Quantum Computing's Impact On The Stock Market In 2025: RGTI And Key Players

Table of Contents

The Rise of Quantum Computing and its Financial Applications (RGTI)

Quantum computing's potential to disrupt finance is immense. However, understanding the RGTI factors is crucial for informed investment decisions.

Risk Assessment and Mitigation

Investing in quantum computing technologies carries inherent risks.

- Technological Limitations: Current quantum computers are still in their early stages of development, facing challenges in scalability and error correction.

- Cybersecurity Threats: The immense computational power of quantum computers could potentially break current encryption methods, posing significant cybersecurity risks.

- Regulatory Uncertainty: The lack of clear regulatory frameworks surrounding quantum computing could create uncertainty and hinder market growth.

- Market Volatility: The quantum computing sector is prone to significant price fluctuations due to its nascent nature and dependence on technological breakthroughs.

Mitigation strategies include diversified investment portfolios, thorough due diligence on individual companies, and a cautious approach to high-risk, high-reward investments. Understanding the limitations of the technology and staying updated on regulatory developments are also critical.

Growth Potential in Quantum Computing Stocks

Despite the risks, the growth potential in quantum computing stocks is substantial.

- Market Projections: Analysts predict a multi-billion dollar market for quantum computing by 2025, with exponential growth projected beyond.

- Anticipated Growth Rates: Depending on technological advancements and market adoption, annual growth rates could reach double or even triple digits in certain segments.

- Potential for Exponential Returns: Early investment in promising quantum computing companies could yield significant returns for savvy investors.

- High-Growth Areas: Quantum algorithms for portfolio optimization, derivative pricing, and fraud detection are poised for explosive growth.

Technological Advancements Driving Market Change

Rapid technological advancements are fueling the quantum computing revolution and creating lucrative market opportunities.

- Improved Qubit Coherence: Increased qubit coherence times translate to more powerful and stable quantum computers.

- New Quantum Algorithms: The development of new quantum algorithms tailored for financial applications significantly enhances the sector's potential.

- Quantum Annealing Advancements: Improvements in quantum annealing hardware are opening up new applications in optimization problems critical to finance.

These advancements translate into improved computational capabilities, faster processing speeds, and the ability to solve complex financial problems previously intractable with classical computers.

Innovation and New Investment Opportunities

Quantum computing's applications in finance extend far beyond stock market analysis.

- Fraud Detection: Quantum algorithms can identify complex patterns indicative of fraudulent activities far more efficiently than classical methods.

- Algorithmic Trading: Quantum computers can analyze vast datasets in real-time, enabling highly sophisticated algorithmic trading strategies.

- Risk Management: Quantum computing enhances risk assessment by modeling complex financial instruments and scenarios with far greater accuracy.

These innovations are opening new avenues for investment, creating opportunities in both established financial institutions and emerging quantum technology startups. New financial products and services based on quantum computing are also likely to emerge, creating additional investment opportunities.

Key Players Shaping the Quantum Computing Landscape

Several key players are driving the quantum computing revolution, influencing the stock market significantly.

Leading Quantum Computing Companies

Major players include:

- IBM: A leader in quantum computing hardware and software, with a significant cloud-based quantum computing platform.

- Google: Pushing the boundaries of quantum computing with its advancements in superconducting qubit technology.

- Microsoft: Developing a unique approach to quantum computing based on topological qubits.

- IonQ: Focusing on trapped ion quantum computers, known for their high fidelity and scalability.

- Rigetti Computing: Offering both cloud-based and on-premise quantum computing solutions.

Their technological advancements and market strategies significantly impact stock prices within the quantum computing sector.

Investment Firms Focusing on Quantum Technologies

Venture capital firms and investment banks are actively investing in quantum computing:

- Sequoia Capital: A prominent investor in several quantum computing startups.

- Andreessen Horowitz: Actively involved in funding quantum computing research and development.

- Goldman Sachs: Investing in and partnering with quantum computing companies to explore financial applications.

Their investments shape market trends and influence stock valuations within the industry.

Government Initiatives and Funding

Government initiatives play a crucial role in driving quantum computing research and development:

- The National Quantum Initiative Act (USA): Provides substantial funding for quantum computing research.

- European Quantum Flagship: A large-scale EU program supporting quantum technology development.

- National Quantum Strategy (China): A significant investment in quantum computing infrastructure and talent.

These initiatives impact relevant companies and their stock prices through direct funding, research collaborations, and the overall advancement of the quantum computing field.

Analyzing the Stock Market's Response to Quantum Computing Advancements

The stock market's response to quantum computing advancements is dynamic and complex.

Current Market Trends

- Stock Price Movements: We've seen significant fluctuations in the stock prices of leading quantum computing companies, influenced by technological breakthroughs, regulatory announcements, and overall market sentiment.

- Market Capitalization Changes: The market capitalization of quantum computing companies has seen considerable growth, indicating investor enthusiasm.

- Investor Sentiment: Investor sentiment is positive but cautiously optimistic, reflecting both the potential and the inherent risks of the technology.

Predictive Modeling and Future Outlook

Predictive modeling suggests several potential scenarios:

- Scenario 1 (High Growth): Rapid technological breakthroughs lead to widespread adoption, resulting in substantial growth in quantum computing stocks.

- Scenario 2 (Moderate Growth): Technological progress is slower than expected, resulting in moderate but steady growth.

- Scenario 3 (Stagnation): Major technological hurdles impede progress, leading to stagnation or even decline in the sector.

However, it is crucial to remember that predictive models are inherently limited and should be viewed with caution. Unforeseen breakthroughs or setbacks could significantly alter the predicted outcomes.

