Private Lender Refinancing: A Guide To Federal Student Loans

Table of Contents

Private lender refinancing refers to the process of replacing your existing federal student loans with a new loan from a private lender. This can be beneficial if you qualify for a lower interest rate, resulting in potential savings over the life of the loan. However, it's essential to weigh the pros and cons carefully, as it involves significant trade-offs. This article will explore the intricacies of student loan refinancing, specifically focusing on private lender refinancing options for those with federal student loans.

Understanding Federal Student Loan Consolidation and Refinancing

Before diving into private lender refinancing, it's vital to understand the difference between consolidation and refinancing. Consolidation combines multiple federal student loans into a single loan with the same federal lender. This simplifies repayment, but it doesn't necessarily lower your interest rate. Refinancing, on the other hand, replaces your existing loans (federal or private) with a new loan from a different lender, often with a lower interest rate.

Refinancing your federal student loans with a private lender means you'll lose the benefits associated with federal loans. This includes:

- Income-driven repayment plans (IDR), which base your monthly payments on your income.

- Deferment and forbearance options, offering temporary pauses in payments during financial hardship.

- Potential for loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF).

Here's a breakdown of the pros and cons:

Federal Loan Consolidation:

- Pros: Simplifies repayment, potentially easier to manage.

- Cons: Doesn't lower interest rates, retains federal loan limitations.

Private Lender Refinancing of Federal Loans:

- Pros: Potential for lower interest rates, potentially shorter repayment terms.

- Cons: Loss of federal student loan benefits, risk of higher interest rates based on credit score.

Understanding the types of federal student loans is crucial. These include:

- Subsidized Loans: The government pays the interest while you're in school.

- Unsubsidized Loans: Interest accrues while you're in school.

- Grad PLUS Loans: Loans for graduate and professional students.

Finding the Right Private Lender for Refinancing

Choosing the right private lender is crucial for securing favorable terms for your student loan refinancing. Consider these factors:

- Interest Rates and APR: Compare interest rates and annual percentage rates (APR) from multiple lenders. The APR includes fees, offering a more comprehensive picture of the cost.

- Fees: Be aware of origination fees, prepayment penalties, and any other hidden costs.

- Repayment Terms: Explore options for loan terms (length of the loan) that fit your budget. Shorter terms mean higher monthly payments but less interest paid over time.

- Customer Reviews and Ratings: Check online reviews and ratings to gauge the lender's reputation for customer service and responsiveness.

- Types of Lenders: Consider various private lenders, including banks, credit unions, and online lenders. Each has its own strengths and weaknesses.

Comparison Shopping Tips:

- Use online comparison tools to quickly compare rates and terms from different lenders.

- Check the lender's eligibility requirements before applying.

- Don't solely focus on the lowest interest rate; consider the total cost of the loan.

The Private Lender Refinancing Application Process

The application process typically involves these steps:

- Pre-qualification: Get a preliminary assessment of your eligibility without affecting your credit score.

- Credit Check: The lender will review your credit report and score. A higher credit score generally leads to better interest rates.

- Application Submission: Complete the loan application and provide all required documentation.

- Loan Approval: The lender will review your application and decide whether to approve your loan.

- Closing: Once approved, you'll sign the loan documents and receive the funds.

Required Documentation: Prepare documents such as:

- Proof of income (pay stubs, tax returns)

- Credit report

Tips for Approval:

- Maintain a good credit score.

- Provide accurate and complete information.

- Have a stable income and employment history.

Risks and Considerations of Private Lender Refinancing

While private lender refinancing can offer lower interest rates, it's essential to be aware of the potential drawbacks:

- Loss of Federal Student Loan Benefits: You lose access to federal loan forgiveness programs, income-driven repayment plans, and deferment/forbearance options.

- Higher Interest Rates: If your credit score declines after refinancing, your interest rate may increase.

- Impact on Credit Score: The application process itself can temporarily lower your credit score.

Careful Review is Key:

- Thoroughly read and understand the loan terms and conditions before signing.

- Compare offers from multiple lenders to find the best terms.

