Palantir Stock: Investment Strategy Before May 5th Earnings Release

Table of Contents

Analyzing Palantir's Recent Performance and Growth Trajectory

Revenue Growth and Key Metrics

Palantir's recent performance offers a crucial lens through which to view the potential for future growth. Analyzing key performance indicators (KPIs) such as revenue growth, customer acquisition costs, and operating margins is essential for gauging the company's health. While past performance doesn't guarantee future results, reviewing trends in these metrics provides valuable insights. For example, a consistent upward trend in revenue, coupled with improving operating margins, suggests a positive trajectory. Conversely, a slowdown in revenue growth might indicate potential headwinds. Referencing recent quarterly reports and financial news sources will provide the most up-to-date data points to support your own analysis of Palantir stock.

Government vs. Commercial Contracts

Palantir's revenue streams are bifurcated between government and commercial contracts. Understanding the contribution of each sector is vital for a comprehensive assessment of Palantir stock. The government sector often provides higher margins but may be subject to budgetary constraints and fluctuating contract awards. The commercial sector, while potentially offering higher growth potential, might involve greater competition and longer sales cycles. A balanced portfolio of contracts across both sectors ideally mitigates risk and fosters stable, sustainable growth.

- Recent contract wins: Analyze recent significant contract wins and their implications for future revenue streams. Large government contracts, for example, can significantly impact short-term performance.

- Market share expansion challenges: Consider the challenges Palantir faces in expanding its market share within both sectors. Increased competition and the need for continuous innovation are key factors to consider.

- Strategic focus shifts: Any shifts in Palantir's strategic focus, such as expansion into new markets or the development of new products, should be thoroughly analyzed for their potential impact on Palantir stock.

Evaluating Market Sentiment and Analyst Predictions

Pre-Earnings Expectations

Analyst predictions for Palantir's upcoming earnings release vary considerably. It's crucial to review a range of predictions to understand the diversity of opinion within the financial community. This provides a more nuanced view of the potential outcomes compared to relying on a single prediction. Consider the range of earnings per share (EPS) estimates and revenue projections, and understand the underlying assumptions driving these forecasts.

Stock Price Volatility

Palantir stock has historically exhibited volatility around earnings announcements. Understanding this volatility is crucial for managing risk. Reviewing past price movements following earnings releases can provide insights into potential price swings. Analyzing the magnitude of these swings can help investors develop a more realistic expectation of potential price fluctuations.

- Influencing news and events: Recent news, product launches, regulatory changes, or geopolitical events can all significantly impact market sentiment toward Palantir and its stock price. Staying informed about these events is crucial for informed investment decisions.

- Financial news and analyst reports: Consult reputable financial news sources and analyst reports for a comprehensive overview of market sentiment and predictions surrounding Palantir stock.

- Factors causing unexpected price swings: Unexpected surprises in the earnings report, changes in guidance, or broader market trends can all contribute to unexpected price volatility. Preparing for this possibility is essential.

Formulating a Pre-Earnings Investment Strategy for Palantir Stock

Risk Assessment

Investing in Palantir stock involves inherent risks. Its dependence on government contracts introduces uncertainty related to contract renewals and budget allocations. Furthermore, the company's valuation is a crucial factor to consider, especially in light of current market conditions and growth projections. A comprehensive risk assessment is essential before making any investment decisions.

Investment Options

Depending on your risk tolerance and investment goals, several strategies are possible:

-

Buying before earnings: A more aggressive strategy, this approach carries higher risk but potentially higher rewards if the earnings report surpasses expectations.

-

Waiting for the announcement: A more conservative approach, allowing you to assess the actual results before making a decision. This minimizes risk but might lead to missing potential gains.

-

Selling existing shares: If you already own Palantir stock and are concerned about potential negative news, selling before earnings might be an option, depending on your overall investment strategy.

-

Conservative strategy: Focus on preservation of capital. Avoid aggressive moves before earnings.

-

Moderate strategy: A balanced approach, potentially involving a small buy or holding existing shares.

-

Aggressive strategy: A high-risk, high-reward approach involving larger purchases before earnings, betting on positive results.

-

Diversification: Always diversify your portfolio to mitigate risk. Don't put all your eggs in one basket.

-

Due diligence: Thorough research and understanding of Palantir's business, financials, and market position are crucial before any investment decision.

Conclusion: Making Informed Decisions on Palantir Stock Before May 5th

This article has provided a framework for assessing Palantir's recent performance, understanding market sentiment, and formulating a pre-earnings investment strategy for Palantir stock. Remember, the information provided is for educational purposes and not financial advice. Before making any decisions regarding Palantir investment, conduct thorough due diligence, consider your personal financial goals, and assess your risk tolerance. The information presented here should inform your strategy, but ultimately, your investment decisions are your own responsibility. Revisit this article post-earnings for a further analysis and to see how the actual results align with the pre-earnings predictions. Remember to always consider your own risk tolerance before investing in Palantir shares or any other stock.

