Palantir's Path To A Trillion-Dollar Market Cap: A 2030 Forecast

Table of Contents

Palantir's Competitive Advantages in the Data Analytics Market

Palantir's success hinges on several key competitive advantages. Its strong foothold in government contracts, coupled with increasing commercial adoption of its platforms, positions it favorably for significant future growth. Moreover, its consistent investment in research and development further strengthens its position in the increasingly competitive data analytics landscape.

Dominant Position in Government and Defense

Palantir enjoys a dominant position in government and defense contracts. Its platforms, particularly Palantir Foundry, are instrumental in national security initiatives, providing crucial data integration and analytical capabilities.

- Successful Deployments: Palantir's technology has been deployed in numerous successful government projects, assisting in intelligence gathering, counterterrorism efforts, and streamlining operational efficiency. These successes build trust and solidify its position as a key technology provider.

- Future Contract Potential: Continued increases in defense spending, coupled with a growing demand for sophisticated data analytics solutions within governmental agencies, present substantial opportunities for future contract wins. This translates directly into revenue growth and a higher Palantir valuation. Government contracts provide a stable revenue stream, mitigating some of the risks associated with the commercial market.

- Palantir Foundry's Role: Palantir Foundry, its flagship platform, plays a crucial role in this success, offering a scalable and secure environment for governments to manage and analyze vast datasets.

Growing Commercial Adoption of Palantir Gotham and Foundry

While its government contracts are a cornerstone of Palantir's current success, the growing adoption of its platforms by commercial clients across various sectors represents a significant driver of future growth.

- Commercial Success Stories: Numerous commercial clients across finance, healthcare, and other industries are leveraging Palantir Gotham and Foundry to improve operational efficiency, enhance decision-making, and gain a competitive edge. These success stories are crucial for attracting new clients.

- Data Integration and AI-Driven Analytics: Palantir's platforms excel at integrating disparate data sources and applying AI-driven analytics, offering solutions that are tailored to specific client needs. This adaptability is a key factor in its commercial success.

- Market Expansion Potential: The potential for market expansion is vast, as more organizations recognize the value of data-driven decision-making and seek powerful platforms like Palantir Gotham and Foundry.

Innovation and Technological Advancements

Palantir's continued investment in research and development (R&D) fuels its technological leadership and its ability to adapt to evolving market demands.

- AI and Machine Learning: Palantir is aggressively pursuing advancements in AI and machine learning, incorporating these capabilities into its platforms to enhance their analytical power and provide even more valuable insights to its clients.

- Data Mining and Advanced Analytics: Its focus on data mining and advanced analytics keeps it at the forefront of technological innovation within the data analytics market, ensuring its platforms remain relevant and competitive.

- Strategic Partnerships and Acquisitions: Strategic partnerships and acquisitions can further accelerate Palantir's technological advancement, adding new capabilities and expanding its market reach.

Challenges and Risks Facing Palantir's Growth

Despite its competitive advantages, Palantir faces significant challenges that could hinder its path to a trillion-dollar valuation. These challenges primarily revolve around competition, dependence on government contracts, and the inherent difficulties of achieving sustainable profitability at scale.

Competition and Market Saturation

The data analytics market is fiercely competitive, with both established players and agile newcomers vying for market share.

- Competitive Landscape: Palantir faces competition from large technology companies, specialized data analytics firms, and open-source solutions. This intense competition puts pressure on pricing and market share.

- Market Saturation Risk: The risk of market saturation exists, particularly as the adoption of data analytics solutions becomes more widespread. This could limit Palantir's growth potential.

- Maintaining Market Share: Palantir needs to continuously innovate and adapt to maintain its market share and prevent erosion by competitors.

Dependence on Large Government Contracts

Palantir's significant reliance on government contracts presents a considerable risk.

- Government Dependence: A significant portion of Palantir's revenue comes from government contracts, making it vulnerable to changes in government policies, budget cuts, and the political landscape.

- Political Risk: Changes in political priorities or administrations could significantly impact the demand for Palantir's services, creating uncertainty in its future revenue streams.

- Contract Renewal Challenges: The successful renewal of existing contracts is crucial for maintaining revenue stability.

Profitability and Scaling Challenges

Achieving sustainable profitability at scale is a crucial hurdle for Palantir.

- Operating Expenses: Managing its growing workforce and scaling its operations efficiently are critical for improving profitability.

