Prediction: 2 Stocks Outperforming Palantir In 3 Years

Table of Contents

Stock #1: CrowdStrike – A Deep Dive into its Growth Potential

CrowdStrike Holdings, Inc. (CRWD), a cybersecurity leader, presents a compelling alternative to Palantir. Its focus on cloud-native endpoint protection positions it for significant growth in the rapidly expanding cybersecurity market.

Disruptive Technology and Market Domination

CrowdStrike's innovative Falcon platform utilizes artificial intelligence (AI) to deliver real-time threat protection. This sets it apart from traditional cybersecurity solutions.

- Unique Selling Proposition (USP): CrowdStrike's cloud-based, AI-powered platform offers superior speed, scalability, and threat detection compared to legacy on-premise solutions. This gives it a significant competitive advantage.

- Market Size and Growth Projections: The global cybersecurity market is booming, projected to reach hundreds of billions of dollars in the coming years. CrowdStrike is well-positioned to capture a significant share of this growth, driven by increasing cyber threats and the adoption of cloud technologies.

- Strategic Partnerships and Acquisitions: CrowdStrike has strategically partnered with major technology companies, further expanding its reach and strengthening its market position. They have also made strategic acquisitions to enhance their platform and expand their capabilities.

Strong Financial Performance and Future Projections

CrowdStrike exhibits impressive financial performance, exceeding expectations in revenue growth and expanding its customer base.

- Key Financial Metrics: CrowdStrike consistently demonstrates strong revenue growth, exceeding industry averages. Compare its year-over-year revenue growth to Palantir's to see the clear advantage. (Note: Actual financial data should be inserted here, sourced from reputable financial websites such as Yahoo Finance or similar.)

- Charts and Graphs: (Insert relevant charts and graphs visualizing CrowdStrike's revenue growth, customer acquisition, and other key metrics. These visuals enhance understanding and engagement.)

- Sources: All financial data and projections are sourced from [cite sources, e.g., CrowdStrike's financial reports, analyst estimates from reputable firms].

Stock #2: Datadog – Riding the Wave of Cloud Monitoring

Datadog (DDOG), a leading provider of cloud monitoring and analytics, is another strong contender. It thrives on the massive and ever-growing cloud computing market.

Capitalizing on a Booming Industry

The cloud computing market is experiencing explosive growth, with businesses of all sizes migrating their operations to the cloud. Datadog perfectly capitalizes on this trend.

- Industry Trend Impact: The increasing adoption of cloud technologies necessitates robust monitoring and analytics solutions. Datadog provides precisely these services, experiencing strong demand fueled by this growth.

- Market Positioning: Datadog holds a leading position in the cloud monitoring space, known for its comprehensive platform and user-friendly interface. This establishes them as a dominant player in the market.

- Regulatory Changes and Technological Advancements: Increased regulatory scrutiny on data security and privacy further benefits Datadog, as its platform helps businesses comply with various regulations.

Robust Business Model and Scalability

Datadog's subscription-based business model ensures recurring revenue, creating a stable and predictable revenue stream.

- Revenue Streams: Datadog’s subscription model provides a reliable revenue base, with significant potential for growth as it expands its customer base and adds new features.

- Expansion Plans and International Reach: Datadog is actively expanding its global reach, targeting new markets and expanding its customer base internationally.

- Competitive Landscape: Although facing competition, Datadog maintains a strong market position through continuous innovation and a superior product offering.

Comparative Analysis: CrowdStrike and Datadog vs. Palantir

| Metric | CrowdStrike (CRWD) | Datadog (DDOG) | Palantir (PLTR) |

|---|---|---|---|

| Revenue Growth (YoY) | (Insert Data) | (Insert Data) | (Insert Data) |

| Market Capitalization | (Insert Data) | (Insert Data) | (Insert Data) |

| Projected Growth (3yr) | (Insert Data) | (Insert Data) | (Insert Data) |

| Key Strengths | AI-powered Security | Cloud Monitoring | Big Data Analytics |

(Note: Insert actual data for each metric. Clearly highlight why CrowdStrike and Datadog are projected to outperform Palantir based on this data. For example, higher revenue growth, stronger market position, or greater potential for expansion in a faster-growing market.)

Why CrowdStrike and Datadog are Poised to Outperform Palantir

Based on the data presented, CrowdStrike and Datadog’s stronger positions in rapidly expanding markets, coupled with their robust financial performance and scalability, suggest a greater potential for returns over the next three years compared to Palantir. Their focus on specific, high-growth sectors provides a more targeted approach, maximizing growth potential.

Conclusion

CrowdStrike and Datadog, with their focus on cybersecurity and cloud monitoring respectively, offer compelling alternatives to Palantir. Their strong financial performance, market positioning, and future projections suggest a higher potential for return over the next three years. While this article provides a prediction, thorough due diligence is crucial before making any investment decisions. Consider conducting your own research on Palantir alternatives and researching these high-growth stocks to see if they align with your investment goals and risk tolerance. Remember, this is a prediction, and past performance does not guarantee future results. Keywords: Palantir alternatives, high-growth stock investment, stock market prediction, investment strategy, future stock performance.

