Palantir Stock: Analyst Forecasts Adjusted After Price Increase

Table of Contents

Pre-Increase Analyst Sentiment and Predictions

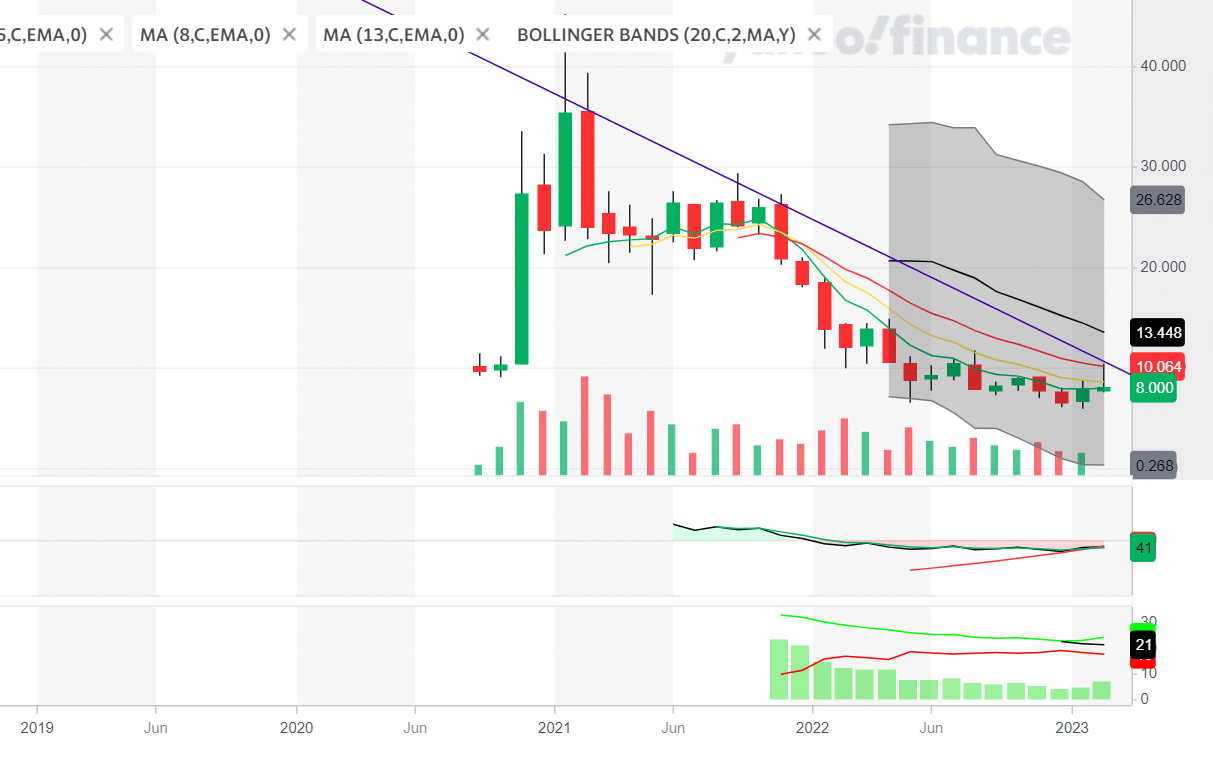

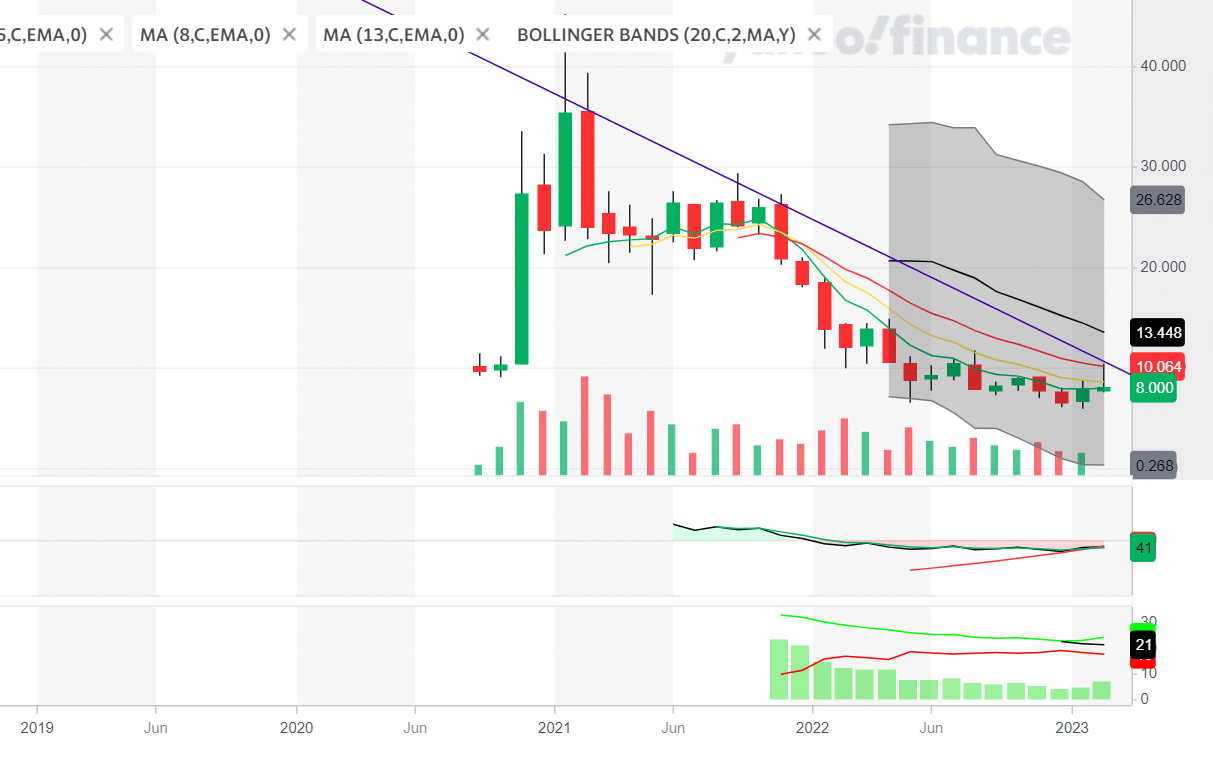

Before the recent price surge, analyst sentiment towards Palantir stock was mixed, with price targets varying considerably.

Average Price Targets Before the Surge

Prior to the recent increase, the average price target for Palantir stock among analysts ranged from $8 to $15, depending on the firm and their specific methodology. For example, some firms, like (Note: Replace with actual examples and citations if available), projected more conservative growth, while others anticipated a more significant upward trajectory based on different interpretations of Palantir's revenue streams and market penetration.

- Range of price targets: The significant variation in price targets reflected differing opinions on Palantir's long-term growth potential and its ability to penetrate new markets.

- Significant variations: The differences highlight the inherent uncertainty in predicting the future performance of a high-growth technology company like Palantir.

- Reasoning behind forecasts: Pre-increase forecasts were largely based on projections of revenue growth driven by increased adoption of Palantir's data analytics platform across both government and commercial sectors. Market share gains and successful expansion into new markets also featured prominently in these predictions.

Factors Driving the Palantir Stock Price Increase

The recent Palantir stock price increase was fueled by a confluence of positive factors.

Positive News and Catalysts

Several positive announcements and market trends contributed to the recent surge in Palantir's stock price.

- Stronger-than-expected earnings reports: Exceeding earnings expectations often signals robust financial health and future growth potential, boosting investor confidence.

- New contracts or partnerships: Securing significant new contracts, especially with large enterprise clients or government agencies, can dramatically increase revenue projections and investor optimism.

