Polluter Reform: DBS Bank's Perspective On A Necessary Transition

Table of Contents

DBS Bank's Commitment to Environmental Sustainability

DBS Bank is deeply committed to Environmental, Social, and Governance (ESG) principles, recognizing their vital role in long-term value creation and a sustainable future. Our commitment extends beyond mere compliance; it’s ingrained in our business strategy and operational practices. We believe that sustainable business practices are not just good for the environment, but also good for business.

-

Specific Initiatives and Targets: DBS Bank has set ambitious targets for reducing its carbon footprint, including a commitment to achieve net-zero emissions across its operations by 2050. This includes significant investments in renewable energy sources and the implementation of energy-efficient technologies across our global offices. We're also actively reducing our paper consumption and promoting responsible waste management.

-

Awards and Recognition: Our dedication to environmental sustainability has been recognized through several prestigious awards, including [insert specific awards and recognitions received by DBS Bank for environmental leadership]. These accolades affirm our commitment and motivate us to continue pushing boundaries.

-

Quantifiable Impact: Our efforts have yielded tangible results. We have achieved a [insert percentage]% reduction in our carbon emissions since [insert year], exceeding our initial targets. This success is a testament to our comprehensive approach and the dedication of our employees.

Financing the Transition to a Low-Carbon Economy

DBS Bank plays a crucial role in financing the transition to a low-carbon economy. We recognize that sustainable development requires significant investment, and we are actively channeling capital towards projects and businesses that contribute to a greener future. Our approach to financing considers both environmental and financial returns.

-

Investment in Renewable Energy: We are significantly investing in renewable energy projects globally, including solar, wind, and hydropower initiatives. This includes both direct investments and financing for renewable energy companies.

-

Green Bonds and Sustainable Finance: We are a leading issuer and underwriter of green bonds, providing access to capital for environmentally friendly projects. We've also developed a robust framework for sustainable finance, ensuring that our lending and investment decisions align with our sustainability goals.

-

Environmental Risk Management: We have implemented a comprehensive framework for assessing and managing environmental risks in our lending practices. This includes rigorous due diligence processes and engagement with our clients to promote sustainable business practices.

-

Partnerships: We collaborate with leading environmental organizations and initiatives to leverage expertise and accelerate the transition to a low-carbon economy. These partnerships allow us to share best practices and learn from industry leaders.

Engaging with Polluting Industries for Responsible Reform

DBS Bank acknowledges the significant role that certain industries play in pollution and understands the need for responsible reform within these sectors. Our approach prioritizes engagement and collaboration rather than simply divestment.

-

Engagement Strategies: We engage with companies in polluting industries through constructive dialogue and collaborative partnerships, encouraging them to adopt more sustainable practices. This involves providing technical assistance, sharing best practices, and working towards mutually beneficial solutions.

-

Promoting Sustainable Practices: We support companies in their transition to more sustainable operations by offering financial incentives and technical expertise. This includes providing financing for clean technologies and assisting in the implementation of environmental management systems.

-

Successful Collaborations: We have successfully collaborated with several companies to reduce their environmental impact, resulting in significant reductions in pollution and greenhouse gas emissions. [Insert specific examples of successful collaborations].

-

Exclusion Policies: While we prioritize engagement, we do have exclusion policies for companies involved in severely polluting activities that fail to demonstrate a commitment to reform. This ensures that our lending practices align with our environmental principles.

The Role of Policy and Regulation in Polluter Reform

Effective polluter reform requires a supportive policy and regulatory environment. Governments play a crucial role in creating the incentives and frameworks needed to drive the transition to a sustainable economy.

-

Stricter Regulations and Carbon Pricing: We advocate for stricter environmental regulations, including carbon pricing mechanisms, to ensure that polluters internalize the environmental costs of their operations. These mechanisms can effectively incentivize the adoption of cleaner technologies.

-

Transparent Reporting Standards: Consistent and transparent reporting standards for environmental impact are essential for accountability and to ensure that companies are held responsible for their actions.

-

International Cooperation: Global cooperation is vital to achieve meaningful polluter reform. International agreements and collaborations are needed to harmonize standards and encourage collective action.

Measuring and Reporting Progress on Polluter Reform

Transparency and accountability are fundamental to our approach to polluter reform. We are committed to measuring and reporting our progress openly and honestly.

-

Measuring Environmental Impact: We utilize various methodologies to measure our environmental impact, including carbon accounting, water usage, and waste generation. This data informs our strategies and helps us track our progress towards our targets.

-

Publicly Available Data: Our progress on sustainability initiatives, including our efforts related to polluter reform, is publicly available through our annual sustainability reports and other publications. [Insert link to relevant reports].

-

Third-Party Verification: We believe in the importance of third-party verification and auditing to ensure the accuracy and credibility of our reporting.

Conclusion:

DBS Bank's commitment to polluter reform is a critical component of our broader sustainability strategy. Our approach emphasizes a multi-faceted strategy that includes internal commitments to reduce our own environmental impact, financing green initiatives, and engaging with polluting industries to promote responsible change. The success of polluter reform hinges on collaborative efforts between financial institutions, governments, and businesses. We are committed to playing our part in this crucial transition. Learn more about DBS Bank's sustainability initiatives and how you can contribute to polluter reform by visiting [link to relevant DBS Bank webpage]. Join the movement towards a more sustainable future and help drive meaningful polluter reform. Together, we can build a greener tomorrow.

