Powell's Fed: A Calculated Risk – Delaying Interest Rate Cuts Despite Trump's Pressure

Table of Contents

The Economic Context: A Slowdown, Not a Recession

The US economy is experiencing a slowdown, a fact acknowledged even by the most ardent critics of Powell's Fed. However, characterizing it as a full-blown recession requires a deeper examination of key economic indicators.

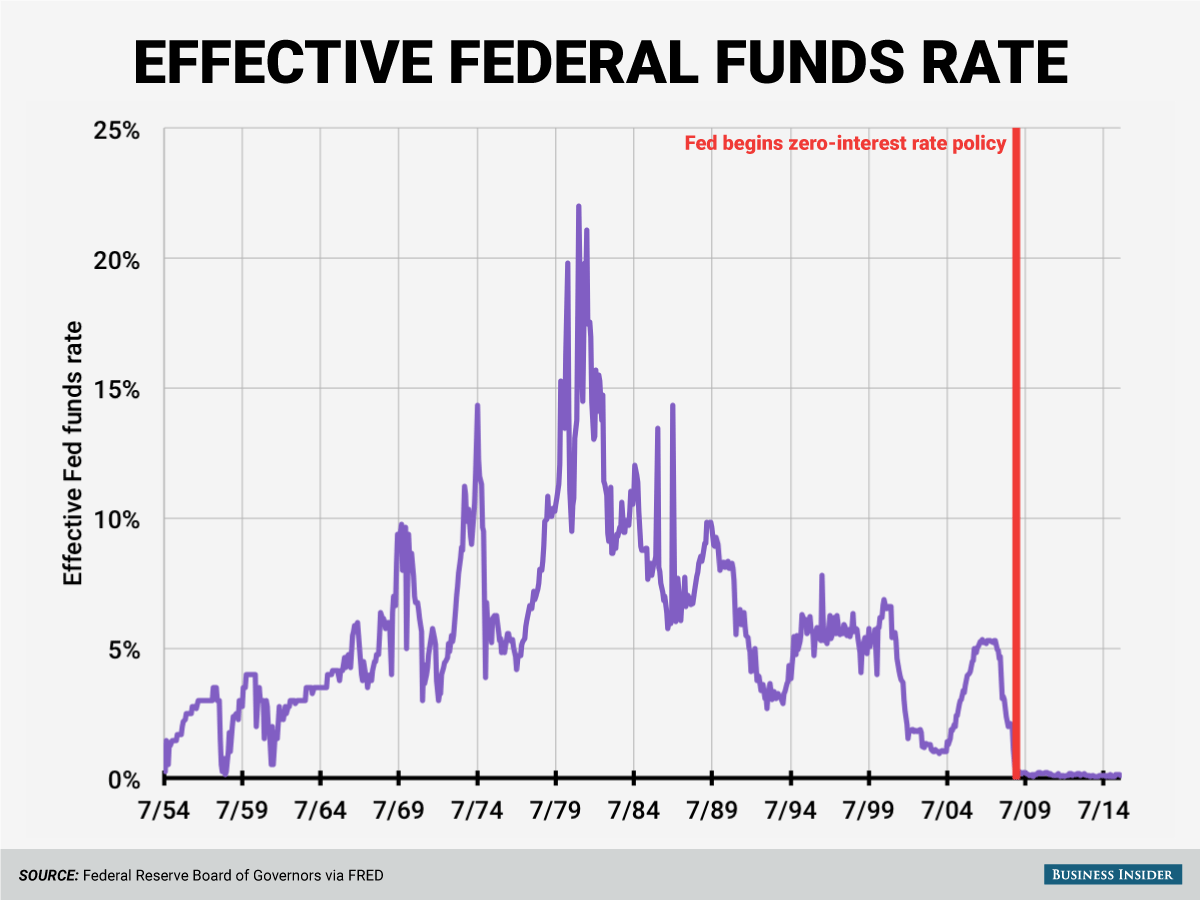

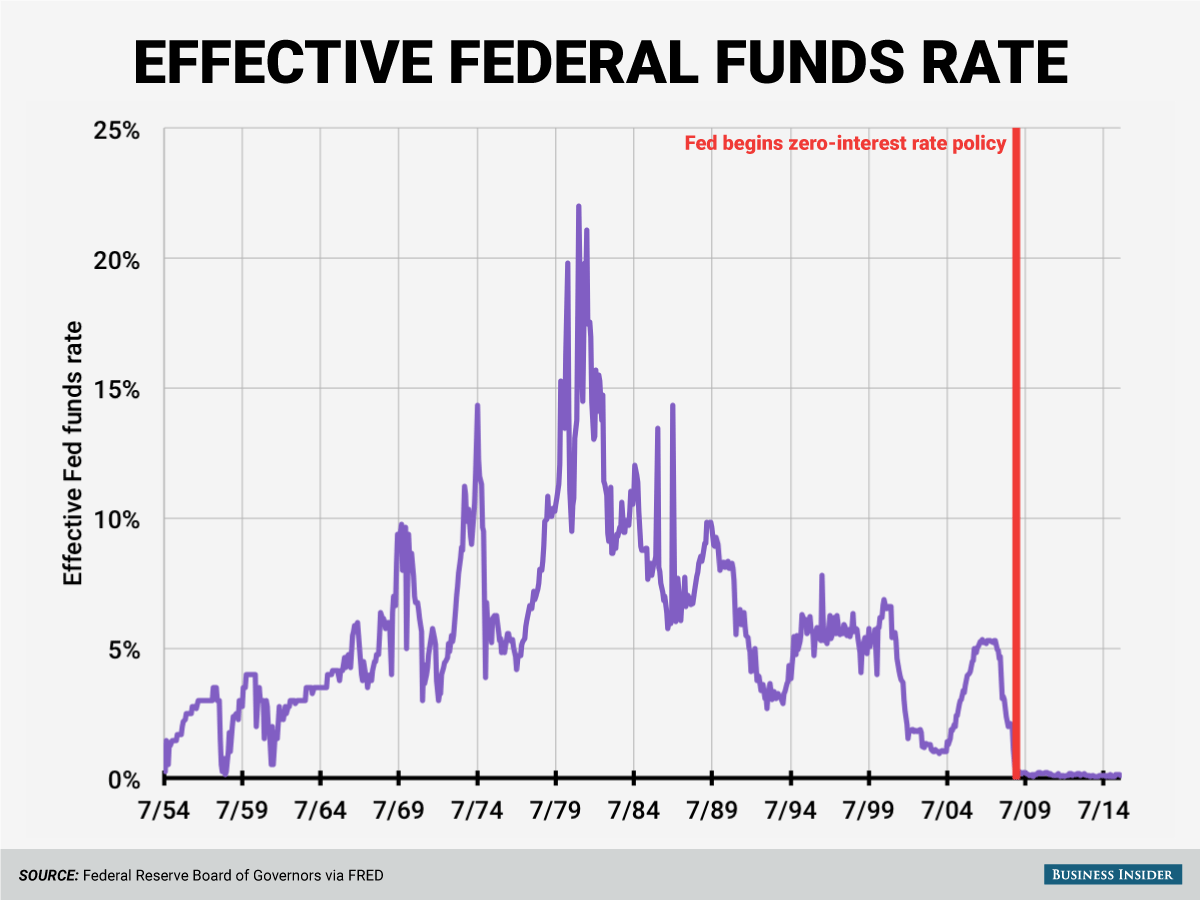

- GDP Growth: While GDP growth has slowed, it remains positive, indicating continued, albeit slower, expansion. This contrasts sharply with the sharp contractions seen during previous recessions. Analyzing the composition of GDP growth – is it driven by consumer spending, investment, or government spending? – provides valuable insights.

- Unemployment Rate: The unemployment rate remains low, historically suggesting a healthy economy. However, a closer look at the types of jobs being created and the participation rate can reveal nuances often missed in headline figures.

- Inflation Rate: Inflation remains relatively tame, suggesting there is no immediate need for aggressive interest rate cuts to combat rising prices. This is a crucial factor influencing Powell's decision, as premature cuts could fuel inflation without significantly boosting growth.

- Consumer Confidence and Spending: Consumer confidence, a key driver of economic growth, has shown some weakening, but hasn't plummeted. Analyzing consumer spending habits – are they shifting towards savings or remaining consistent? – helps gauge the true health of the economy.

Powell’s cautious approach stems from a belief that the current situation warrants a measured response. Premature interest rate cuts, he argues, risk igniting inflation without adequately addressing underlying economic weaknesses. This calculated risk prioritizes the long-term health of the economy over short-term political gains.

Political Pressure and the Independence of the Fed

President Trump's repeated calls for interest rate cuts have put immense pressure on Powell and the Federal Reserve. Trump's public criticism of Powell's actions, bordering on attacks, raises serious concerns about the independence of the central bank.