- Positive industry trends: Favorable trends in the data analytics and artificial intelligence sectors provide a tailwind for Palantir and its growth prospects.

- Increased institutional investor interest: Increased buying pressure from large institutional investors can significantly impact a stock's price.

- Short squeezes: In some cases, a short squeeze, where investors who bet against the stock are forced to buy it to cover their positions, can propel prices upward.

Revised Analyst Forecasts Post-Price Increase

The price increase prompted analysts to revise their price targets and ratings for Palantir stock.

Updated Price Targets and Ratings

Following the price surge, the average analyst price target for Palantir increased significantly, reflecting a more bullish outlook. Some analysts even upgraded their ratings from "Hold" or "Sell" to "Buy."

- Revised average price target: The new average price target reflects a reassessment of Palantir's valuation in light of the recent price increase and the underlying factors driving it.

- Changes in analyst ratings: Upgrades in analyst ratings signal increased confidence in Palantir's future performance.

- Reasoning behind revised forecasts: The revised forecasts incorporate the positive developments that triggered the price increase, leading to higher revenue expectations and a reassessment of Palantir's long-term growth trajectory.

- Bullish or Bearish Outlook: The shift in average price targets and ratings largely indicates a more bullish sentiment among analysts.

Evaluating the Long-Term Outlook for Palantir Stock

While the recent price increase is positive, investors should consider both the opportunities and risks associated with Palantir.

Risks and Opportunities

Palantir's long-term growth prospects depend on several factors.

- Competition: The data analytics market is highly competitive, with established players and new entrants constantly vying for market share.

- Government contracts: Palantir's reliance on government contracts introduces a degree of risk related to government spending and policy changes.

- Innovation: Palantir's ability to innovate and develop new products and services will be crucial to maintaining its competitive edge.

- Market conditions: Macroeconomic factors and overall market conditions can significantly impact the performance of technology stocks.

Implications for Investors

Investors considering Palantir stock should adopt a strategic approach.

Strategies for Navigating the Market

Investing in Palantir requires careful consideration.

- Risk tolerance: Assess your risk tolerance before investing in a high-growth, potentially volatile stock like Palantir.

- Diversification: Diversify your portfolio to mitigate risk. Don't put all your eggs in one basket.

- Due diligence: Conduct thorough due diligence before making any investment decisions.

- Investment horizon: Consider your investment horizon – long-term investors may be more tolerant of short-term price fluctuations.

Conclusion

Analyst forecasts for Palantir stock have undergone significant adjustments following the recent price increase. The surge was driven by a combination of strong earnings, new contracts, positive industry trends, and potentially increased institutional investor interest. While analysts now generally hold a more bullish outlook, investors should acknowledge both the opportunities and risks involved. While analyst forecasts for Palantir stock offer valuable insights, thorough research and a well-defined investment strategy remain crucial. Continue to monitor Palantir's stock performance and analyst updates to make informed decisions about your investment. Stay updated on future Palantir stock predictions to optimize your portfolio.

Featured Posts

-

Warren Buffett Jeff Bezos Among Billionaires Hurt By Trump Tariffs

May 10, 2025

Warren Buffett Jeff Bezos Among Billionaires Hurt By Trump Tariffs

May 10, 2025 -

Trumps Transgender Military Ban Unpacking The Controversy

May 10, 2025

Trumps Transgender Military Ban Unpacking The Controversy

May 10, 2025 -

Dakota Johnsons Figure Hugging Dress A Materialists Premiere Highlight

May 10, 2025

Dakota Johnsons Figure Hugging Dress A Materialists Premiere Highlight

May 10, 2025 -

Trumps 10 Tariff Threat Conditions For Exceptions

May 10, 2025

Trumps 10 Tariff Threat Conditions For Exceptions

May 10, 2025 -

Inquiry Into Nottingham Attacks Retired Judge Takes The Lead

May 10, 2025

Inquiry Into Nottingham Attacks Retired Judge Takes The Lead

May 10, 2025