India-Pakistan Tensions Cast Shadow On IMF's $1.3 Billion Loan Review For Pakistan

Table of Contents

Geopolitical Risks and Economic Instability

Heightened India-Pakistan tensions directly impact investor confidence, foreign investment, and the Pakistani Rupee's value. The volatile security environment creates uncertainty, deterring both domestic and foreign investment crucial for economic growth. This uncertainty translates into tangible economic consequences:

-

Increased military spending: Diversion of resources away from essential social programs like healthcare and education, hindering long-term development and exacerbating existing inequalities. This increased military expenditure further strains the already burdened national budget, making it more challenging to meet the IMF's fiscal targets.

-

Deterioration of trade relations: Strained relations hamper bilateral trade, reducing Pakistan's export capabilities and impacting its balance of payments. This limits access to essential goods and services, impacting both businesses and consumers. The resulting trade deficit adds to the economic pressure on the nation.

-

Heightened uncertainty discouraging foreign direct investment (FDI): Investors are hesitant to commit capital in an unstable environment, leading to a shortfall in much-needed FDI for infrastructure development and job creation. This lack of investment further impedes economic growth and contributes to the ongoing economic crisis.

-

Volatility in the Pakistani Rupee: Fluctuations in the currency's value significantly impact import costs, leading to higher inflation and eroding purchasing power. This makes it more difficult for Pakistan to service its external debt and meet its financial obligations.

-

Potential for capital flight: Investors and citizens may withdraw their funds from Pakistan, leading to a further depletion of foreign exchange reserves and worsening the economic crisis. This capital flight further destabilizes the economy and makes it more difficult for the government to implement necessary reforms.

IMF Loan Review Conditions and Challenges

The IMF's $1.3 billion loan disbursement is contingent upon Pakistan meeting a series of strict conditions aimed at stabilizing the economy and promoting sustainable growth. These conditions, while necessary, are challenging to implement given the current political and economic climate.

-

Fiscal reforms and austerity measures: The IMF demands significant cuts in government spending to reduce the budget deficit. These austerity measures can be politically unpopular and lead to social unrest.

-

Revenue generation targets and tax reforms: Pakistan needs to significantly increase tax revenue to meet the IMF's targets. This requires implementing effective tax reforms, improving tax collection mechanisms, and broadening the tax base. This can be a challenging task given the existing informal economy and capacity limitations within the tax administration.

-

Structural adjustments and economic reforms: The IMF requires far-reaching structural reforms to improve governance, transparency, and the efficiency of state-owned enterprises. This process involves significant institutional changes and often faces resistance from vested interests.

-

Difficult political landscape hindering the implementation of these reforms: Political instability and infighting can hamper the implementation of necessary reforms. The lack of political consensus makes it difficult to enact and enforce crucial economic policies.

-

The impact of external shocks, like the India-Pakistan tensions, on meeting IMF targets: Geopolitical instability directly impacts Pakistan's ability to meet the IMF's conditions. The ongoing tensions divert resources, disrupt trade, and create uncertainty, making it harder to achieve the required economic targets.

The Role of External Debt in the Crisis

Pakistan's high level of external debt significantly contributes to its economic vulnerability. This heavy debt burden limits fiscal flexibility and increases dependence on external financing, leaving the country exposed to global economic downturns and external shocks.

-

Existing debt burden limiting Pakistan's fiscal flexibility: The substantial debt servicing costs constrain the government's ability to invest in crucial sectors and implement necessary social programs. This limits the government's capacity to respond effectively to economic crises.

-

Reliance on external financing increasing vulnerability to global economic downturns: Pakistan's dependence on external financing makes it highly susceptible to global economic shocks and changes in international financial markets. This increases the risk of debt distress and potential defaults.

-

The impact of sanctions and trade restrictions on debt servicing capacity: Any further sanctions or trade restrictions, potentially stemming from the ongoing geopolitical tensions, could severely impact Pakistan's ability to service its debt, potentially leading to a debt crisis.

Potential Impacts of Loan Approval/Rejection

The IMF's decision regarding the loan will have profound consequences for Pakistan's economy and its relationship with the international community.

-

Economic consequences of loan approval: While approval offers short-term relief, the long-term challenges remain significant. Pakistan still needs to implement substantial reforms to achieve sustainable economic growth and reduce its reliance on external financing.

-

Economic consequences of loan rejection: A rejection could trigger a sovereign debt default, leading to a further economic collapse, potential social unrest, and severely damaged international credibility. This would have devastating consequences for the Pakistani economy and its citizens.

