Palantir Technology Stock: Should You Invest Before May 5th?

Table of Contents

Palantir Technologies (PLTR) stock has experienced significant volatility. With a crucial date like May 5th approaching, many investors are questioning whether now is the right time to buy, sell, or hold. This article delves into the key factors to consider before making an investment decision regarding Palantir stock. We'll explore Palantir's recent performance, market sentiment, potential risks, and offer strategic considerations to help you navigate this complex investment landscape.

Palantir's Recent Financial Performance and Future Growth Projections

Analyzing Palantir's recent quarterly earnings reports is crucial for understanding its current financial health and future potential. Key financial metrics provide a strong foundation for investment decisions.

- Revenue Growth: Examining the revenue growth rate compared to previous quarters and years reveals the trajectory of the company's performance. A consistent upward trend indicates strong growth, while stagnation or decline warrants further investigation.

- Profitability: Analyzing gross margin, operating margin, and net income offers insight into Palantir's profitability. Improving margins suggest enhanced efficiency and cost management.

- Revenue Drivers: Understanding the key drivers of revenue growth, such as government contracts and commercial partnerships, helps predict future performance. Diversification across these sectors reduces reliance on any single source of income.

- New Product Launches: Palantir's ongoing innovation and new product launches are vital to its long-term success. Analyzing the potential impact of these new offerings on revenue is crucial for assessing future growth potential. For example, the success of new AI-powered platforms could significantly boost revenue streams.

Palantir's guidance for future quarters and its long-term growth strategy should also be carefully reviewed. Ambitious yet realistic projections demonstrate a clear path to sustained growth. A well-defined strategy, combined with strong financial performance, indicates a healthy outlook for the company and its stock.

Market Sentiment and Analyst Ratings for Palantir Stock

Understanding market sentiment and analyst ratings is crucial for assessing the overall perception of Palantir stock.

- Analyst Ratings: A summary of average analyst price targets and the range of analyst ratings (buy, hold, sell) provides a consensus view from industry experts. A preponderance of "buy" ratings suggests positive sentiment.

- News and Press Releases: Recent news articles and press releases can significantly impact stock price. Positive news, such as securing major contracts or successful product launches, often leads to price increases. Conversely, negative news can cause declines.

- Market Sentiment: The overall market sentiment towards Palantir and the tech sector at large influences investor behavior. Positive market sentiment generally supports higher stock prices, while negative sentiment can drive prices down.

- Competitor Performance: Comparing Palantir's performance to its competitors in the data analytics and software markets provides context and helps assess its competitive advantage.

Risks and Potential Downsides of Investing in Palantir Stock

While Palantir offers considerable potential, it’s essential to acknowledge the associated risks.

- Competition: The data analytics market is highly competitive. Analyzing the major competitors and their market share helps gauge Palantir's competitive position.

- Regulatory Hurdles: Palantir operates in a heavily regulated environment. Potential regulatory challenges could impact its operations and financial performance.

- Economic Downturns: Palantir's performance is sensitive to macroeconomic factors. Economic downturns can reduce demand for its services, especially from government and commercial clients.

- Valuation: Analyzing valuation metrics like the P/E ratio and Price-to-Sales ratio helps determine whether Palantir stock is currently overvalued or undervalued. A high valuation might indicate inflated expectations, while a low valuation could signal an opportunity.

Strategic Considerations for Investing in Palantir Before May 5th

Developing a sound investment strategy is paramount before making any decisions regarding Palantir stock.

- Investment Horizon: Consider a long-term versus short-term investment approach. Long-term investors are generally less concerned about short-term fluctuations and focus on the company's long-term growth potential. Short-term investors, on the other hand, are more sensitive to market volatility.

- Portfolio Diversification: Diversifying your investment portfolio across different asset classes is crucial to manage risk. Investing heavily in a single stock, even one with high growth potential, is not advisable.

- Risk Tolerance: Assess your individual risk tolerance before investing in Palantir. The stock's volatility necessitates a higher risk tolerance.

- Due Diligence: Thorough research and due diligence are essential before investing in any stock. Understanding the company's financials, its competitive landscape, and the potential risks is paramount.

Conclusion

Investing in Palantir Technologies stock before May 5th requires careful consideration of its recent financial performance, market sentiment, potential risks, and your own investment goals. While Palantir shows promise in its innovative data analytics solutions and government contracts, it's crucial to weigh the potential rewards against the inherent risks. A thorough analysis of its financial statements, market positioning, and competitive landscape is crucial. Before making any investment decisions regarding Palantir Technology stock, conduct thorough research and consult with a financial advisor. Remember that this analysis is for informational purposes only and not financial advice. Make informed decisions about your Palantir investment strategy.

