PwC's Controversial Exit: Over A Dozen Countries Affected

Table of Contents

The Scope of PwC's Withdrawal: A Global Impact

PwC's decision to withdraw from multiple countries represents a significant event in the history of global accounting. The sheer number of affected countries – exceeding a dozen – underscores the far-reaching consequences of this action. The exits span various regions and encompass a wide range of PwC's services, impacting not only its operations but also the economies and regulatory landscapes of affected nations.

- Regions Most Impacted: Europe, Asia, and parts of South America have been significantly affected by PwC's withdrawals.

- Affected Countries: While a complete list is not yet publicly available due to ongoing investigations, reports indicate that countries in multiple regions have been impacted. Specific names of countries are being withheld for the sake of this article, pending further public disclosures.

- Services Affected: PwC's presence in these countries encompassed a wide spectrum of services, including auditing, tax advisory, consulting, and financial advisory. The withdrawal leaves a significant gap in the market for these services.

Reasons Behind PwC's Controversial Exits: Unraveling the Causes

The reasons behind PwC's controversial exits are complex and multifaceted. Several interconnected factors appear to have contributed to this unprecedented decision.

-

Regulatory Investigations and Scrutiny: Numerous countries are reportedly conducting investigations into PwC's operations. These probes often focus on issues like potential breaches of tax regulations, conflicts of interest, and lack of transparency. Specific examples are currently emerging in various news reports and official documents.

-

Allegations of Tax Evasion, Fraud, or Other Financial Irregularities: Allegations of serious financial misconduct have surfaced in various jurisdictions, leading to increased regulatory scrutiny and damage to PwC's reputation. These allegations vary in nature but often center on the misuse of confidential information or facilitating tax avoidance schemes for clients.

-

Reputational Damage and Loss of Client Trust: The combined effect of regulatory investigations and allegations of misconduct has severely impacted PwC's reputation. This loss of trust has likely contributed to the firm's decision to withdraw from certain markets rather than face prolonged and potentially damaging legal battles.

-

Key Reasons Summarized:

- Lack of transparency and ethical lapses: Internal failures to maintain proper ethical standards and transparent operational procedures fueled regulatory scrutiny.

- Conflict of interest concerns: Evidence suggests instances where PwC's interests conflicted with those of its clients, potentially undermining its objectivity and integrity.

- Failure to comply with international accounting standards: Allegations of failure to adhere to global accounting regulations further damaged PwC's reputation and fueled calls for greater oversight.

The role of specific individuals and teams within PwC is currently under investigation in various jurisdictions. The ongoing investigations will likely shed more light on the extent of internal responsibility.

The Ripple Effect: Consequences for Affected Countries and Clients

PwC's withdrawal has significant consequences for both the affected countries and its former clients.

-

Loss of Expertise and Employment: The exits lead to a loss of highly skilled accounting professionals and potential job losses. This impacts the local talent pool and the availability of crucial accounting expertise in affected markets.

-

Disruptions to Businesses Reliant on PwC's Services: Businesses that relied on PwC for auditing, tax services, or consulting face disruptions and increased costs in finding replacement providers. This is particularly challenging for smaller companies that lack the resources to quickly transition to new service providers.

-

Impact on Government Revenue and Tax Collection: The loss of PwC's expertise could impact government revenue, particularly in areas related to tax collection and auditing. This is especially relevant in countries heavily reliant on tax revenues.

-

Economic Consequences: The economic impact includes potential increases in business costs, reduced efficiency, and potential long-term negative effects on foreign investment.

-

Challenges for PwC Clients: Clients face the immediate challenge of securing alternative service providers, which involves a significant amount of effort and disruption.

-

Implications for Regulatory Oversight: This scandal will likely intensify regulatory oversight of accounting firms, leading to stronger compliance requirements and greater scrutiny of their practices.

Looking Ahead: Future Implications for PwC and the Accounting Industry

PwC's actions will have long-term implications for its brand, future operations, and the broader accounting industry.

-

Long-Term Consequences for PwC: PwC's brand reputation has suffered significantly, impacting client trust and potentially hindering its ability to attract and retain talent. Its future operations will need to prioritize rebuilding trust and implementing stronger ethical and compliance measures.

-

Impact on the Accounting Industry: The events surrounding PwC's withdrawals are likely to increase scrutiny of the entire industry. This may lead to changes in global accounting standards, stricter regulatory oversight, and increased emphasis on ethical conduct and compliance.

-

Potential Reforms and Changes: Expect an increase in regulatory oversight, more stringent ethical guidelines, and potentially greater transparency requirements within the accounting profession.

-

Increased Regulatory Scrutiny: Global regulators are likely to increase their scrutiny of large accounting firms, leading to more frequent audits, stricter penalties for non-compliance, and increased enforcement.

-

Reshaping the Industry's Approach: The accounting industry will likely embrace more robust ethical training, stronger internal controls, and a greater focus on fostering a culture of compliance.

