnerable to climate change, with extreme weather events causing significant economic damage. Recent devastating floods have further strained the already fragile economy, requiring substantial resources for relief and recovery efforts.

-

Social and Political Instability: Ongoing social and political instability further complicates the economic situation. Uncertainty surrounding the political landscape discourages investment and hinders economic recovery efforts. These factors are deeply intertwined, creating a vicious cycle of economic hardship and political turmoil. The IMF will closely monitor these factors as part of their review.

The IMF's Conditions and Pakistan's Compliance

The IMF's $1.3 billion loan is contingent upon Pakistan implementing significant structural and fiscal reforms. These reforms, while necessary for long-term economic stability, are politically challenging and unpopular. Key conditions include:

-

Fiscal Consolidation Measures: The IMF demands significant cuts in government spending and an increase in tax revenue. This necessitates difficult choices regarding subsidies, public sector employment, and social programs.

-

Monetary Policy Adjustments: The IMF will require Pakistan to maintain a tight monetary policy to curb inflation. This may involve raising interest rates, which can further stifle economic growth in the short term.

-

Structural Reforms: The IMF will likely push for reforms in various sectors, including privatization of state-owned enterprises and improvements in governance and transparency. These reforms often face strong resistance from vested interests.

-

Political Challenges: Implementing these unpopular reforms will be a significant political challenge for the government. Balancing the need for economic stability with maintaining public support will be crucial.

-

Renegotiation Potential: Given the exceptional circumstances facing Pakistan, there is a possibility of some renegotiation of the conditions, although the IMF will likely insist on substantial progress towards fiscal sustainability.

Geopolitical Implications and Regional Tensions

The geopolitical landscape significantly impacts Pakistan's economic stability and the IMF's assessment. Several factors are at play:

-

Regional Instability: Regional tensions, particularly the ongoing conflict in Afghanistan and strained relations with India, create uncertainty and hinder economic growth. These tensions can divert resources away from development and exacerbate existing economic vulnerabilities.

-

Influence of External Actors: External actors, including China and other regional players, can influence the IMF's decision-making process, either directly or indirectly. Their involvement adds another layer of complexity to the situation.

-

Impact of Afghanistan: The instability in Afghanistan has significant spillover effects on Pakistan's economy, including increased security costs, refugee flows, and disruptions to trade.

-

China-Pakistan Economic Corridor (CPEC): The CPEC's future plays a critical role in Pakistan's economic outlook. Any setbacks to the project could have significant negative consequences.

The Potential Outcomes of the IMF Review

The IMF review could lead to several different outcomes, each with significant consequences:

-

Scenario 1: Successful Review and Disbursement: A successful review would lead to the disbursement of the $1.3 billion loan, providing some much-needed financial relief and boosting investor confidence. However, successful implementation of the IMF's conditions remains crucial for long-term success.

-

Scenario 2: Partial Disbursement: The IMF might agree to a partial disbursement, contingent upon Pakistan achieving further progress on specific reforms. This would provide some short-term relief but leaves Pakistan's long-term economic stability uncertain.

-

Scenario 3: Failure of the Review and Potential Default: A failure of the review would likely lead to a default on Pakistan's debt, triggering a severe economic crisis with potentially devastating consequences for the country. International relations would also be significantly impacted.

Conclusion

The $1.3 billion IMF bailout review is a critical juncture for Pakistan's economic future. The success of the review hinges on Pakistan's ability to meet the IMF's conditions while navigating a challenging economic climate and complex geopolitical landscape. The potential outcomes range from a successful economic recovery to a potentially devastating default. Understanding the nuances of this situation is crucial for comprehending the future economic stability of Pakistan and the wider regional implications. Stay informed about the developments in Pakistan's IMF bailout negotiations and follow our updates for further insights and analysis on the Pakistan IMF bailout.

Featured Posts

-

The Unthinkable A Family Torn Apart By A Racist Killing

May 10, 2025

The Unthinkable A Family Torn Apart By A Racist Killing

May 10, 2025 -

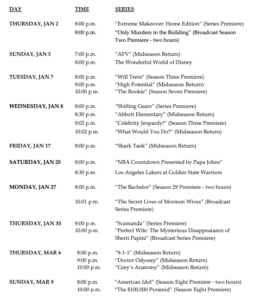

Why Abc Is Re Airing High Potential Episodes In March 2025

May 10, 2025

Why Abc Is Re Airing High Potential Episodes In March 2025

May 10, 2025 -

Four New Theories On Randall Flagg That Redefine Your Understanding Of Stephen Kings Work

May 10, 2025

Four New Theories On Randall Flagg That Redefine Your Understanding Of Stephen Kings Work

May 10, 2025 -

Operation Sindoor And Its Fallout Analyzing The Kse 100 Crash

May 10, 2025

Operation Sindoor And Its Fallout Analyzing The Kse 100 Crash

May 10, 2025 -

Stephen Kings 2024 Movie Slate The Monkey And Beyond

May 10, 2025

Stephen Kings 2024 Movie Slate The Monkey And Beyond

May 10, 2025