Featured Posts

-

Nottingham Survivors Recount Experiences After Devastating Attacks

May 09, 2025

Nottingham Survivors Recount Experiences After Devastating Attacks

May 09, 2025 -

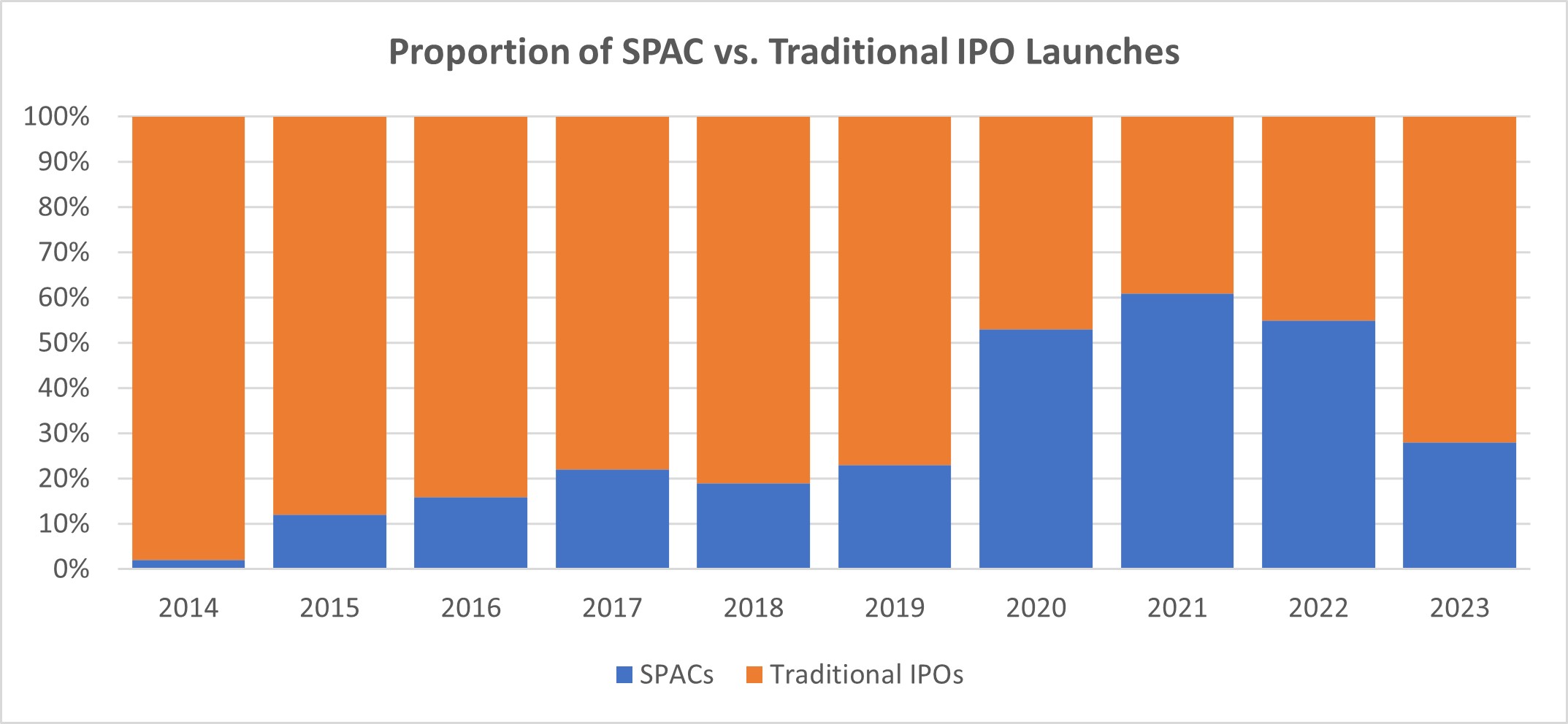

Is This Hot New Spac Stock A Smart Investment Comparing It To Micro Strategy

May 09, 2025

Is This Hot New Spac Stock A Smart Investment Comparing It To Micro Strategy

May 09, 2025 -

U S China Trade Talks De Escalation Efforts This Week

May 09, 2025

U S China Trade Talks De Escalation Efforts This Week

May 09, 2025 -

11 Lojtaret Kryesore Te Psg Se Analize E Performances

May 09, 2025

11 Lojtaret Kryesore Te Psg Se Analize E Performances

May 09, 2025 -

Planning Your Summer Trip Understanding Real Id Compliance

May 09, 2025

Planning Your Summer Trip Understanding Real Id Compliance

May 09, 2025

Latest Posts

-

From Wolves Reject To European Champion The Rise Of A Football Star

May 09, 2025

From Wolves Reject To European Champion The Rise Of A Football Star

May 09, 2025 -

Barys San Jyrman Msyrt Nhw Tarykh Abtal Awrwba

May 09, 2025

Barys San Jyrman Msyrt Nhw Tarykh Abtal Awrwba

May 09, 2025 -

Olly Murs To Headline Massive Music Festival At A Beautiful Castle Near Manchester

May 09, 2025

Olly Murs To Headline Massive Music Festival At A Beautiful Castle Near Manchester

May 09, 2025 -

Hlm Barys San Jyrman Alttwyj Blqb Dwry Abtal Awrwba

May 09, 2025

Hlm Barys San Jyrman Alttwyj Blqb Dwry Abtal Awrwba

May 09, 2025 -

Barys San Jyrman Hl Yhqq Hlm Dwry Abtal Awrwba

May 09, 2025

Barys San Jyrman Hl Yhqq Hlm Dwry Abtal Awrwba

May 09, 2025