Palantir's 30% Drop: Should You Buy The Dip?

Table of Contents

Analyzing Palantir's Recent Performance & the 30% Drop

Understanding the Reasons Behind the Drop

The recent 30% fall in "PLTR stock price" is multifaceted. Several factors likely contributed to this "technology stock downturn," including broader market corrections and company-specific concerns. Analyzing these elements is vital for understanding the current "Palantir stock" situation.

- Disappointing Q[Quarter] earnings report: The most recent earnings report may have revealed slower-than-expected revenue growth, negatively impacting investor sentiment and driving down the "Palantir stock price." Specific details from the report, such as reduced guidance, would need to be analyzed.

- Negative analyst sentiment and revised price targets: Analyst downgrades and lowered price targets often amplify negative market reactions. A confluence of negative analyst opinions could exacerbate downward pressure on "Palantir earnings" and the overall stock price.

- Broader market sell-off affecting the tech sector: A general market correction, particularly impacting the technology sector, can disproportionately affect high-growth companies like Palantir, regardless of their individual performance.

Evaluating Palantir's Long-Term Growth Potential

Despite the recent setbacks, Palantir boasts considerable long-term growth potential. Its core business, focused on providing advanced data analytics and AI solutions, remains highly relevant in today's data-driven world.

- Strong government contracts and potential for further expansion: Palantir enjoys significant revenue from government contracts, providing a stable revenue stream and potential for expansion into new government agencies.

- Growing adoption of its data analytics platform in the commercial sector: The company's strategic push into the commercial sector, offering its powerful data analytics platform to businesses, holds immense potential for growth. This expansion into new markets diversifies revenue streams.

- Potential for significant growth in the artificial intelligence (AI) market: Palantir is actively involved in the rapidly expanding AI market, leveraging its data analytics expertise to develop cutting-edge AI solutions. This positions the company favorably for significant future growth. Continued investment in "AI" and "data analytics" technologies are key drivers of this potential.

Assessing the Risks Involved in Buying Palantir Stock

Evaluating Palantir's Valuation

Determining whether the current "Palantir valuation" is justified requires a thorough analysis of several key metrics. Investors should compare its "price-to-sales ratio" to competitors and assess its "market capitalization" relative to its growth prospects. Understanding the company's "stock valuation metrics" is critical to making an informed investment decision. Comparing Palantir's valuation to similar companies in the data analytics and AI sectors offers a more complete picture.

Identifying Potential Downside Risks

Despite the growth potential, several significant risks are associated with investing in Palantir stock. A prudent investor must carefully consider these "investment risks" before committing capital.

- Increased competition from established players in the data analytics market: The data analytics market is increasingly competitive, with numerous established players vying for market share. This competition could impact Palantir's ability to maintain its growth trajectory.

- Reliance on government contracts for a significant portion of revenue: While providing stability, heavy reliance on government contracts exposes Palantir to the risks associated with government funding cycles and potential policy changes.

- Volatility in the overall stock market: The inherent volatility of the "stock market" can impact even fundamentally sound companies. The recent market correction highlights this risk.

Should You Buy the Dip? A Balanced Perspective

The decision of whether to employ a "buy the dip strategy" with Palantir stock requires a careful "risk assessment." While the 30% drop presents a potentially attractive entry point, the risks outlined above cannot be ignored. The potential rewards of investing in Palantir's long-term growth must be weighed against the significant risks. A balanced perspective acknowledges both the upside potential and the downside risks inherent in this investment. Thorough "stock market analysis" is crucial.

Conclusion: Making Informed Decisions about Palantir Stock

Palantir's recent stock performance reflects a complex interplay of positive long-term growth potential and significant short-term risks. The 30% drop in "Palantir stock" presents a compelling opportunity for some, but a cautionary tale for others. Reiterating the importance of conducting thorough due diligence, investors should consider consulting with financial advisors before making any investment decisions regarding "PLTR stock." Remember to analyze "Palantir stock's" potential, considering both the current market dip and the long-term outlook. Ultimately, the decision of whether to buy Palantir stock after its 30% drop is a personal one. Conduct your own research and consider your risk tolerance before investing in Palantir stock or any other stock. Thoroughly analyze the "Palantir stock" situation, weighing the potential for growth against the inherent risks.

Featured Posts

-

New Uk Student Visa Regulations A Focus On Asylum Risk

May 09, 2025

New Uk Student Visa Regulations A Focus On Asylum Risk

May 09, 2025 -

Arkema Premiere Ligue Victoire Difficile Du Psg Contre Dijon

May 09, 2025

Arkema Premiere Ligue Victoire Difficile Du Psg Contre Dijon

May 09, 2025 -

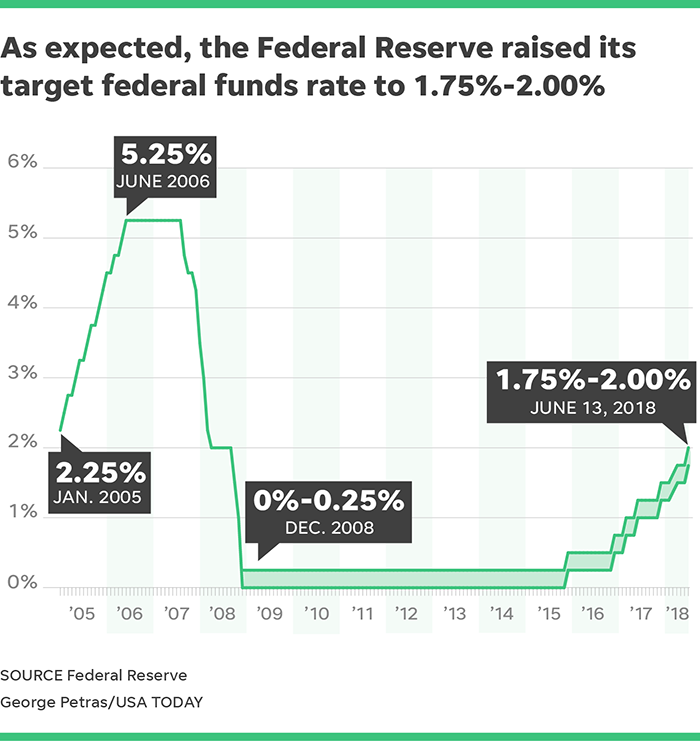

U S Federal Reserve Interest Rate Decision A Balancing Act

May 09, 2025

U S Federal Reserve Interest Rate Decision A Balancing Act

May 09, 2025 -

Netflixs Drive To Survive Jack Doohan And Briatores Tense Confrontation

May 09, 2025

Netflixs Drive To Survive Jack Doohan And Briatores Tense Confrontation

May 09, 2025 -

Expanding Wireless Mesh Networks Market A 9 8 Cagr Analysis

May 09, 2025

Expanding Wireless Mesh Networks Market A 9 8 Cagr Analysis

May 09, 2025

Latest Posts

-

News From The Bangkok Post The Push For Better Transgender Rights

May 10, 2025

News From The Bangkok Post The Push For Better Transgender Rights

May 10, 2025 -

The Bangkok Post And The Ongoing Struggle For Transgender Equality

May 10, 2025

The Bangkok Post And The Ongoing Struggle For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025 -

Examining Transgender Equality Issues Highlighted By The Bangkok Post

May 10, 2025

Examining Transgender Equality Issues Highlighted By The Bangkok Post

May 10, 2025 -

The Bangkok Post And The Fight For Transgender Equality In Thailand

May 10, 2025

The Bangkok Post And The Fight For Transgender Equality In Thailand

May 10, 2025