Featured Posts

-

Allegations Of Concealment Senate Democrats Probe Pam Bondis Handling Of Epstein Records

May 10, 2025

Allegations Of Concealment Senate Democrats Probe Pam Bondis Handling Of Epstein Records

May 10, 2025 -

The Best Victim In High Potential Season 2 A Case For Character Name

May 10, 2025

The Best Victim In High Potential Season 2 A Case For Character Name

May 10, 2025 -

Leon Draisaitl Injury Oilers Leading Scorer Leaves Game

May 10, 2025

Leon Draisaitl Injury Oilers Leading Scorer Leaves Game

May 10, 2025 -

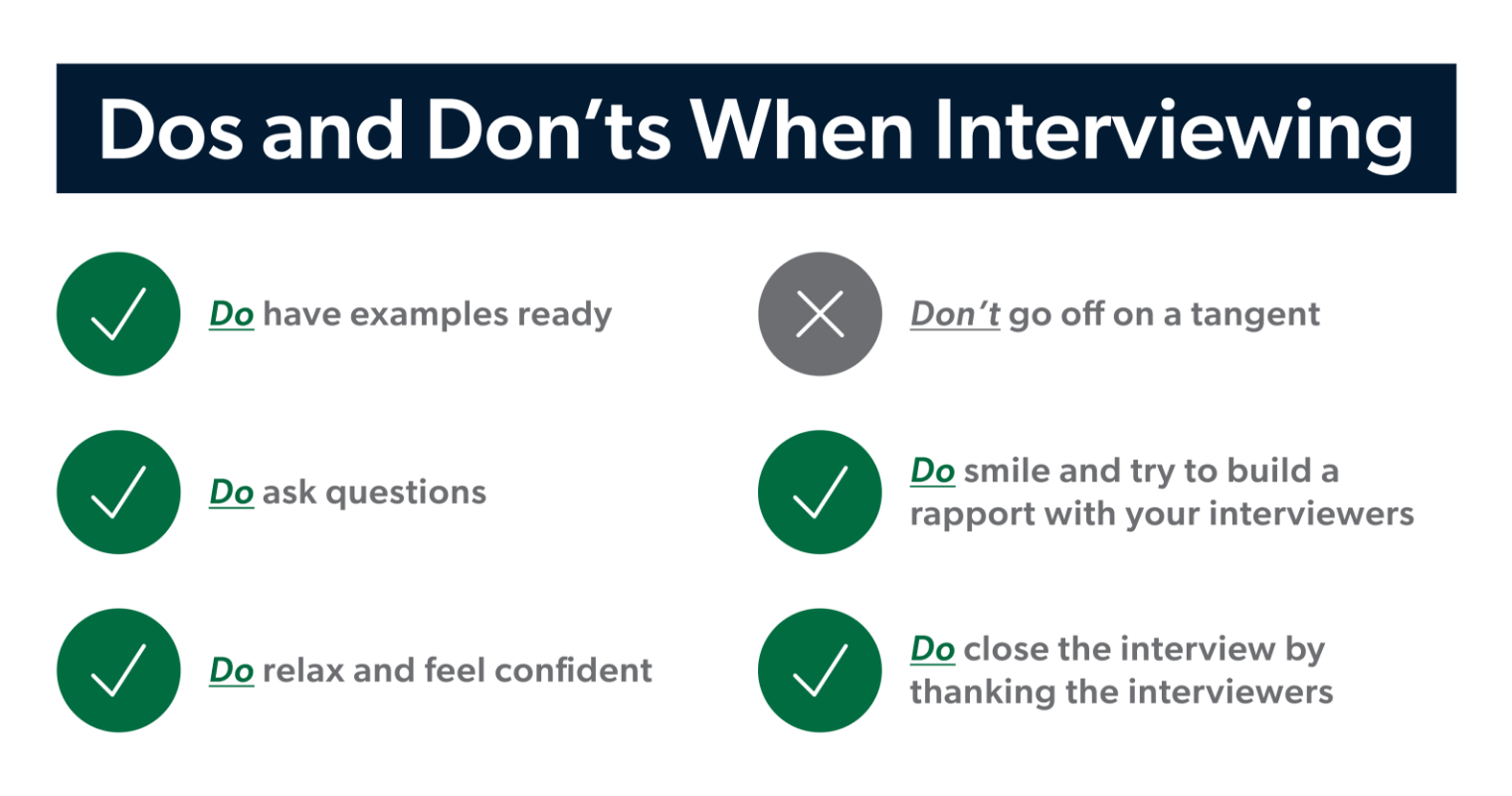

Navigate The Private Credit Boom 5 Job Landing Dos And Don Ts

May 10, 2025

Navigate The Private Credit Boom 5 Job Landing Dos And Don Ts

May 10, 2025 -

Examining Pam Bondis Video The Controversy Surrounding Killing American Citizens

May 10, 2025

Examining Pam Bondis Video The Controversy Surrounding Killing American Citizens

May 10, 2025