Power Finance Corporation (PFC) Dividend 2025: March 12th Announcement Expected

Table of Contents

Understanding Power Finance Corporation (PFC) and its Dividend History

PFC's Role in India's Power Sector

Power Finance Corporation (PFC) plays a vital role in India's power sector, acting as a primary lender and investor in power infrastructure development. PFC provides financial assistance for various projects, contributing significantly to the nation's electricity generation and distribution capabilities. Key activities include:

- Financing thermal, hydro, and renewable energy projects.

- Supporting transmission and distribution infrastructure development.

- Providing financial assistance to state electricity boards.

- Investing in private sector power projects.

PFC's influence on India's power infrastructure financing is undeniable, making it a key player in the nation's economic growth.

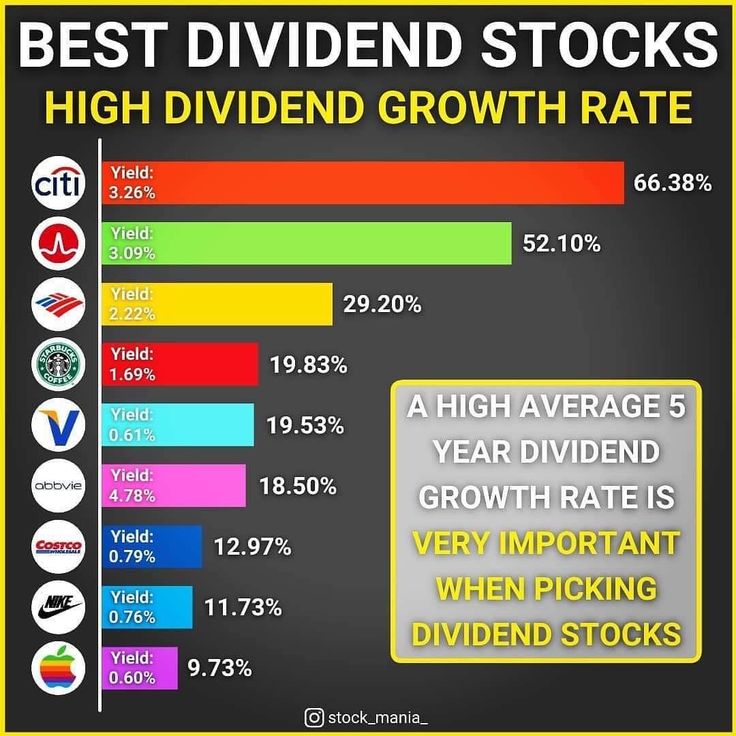

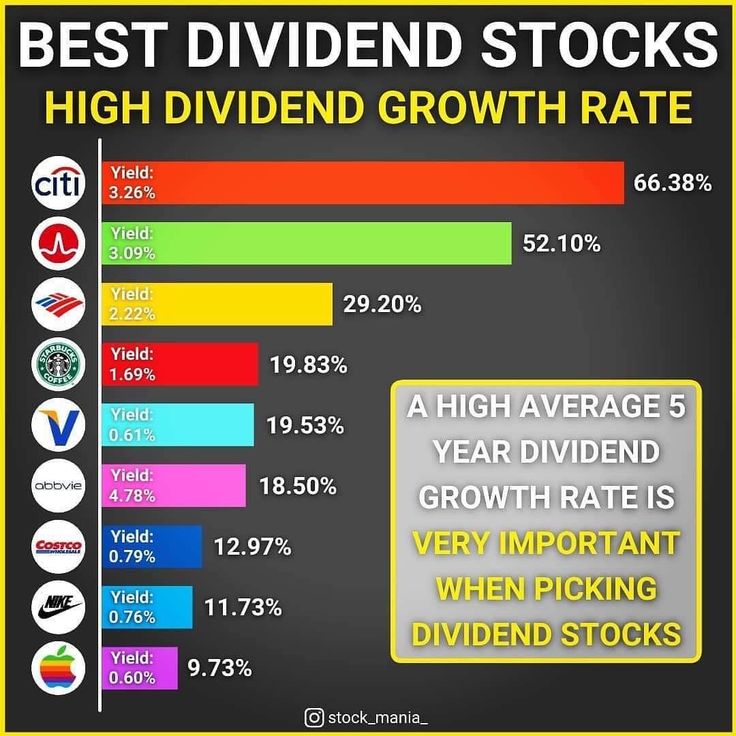

Analyzing Past PFC Dividend Trends

Analyzing the PFC dividend history reveals valuable insights into the company's dividend payout ratio and historical dividend yield. While specific data requires referencing official PFC documents and financial reports, observing past trends helps understand potential future payouts. A consistent dividend payout, or a pattern of increases, suggests a healthy financial outlook. Examining the relationship between profitability and dividend payouts is also crucial. A historical analysis might reveal:

- Years of higher-than-average dividend payouts, possibly correlated with periods of strong financial performance.

- Years of lower-than-average or no dividend payouts, potentially linked to economic downturns or company-specific challenges.

(Note: A table or chart visualizing past dividend data would be inserted here if available)

Factors Influencing PFC's Dividend Policy

Several factors influence PFC's dividend policy, including:

- Profitability: Higher profits generally allow for larger dividend payouts.

