Palantir Stock: Weighing The Risks And Rewards Of A Potential 40% Rise By 2025

Table of Contents

Palantir Technologies is a data analytics company specializing in providing software platforms to government agencies and commercial clients. Its flagship products, Gotham and Foundry, enable organizations to integrate and analyze vast amounts of data to improve operational efficiency, enhance security, and gain a competitive edge. This article aims to analyze the potential for a 40% rise in Palantir stock by 2025, carefully weighing the associated rewards and risks.

Palantir's Growth Potential and Catalysts for a 40% Rise

Several factors contribute to the optimistic prediction of a 40% increase in Palantir stock price by 2025.

Expanding Government Contracts

Palantir enjoys a significant presence in the government contracting space, particularly with US intelligence agencies and defense departments, but also increasingly with international governments. Increased defense spending and a growing demand for advanced data analytics solutions present significant opportunities for revenue growth.

- Examples of key government contracts: While specifics are often classified, Palantir's work with the CIA, FBI, and various branches of the US military is well-documented. Increasing international partnerships also contribute significantly.

- Projections for future contract wins: Analysts predict continued growth in government spending on data analytics and cybersecurity, leading to a substantial pipeline of potential contracts for Palantir.

- Analysis of government spending trends: Government budgets focused on national security and counterterrorism initiatives consistently demonstrate strong spending in areas Palantir serves. This trend is expected to continue, fueling Palantir government contracts revenue.

Commercial Sector Growth

While government contracts form a significant portion of Palantir's revenue, the company is actively expanding its presence in the commercial sector. This diversification is a key driver of future growth.

- Key partnerships: Palantir has established key partnerships with major players in the financial services, healthcare, and other industries, demonstrating its ability to leverage its data analytics platform in diverse contexts.

- Successful case studies: The company highlights successful implementations of its Foundry platform, showcasing tangible returns on investment for its commercial clients. These success stories help build confidence and attract new customers.

- Market penetration strategies: Palantir's focus on building strong relationships with key clients and demonstrating clear value propositions is crucial for driving market penetration and boosting Palantir commercial clients' adoption of its platform.

- Projections for commercial revenue growth: Analysts anticipate significant growth in commercial revenue, driven by increasing adoption of data analytics across diverse industries. This will significantly contribute to overall revenue growth and support the predicted rise in Palantir stock.

Technological Innovation and Product Development

Palantir's consistent investment in research and development is another crucial factor. Continuous innovation and new product releases are essential for maintaining a competitive edge and driving revenue growth.

- Examples of new products/features: The evolution of Palantir Foundry, incorporating advanced AI capabilities and improved data integration features, exemplifies the company's commitment to innovation. The introduction of AIPlatform is another example of this approach.

- Technological advancements: Palantir is actively developing and deploying cutting-edge technologies such as artificial intelligence and machine learning, helping it to stay ahead of the competition and meet the increasing demands of its clients.

- Competitive advantages: Palantir's unique ability to handle complex, unstructured data sets gives it a significant competitive advantage in the market. This expertise is hard to replicate, creating a barrier to entry for potential competitors.

Risks Associated with Investing in Palantir Stock

Despite the significant growth potential, investing in Palantir stock carries substantial risks.

Valuation and Market Sentiment

Palantir's current valuation, relative to its earnings and compared to competitors, is a key factor to consider. Market sentiment can significantly impact the Palantir stock price, leading to volatility.

- Price-to-earnings ratio (P/E): Analyzing Palantir's P/E ratio in comparison to industry peers helps investors gauge its valuation relative to its earnings potential.

- Comparison to competitors: A comparison with competitors like AWS, Microsoft, and Google helps determine Palantir's relative strengths and weaknesses in the market.

- Analyst ratings and forecasts: Studying analyst ratings and forecasts provides insights into the market's overall sentiment towards the company and its future prospects.

Dependence on Government Contracts

Palantir's significant reliance on government contracts exposes it to several risks.

- Potential for contract loss: The loss of a major government contract could significantly impact revenue and stock price.

- Diversification strategies: While Palantir is diversifying into the commercial sector, its dependence on government contracts remains a key risk factor.

- Analysis of government funding stability: Changes in government priorities and budget cuts can impact funding for data analytics initiatives, directly affecting Palantir's revenue.

Competition in the Data Analytics Market

The data analytics market is highly competitive, with major players like AWS, Microsoft, and Google constantly vying for market share.

- Major competitors: Understanding the competitive landscape and the strengths and weaknesses of competitors is crucial for assessing Palantir's long-term viability.

- Competitive advantages of Palantir: Palantir's proprietary technology and deep expertise in handling complex data sets are crucial differentiators in the market.

- Strategies to counter competition: Palantir's strategies for maintaining its competitive edge, such as continuous innovation and strategic partnerships, are critical for long-term success.

Conclusion

The potential for a 40% rise in Palantir stock by 2025 is driven by several factors, including growth in government and commercial contracts, and technological innovation. However, investors should carefully consider the inherent risks, including valuation concerns, reliance on government contracts, and competition in the data analytics market. While the potential rewards are substantial, investing in Palantir stock requires a thorough understanding of both the opportunities and the challenges. Before making any investment decisions, conduct thorough research, carefully review Palantir's financial reports, and consult with a financial advisor to assess your risk tolerance. Consider further reading on Palantir share price trends and independent industry analyses to form a well-rounded perspective on Palantir stock investment.

