Palantir Stock Down 30%: Is This A Buying Opportunity?

Table of Contents

Understanding Palantir's Business Model and Recent Performance

Palantir Technologies is a prominent player in the big data analytics market, offering sophisticated software platforms designed to help organizations analyze vast amounts of complex data. Its core offerings, Gotham and Foundry, cater to both government and commercial clients. Gotham, focusing on government and defense contracts, leverages Palantir's expertise in data integration and analysis for national security and intelligence applications. Foundry, targeted toward commercial enterprises, enables organizations to leverage their data for improved operational efficiency and strategic decision-making.

Analyzing Palantir's recent financial performance is crucial for assessing the current situation. While revenue growth has been impressive in some quarters, profitability remains a key focus for the company. Let's review some key performance indicators (KPIs):

- Revenue growth in Q[insert latest quarter]: [Insert actual data here. For example: "Q2 2024 showed a revenue increase of X% year-over-year."]

- Profitability margins (gross & operating): [Insert actual data here. Example: "Gross margins were Y%, while operating margins were Z%."]

- Customer churn rate: [Insert actual data or range here. Example: "Customer churn remained relatively stable at approximately A%."]

- Government vs. Commercial revenue breakdown: [Insert actual data here showcasing the percentage breakdown. Example: "Government contracts accounted for approximately B% of total revenue, while commercial clients contributed the remaining C%."]

- Recent contract wins/losses: [Mention significant contract wins or losses and their potential impact on future revenue.]

Analyzing these KPIs alongside the broader market context provides a more complete understanding of Palantir's current financial health and future prospects.

Factors Contributing to the 30% Stock Price Drop

The significant 30% drop in Palantir's stock price is likely a confluence of factors. Macroeconomic conditions have played a considerable role. Rising interest rates, increased inflation, and a general market correction have all negatively impacted growth stocks like Palantir.

Company-specific factors also contribute to the decline. Competition in the data analytics market is fierce, with established players and emerging competitors vying for market share. Concerns about slower-than-expected growth and the company's path to sustained profitability might also be influencing investor sentiment. Let's delve into specifics:

- Impact of rising interest rates on growth stocks: Higher interest rates increase the discount rate used in valuation models, making future earnings less valuable and thus impacting the present stock price.

- Competitive landscape analysis (mention key competitors): Companies like [mention key competitors, e.g., Databricks, Snowflake] pose significant competitive challenges.

- Analysis of recent news or announcements that might have affected the stock price: [Analyze recent news releases, earnings calls, or any other announcements that could have negatively affected investor confidence.]

- Investor sentiment and analyst ratings: A shift in analyst ratings or a decline in overall investor confidence can significantly impact a stock's price.

Evaluating the Risk and Reward of Investing in Palantir Now

Investing in Palantir at its current valuation involves both significant risks and potential rewards. The stock's high volatility makes it a risky investment, especially for risk-averse investors. There's a possibility of further price drops, particularly if the macroeconomic environment deteriorates or the company faces unforeseen challenges.

However, the potential rewards could be substantial. Palantir operates in a rapidly growing market with significant long-term growth potential. If the company can successfully navigate the competitive landscape and achieve sustained profitability, the stock price could recover and potentially generate significant returns for long-term investors.

Different investment strategies can help mitigate risks:

- Potential upside and downside scenarios: Outline potential scenarios based on various growth rates and market conditions.

- Comparison to other similar companies in the market: Compare Palantir's valuation and growth potential to competitors.

- Risk tolerance assessment for different investor profiles: Consider the suitability of Palantir as an investment based on different risk tolerance levels.