- Financial Stability: A strong financial position ensures the company can maintain consistent dividend payments.

- Regulatory Requirements: Compliance with relevant regulations impacts dividend distribution policies.

- Growth Opportunities: Investment needs and expansion plans may influence the amount allocated to dividends.

- Market Conditions: Overall economic conditions and investor sentiment affect the decision-making process.

These factors will likely influence the 2025 dividend announcement.

Expectations and Predictions for the PFC Dividend 2025

Analyst Forecasts and Market Sentiment

Analyst forecasts and market sentiment surrounding the PFC dividend 2025 vary. While specific predictions are subject to change, a review of reputable financial news sources and analyst reports will offer a clearer picture of current expectations. Looking at the consensus view among analysts is a good starting point, but remember that these are predictions, not guarantees.

- Many financial experts base their projections on the company’s past performance and future prospects.

- Market sentiment, reflected in stock price movements, also provides clues about investor expectations concerning the dividend.

Impact of Current Economic Conditions

Current economic conditions, particularly inflation and interest rates, significantly influence PFC's dividend payout. High inflation could reduce profitability, potentially limiting the dividend. Conversely, a stable economic environment may allow for a more generous payout. It is important to consider:

- The impact of inflation on PFC's operating costs and revenues.

- The effect of interest rate changes on PFC's borrowing costs and profitability.

- Overall macroeconomic trends and their influence on the Indian power sector.

Potential Dividend Yield and Implications for Investors

The potential dividend yield is a crucial factor for investors. The dividend yield is calculated by dividing the annual dividend per share by the current market price per share. A higher yield is generally more attractive to income-seeking investors. Understanding the potential range of yields and their implications for returns on investment is critical. Potential scenarios include:

- A higher-than-expected yield attracting more investors and potentially boosting the share price.

- A lower-than-expected yield potentially leading to a decrease in share price, depending on other market factors.

How to Stay Updated on the PFC Dividend 2025 Announcement

Official Sources for Information

The most reliable information will come from official channels. Always check:

- The official Power Finance Corporation (PFC) website.

- Announcements from major stock exchanges where PFC is listed.

These are the most accurate and up-to-date sources.

Reliable Financial News Outlets

Reputable financial news sources provide valuable insights and updates. It's crucial to rely on trusted sources to avoid misinformation. Always cross-reference information from multiple credible sources.

Setting up Alerts and Notifications

To stay informed, set up alerts:

- Subscribe to email alerts from PFC's investor relations section.

- Use financial news aggregators with customisable alerts.

- Follow reputable financial news sources on social media for breaking news.

Conclusion: Staying Informed about the Power Finance Corporation (PFC) Dividend 2025

The upcoming March 12th announcement of the PFC dividend 2025 is highly anticipated by investors. Understanding the company's history, considering economic factors influencing the decision, and monitoring official sources for information are crucial steps. Remember, staying informed allows for better investment decisions. Stay tuned for the PFC dividend 2025 announcement and monitor the official PFC channels for the latest updates. Follow the PFC dividend developments closely to make informed investment choices.

Featured Posts

-

Canadas Divided Response To Trump Albertas Oil Industry And The National Narrative

Apr 27, 2025

Canadas Divided Response To Trump Albertas Oil Industry And The National Narrative

Apr 27, 2025 -

Canadas Trade Strategy Waiting For A Favorable Us Deal

Apr 27, 2025

Canadas Trade Strategy Waiting For A Favorable Us Deal

Apr 27, 2025 -

Professional Hair And Tattoo Transformations Ariana Grandes Stunning New Look

Apr 27, 2025

Professional Hair And Tattoo Transformations Ariana Grandes Stunning New Look

Apr 27, 2025 -

Us Economy Feels The Pinch Analyzing The Impact Of The Canadian Travel Boycott

Apr 27, 2025

Us Economy Feels The Pinch Analyzing The Impact Of The Canadian Travel Boycott

Apr 27, 2025 -

French Auction Camille Claudel Bronze Sculpture Commands 3 Million

Apr 27, 2025

French Auction Camille Claudel Bronze Sculpture Commands 3 Million

Apr 27, 2025

Latest Posts

-

Open Ais Chat Gpt An Ftc Investigation And Its Potential Consequences

Apr 28, 2025

Open Ais Chat Gpt An Ftc Investigation And Its Potential Consequences

Apr 28, 2025 -

Chat Gpt Developer Open Ai Faces Ftc Investigation

Apr 28, 2025

Chat Gpt Developer Open Ai Faces Ftc Investigation

Apr 28, 2025 -

Ftc Investigates Open Ais Chat Gpt What It Means For Ai Development

Apr 28, 2025

Ftc Investigates Open Ais Chat Gpt What It Means For Ai Development

Apr 28, 2025 -

Jan 6 Witness Cassidy Hutchinson To Publish Memoir This Fall

Apr 28, 2025

Jan 6 Witness Cassidy Hutchinson To Publish Memoir This Fall

Apr 28, 2025 -

Cassidy Hutchinson Plans Memoir A Look Inside The January 6th Hearings

Apr 28, 2025

Cassidy Hutchinson Plans Memoir A Look Inside The January 6th Hearings

Apr 28, 2025