- Trump's Criticism: Trump's statements highlight the political pressure on the Federal Reserve to act in ways that might benefit his re-election prospects, even if detrimental to the long-term economic health of the nation.

- Federal Reserve Independence: The independence of the Federal Reserve is paramount to its ability to effectively manage monetary policy. Political interference can compromise the Fed’s objectivity and credibility, leading to unpredictable and potentially damaging economic consequences.

- Consequences of Political Interference: Historically, political interference in monetary policy has often resulted in economic instability and inflation. Maintaining the Fed’s independence is crucial for preserving its long-term effectiveness and trustworthiness.

- Historical Examples: Several historical instances demonstrate the negative impacts of politicizing central bank decisions. These examples underscore the importance of maintaining the Fed's autonomy to make decisions based solely on economic data and analysis, without political bias.

Powell’s steadfast resistance to this pressure underscores his commitment to preserving the Fed's independence and making decisions based on economic fundamentals, rather than political expediency.

Powell's Strategy: A Cautious Approach to Rate Cuts

Powell's strategy is characterized by a cautious approach to interest rate cuts, prioritizing a wait-and-see approach before implementing drastic measures.

- Reasons for Delay: Powell has cited the relatively low inflation rate and the need to assess the effectiveness of other measures before resorting to interest rate cuts.

- Alternative Tools: Besides interest rate cuts, the Fed has other tools at its disposal, including quantitative easing (QE) and forward guidance. QE involves purchasing government bonds to increase the money supply, while forward guidance involves communicating the Fed’s intentions to influence market expectations.

- Benefits of a Wait-and-See Approach: A cautious approach allows the Fed to gather more data and assess the impact of current economic trends before intervening, reducing the risk of making policy mistakes.

- Risks of Delay: However, delaying action too long carries the risk of exacerbating the economic slowdown, potentially leading to a more significant downturn. This calculated risk necessitates careful monitoring of economic indicators and a willingness to adapt the strategy as needed.

This balanced approach reflects Powell's commitment to making data-driven decisions, even in the face of significant political pressure.

Assessing the Risks and Rewards

Powell's decision involves a careful weighing of potential risks and rewards.

- Downsides of Delaying Rate Cuts: A prolonged economic slowdown, increased market volatility, and a potential loss of consumer confidence are all risks associated with delaying interest rate cuts.

- Upsides of a Cautious Approach: Avoiding inflationary pressures, maintaining the Fed’s credibility, and allowing time for other economic policies to take effect are potential benefits of a more cautious strategy.

- Economic Forecasting Uncertainty: Economic forecasting is inherently uncertain. The Fed faces significant challenges in accurately predicting future economic conditions and making optimal decisions in a complex and dynamic environment.

The success of Powell's strategy will ultimately depend on the accuracy of its economic forecasts and the effectiveness of its alternative measures in addressing the current slowdown.

Conclusion

Powell's decision to delay interest rate cuts, despite significant political pressure from President Trump, represents a calculated risk. The current economic slowdown, concerns about inflation, and the critical importance of maintaining the Fed's independence all inform this strategy. While delaying action carries inherent risks, a cautious approach allows the Fed to assess the situation more thoroughly and potentially avoid more significant problems in the long run. This careful balancing act demonstrates the complexities facing Powell's Fed in navigating the current economic climate.

Understanding the intricacies of Powell's Fed and its approach to interest rate cuts is crucial for navigating the complexities of the current economic climate. Stay informed on the latest developments regarding Powell's Fed and its monetary policy decisions to make well-informed financial choices.

Featured Posts

-

Yes Bank And Smfg A Strategic Partnership On The Horizon

May 07, 2025

Yes Bank And Smfg A Strategic Partnership On The Horizon

May 07, 2025 -

Sensatsiyna Fotosesiya Rianna V Spokuslivomu Rozhevomu

May 07, 2025

Sensatsiyna Fotosesiya Rianna V Spokuslivomu Rozhevomu

May 07, 2025 -

Complete 2025 Game Release Calendar Ps 5 Ps 4 Xbox Pc Nintendo Switch

May 07, 2025

Complete 2025 Game Release Calendar Ps 5 Ps 4 Xbox Pc Nintendo Switch

May 07, 2025 -

Steph Currys All Star Mvp Performance A Highlight In A Controversial Weekend

May 07, 2025

Steph Currys All Star Mvp Performance A Highlight In A Controversial Weekend

May 07, 2025 -

John Wick 5 Reimagining The Franchise After The High Table

May 07, 2025

John Wick 5 Reimagining The Franchise After The High Table

May 07, 2025