Public Sector Pension Reform: Addressing The Taxpayer Burden

Table of Contents

The Mounting Cost of Public Sector Pensions and its Impact on Taxpayers

The rising cost of public sector pensions is a significant concern for governments worldwide. Years of generous benefits, combined with increased life expectancy and declining workforce participation rates, have created a massive burden of pension liabilities. Many pension schemes are significantly underfunded, leading to substantial unfunded liabilities – the difference between the promised benefits and the assets available to pay them. This gap is primarily filled by taxpayers, either through higher taxes or reduced spending in other critical areas.

-

Unfunded Pension Liabilities: These represent a ticking time bomb for public finances. Unmet obligations accumulate year after year, placing an increasing strain on national budgets and potentially leading to credit downgrades.

-

Impact on Tax Rates and Public Services: The sheer scale of pension costs forces governments to make difficult choices. Higher taxes are often implemented to cover the shortfall, impacting taxpayers' disposable income and potentially hindering economic growth. Alternatively, cuts to vital public services become necessary, undermining the quality of life for citizens.

-

Long-Term Fiscal Risks: Unsustainable pension systems pose significant long-term fiscal risks. The growing burden of pension payments can crowd out other crucial government investments, hindering economic development and potentially leading to social unrest.

For example, [insert specific example of a country or region facing significant pension challenges, including data on rising costs and the impact on taxation or public services]. This highlights the urgent need for proactive and effective public sector pension reform.

Strategies for Public Sector Pension Reform: Finding a Sustainable Path

Several strategies can be employed to make public sector pension systems more sustainable and reduce the taxpayer burden. These reforms often involve a combination of approaches tailored to the specific circumstances of each country. Careful consideration must be given to the impact on both current and future retirees.

-

Benefit Adjustments: This could involve reducing annual cost-of-living increases, introducing tiered benefits based on salary levels, or adjusting early retirement incentives.

-

Raising the Retirement Age: Gradually increasing the retirement age aligns pension payments with longer lifespans and reduces the period over which benefits are paid.

-

Shifting to Defined Contribution Plans: Moving from defined benefit (DB) schemes, which promise a specific level of income in retirement, to defined contribution (DC) plans, where benefits depend on contributions and investment performance, can reduce long-term liabilities for governments.

-

Hybrid Pension Models: These models combine elements of both DB and DC plans, aiming to balance the security of a guaranteed income with the flexibility and individual responsibility of a DC scheme.

-

Increased Employee Contributions: Requiring higher employee contributions can help to reduce the burden on taxpayers and promote a sense of shared responsibility for pension provision.

The optimal approach will depend on factors like the existing pension system's structure, demographic trends, and the country's overall economic situation. A carefully considered strategy, implemented gradually, is crucial for success.

The Political and Social Challenges of Pension Reform

Implementing public sector pension reform is rarely easy. It often faces significant political and social resistance.

-

Resistance from Unions and Retirees: Public sector unions and retirees may strongly oppose reforms perceived as reducing their benefits or altering their retirement plans. Negotiations and careful stakeholder engagement are critical for building consensus.

-

Public Awareness Campaigns: Transparency and clear communication are essential to ensure that the public understands the need for reform and the rationale behind the proposed changes. Public awareness campaigns can help to mitigate potential opposition.

-

Protecting Vulnerable Retirees: Reform strategies must consider the impact on vulnerable retirees and include mechanisms to protect their income and wellbeing. This might include transitional arrangements or targeted support programs.

[Insert example of a country successfully implementing pension reform, highlighting the strategies used and the challenges overcome.] Learning from successful reforms elsewhere can provide valuable insights.

Ensuring a Fair and Equitable Transition

A phased implementation of pension reforms is crucial to minimize disruption and ensure a fair transition for all stakeholders. This might involve introducing changes gradually over several years, allowing individuals time to adjust to the new system and ensuring adequate transitional arrangements for those nearing retirement. The goal is to achieve a sustainable system while protecting the rights and well-being of current and near-retirement public sector employees, minimizing any negative social impact. A robust social safety net must be maintained to support vulnerable retirees.

Conclusion

The escalating cost of public sector pensions poses a significant threat to public finances and the taxpayer burden. Addressing this requires comprehensive and timely public sector pension reform. Various strategies are available, but their implementation faces significant political and social challenges. A successful reform process needs a carefully planned approach with phased implementation, transparent communication, and mechanisms to protect vulnerable retirees. By engaging in informed discussions and advocating for responsible and effective public sector pension reform, we can secure a sustainable and equitable system for future generations, reducing the undue financial strain on taxpayers. Visit [link to relevant government website or advocacy group] to learn more about public sector pension reform initiatives in your area and get involved in shaping the future of your pension system.

