Positive Market Sentiment: India's Nifty 50 Experiences Strong Growth

Table of Contents

Economic Indicators Driving Positive Sentiment

Strong economic indicators play a pivotal role in boosting investor confidence and driving the Nifty 50's performance. Positive economic data translates directly into increased investor optimism, fueling further investment and market growth. Several key indicators contribute to this positive sentiment:

-

GDP Growth Projections and Their Impact: India's robust GDP growth projections for the current fiscal year have significantly bolstered investor confidence. These projections, often exceeding global averages, signal a healthy and expanding economy, attracting both domestic and foreign investment. This positive outlook contributes directly to the upward trajectory of the Nifty 50.

-

Inflation Rates and Their Influence on Market Sentiment: While inflation remains a concern globally, India's relatively controlled inflation rates compared to other major economies have reassured investors. Stable inflation fosters a predictable investment environment, encouraging long-term investment strategies and contributing to the overall positive market sentiment.

-

Positive Employment Data and Consumer Spending: Positive employment data points to a thriving economy with increased consumer spending power. Rising consumer spending fuels demand for goods and services, further bolstering corporate profits and, subsequently, stock prices within the Nifty 50.

-

Government Initiatives Supporting Economic Growth: Government initiatives aimed at fostering economic growth, such as infrastructure development projects and reforms aimed at improving the ease of doing business, create a positive environment for investment and contribute to the overall positive market sentiment. These initiatives instill confidence in investors, both domestically and internationally.

Global Factors Contributing to the Nifty 50's Rise

The Nifty 50's rise isn't solely attributable to domestic factors; global events and trends significantly impact the Indian stock market. These external influences often interplay with domestic conditions to shape the overall market sentiment.

-

Foreign Institutional Investor (FII) Inflows and Their Effect: Significant inflows of foreign institutional investor (FII) capital into the Indian stock market reflect global confidence in India's economic prospects. These inflows inject substantial liquidity into the market, driving up stock prices and reinforcing the positive market sentiment.

-

Global Economic Recovery and Its Influence on Emerging Markets: A global economic recovery typically benefits emerging markets like India. As global economies strengthen, investors often seek higher growth opportunities in emerging markets, leading to increased investment in indices like the Nifty 50.

-

Geopolitical Stability and Its Impact on Investor Confidence: Periods of relative geopolitical stability globally contribute to increased investor confidence, as reduced uncertainty encourages investment in riskier assets, including emerging market equities.

-

Performance of Global Indices and Their Correlation with the Nifty 50: While not perfectly correlated, the performance of major global indices often influences the Nifty 50. Positive performance in global markets tends to spill over into emerging markets, bolstering positive sentiment.

