Post-Trump Presidency: Quantifying The Financial Losses Of Elon Musk, Jeff Bezos, And Mark Zuckerberg

Table of Contents

Elon Musk's Post-Trump Presidency Financial Performance

Elon Musk's financial trajectory since the end of the Trump presidency has been a rollercoaster, largely mirroring the volatility of Tesla's stock price. While the Trump administration's focus on deregulation initially benefited Tesla through reduced environmental regulations, the subsequent shift brought about new challenges.

-

Policy Changes and Tesla's Stock: The Biden administration's emphasis on electric vehicle (EV) infrastructure, while seemingly positive for Tesla, also led to increased competition. Specific policies like tax credits and incentives for domestic EV production created a more crowded market, influencing Tesla's stock price fluctuations. For example, the introduction of certain tax credits for domestically produced EVs directly impacted Tesla's pricing strategies and market share.

-

SpaceX and Government Contracts: SpaceX, Musk's space exploration company, also experienced shifts. While SpaceX continued to secure significant contracts from both private and government entities, the changing political landscape brought about uncertainty in future contract awards and funding levels for space exploration initiatives.

-

Musk's Public Statements and Market Perception: Musk's often controversial public statements have consistently influenced Tesla's stock price. Market sentiment towards him, both positive and negative, directly impacts investor confidence and the company's valuation, significantly influencing his personal net worth.

Quantifying precise financial losses is difficult due to the complex interplay of factors. However, analysts have observed periods of significant decline in Tesla's stock price and thus Musk's net worth following the change in administration, although he has also experienced periods of substantial gains as well. Reliable sources like Bloomberg and Forbes provide ongoing updates on his net worth.

Jeff Bezos's Post-Trump Presidency Financial Trajectory

Jeff Bezos's financial performance since the end of the Trump era has been marked by a complex mix of factors. While Amazon experienced continued growth, increased regulatory scrutiny presented new challenges.

-

Antitrust Concerns and Regulatory Changes: The increased focus on antitrust concerns and the examination of Amazon's market dominance under the new administration led to various investigations and regulatory actions. These actions, though not necessarily resulting in immediate financial penalties, generated uncertainty in the market and impacted investor confidence.

-

Amazon's Expansion and Diversification: Amazon's continued expansion into new sectors (like healthcare and cloud computing) and its diversification strategies have mitigated some of the risks associated with regulatory challenges. However, these expansion efforts require significant investment, potentially impacting short-term profitability.

-

The Pandemic's Impact: The COVID-19 pandemic significantly boosted Amazon's stock price initially, as online shopping surged. However, this effect lessened as the pandemic subsided, and logistical challenges and increased operating costs impacted profitability in the following periods.

Estimating Bezos's post-Trump financial losses is challenging; while Amazon's stock price has experienced significant fluctuations, overall growth has continued, resulting in overall gains for Bezos' net worth.

Mark Zuckerberg's Post-Trump Presidency Financial Landscape

Mark Zuckerberg and Meta (formerly Facebook) faced a unique set of challenges in the post-Trump era, primarily stemming from increased regulatory scrutiny and evolving social media landscapes.

-

Social Media Regulation and Data Privacy: The increasing focus on social media regulation and data privacy concerns led to significant regulatory changes and fines impacting Meta's financial performance. Regulations regarding data collection, advertising practices, and content moderation had notable effects on the company's revenue and profitability.

-

Facebook's Responses and Financial Implications: Meta's responses to these regulatory challenges, including investments in compliance and content moderation, incurred substantial costs. The shift to the metaverse also involved significant investment, with yet-to-be-seen returns on investment.

-

Evolving Social Media Landscape: The evolving competitive landscape, with the rise of TikTok and other social media platforms, also impacted Meta's user growth and advertising revenue, placing downward pressure on the company’s valuation and Zuckerberg's net worth.