Featured Posts

-

Minnesota Governor Defies Us Attorney General On Transgender Athlete Ban

Apr 29, 2025

Minnesota Governor Defies Us Attorney General On Transgender Athlete Ban

Apr 29, 2025 -

Dari Zuffenhausen Ke Dunia Mengungkap Sejarah Porsche 356

Apr 29, 2025

Dari Zuffenhausen Ke Dunia Mengungkap Sejarah Porsche 356

Apr 29, 2025 -

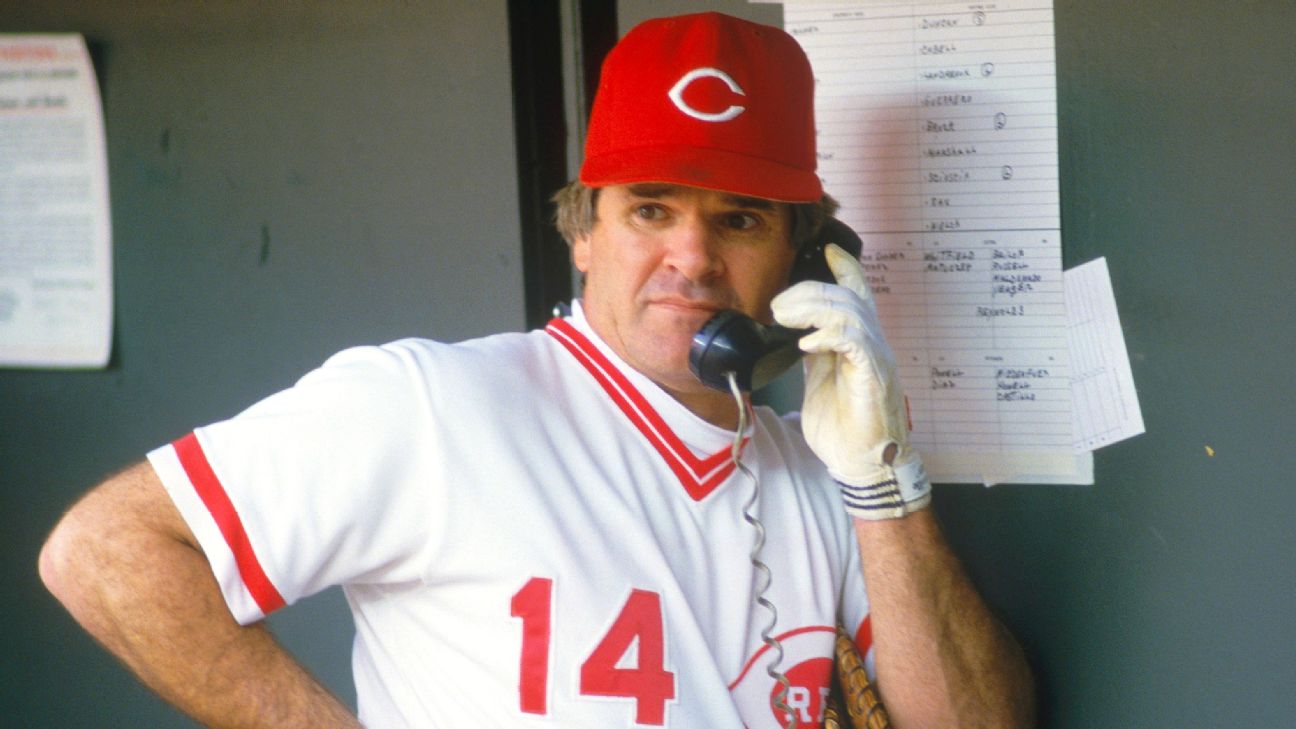

Pete Rose Pardon Trumps Pledge After Baseball Legends Passing

Apr 29, 2025

Pete Rose Pardon Trumps Pledge After Baseball Legends Passing

Apr 29, 2025 -

Food Fuel And Water Scarcity In Gaza Fuel Calls To End Israeli Aid Ban

Apr 29, 2025

Food Fuel And Water Scarcity In Gaza Fuel Calls To End Israeli Aid Ban

Apr 29, 2025 -

Pw C Us Internal Probe Leads To Partner Brokerage Relationship Termination

Apr 29, 2025

Pw C Us Internal Probe Leads To Partner Brokerage Relationship Termination

Apr 29, 2025

Latest Posts

-

Obrushenie Gorki V Tyumeni Postradavshie Otkazalis Ot Pomoschi Vlastey

Apr 30, 2025

Obrushenie Gorki V Tyumeni Postradavshie Otkazalis Ot Pomoschi Vlastey

Apr 30, 2025 -

Our Farm Next Door A Familys Story Of Farming And Community

Apr 30, 2025

Our Farm Next Door A Familys Story Of Farming And Community

Apr 30, 2025 -

Meet Amanda Clive And The Kids A Day In The Life Of Our Farm Next Door

Apr 30, 2025

Meet Amanda Clive And The Kids A Day In The Life Of Our Farm Next Door

Apr 30, 2025 -

Life On Our Farm Next Door Amanda Clive And Their Family

Apr 30, 2025

Life On Our Farm Next Door Amanda Clive And Their Family

Apr 30, 2025 -

Meet Amanda Clive And Kids A Day In The Life Of Our Farm Next Door

Apr 30, 2025

Meet Amanda Clive And Kids A Day In The Life Of Our Farm Next Door

Apr 30, 2025