Conclusion: Investing Wisely in the Quantum Computing Revolution

Quantum Computing's Impact on the Stock Market in 2025 is poised to be transformative, presenting both substantial opportunities and significant risks. Understanding the RGTI factors – risk, growth, technology, and innovation – and identifying key players is paramount for navigating this dynamic landscape. While the potential for exponential returns is enticing, it's crucial to conduct thorough research, diversify your investment portfolio, and carefully assess the risks involved before investing in quantum computing stocks. Further research into specific companies, market trends, and regulatory developments will be critical to making informed investment decisions. Capitalize on the emerging opportunities presented by the quantum computing revolution by remaining informed and adopting a strategic investment approach.

Featured Posts

-

Budget Logements Saisonniers Et Sainte Eugenie Les Decisions Du Conseil Municipal De Biarritz

May 20, 2025

Budget Logements Saisonniers Et Sainte Eugenie Les Decisions Du Conseil Municipal De Biarritz

May 20, 2025 -

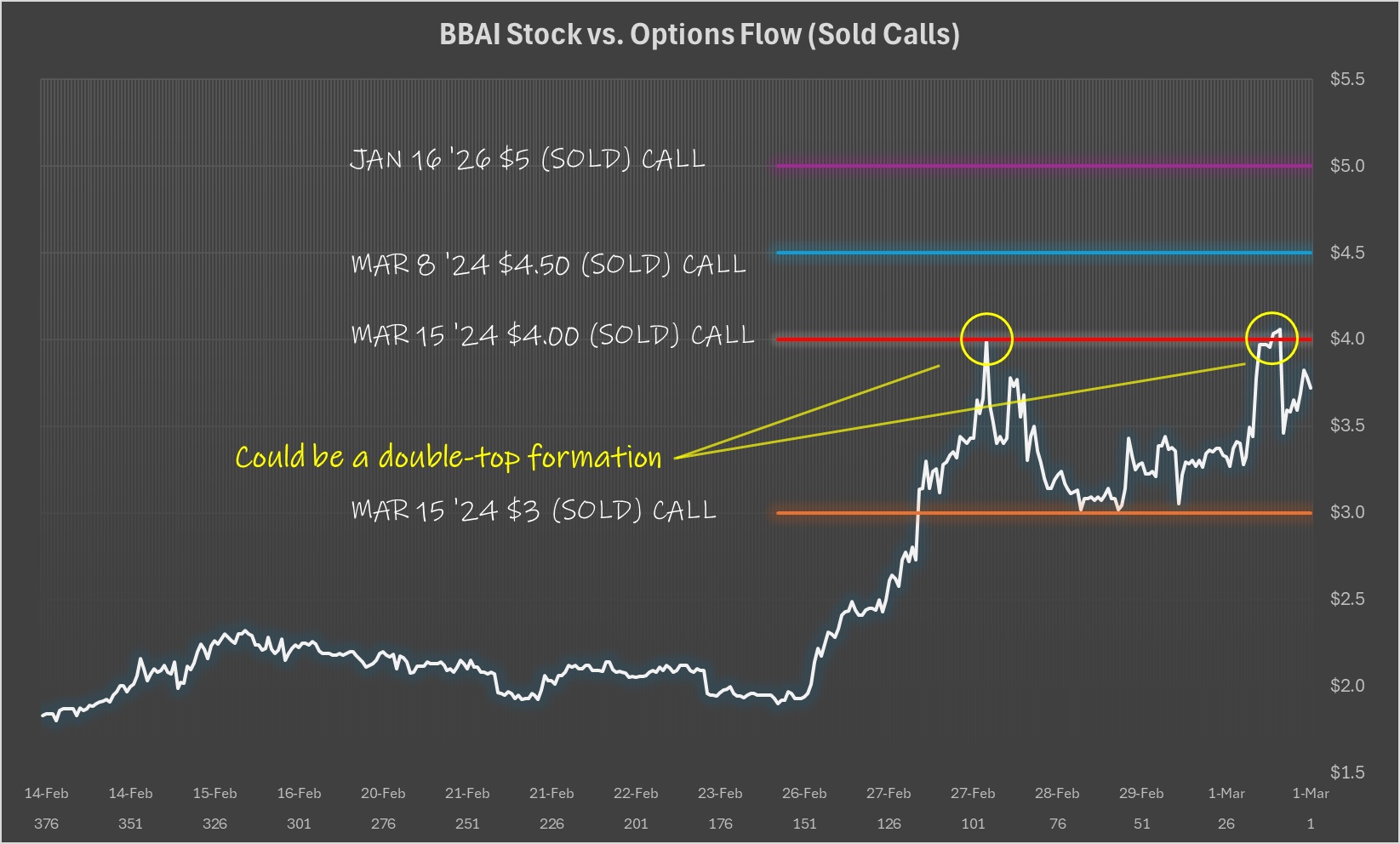

Investing In Big Bear Ai Bbai A Penny Stock Ai Opportunity

May 20, 2025

Investing In Big Bear Ai Bbai A Penny Stock Ai Opportunity

May 20, 2025 -

Blue Origin Rocket Launch Abruptly Halted Subsystem Problem Identified

May 20, 2025

Blue Origin Rocket Launch Abruptly Halted Subsystem Problem Identified

May 20, 2025 -

Ending Daily Mail Delivery A Canada Post Commission Report Recommendation

May 20, 2025

Ending Daily Mail Delivery A Canada Post Commission Report Recommendation

May 20, 2025 -

Epistrofi Giakoymaki Sto Mls To Oneiro Ton Amerikanon

May 20, 2025

Epistrofi Giakoymaki Sto Mls To Oneiro Ton Amerikanon

May 20, 2025