Recent Developments In US-China Trade Relations: Tariff Exemptions

Table of Contents

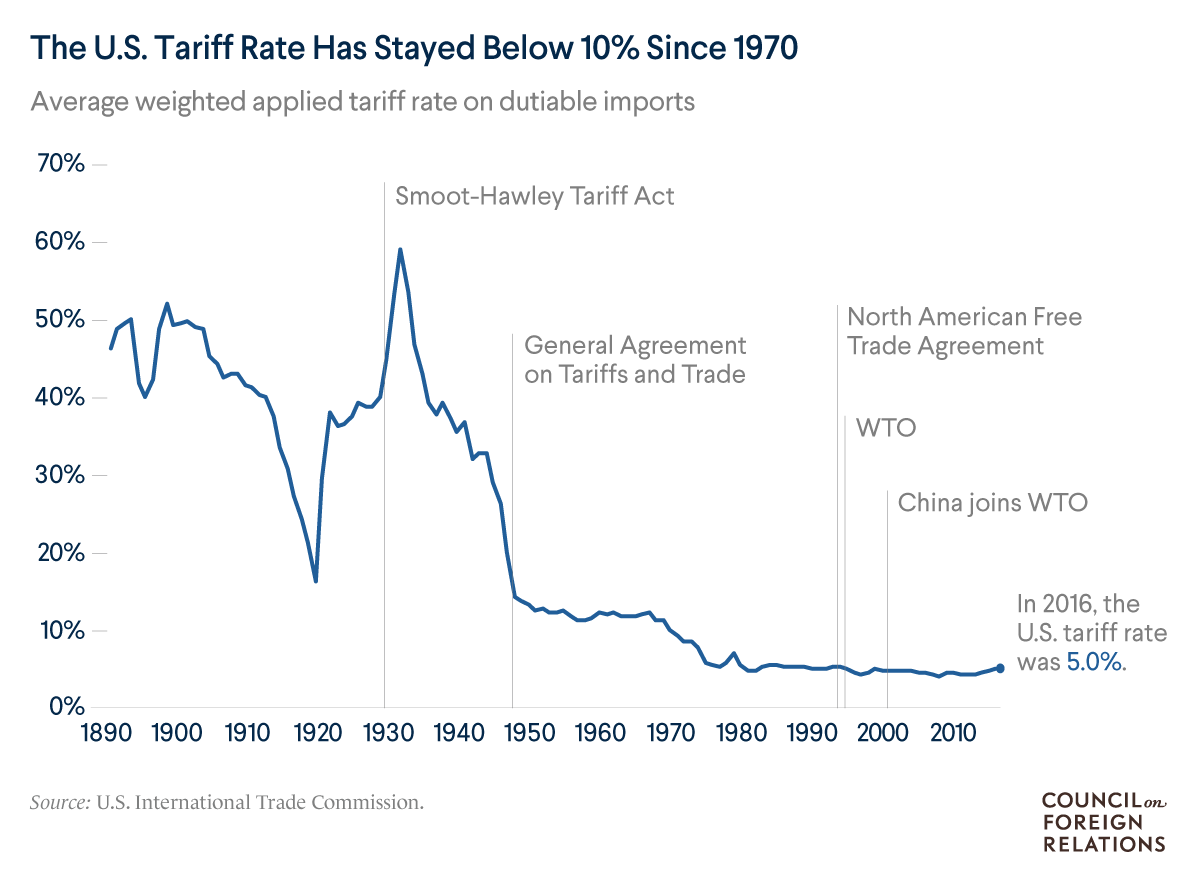

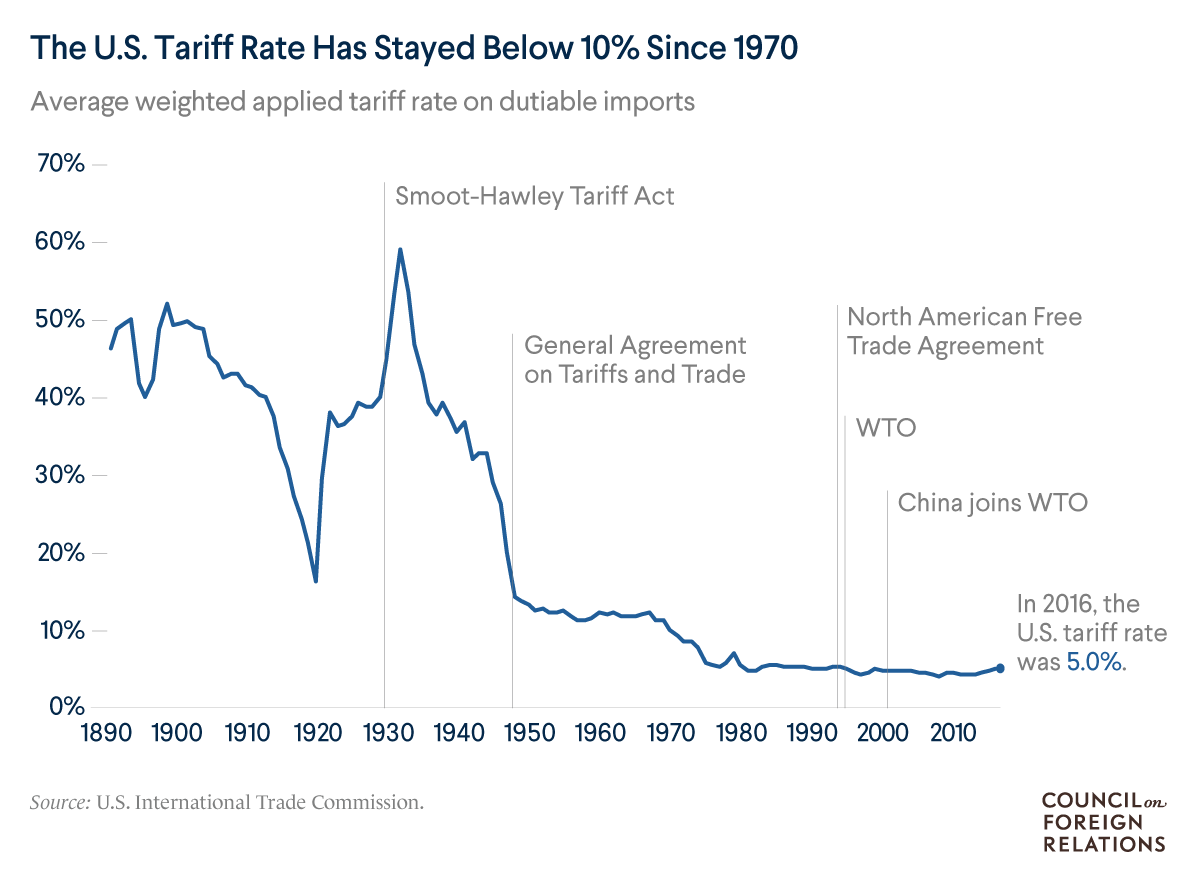

The Historical Context of US-China Tariffs

The US-China trade war, initiated in 2018, dramatically altered the landscape of bilateral trade. The Trump administration imposed significant tariffs on a wide range of Chinese goods, ostensibly to address issues of intellectual property theft and unfair trade practices. These tariffs, initially targeting specific sectors, quickly escalated, impacting numerous industries and creating significant uncertainty for businesses on both sides of the Pacific.

-

Timeline of major tariff increases and decreases:

- July 2018: Initial tariffs of 25% on $34 billion worth of Chinese goods.

- September 2018: Tariffs expanded to $200 billion worth of goods.

- May 2019: Further tariff increases threatened.

- January 2020: "Phase One" trade deal led to some tariff reductions.

- Ongoing: The situation remains fluid, with the possibility of future tariff adjustments.

-

Key industries affected: Technology, agriculture (soybeans, pork), manufacturing (steel, aluminum), and consumer goods experienced significant disruptions.

-

Initial economic consequences: Both countries faced economic repercussions, including increased prices for consumers, reduced exports, and supply chain disruptions. The impact varied significantly across different sectors and regions.

The Mechanisms and Criteria for Tariff Exemptions

The US government established processes for companies to apply for exclusions or exemptions from these tariffs. The application process typically required detailed documentation demonstrating the applicant's reliance on the specific imported goods and the unavailability of comparable domestic alternatives. The process was highly competitive, with a large volume of applications submitted.

-

Specific requirements for exemption applications: Applicants needed to provide evidence of economic hardship, demonstrate the lack of suitable domestic substitutes, and justify why the exemption was necessary.

-

The role of lobbying and political influence: While the official process emphasized objective criteria, lobbying efforts by affected industries and their representatives played a significant role in influencing exemption decisions.

-

Examples of successfully granted and denied exemptions: Some sectors, like certain medical equipment manufacturers, successfully secured exemptions, while others, especially in competing industries, faced rejection. The decisions often reflected the complexities of balancing economic considerations with broader geopolitical strategies.

Recent Developments in Tariff Exemption Policy