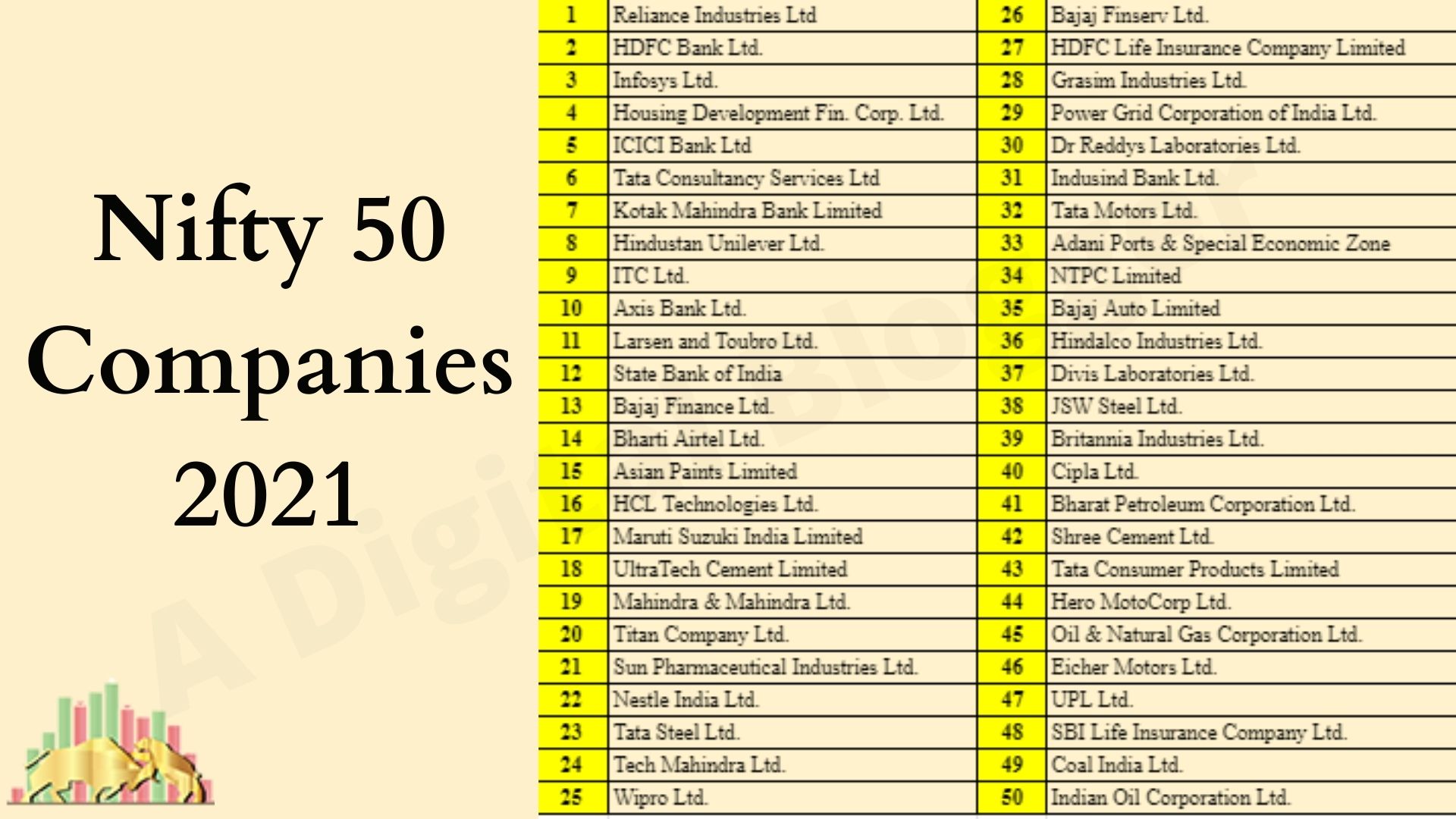

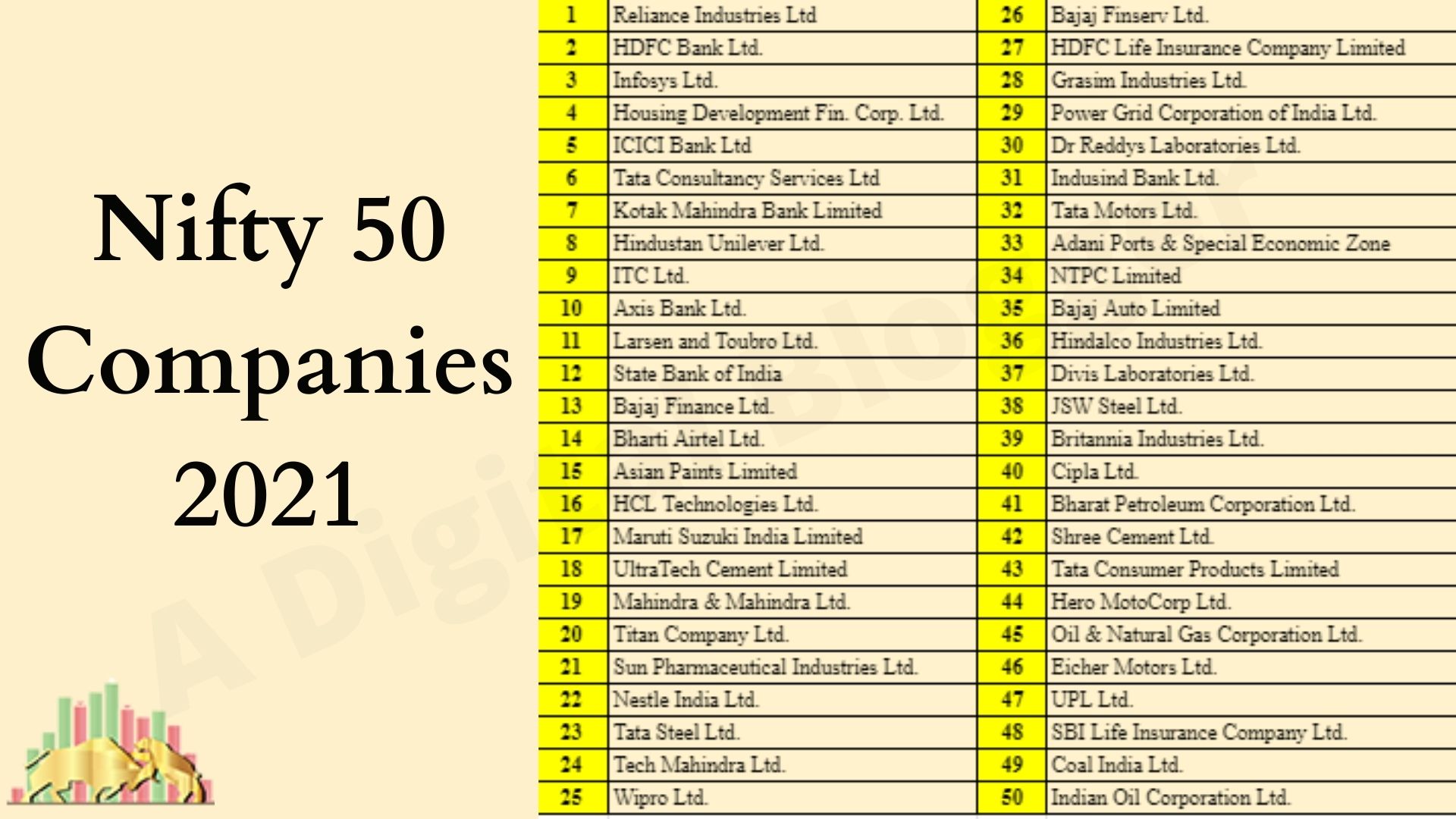

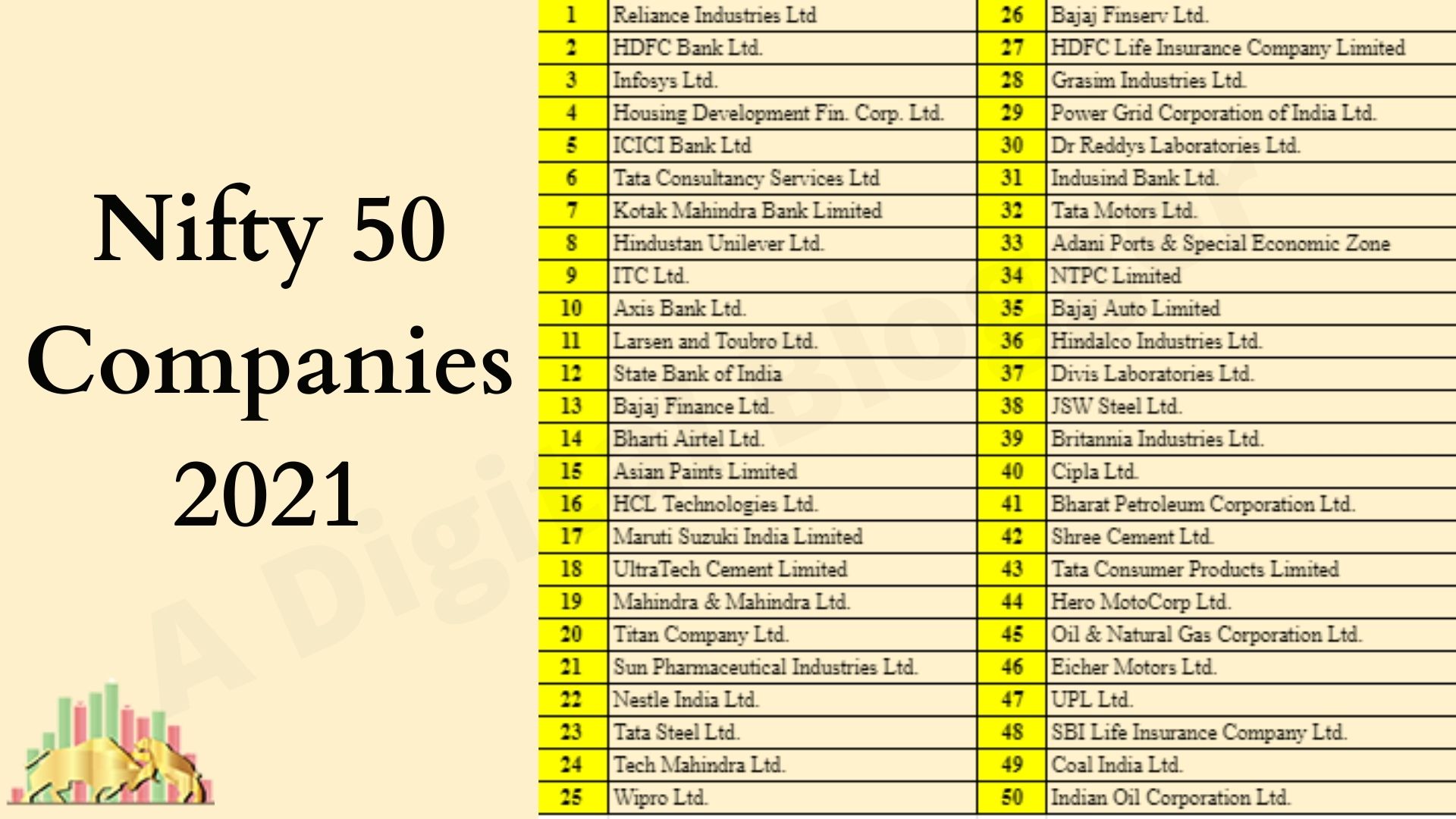

Sector-Specific Performance within the Nifty 50

Analyzing the performance of individual sectors within the Nifty 50 provides a granular view of the market's dynamics. Certain sectors consistently outperform others, reflecting specific economic trends and investment preferences.

-

Strong Performance of Specific Sectors (e.g., Technology, Financials, etc.): The technology and financial sectors, for example, have often exhibited strong performance, driven by factors such as digital transformation and increased financial activity. These sectors' success contributes significantly to the overall positive market sentiment and Nifty 50 growth.

-

Reasons for the Outperformance of These Sectors: Strong corporate earnings, innovative advancements, and increasing demand for their products and services often fuel the outperformance of these sectors.

-