Featured Posts

-

The Pritzker Family Penny Pritzker And The Harvard Admissions Fight

May 08, 2025

The Pritzker Family Penny Pritzker And The Harvard Admissions Fight

May 08, 2025 -

Understanding The European Digital Identity Wallet A Comprehensive Overview

May 08, 2025

Understanding The European Digital Identity Wallet A Comprehensive Overview

May 08, 2025 -

Road Rage Incident Van Strikes Motorcycle Cnn Coverage

May 08, 2025

Road Rage Incident Van Strikes Motorcycle Cnn Coverage

May 08, 2025 -

Bitcoin Madenciliginin Suerdueruelebilirligi Son Mu

May 08, 2025

Bitcoin Madenciliginin Suerdueruelebilirligi Son Mu

May 08, 2025 -

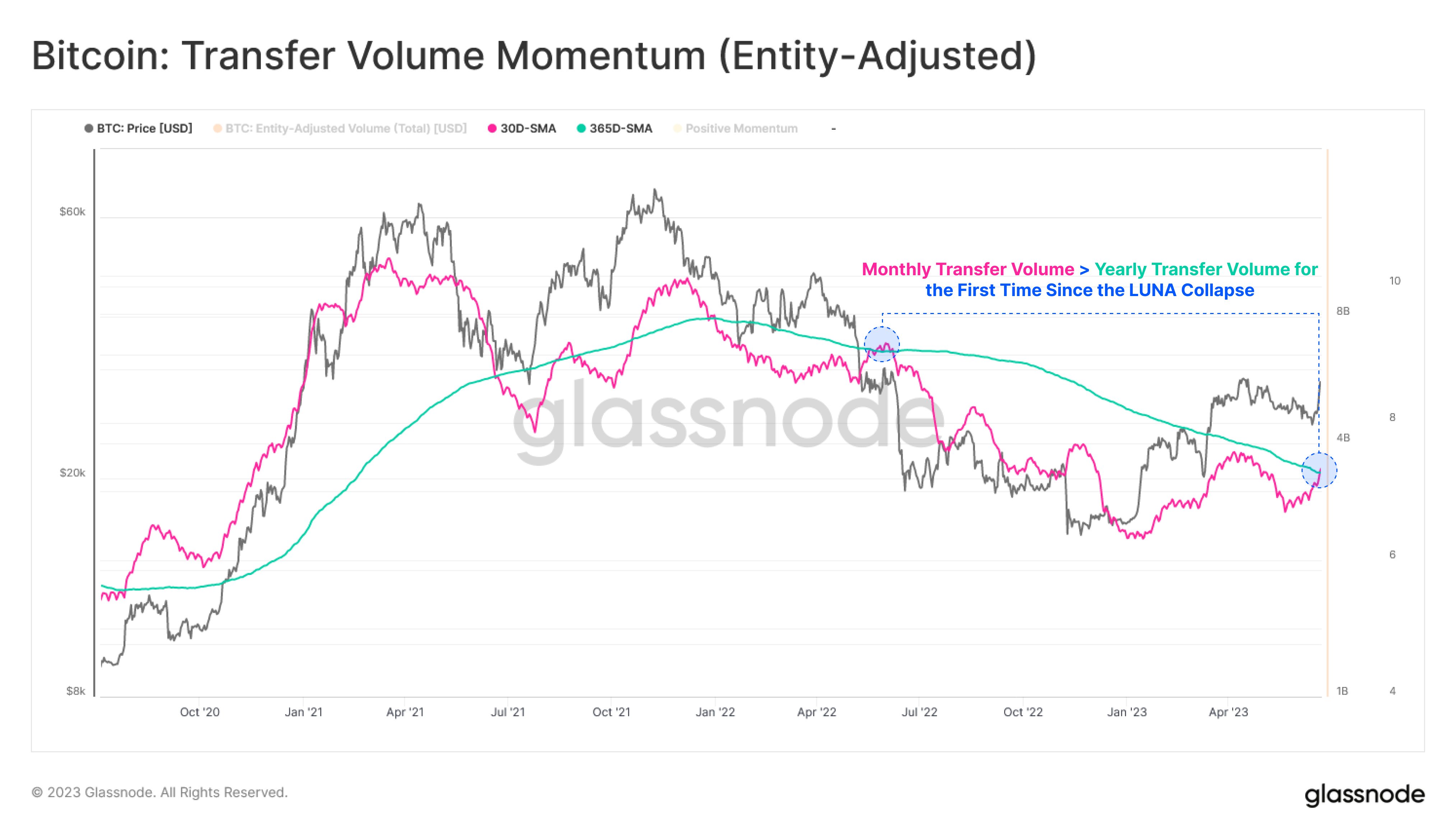

Bitcoin Buying Volume Surges Past Selling On Binance After Six Months

May 08, 2025

Bitcoin Buying Volume Surges Past Selling On Binance After Six Months

May 08, 2025

Latest Posts

-

Universal Credit Recipients Face Benefit Cuts Under Dwp Reforms

May 08, 2025

Universal Credit Recipients Face Benefit Cuts Under Dwp Reforms

May 08, 2025 -

Dwp To Axe Two Benefits Final Payments Incoming

May 08, 2025

Dwp To Axe Two Benefits Final Payments Incoming

May 08, 2025 -

Dwp Overhaul Universal Credit Changes And Potential Loss Of Benefits

May 08, 2025

Dwp Overhaul Universal Credit Changes And Potential Loss Of Benefits

May 08, 2025 -

Dwp Increases Home Visits For Benefit Claimants Impact And Concerns

May 08, 2025

Dwp Increases Home Visits For Benefit Claimants Impact And Concerns

May 08, 2025 -

Dwp Doubles Home Visits Thousands Of Benefit Claimants Affected

May 08, 2025

Dwp Doubles Home Visits Thousands Of Benefit Claimants Affected

May 08, 2025