While Zuckerberg has experienced some financial losses in certain periods, primarily linked to the reduced stock price of Meta, the overall picture is complex and depends on the timeframe under consideration.

Comparative Analysis: A Holistic View of Post-Trump Financial Impacts on Tech Leaders

Comparing the financial performance of Musk, Bezos, and Zuckerberg post-Trump reveals both commonalities and unique challenges. All three faced increased regulatory scrutiny, but the specific challenges and their financial impacts varied significantly.

| CEO | Key Challenges | Major Financial Impacts | Overall Trend (Post-Trump) |

|---|---|---|---|

| Elon Musk | Tesla stock volatility, SpaceX funding | Fluctuations in net worth, periods of both gains and losses | Mixed |

| Jeff Bezos | Antitrust concerns, Amazon market dominance | Continued growth, but with increased regulatory pressure | Overall gains |

| Mark Zuckerberg | Social media regulation, competition | Stock price decline, increased operating costs | Mixed, but more negative |

The experiences of these three tech leaders highlight the interconnectedness of politics, regulation, and the financial well-being of major tech companies.

Conclusion: Understanding the Post-Trump Presidency’s Impact on Tech Billionaire Wealth

The post-Trump presidency has significantly impacted the financial trajectories of Elon Musk, Jeff Bezos, and Mark Zuckerberg. While some experienced overall net gains, others faced significant challenges leading to periods of loss. Understanding the interplay between political shifts and the financial performance of tech giants is crucial for investors, policymakers, and the tech industry itself. The "Post-Trump Presidency Financial Losses," or gains, underscore the need for a nuanced understanding of the complex relationship between government policy and the success of these influential companies. Further research into the "Post-Trump Presidency Financial Losses" of other tech leaders will help paint a more complete picture. Share your thoughts and insights in the comments below!