Identify Any Underperforming Sectors and Explain the Reasons: While certain sectors thrive, others may underperform due to various factors, including cyclical downturns, regulatory changes, or increased competition. Understanding these dynamics is crucial for informed investment strategies.

Analyzing the Sustainability of Positive Market Sentiment

While the current positive market sentiment is encouraging, it's essential to acknowledge potential challenges and risks that could impact its sustainability. A comprehensive risk assessment is crucial for informed investment decisions.

-

Potential for Inflation to Rise Unexpectedly: Unforeseen inflationary pressures could erode investor confidence and negatively impact market performance. Monitoring inflation rates remains crucial for assessing the long-term outlook.

-

Geopolitical Uncertainties and Their Potential Impact: Escalating geopolitical tensions or unforeseen global events can significantly impact market sentiment and introduce volatility.

-

Global Economic Slowdown Risks: A global economic slowdown could negatively impact India's economy, potentially dampening investor confidence and affecting the Nifty 50's performance.

-

Evaluation of the Sustainability of Current Growth Rates: Sustaining current growth rates requires consistent positive economic performance and addressing potential challenges proactively.

Conclusion: Understanding and Leveraging Positive Market Sentiment in India's Nifty 50

The positive market sentiment fueling India's Nifty 50 growth is driven by a combination of robust economic indicators, favorable global trends, and strong sectoral performance. However, maintaining this positive trajectory requires continuous monitoring of economic indicators and global events to assess potential risks. Understanding positive market sentiment is crucial for navigating the Indian stock market. Conduct thorough research and consider seeking professional advice before making any investment decisions related to the Nifty 50 or other Indian stocks based on positive market sentiment. Learn more about investing in the Nifty 50 and making informed decisions based on current market conditions.

