Steepening Japanese Bond Yield Curve: Investor Divisions And Economic Implications

Table of Contents

Factors Contributing to the Steepening Japanese Bond Yield Curve

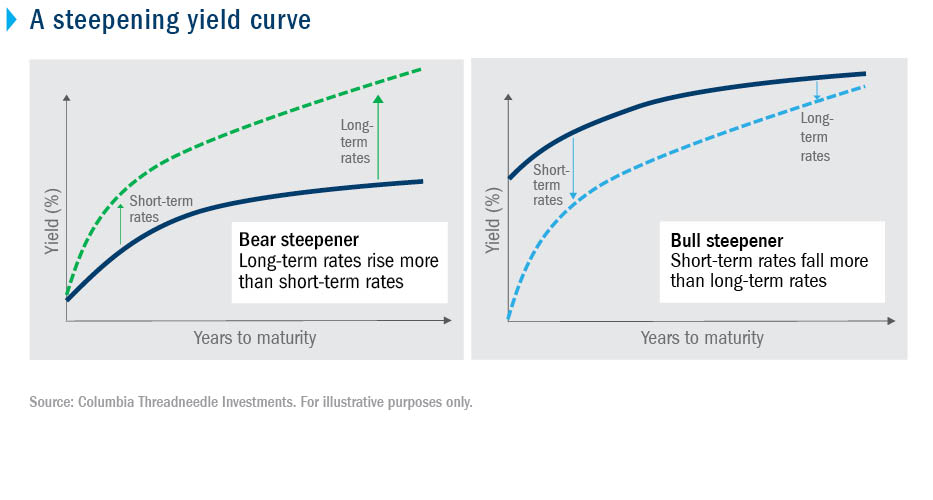

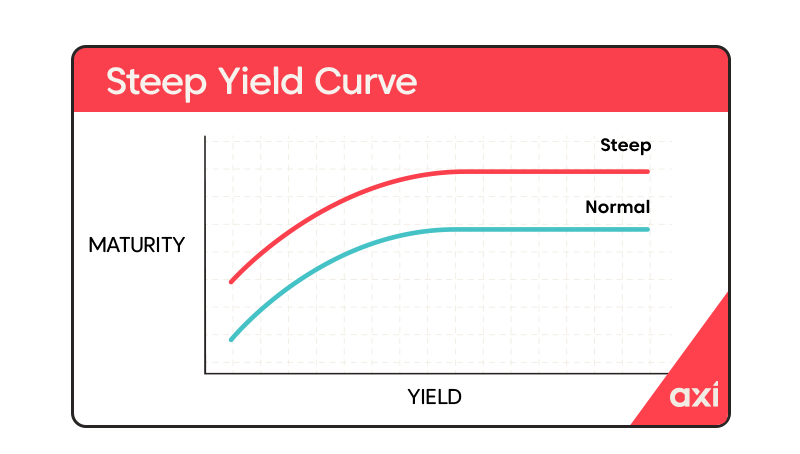

Several interconnected factors contribute to the recent steepening of the Japanese bond yield curve. Understanding these dynamics is crucial for interpreting the current market situation and predicting future trends in Japanese Government Bonds (JGBs).

The Bank of Japan's (BOJ) Policy Shift

The Bank of Japan's (BOJ) adjustments to its Yield Curve Control (YCC) policy are a primary driver of the steepening curve.

- Widening Yield Band: The BOJ's decision to widen the trading band for 10-year JGB yields from ±0.25% to ±0.5% signaled a significant shift towards a more flexible monetary policy. This allowed long-term yields to rise more freely.

- Market Speculation: Market participants are speculating about the BOJ's future policy moves, anticipating a potential complete abandonment of YCC. This speculation itself fuels upward pressure on long-term yields.

- Inflationary Pressures: While still relatively subdued compared to other developed nations, rising inflation expectations in Japan are contributing to increased demand for higher-yielding assets, further steepening the curve. The BOJ's previous commitment to keeping yields extremely low is increasingly at odds with the current economic reality.