Conclusion

PwC's controversial exit from over a dozen countries represents a watershed moment for the global accounting industry. The reasons behind these withdrawals, including regulatory investigations, allegations of misconduct, and reputational damage, underscore the urgent need for greater transparency, stronger ethical standards, and robust regulatory oversight. The ripple effects extend beyond PwC, impacting affected countries and the broader accounting profession. The long-term consequences will necessitate industry-wide reforms and a fundamental shift towards greater ethical conduct and compliance. Stay informed about the ongoing developments in the PwC scandal and the broader accounting industry. Follow reputable news sources for updates on the PwC exit and its effects on global accounting firms. Understanding the intricacies of this controversial exit is crucial for businesses and governments alike.

Featured Posts

-

Analyzing The Effectiveness Of Film Tax Credits In Minnesota

Apr 29, 2025

Analyzing The Effectiveness Of Film Tax Credits In Minnesota

Apr 29, 2025 -

Akeso Stock Drops After Cancer Drug Trial Fails To Meet Expectations

Apr 29, 2025

Akeso Stock Drops After Cancer Drug Trial Fails To Meet Expectations

Apr 29, 2025 -

Dealerships Intensify Fight Against Ev Mandate Requirements

Apr 29, 2025

Dealerships Intensify Fight Against Ev Mandate Requirements

Apr 29, 2025 -

Diamond Johnson From Norfolk State To Minnesota Lynx Wnba Camp

Apr 29, 2025

Diamond Johnson From Norfolk State To Minnesota Lynx Wnba Camp

Apr 29, 2025 -

Cost Cutting Measures How U S Businesses Respond To Tariff Instability

Apr 29, 2025

Cost Cutting Measures How U S Businesses Respond To Tariff Instability

Apr 29, 2025

Latest Posts

-

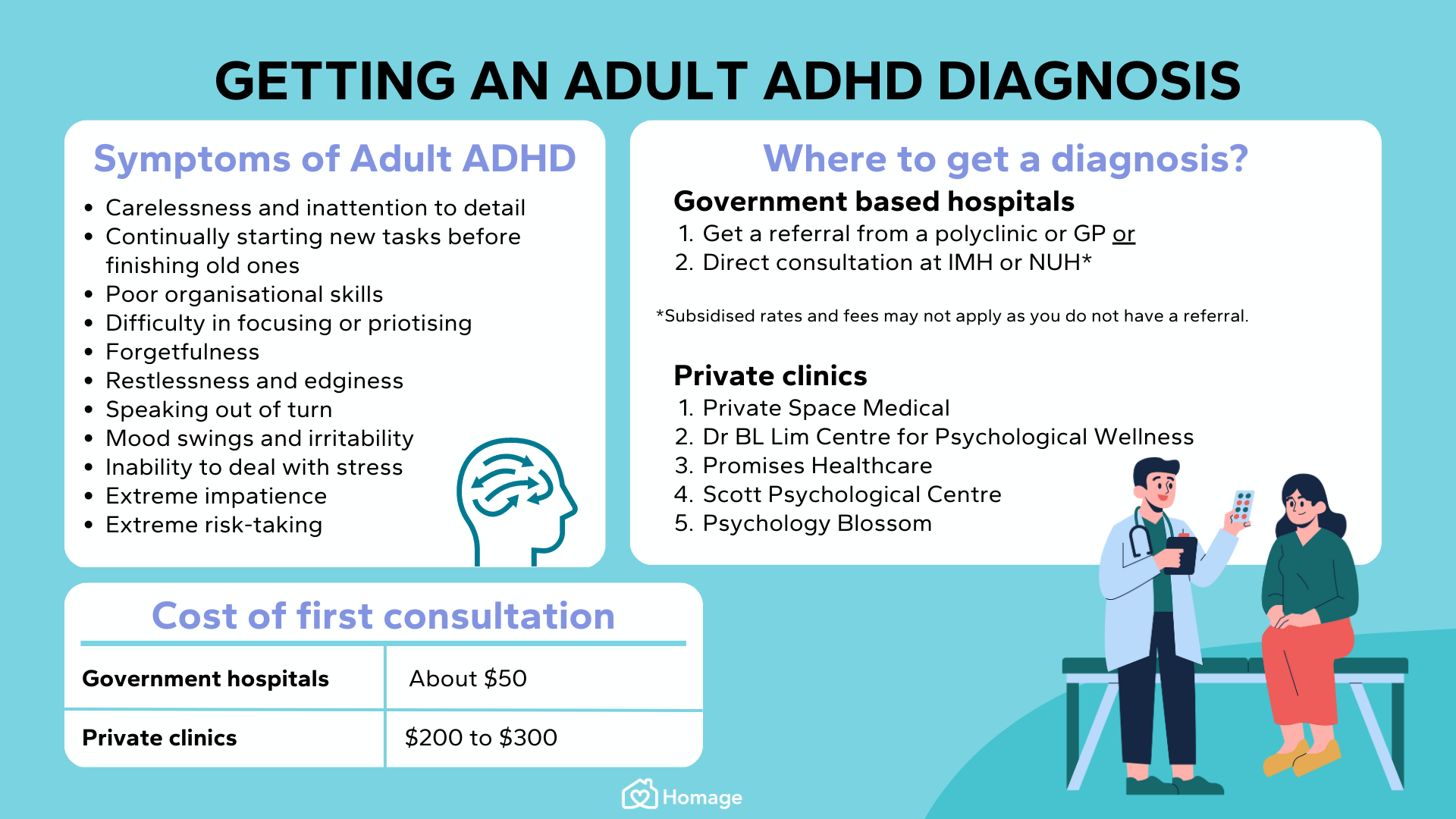

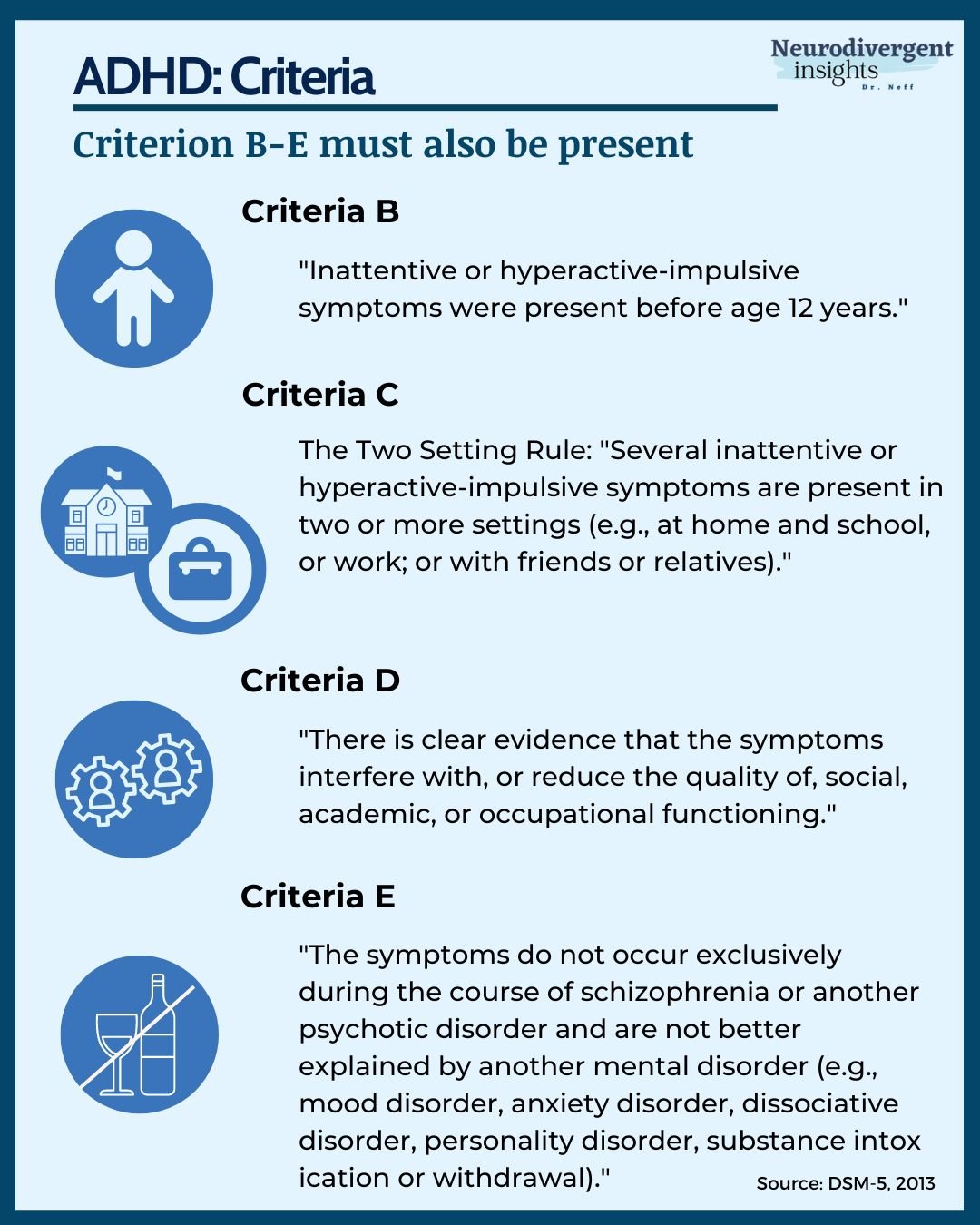

Navigating A Suspected Adult Adhd Diagnosis

Apr 29, 2025

Navigating A Suspected Adult Adhd Diagnosis

Apr 29, 2025 -

Diagnosed With Adult Adhd Your Action Plan

Apr 29, 2025

Diagnosed With Adult Adhd Your Action Plan

Apr 29, 2025 -

Adult Adhd Next Steps After A Suspected Diagnosis

Apr 29, 2025

Adult Adhd Next Steps After A Suspected Diagnosis

Apr 29, 2025 -

Understanding Adult Adhd Diagnosis And Next Steps

Apr 29, 2025

Understanding Adult Adhd Diagnosis And Next Steps

Apr 29, 2025 -

Diagnosed With Adult Adhd Your Action Plan Starts Here

Apr 29, 2025

Diagnosed With Adult Adhd Your Action Plan Starts Here

Apr 29, 2025