- Revenue Growth vs. Expenses: Balancing rapid revenue growth with controlled operating expenses is crucial for maximizing profits and ensuring long-term sustainability.

- Path to Profitability: A clear and achievable path to sustained profitability is essential for attracting investors and justifying a high valuation.

Financial Projections and Valuation Analysis

Predicting Palantir's future financial performance and market capitalization is inherently speculative, but we can offer some realistic projections.

- Revenue Projections: Achieving a trillion-dollar market cap would require substantial revenue growth, fueled by both government and commercial contracts. Conservative estimates suggest significant yearly revenue growth is necessary to reach this target.

- Earnings Estimates: Profitability is key. Accurate earnings projections depend on effective cost management and sustained revenue growth.

- Valuation Analysis: Different valuation methodologies, such as discounted cash flow (DCF) analysis and comparable company analysis, yield varying estimates. A detailed analysis considering multiple factors is necessary for a comprehensive valuation.

- Factors Affecting Projections: Several factors, including competition, technological advancements, and macroeconomic conditions, will significantly impact these projections.

Conclusion: The Likelihood of Palantir Reaching a Trillion-Dollar Market Cap

Palantir's path to a trillion-dollar market cap by 2030 is ambitious but not impossible. While the company possesses significant competitive advantages in the data analytics market, it also faces substantial challenges. Its success hinges on maintaining its strong government contracts, successfully scaling its commercial operations, managing competition, and consistently innovating to stay ahead of the curve. The financial projections suggest that substantial and sustained growth is necessary to achieve this goal. A realistic assessment considers both its immense potential and inherent risks.

What are your thoughts on Palantir's path to a trillion-dollar market cap? Share your predictions and analysis in the comments below. Keep following Palantir's progress to see if this ambitious goal is achievable.

Featured Posts

-

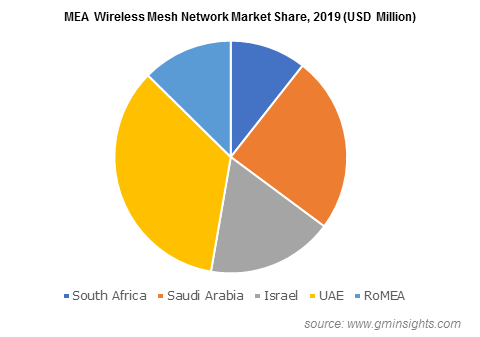

Wireless Mesh Network Market To Expand At A 9 8 Compound Annual Growth Rate

May 09, 2025

Wireless Mesh Network Market To Expand At A 9 8 Compound Annual Growth Rate

May 09, 2025 -

Post Trade Deadline Power Rankings 2025 Nhl Playoff Predictions

May 09, 2025

Post Trade Deadline Power Rankings 2025 Nhl Playoff Predictions

May 09, 2025 -

Understanding The Bitcoin Rebound A Guide For Investors

May 09, 2025

Understanding The Bitcoin Rebound A Guide For Investors

May 09, 2025 -

Bayern Munich Vs Fc St Pauli A Comprehensive Match Preview

May 09, 2025

Bayern Munich Vs Fc St Pauli A Comprehensive Match Preview

May 09, 2025 -

Revealed The Content Of Franco Colapintos Deleted Drive To Survive Message

May 09, 2025

Revealed The Content Of Franco Colapintos Deleted Drive To Survive Message

May 09, 2025

Latest Posts

-

Psgs Ligue 1 Triumph A Strategic Analysis Of Luis Enriques Coaching

May 09, 2025

Psgs Ligue 1 Triumph A Strategic Analysis Of Luis Enriques Coaching

May 09, 2025 -

Njwm Krt Alqdm Waltbgh Drast Fy Altnaqdat

May 09, 2025

Njwm Krt Alqdm Waltbgh Drast Fy Altnaqdat

May 09, 2025 -

Analyzing Luis Enriques Influence On Paris Saint Germains Ligue 1 Win

May 09, 2025

Analyzing Luis Enriques Influence On Paris Saint Germains Ligue 1 Win

May 09, 2025 -

Mdkhnw Krt Alqdm Asmae Shhyrt Wmsarat Mhnyt Mtathrt

May 09, 2025

Mdkhnw Krt Alqdm Asmae Shhyrt Wmsarat Mhnyt Mtathrt

May 09, 2025 -

Paris Saint Germains Success Luis Enriques Impact On Ligue 1

May 09, 2025

Paris Saint Germains Success Luis Enriques Impact On Ligue 1

May 09, 2025