Featured Posts

-

Positive Market Sentiment Indias Nifty 50 Experiences Strong Growth

Apr 24, 2025

Positive Market Sentiment Indias Nifty 50 Experiences Strong Growth

Apr 24, 2025 -

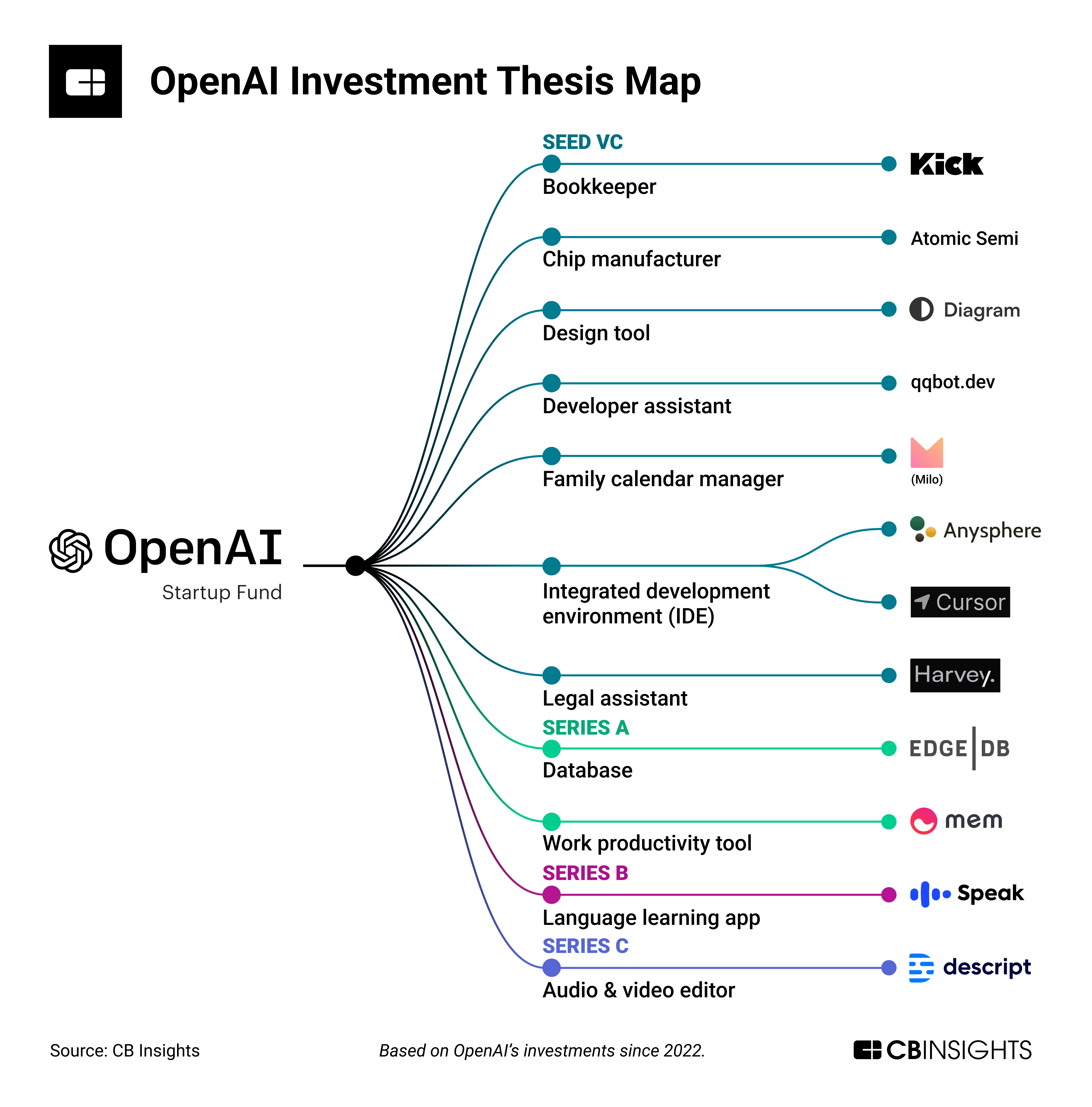

Building Voice Assistants Made Easy Open Ais New Tools

Apr 24, 2025

Building Voice Assistants Made Easy Open Ais New Tools

Apr 24, 2025 -

Bethesdas Oblivion Remastered Officially Released Today

Apr 24, 2025

Bethesdas Oblivion Remastered Officially Released Today

Apr 24, 2025 -

Startup Airlines Controversial Choice Utilizing Deportation Flights For Profit

Apr 24, 2025

Startup Airlines Controversial Choice Utilizing Deportation Flights For Profit

Apr 24, 2025 -

35 Unlimited Google Fis Latest Mobile Plan Explained

Apr 24, 2025

35 Unlimited Google Fis Latest Mobile Plan Explained

Apr 24, 2025