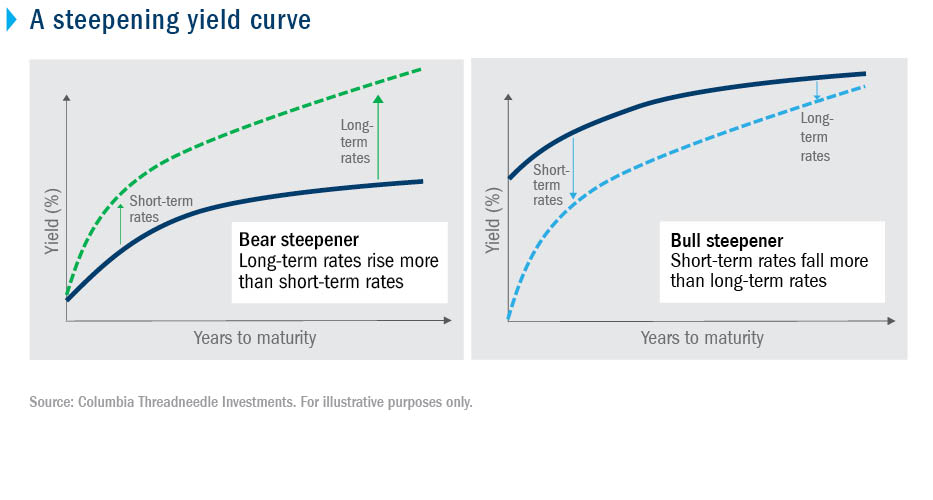

- Data Analysis: Charts showing the widening gap between short-term and long-term JGB yields visually illustrate the steepening curve. (Insert relevant chart here showing the yield curve's evolution).

Increased Global Interest Rates

The global rise in interest rates, primarily driven by the US Federal Reserve's aggressive monetary tightening, exerts significant pressure on the Japanese bond market.

- Capital Outflows: Higher yields in other developed markets attract capital away from Japan, reducing demand for JGBs and putting upward pressure on their yields.

- Currency Fluctuations: The relative strength of the US dollar against the Japanese yen also influences capital flows and consequently the JGB market. A stronger dollar can exacerbate capital outflows from Japan.

- International Spillover Effects: Global monetary policy decisions, particularly from the US, have a significant impact on the Japanese economy and its bond market, given the interconnectedness of global financial systems.

Stronger Yen

A strengthening yen, while generally positive for the Japanese economy, can paradoxically contribute to a steeper yield curve.

- Reduced Inflationary Pressure: A stronger yen can curb imported inflation, potentially causing the BOJ to maintain a more accommodative monetary policy stance (though this appears to be changing).

- Foreign Investment: A stronger yen can increase the attractiveness of Japanese assets to foreign investors, leading to increased demand for JGBs, albeit potentially in the shorter term.

- International Implications: The yen's strength reflects global economic trends and investor sentiment towards the Japanese economy, impacting the overall demand dynamics for Japanese bonds.

Diverging Investor Opinions on the Steepening Curve

The steepening Japanese bond yield curve has created a division within the investor community, with differing views on its implications.

Bullish vs. Bearish Sentiment

- Bullish Outlook: Some investors believe the steepening curve reflects a healthy normalization of monetary policy and signals a strengthening Japanese economy. They see opportunities in increased investment returns and potential for higher corporate profits.

- Bearish Outlook: Conversely, others are wary, concerned that rising yields will significantly increase borrowing costs for businesses, potentially stifling economic growth and leading to a slowdown in investment. This could negatively impact corporate earnings and stock valuations.

- Expert Opinions: Financial analysts and investment firms offer contrasting perspectives, making it crucial for investors to carefully assess the risks and opportunities. For example, (mention specific analysts and their viewpoints, citing sources).

Strategic Allocation Decisions

Investors are actively adjusting their portfolio allocations in response to the shifting landscape.

- Shifting Demand: The demand for longer-term JGBs has decreased, while the demand for shorter-term JGBs might remain higher. Investors are reassessing their duration exposure to mitigate interest rate risks.

- Diversification: Many investors are diversifying into other asset classes, including foreign bonds, equities, and alternative investments, to balance their portfolios in light of the changing JGB market.

