Personal Loans For Bad Credit: Finding The Right Direct Lender

Table of Contents

Securing a personal loan with bad credit can feel daunting. Many lenders shy away from applicants with less-than-perfect credit histories. However, finding the right direct lender is key to accessing the funds you need for unexpected expenses, debt consolidation, or home improvements. This article will guide you through the process of obtaining a personal loan for bad credit, focusing on how to find a reliable and trustworthy direct lender.

Understanding Your Credit Score and its Impact

Your credit score is a three-digit number that represents your creditworthiness. Lenders use it to assess the risk of lending you money. A higher credit score indicates a lower risk, making it easier to qualify for loans with favorable interest rates. A lower credit score, often considered "bad credit," signifies a higher risk, potentially resulting in higher interest rates or loan denial.

-

Factors Affecting Credit Scores: Your credit score is calculated based on several factors:

- Payment History: Do you pay your bills on time? Late or missed payments significantly impact your score.

- Amounts Owed: How much debt do you have relative to your available credit? High credit utilization negatively affects your score.

- Length of Credit History: A longer history of responsible credit management generally leads to a better score.

- New Credit: Opening several new accounts in a short period can lower your score.

- Credit Mix: Having a variety of credit accounts (credit cards, loans) can positively impact your score.

-

Checking Your Credit Report: You are entitled to a free credit report annually from each of the three major credit bureaus (Equifax, Experian, and TransUnion). Check your reports for any errors that could be lowering your score.

-

Strategies for Improving Your Credit Score: Before applying for a loan, consider strategies to improve your credit score. This includes paying down debt, paying bills on time, and avoiding new credit applications unless absolutely necessary. Consider credit repair services if needed, but research carefully to avoid scams.

Identifying Reputable Direct Lenders for Bad Credit

When searching for a personal loan with bad credit, it's crucial to choose a reputable direct lender. Direct lenders are financial institutions that provide loans directly to borrowers, unlike brokers who act as intermediaries.

-

Advantages of Direct Lenders: Direct lenders often offer more transparent terms and conditions, faster processing times, and potentially better customer service than brokers.

-

Tips for Identifying Legitimate Direct Lenders:

- Check online reviews from previous borrowers to gauge their experiences.

- Verify the lender's licensing and registration with relevant authorities.

- Beware of lenders who promise guaranteed approval or unusually low interest rates, as these might be predatory lenders.

-

Questions to Ask Potential Lenders:

- What are the interest rates and fees associated with the loan?

- What are the repayment terms and schedule?

- What are the requirements for loan approval?

- What is the lender's complaint resolution process?

-

Comparing Loan Offers: It’s crucial to compare loan offers from multiple lenders before making a decision. This ensures you get the best possible terms and interest rate.

Navigating the Application Process for Bad Credit Loans

Applying for a bad credit personal loan requires careful preparation and attention to detail.

-

Step-by-Step Guide:

- Research and select a reputable direct lender.

- Pre-qualify to get an idea of your chances of approval and potential interest rates. This is a soft inquiry that won't affect your credit score significantly.

- Gather necessary documents, such as proof of income (pay stubs, tax returns), identification, and bank statements.

- Complete the loan application accurately and honestly. Inaccurate information can lead to rejection or even legal consequences.

- Review the loan terms and conditions carefully before signing the agreement.

-

Understanding the Loan Terms: Pay close attention to the Annual Percentage Rate (APR), which includes the interest rate and other fees. Understand the repayment schedule and any penalties for late payments.

Types of Personal Loans for Bad Credit

Several loan options cater to individuals with bad credit, each with its own advantages and disadvantages.

-

Secured Loans: These loans require collateral, such as a car or savings account, to secure the loan. If you default, the lender can seize the collateral. Secured loans typically offer lower interest rates than unsecured loans.

-

Unsecured Loans: Unsecured loans don't require collateral. However, they usually come with higher interest rates due to the increased risk for the lender.

-

Payday Loans: These are short-term, high-interest loans intended to be repaid on your next payday. Payday loans should be avoided if possible due to their extremely high interest rates and potential for creating a debt cycle. They are often considered a last resort.

Managing Your Loan and Avoiding Default

Responsible loan management is crucial to avoid default and maintain a healthy credit score.