Featured Posts

-

Inter Milan Eyeing De Ligt Loan With Option To Buy From Manchester United

May 09, 2025

Inter Milan Eyeing De Ligt Loan With Option To Buy From Manchester United

May 09, 2025 -

India Pakistan Tensions Cast Shadow On Imfs 1 3 Billion Loan Review For Pakistan

May 09, 2025

India Pakistan Tensions Cast Shadow On Imfs 1 3 Billion Loan Review For Pakistan

May 09, 2025 -

Expected Announcement Trump And Britain Conclude Trade Negotiations

May 09, 2025

Expected Announcement Trump And Britain Conclude Trade Negotiations

May 09, 2025 -

Cite De La Gastronomie De Dijon Le Cas Epicure Et Le Role De La Ville

May 09, 2025

Cite De La Gastronomie De Dijon Le Cas Epicure Et Le Role De La Ville

May 09, 2025 -

Analysis Of Pam Bondis Comments Regarding The Death Of American Citizens

May 09, 2025

Analysis Of Pam Bondis Comments Regarding The Death Of American Citizens

May 09, 2025

Latest Posts

-

Strengthening The Eu Response To Us Tariffs A French Ministers Plea

May 09, 2025

Strengthening The Eu Response To Us Tariffs A French Ministers Plea

May 09, 2025 -

Further Eu Action Needed On Us Tariffs Says French Minister

May 09, 2025

Further Eu Action Needed On Us Tariffs Says French Minister

May 09, 2025 -

French Minister Urges More Aggressive Eu Action Against Us Tariffs

May 09, 2025

French Minister Urges More Aggressive Eu Action Against Us Tariffs

May 09, 2025 -

Eus Response To Us Tariffs French Minister Advocates For Stronger Action

May 09, 2025

Eus Response To Us Tariffs French Minister Advocates For Stronger Action

May 09, 2025 -

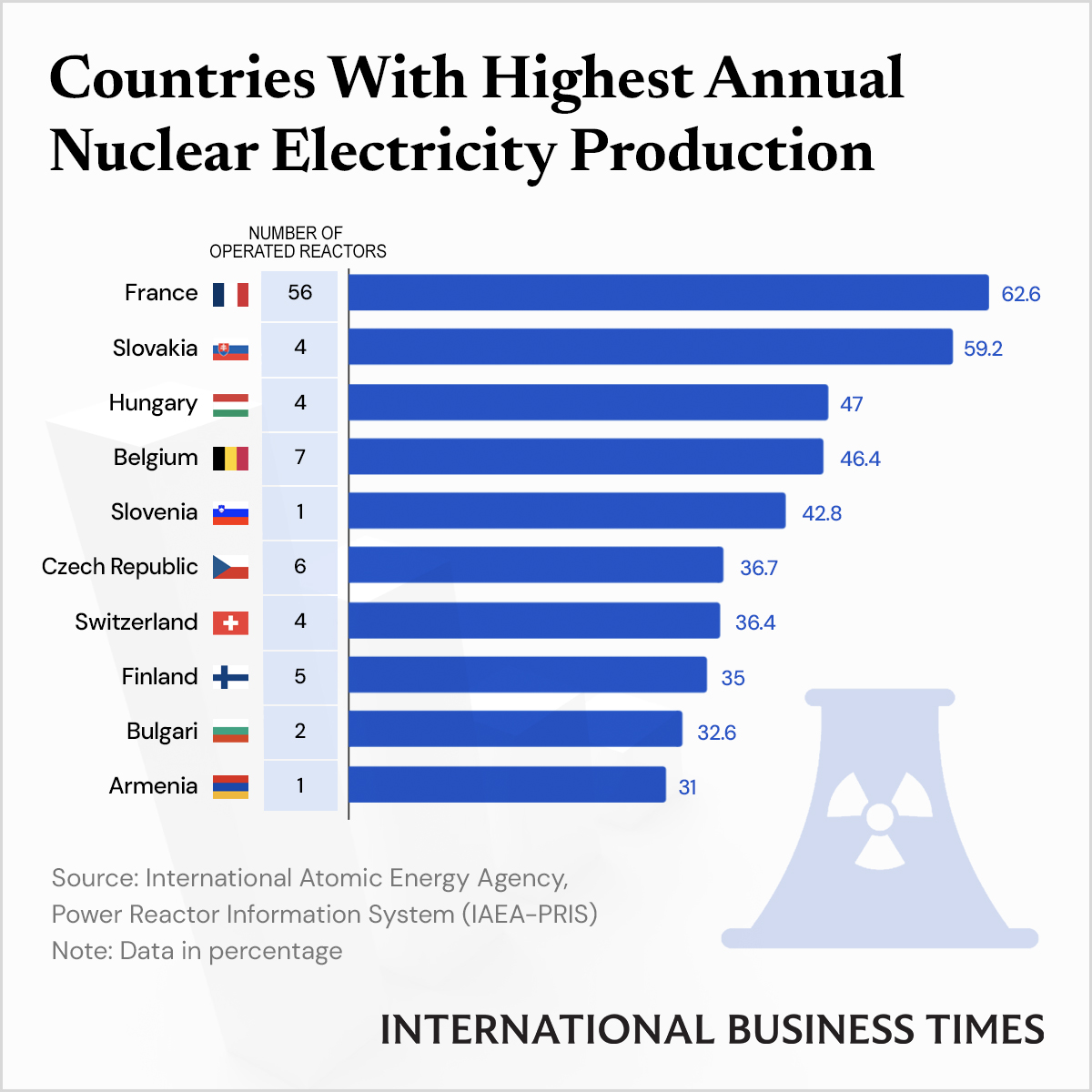

Frances Nuclear Shield A Proposal For Shared European Security

May 09, 2025

Frances Nuclear Shield A Proposal For Shared European Security

May 09, 2025