- Tactical Adjustments: Active management strategies are becoming increasingly important as investors attempt to capitalize on shifts in relative value across different maturities and asset classes within the Japanese bond market.

Economic Implications of a Steepening Japanese Bond Yield Curve

The steepening Japanese bond yield curve carries significant economic implications, both positive and negative.

Impact on Inflation

The relationship between the yield curve and inflation is complex.

- Higher Borrowing Costs: Steeper curves generally translate to higher borrowing costs for businesses and consumers, potentially dampening economic growth and reducing inflationary pressure through decreased demand.

- Consumer Spending: Rising interest rates can lead to decreased consumer spending and investment, counteracting inflationary pressures.

- Monetary Policy Response: The BOJ’s response to inflation will be critical in determining the overall economic impact. A delayed or inadequate response could exacerbate inflationary pressures despite higher borrowing costs.

Effect on Government Borrowing Costs

The Japanese government faces substantially increased borrowing costs.

- Fiscal Policy Adjustments: Rising interest rates necessitate adjustments in fiscal policy, potentially requiring cuts in government spending or increased taxation to manage the growing debt burden.

- Debt Sustainability: The increasing cost of servicing the national debt poses a significant challenge to the Japanese government's fiscal sustainability.

Overall Economic Growth

The overall impact on economic growth is uncertain.

- Potential for Slowdown: Higher borrowing costs and reduced investment could lead to a slowdown in economic growth.

- Potential for Adjustment: A more normalized yield curve may eventually foster a healthier economic environment in the long run, though the short-term effects are likely to be challenging. This depends on the BOJ’s management of the situation.

- Scenario Planning: Different economic scenarios must be considered, ranging from mild adjustments to more significant disruptions depending on the response from the government and the BOJ.

Conclusion

The steepening Japanese bond yield curve presents a complex and dynamic situation, creating significant divisions among investors and raising crucial questions about Japan's economic future. Understanding the underlying factors – including the BOJ's policy shifts, global interest rate increases, and currency movements – is critical for effective market navigation. While some investors see opportunities, others remain cautious. The ultimate economic implications remain uncertain, necessitating continuous monitoring of this evolving situation. Further detailed analysis of the Japanese bond yield curve and its related factors is essential for making well-informed investment decisions.

Featured Posts

-

Angel Reeses Sharp Response To Chrisean Rock Interview Criticism

May 17, 2025

Angel Reeses Sharp Response To Chrisean Rock Interview Criticism

May 17, 2025 -

Analysis Japans Steep Bond Curve And Its Economic Consequences

May 17, 2025

Analysis Japans Steep Bond Curve And Its Economic Consequences

May 17, 2025 -

Ichiro Suzuki His Enduring Influence On Baseball 20 Years Later

May 17, 2025

Ichiro Suzuki His Enduring Influence On Baseball 20 Years Later

May 17, 2025 -

Paramounts Mission Impossible Gets China Release Date

May 17, 2025

Paramounts Mission Impossible Gets China Release Date

May 17, 2025 -

Secret Service Investigation Cocaine Found At White House Case Closed

May 17, 2025

Secret Service Investigation Cocaine Found At White House Case Closed

May 17, 2025

Latest Posts

-

Ex Mariners Star Blasts Teams Inaction During Offseason

May 17, 2025

Ex Mariners Star Blasts Teams Inaction During Offseason

May 17, 2025 -

April 4 6 Giants Vs Mariners Whos On The Injured List

May 17, 2025

April 4 6 Giants Vs Mariners Whos On The Injured List

May 17, 2025 -

Seattle Mariners Quiet Winter Draws Criticism From Former Player

May 17, 2025

Seattle Mariners Quiet Winter Draws Criticism From Former Player

May 17, 2025 -

Mariners Giants Injury News Key Players Out For April 4 6 Series

May 17, 2025

Mariners Giants Injury News Key Players Out For April 4 6 Series

May 17, 2025 -

Former Mariners Infielder Criticizes Seattles Quiet Offseason

May 17, 2025

Former Mariners Infielder Criticizes Seattles Quiet Offseason

May 17, 2025