Alternative Investment Options and Diversification

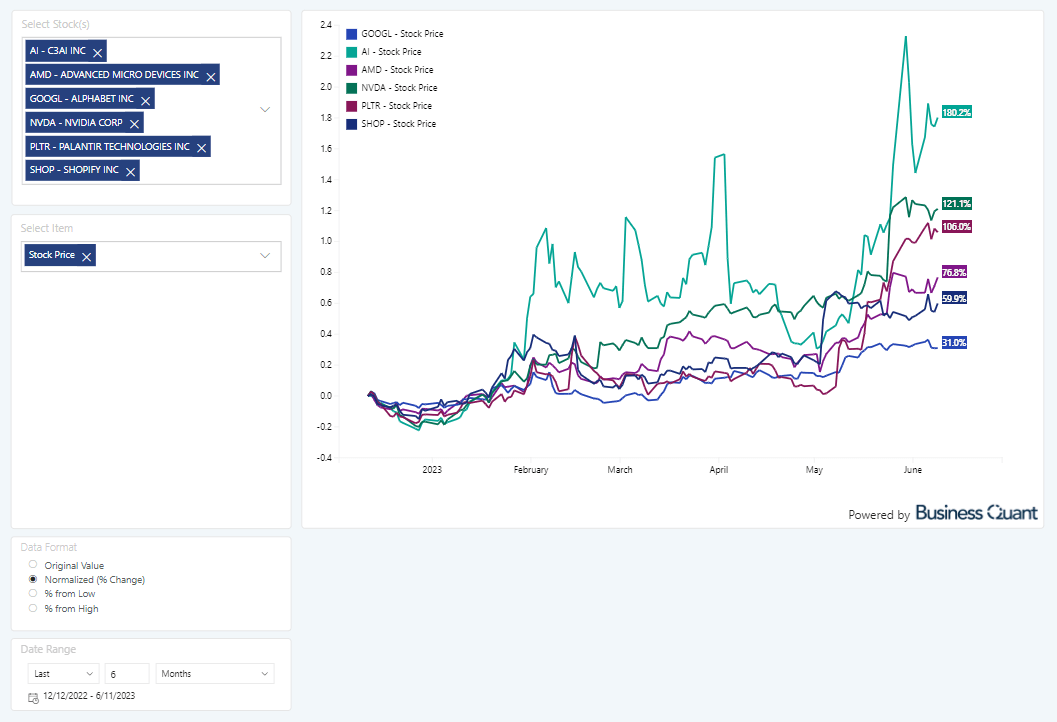

While Palantir presents a potentially lucrative investment opportunity, diversification is crucial for any investment portfolio. Investing solely in Palantir would be risky due to its volatility. Consider diversifying into other technology stocks with different risk profiles and growth potential.

- Examples of alternative tech stocks: Mention other technology companies with strong fundamentals and less volatility.

- Importance of diversifying across sectors: Emphasize the need to diversify across various asset classes and sectors to mitigate overall portfolio risk.

- Considerations for risk management: Discuss strategies to manage risk, such as dollar-cost averaging or setting stop-loss orders.

Conclusion: Is Palantir Stock a Buy After the 30% Drop?

The 30% drop in Palantir's stock price is a complex event stemming from a combination of macroeconomic factors and company-specific concerns. While the current valuation might seem attractive, investing in Palantir carries significant risks due to its volatility and the competitive nature of the data analytics market. However, the potential for long-term growth remains, particularly if Palantir successfully executes its strategic plan and achieves sustained profitability.

Therefore, whether this represents a buying opportunity depends entirely on your individual risk tolerance and investment horizon. A thorough understanding of Palantir's business model, its competitive landscape, and the overall market conditions is paramount.

Conduct your own due diligence before making any investment decisions concerning Palantir stock. Understanding the risks and potential rewards is crucial when evaluating whether this represents a true buying opportunity for your portfolio.

Featured Posts

-

Harry Styles Reacts To A Hilarious And Awful Snl Impression

May 10, 2025

Harry Styles Reacts To A Hilarious And Awful Snl Impression

May 10, 2025 -

White House Cocaine Incident Secret Service Announces End Of Investigation

May 10, 2025

White House Cocaine Incident Secret Service Announces End Of Investigation

May 10, 2025 -

Red Wings Suffer Setback 6 3 Defeat Dashes Playoff Dreams

May 10, 2025

Red Wings Suffer Setback 6 3 Defeat Dashes Playoff Dreams

May 10, 2025 -

Review Of Wynne And Joanna All At Sea A Critical Analysis

May 10, 2025

Review Of Wynne And Joanna All At Sea A Critical Analysis

May 10, 2025 -

Should You Buy Palantir Stock Before May 5th A Pre Earnings Analysis

May 10, 2025

Should You Buy Palantir Stock Before May 5th A Pre Earnings Analysis

May 10, 2025