Personal Loans: Check Today's Interest Rates And Apply

Table of Contents

Understanding Personal Loan Interest Rates

The interest rate you'll pay on a personal loan is a significant factor influencing your overall cost. Several key elements determine your rate. Understanding these factors will help you secure the most favorable terms.

-

Credit Score: Your credit score is a primary determinant of your interest rate. Lenders view a higher credit score (generally above 700) as indicating lower risk, resulting in lower interest rates on personal loans. Improving your credit score before applying for a loan can significantly impact your eligibility for better rates. Consider checking your credit report for errors and paying down existing debts to boost your score.

-

Loan Amount: Generally, larger loan amounts might come with slightly higher interest rates. Lenders perceive larger loans as carrying more risk.

-

Loan Term: The length of your loan term (the time you have to repay the loan) also impacts the interest rate. Shorter loan terms usually mean higher monthly payments but lower overall interest paid because you're paying off the principal faster. Longer terms often result in lower monthly payments but significantly higher total interest over the loan's life. Carefully weigh your monthly budget against the long-term cost of interest.

-

Lender Type: Different lenders—banks, credit unions, and online lenders—offer varying interest rates. Banks often have a wide range of loan options, while credit unions may offer more competitive rates to their members. Online lenders frequently provide a streamlined application process and sometimes more flexible terms. Comparing rates from multiple lenders is crucial to find the best personal loan for your circumstances.

Where to Check Today's Interest Rates

Finding the best personal loan interest rates requires diligent research. Start by using online comparison tools that allow you to input your financial information and receive personalized rate quotes from various lenders. Many reputable websites offer this service, helping you save time and effort.

Don't rely solely on comparison websites. Visit the websites of individual lenders to check their current rates and loan terms. Pay close attention to the Annual Percentage Rate (APR), which includes the interest rate and other fees associated with the loan.

Remember to compare multiple offers before applying. Pre-qualification is a valuable tool. Many lenders offer pre-qualification checks that don't impact your credit score, allowing you to see what rates you're likely to qualify for without harming your creditworthiness.

Types of Personal Loans and Their Uses

Personal loans come in various forms, each suited to different financial needs. Understanding these types will help you choose the most appropriate option.

-

Unsecured Personal Loans: These loans don't require collateral. This makes them accessible to a broader range of borrowers, but they usually come with higher interest rates due to the increased risk for the lender. Unsecured personal loans are ideal for smaller loan amounts and those with good credit.

-

Secured Personal Loans: Secured loans require collateral, such as a car or savings account. This collateral reduces the lender's risk, leading to lower interest rates. However, if you default on the loan, the lender could seize your collateral. Secured loans are suitable for larger loan amounts.

-

Debt Consolidation Loans: These loans are specifically designed to combine multiple debts (credit cards, medical bills, etc.) into a single monthly payment. This simplifies your finances and potentially lowers your overall interest rate if you're able to secure a lower rate than the combined rates of your existing debts.

Choosing the Right Loan for Your Needs

Selecting the right personal loan involves carefully assessing your financial situation. Consider your credit score, debt-to-income ratio, and the purpose of the loan. Determine how much you can comfortably afford to repay each month without straining your budget.

Read the loan agreement thoroughly before signing. Pay close attention to the APR, loan fees, repayment terms, and any other conditions. Understanding these details will protect you from unexpected costs and ensure you choose a loan that aligns with your financial goals and repayment capacity.

The Application Process for Personal Loans

Applying for a personal loan is generally straightforward, primarily done online. However, understanding the steps involved will help ensure a smoother application process.

-

Gather Necessary Documents: Before you start, gather the required documents, including proof of income (pay stubs, tax returns), identification, and potentially bank statements.

-

Complete the Online Application: Most lenders offer online application portals. Complete the application accurately and thoroughly. Inaccurate information can delay the process or even lead to rejection.

-

Understand the Loan Agreement: Carefully review the loan agreement before signing. Ensure you understand all terms and conditions, including the interest rate, fees, repayment schedule, and any penalties for late payments.

Tips for a Successful Application

-

Improve Your Credit Score: Improving your credit score before applying can significantly improve your chances of securing a lower interest rate. Paying down existing debts and avoiding new credit applications can help boost your score.

-

Shop Around for the Best Rates: Don't settle for the first offer you receive. Compare rates and terms from multiple lenders to find the best deal.

-

Maintain a Good Debt-to-Income Ratio: Lenders assess your debt-to-income ratio (DTI) to determine your ability to repay the loan. Keeping your DTI low increases your chances of approval.

Conclusion

Securing a personal loan involves understanding interest rates, choosing the right loan type, and navigating the application process effectively. By researching different lenders, comparing rates, and preparing your documentation, you can increase your chances of securing favorable terms. Remember, improving your credit score and maintaining a healthy debt-to-income ratio are key to obtaining the best personal loan rates.

Ready to find the best personal loan rates for your needs? Check today's interest rates and apply now! Start your search for the perfect personal loan today! Don't wait, find the best personal loan options available now!

Featured Posts

-

Waspada Modus Kawin Kontrak Untuk Kuasai Properti Di Bali

May 28, 2025

Waspada Modus Kawin Kontrak Untuk Kuasai Properti Di Bali

May 28, 2025 -

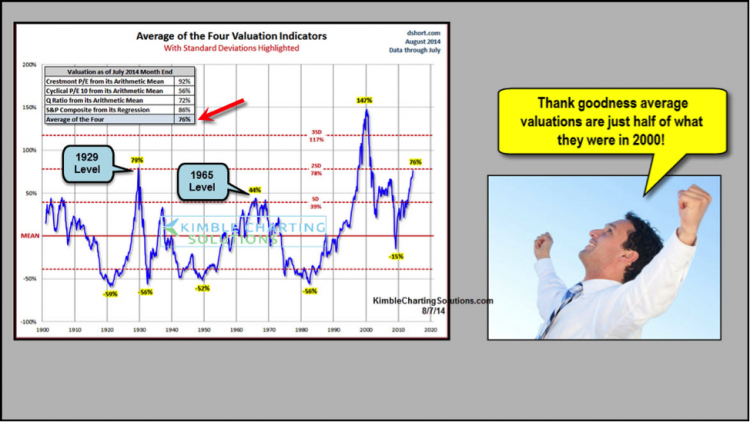

Stock Market Valuations Bof As Case For Calm Amidst High Prices

May 28, 2025

Stock Market Valuations Bof As Case For Calm Amidst High Prices

May 28, 2025 -

Ana Peleteiro Objetivo Mundial De Atletismo En Pista Cubierta Nanjing 2024

May 28, 2025

Ana Peleteiro Objetivo Mundial De Atletismo En Pista Cubierta Nanjing 2024

May 28, 2025 -

Did They Reconcile Kanye West And Bianca Censoris Spanish Dinner Date

May 28, 2025

Did They Reconcile Kanye West And Bianca Censoris Spanish Dinner Date

May 28, 2025 -

Comparatif Samsung Galaxy S25 256 Go Face A La Concurrence 775 E

May 28, 2025

Comparatif Samsung Galaxy S25 256 Go Face A La Concurrence 775 E

May 28, 2025