-

Creating a Budget: Create a realistic budget that includes your loan repayments. This helps ensure you can afford your payments without jeopardizing other essential expenses.

-

Setting Up Automatic Payments: Automate your loan payments to avoid late fees and missed payments.

-

Contacting Your Lender: If you anticipate difficulty making payments, contact your lender immediately. They might offer options like a payment plan or loan modification to help you avoid default.

Conclusion

Obtaining a personal loan with bad credit requires careful planning and research. By understanding your credit score, identifying reputable direct lenders, and navigating the application process responsibly, you can increase your chances of securing the funding you need. Remember to compare loan offers and choose a lender that offers fair terms and transparent practices. Don't let a less-than-perfect credit history hold you back from achieving your financial goals.

Call to Action: Start your search for the right personal loan for bad credit today. Find a trustworthy direct lender and take control of your financial future.

Featured Posts

-

Mathurins 28 Points Lead Pacers To Overtime Win Against Nets

May 28, 2025

Mathurins 28 Points Lead Pacers To Overtime Win Against Nets

May 28, 2025 -

The Phoenician Scheme A Look At The Worlds Creation

May 28, 2025

The Phoenician Scheme A Look At The Worlds Creation

May 28, 2025 -

Arsenal Transfer News Keown Hints At New Striker Arrival

May 28, 2025

Arsenal Transfer News Keown Hints At New Striker Arrival

May 28, 2025 -

Sinners Doping Ban Italian Open Star Avoids Grand Slam Absence

May 28, 2025

Sinners Doping Ban Italian Open Star Avoids Grand Slam Absence

May 28, 2025 -

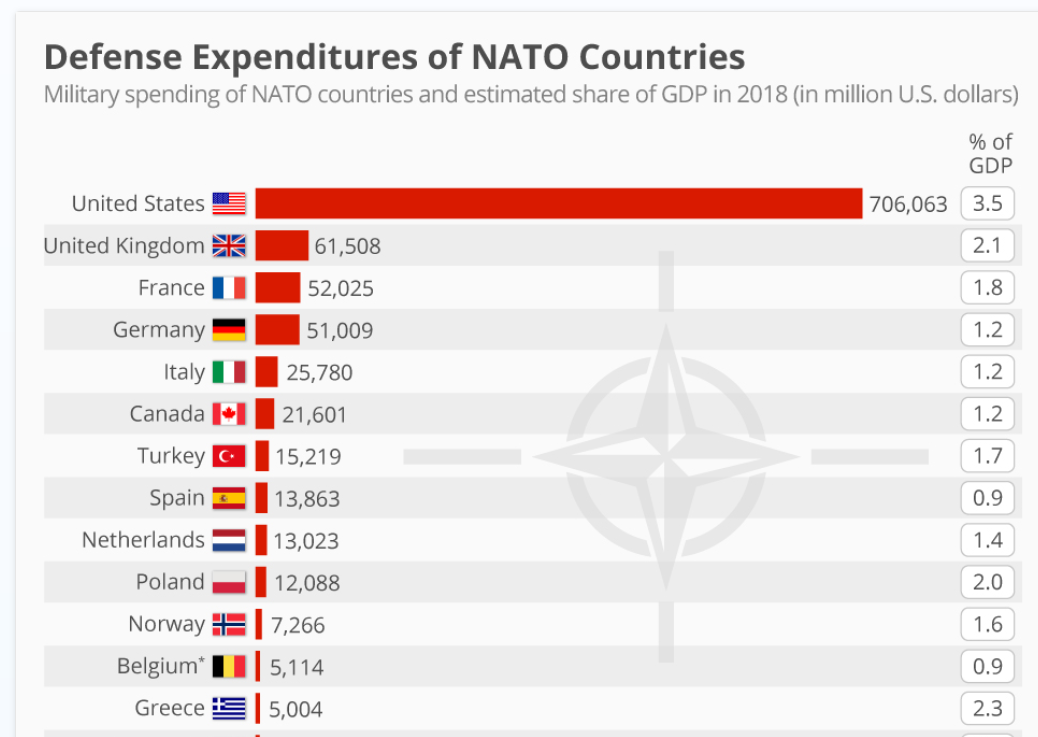

Nato Defense Spending Progress And Challenges

May 28, 2025

Nato Defense Spending Progress And Challenges

May 28, 2025