-

Impact on Pakistan's international relations and standing: The outcome of the loan review will significantly influence Pakistan's standing in the international community and its relationship with other global financial institutions.

Conclusion

The ongoing India-Pakistan tensions are undeniably exacerbating Pakistan's already fragile economic situation, creating significant hurdles in securing the crucial IMF loan. The stringent conditions imposed by the IMF, coupled with the geopolitical instability, present a complex challenge requiring careful consideration. The success or failure of this loan review will significantly impact Pakistan's economic trajectory and its ability to navigate the turbulent waters of its current financial crisis. Understanding the intricacies of the India-Pakistan tensions IMF loan Pakistan situation is vital for anyone following global finance and geopolitical affairs. Staying informed about developments in this crucial situation is essential. Follow reputable news sources and analytical reports to stay updated on the latest developments regarding the India-Pakistan tensions and their impact on Pakistan's economic stability and its quest for the crucial IMF loan.

Featured Posts

-

Apples Ai Future A Crossroads Of Innovation

May 09, 2025

Apples Ai Future A Crossroads Of Innovation

May 09, 2025 -

Palantir Stock Before May 5th Is Now The Time To Buy Wall Streets Verdict

May 09, 2025

Palantir Stock Before May 5th Is Now The Time To Buy Wall Streets Verdict

May 09, 2025 -

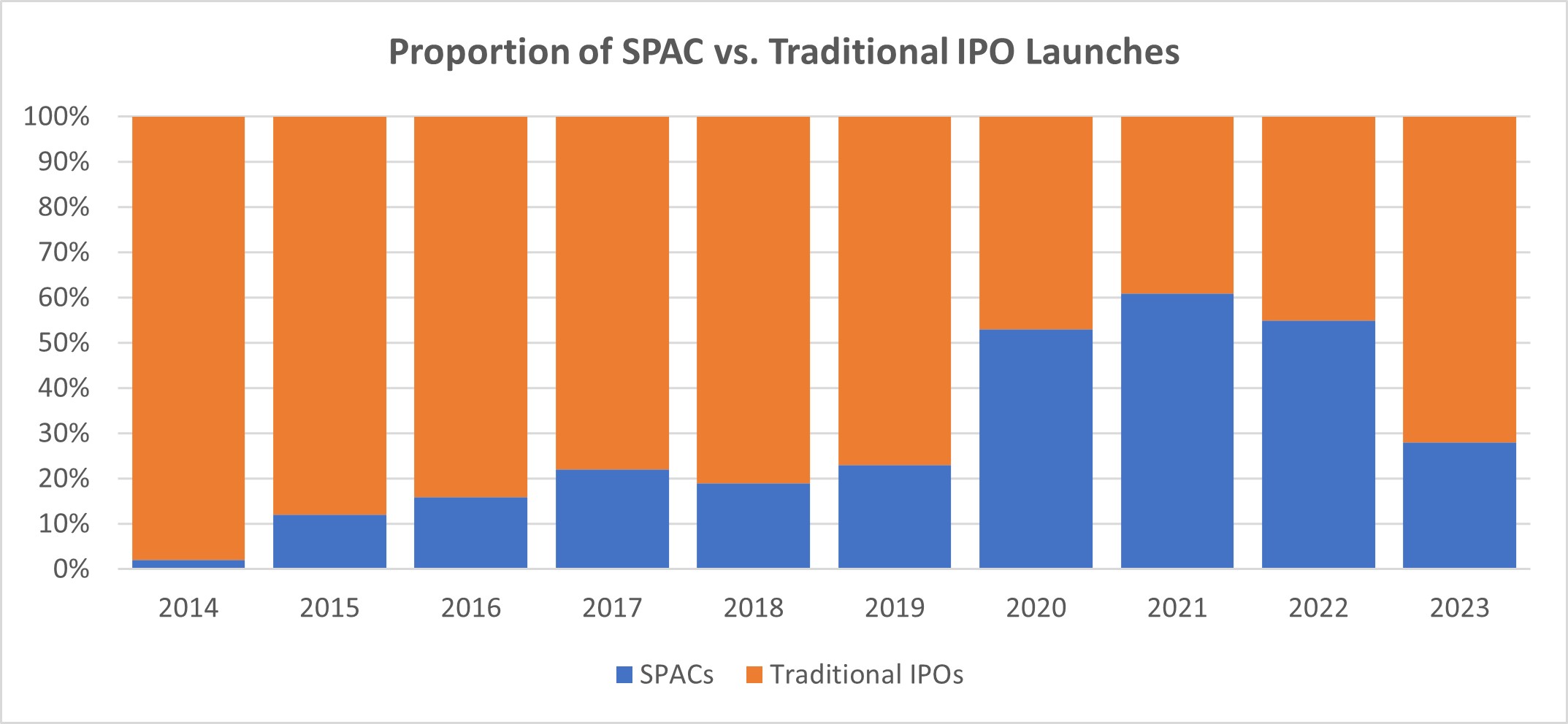

Is This Hot New Spac Stock A Smart Investment Comparing It To Micro Strategy

May 09, 2025

Is This Hot New Spac Stock A Smart Investment Comparing It To Micro Strategy

May 09, 2025 -

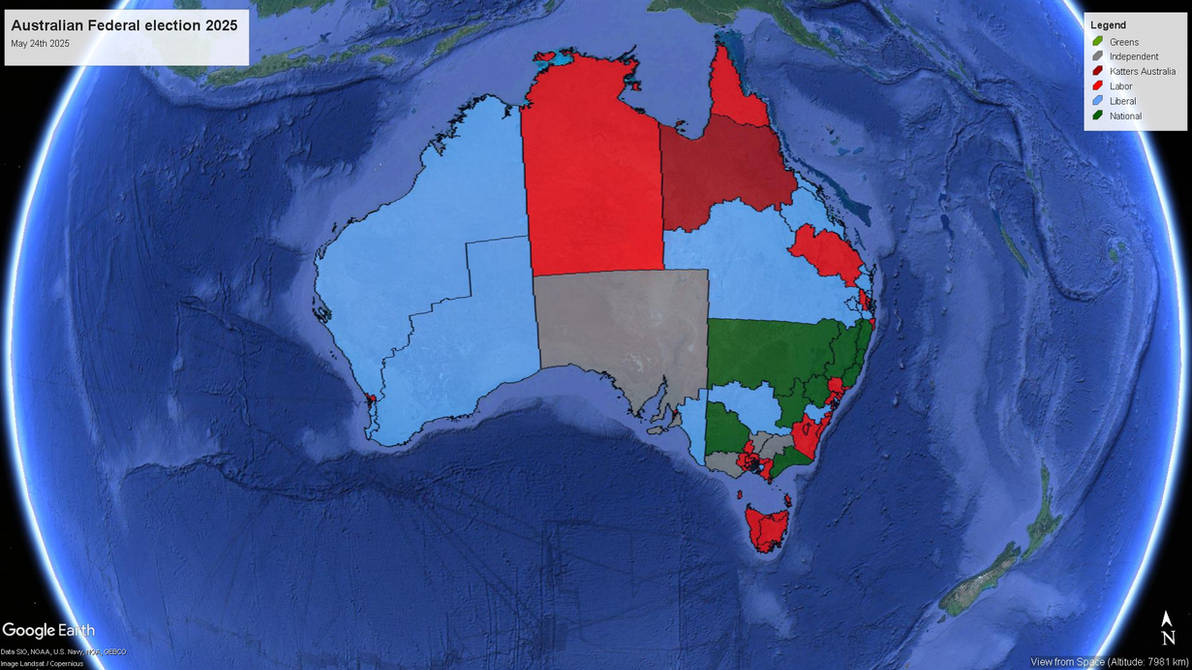

2024 Nl Federal Election Candidate Information And Resources

May 09, 2025

2024 Nl Federal Election Candidate Information And Resources

May 09, 2025 -

Tien Giang Dieu Tra Ky Luong Vu Bao Mau Bao Hanh Tre Em

May 09, 2025

Tien Giang Dieu Tra Ky Luong Vu Bao Mau Bao Hanh Tre Em

May 09, 2025

Latest Posts

-

News From The Bangkok Post The Push For Better Transgender Rights

May 10, 2025

News From The Bangkok Post The Push For Better Transgender Rights

May 10, 2025 -

The Bangkok Post And The Ongoing Struggle For Transgender Equality

May 10, 2025

The Bangkok Post And The Ongoing Struggle For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025 -

Examining Transgender Equality Issues Highlighted By The Bangkok Post

May 10, 2025

Examining Transgender Equality Issues Highlighted By The Bangkok Post

May 10, 2025 -

The Bangkok Post And The Fight For Transgender Equality In Thailand

May 10, 2025

The Bangkok Post And The Fight For Transgender Equality In Thailand

May 10, 2025