Trump's 10% Tariff Threat: Conditions For Exceptions

Table of Contents

Eligibility Criteria for Tariff Exemptions

Securing a tariff exclusion wasn't automatic. Businesses needed to meet specific eligibility requirements to even apply. The process, overseen by the Office of the U.S. Trade Representative (USTR), focused on demonstrating genuine hardship or national interest considerations. Generally, applicants had to prove that:

- Domestic Unavailability: The product wasn't readily available in the U.S. in sufficient quantities and quality.

- Significant Economic Hardship: The tariff imposed an undue burden on the business, potentially leading to job losses or significant financial distress.

- National Security Implications: The tariff impacted products critical to national security or defense.

The USTR played a critical role, acting as the gatekeeper for tariff exclusion requests. They reviewed applications rigorously, considering the broader economic context and potential implications of granting exemptions. The application process was competitive, with a limited number of exceptions granted relative to the number of applications received.

The Evidence Required for a Successful Application

A successful exemption request hinged on providing compelling supporting documentation. The USTR expected clear, concise, and persuasive evidence substantiating the claims made in the application. Businesses needed to demonstrate their case convincingly, providing:

- Detailed Financial Data: Demonstrating the financial impact of the tariffs on the applicant's business, including sales figures, profit margins, and employment levels.

- Market Research: Providing comprehensive market analysis to illustrate the lack of domestic alternatives and the competitive landscape.

- Supply Chain Analysis: Showing the applicant's reliance on the specific imported goods and the difficulty of sourcing comparable products domestically.

The quality of evidence was crucial. Poorly presented or insufficient data significantly reduced the chances of application approval. Common mistakes included vague statements, unsupported assertions, and a failure to address potential counterarguments.

The USTR Review Process and Timeline

The USTR review process involved several steps, from initial application submission to final decision. While the exact application timeline varied, applicants generally faced a waiting period of several months. Factors affecting processing time included:

- Volume of Applications: The sheer number of exemption requests submitted could create significant delays.

- Complexity of Cases: Applications requiring extensive analysis or involving contentious issues naturally took longer to process.

- Resource Constraints: Limited resources within the USTR could also contribute to processing delays.

Applicants could face challenges throughout this process. Understanding the potential for delays and having a strategy for addressing them proactively was essential.

Post-Approval Monitoring and Compliance

Securing a tariff exception wasn't a permanent solution. Businesses granted exemptions faced ongoing compliance requirements. Maintaining accurate records and adhering to reporting obligations was critical. Failure to comply with these post-approval stipulations could lead to:

- Revocation of the Exception: The USTR could revoke the granted exemption if non-compliance was discovered.

- Financial Penalties: Businesses might face significant financial penalties for violating the terms of the exception.

- Reputational Damage: Non-compliance could tarnish a company's reputation and damage its relationships with governmental agencies.

Impact of the 10% Tariff and its Exceptions on Businesses

Trump's 10% import tariffs, and the subsequent tariff exceptions, had a far-reaching impact on businesses. Some companies successfully navigated the complexities of the application process, securing tariff exclusions that mitigated the negative effects of the tariffs. However, many others struggled, facing increased costs, reduced competitiveness, and potential job losses.

Case studies showed a wide spectrum of outcomes, highlighting the importance of strategic planning and proactive engagement with the USTR. The long-term implications of these tariffs are still being analyzed, impacting global trade and strategic business decisions.

Conclusion: Protecting Your Business from Trump's 10% Tariff Threat

Successfully navigating the complexities of Trump tariffs and securing tariff exceptions required meticulous preparation and thorough documentation. Understanding the eligibility requirements, gathering compelling evidence, and managing the USTR review process were all critical elements. Businesses that proactively addressed these aspects were better positioned to overcome the challenges posed by the 10% tariff. If you're facing challenges with trade compliance or require assistance with your tariff exception application, seeking professional legal advice is highly recommended. Understanding the nuances of Trump's 10% tariff and the conditions for exceptions is crucial for navigating the complexities of international trade. Don't wait – take proactive steps to assess your eligibility for tariff exceptions today! [Link to relevant resource 1] [Link to relevant resource 2]

Featured Posts

-

Report Uk Plans To Restrict Visas From Pakistan Nigeria And Sri Lanka

May 10, 2025

Report Uk Plans To Restrict Visas From Pakistan Nigeria And Sri Lanka

May 10, 2025 -

Trumps Surgeon General Nominee Implications Of Choosing Casey Means

May 10, 2025

Trumps Surgeon General Nominee Implications Of Choosing Casey Means

May 10, 2025 -

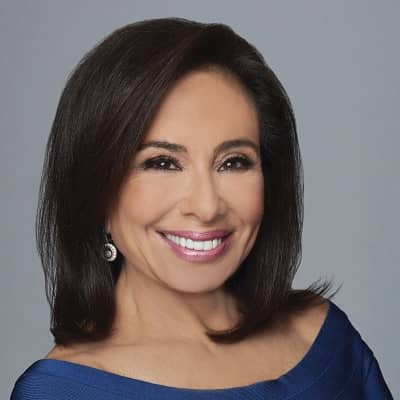

Stock Market Prediction Jeanine Pirros Advice To Investors

May 10, 2025

Stock Market Prediction Jeanine Pirros Advice To Investors

May 10, 2025 -

Us Funding Of Transgender Mouse Research Fact Or Fiction

May 10, 2025

Us Funding Of Transgender Mouse Research Fact Or Fiction

May 10, 2025 -

El Bolso Hereu De Dakota Johnson Minimalista Practico Y Tendencia

May 10, 2025

El Bolso Hereu De Dakota Johnson Minimalista Practico Y Tendencia

May 10, 2025