Making Informed Decisions about Private Lender Refinancing

Private lender refinancing can be a powerful tool for managing federal student loan debt, but it's not without risks. Weigh the potential benefits of lower interest rates and shorter repayment periods against the loss of crucial federal student loan benefits. Careful research and comparison shopping are paramount. Before making a decision, explore your options and consider whether private lender refinancing aligns with your financial goals and risk tolerance. Explore private student loan refinancing options carefully, comparing multiple lenders and understanding all associated fees and terms. Learn more about private lender refinancing today.

For a helpful resource to compare lenders and explore your options, visit [Insert a reputable student loan comparison website link here].

Featured Posts

-

Ukraina Pod Massirovannym Obstrelom Rf Vypustila Bolee 200 Raket I Bespilotnikov

May 17, 2025

Ukraina Pod Massirovannym Obstrelom Rf Vypustila Bolee 200 Raket I Bespilotnikov

May 17, 2025 -

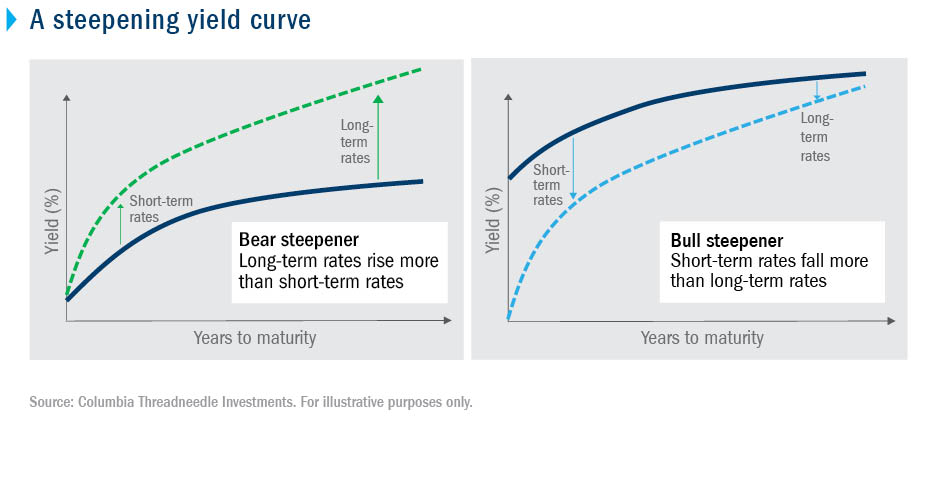

Steepening Japanese Bond Yield Curve Investor Divisions And Economic Implications

May 17, 2025

Steepening Japanese Bond Yield Curve Investor Divisions And Economic Implications

May 17, 2025 -

Kortlarin Efendisi Novak Djokovic

May 17, 2025

Kortlarin Efendisi Novak Djokovic

May 17, 2025 -

Review Of Mirax Casino A Top Ontario Online Casino For 2025

May 17, 2025

Review Of Mirax Casino A Top Ontario Online Casino For 2025

May 17, 2025 -

I Episkepsi Tramp Stin Saoydiki Aravia Leptomereies Apo Tin Ekthamvotiki Teleti Ypodoxis

May 17, 2025

I Episkepsi Tramp Stin Saoydiki Aravia Leptomereies Apo Tin Ekthamvotiki Teleti Ypodoxis

May 17, 2025

Latest Posts

-

Wnba Zvaigzde J Jocyte Gins Lietuvos Garbe Europoje

May 17, 2025

Wnba Zvaigzde J Jocyte Gins Lietuvos Garbe Europoje

May 17, 2025 -

J Jocyte Lietuvos Krepsinio Viltis Europos Cempionate

May 17, 2025

J Jocyte Lietuvos Krepsinio Viltis Europos Cempionate

May 17, 2025 -

0 0 Everton Vina Y Coquimbo Unido Empatan En Un Partido Sin Goles

May 17, 2025

0 0 Everton Vina Y Coquimbo Unido Empatan En Un Partido Sin Goles

May 17, 2025 -

Analisis Del Partido Talleres 2 0 Alianza Lima

May 17, 2025

Analisis Del Partido Talleres 2 0 Alianza Lima

May 17, 2025 -

Everton Vina Y Coquimbo Unido Reporte Del Partido 0 0

May 17, 2025

Everton Vina Y Coquimbo Unido Reporte Del Partido 0 0

May 17, 2025