Featured Posts

-

The Evolution Of Elizabeth Hurleys Cleavage From Red Carpet To Everyday Style

May 09, 2025

The Evolution Of Elizabeth Hurleys Cleavage From Red Carpet To Everyday Style

May 09, 2025 -

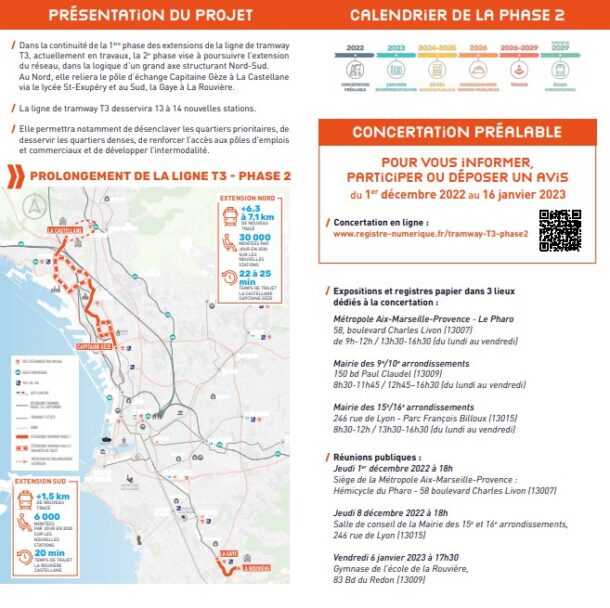

Projet De 3e Ligne De Tramway A Dijon Concertation Publique Et Adoption Par Le Conseil Metropolitain

May 09, 2025

Projet De 3e Ligne De Tramway A Dijon Concertation Publique Et Adoption Par Le Conseil Metropolitain

May 09, 2025 -

Luxury Carmakers Face Headwinds In China Analyzing The Market Slowdown

May 09, 2025

Luxury Carmakers Face Headwinds In China Analyzing The Market Slowdown

May 09, 2025 -

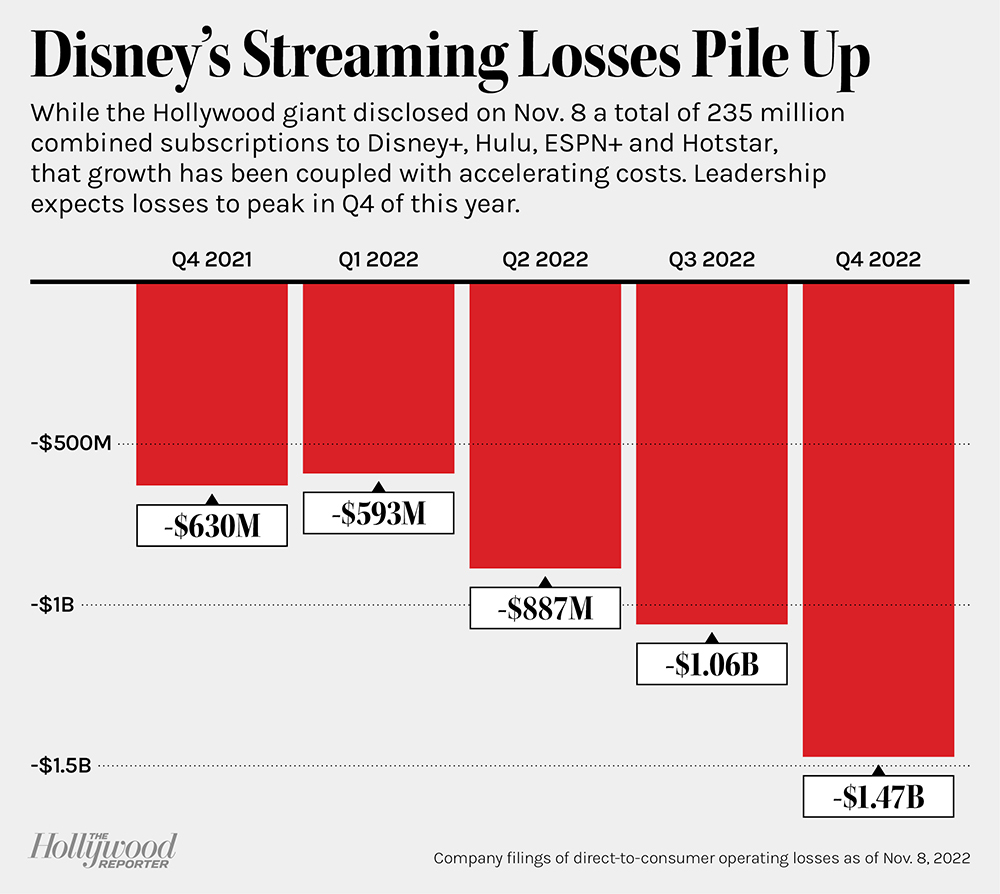

Positive Disney Profit Revision Thanks To Theme Parks And Streaming

May 09, 2025

Positive Disney Profit Revision Thanks To Theme Parks And Streaming

May 09, 2025 -

Iditarod 2024 Following Seven Rookie Teams To Nome

May 09, 2025

Iditarod 2024 Following Seven Rookie Teams To Nome

May 09, 2025

Latest Posts

-

News From The Bangkok Post The Push For Better Transgender Rights

May 10, 2025

News From The Bangkok Post The Push For Better Transgender Rights

May 10, 2025 -

The Bangkok Post And The Ongoing Struggle For Transgender Equality

May 10, 2025

The Bangkok Post And The Ongoing Struggle For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025 -

Examining Transgender Equality Issues Highlighted By The Bangkok Post

May 10, 2025

Examining Transgender Equality Issues Highlighted By The Bangkok Post

May 10, 2025 -

The Bangkok Post And The Fight For Transgender Equality In Thailand

May 10, 2025

The Bangkok Post And The Fight For Transgender Equality In Thailand

May 10, 2025