Featured Posts

-

Liberation Day And After The Financial Fallout For Trumps Wealthy Allies

May 10, 2025

Liberation Day And After The Financial Fallout For Trumps Wealthy Allies

May 10, 2025 -

Elizabeth Hurleys Boldest Cleavage Iconic Moments And Red Carpet Gowns

May 10, 2025

Elizabeth Hurleys Boldest Cleavage Iconic Moments And Red Carpet Gowns

May 10, 2025 -

Harry Styles Response To A Critically Bad Snl Impression

May 10, 2025

Harry Styles Response To A Critically Bad Snl Impression

May 10, 2025 -

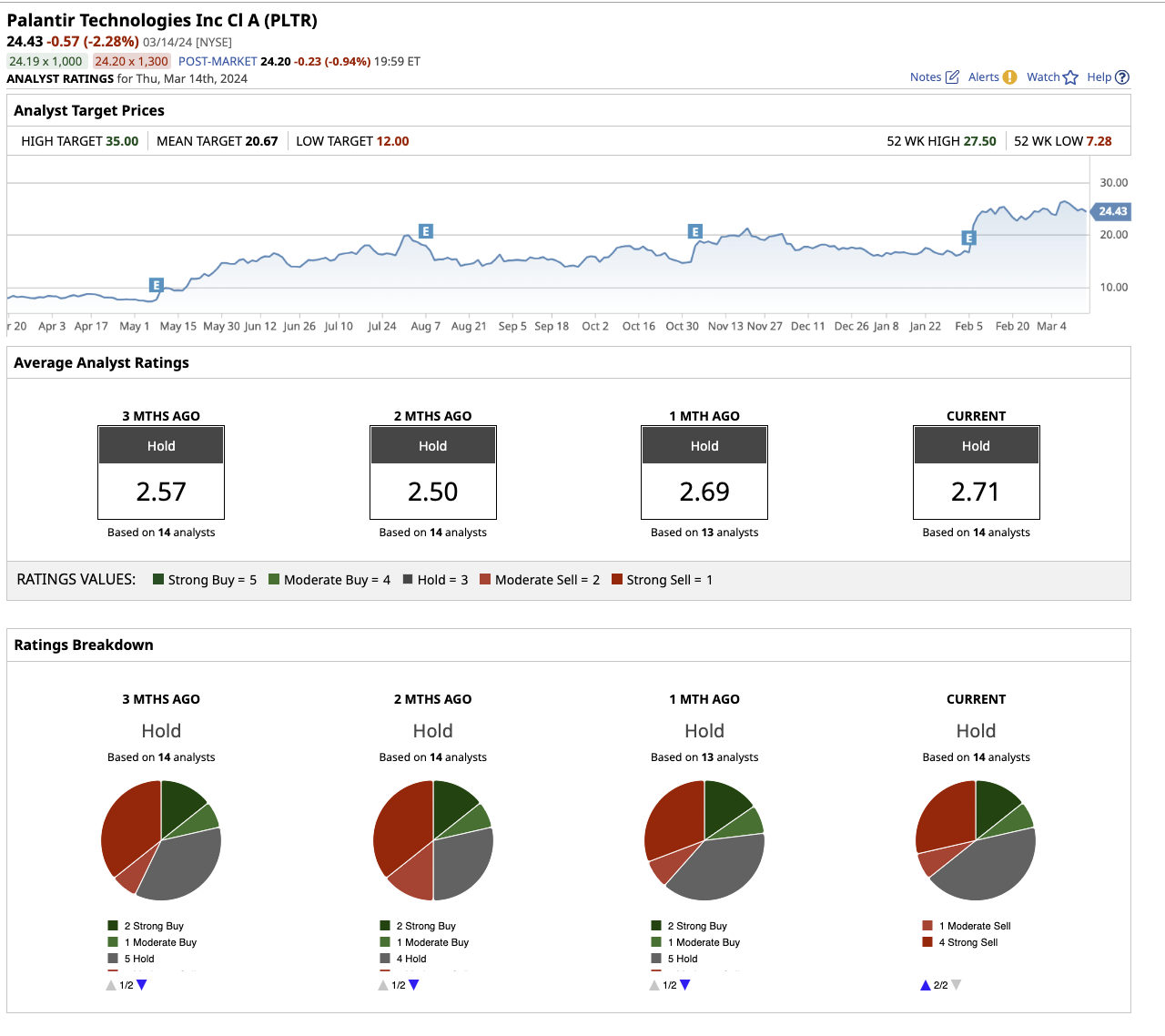

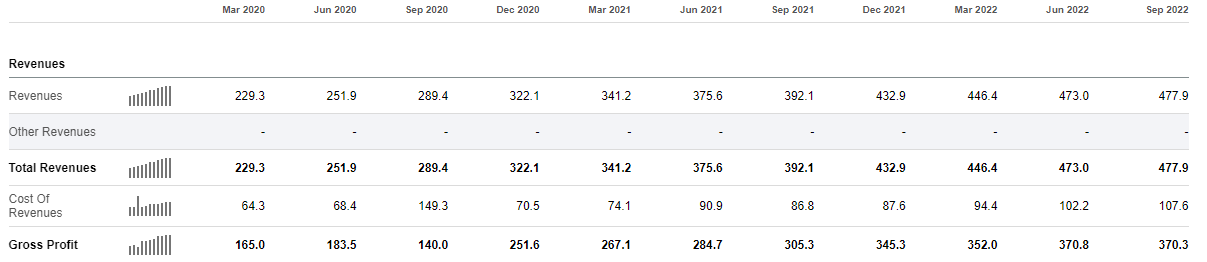

Analyzing Palantirs Potential A 40 Increase By 2025 A Realistic Outlook

May 10, 2025

Analyzing Palantirs Potential A 40 Increase By 2025 A Realistic Outlook

May 10, 2025 -

Investing In Palantir After A 30 Market Correction

May 10, 2025

Investing In Palantir After A 30 Market Correction

May 10, 2025