The approach to US-China tariff exemptions has evolved since the initial imposition of tariffs. Early processes were often criticized for being opaque and inconsistently applied. Later refinements aimed to enhance transparency and provide clearer guidelines. However, political factors and ongoing trade negotiations continue to influence the exemption landscape.

-

Specific examples of recent changes in policy: Changes in application deadlines, increased emphasis on national security considerations, and adjustments to the criteria for eligibility.

-

Analysis of the reasons behind these changes: The changes often reflected the shifting political climate, evolving trade strategies, and attempts to address concerns about the fairness and effectiveness of the initial exemption process.

-

The influence of bilateral negotiations and agreements: The "Phase One" trade deal significantly influenced the trajectory of tariff exemptions. Some tariffs were reduced or eliminated as part of the agreement, impacting the need for individual exemptions.

The Impact of Tariff Exemptions on Specific Sectors

The impact of US-China tariff exemptions has varied significantly across different sectors. Some industries benefited greatly from securing exemptions, mitigating the negative impacts of tariffs, while others faced continued challenges.

-

Case studies of companies receiving exemptions: Examining individual case studies reveals the diverse range of impacts. Some companies saw their profitability restored by securing exemptions, while others still struggled with the complexities of navigating the exemption process.

-

Analysis of the economic consequences for those sectors: The economic consequences extended beyond individual companies, influencing supply chains, employment levels, and overall sector competitiveness.

-

Comparison of affected sectors across different industries: A comparative analysis across sectors like agriculture and technology illustrates how the impact of tariffs and exemptions varied widely based on industry structure, supply chain dependence, and domestic alternatives.

Future Outlook for US-China Tariff Exemptions

Predicting the future of US-China tariff exemptions is challenging given the dynamic nature of the relationship. However, several factors suggest potential trajectories. The outcome of future elections and shifts in US administration policy will play a significant role in shaping trade relations and, consequently, the availability of tariff exemptions.

-

Predictions on future tariff exemption policies: Depending on future administration priorities, we might see either a continuation of the current approach, a tightening of exemption criteria, or potentially a complete removal of the exemption process.

-

Potential for further negotiations and agreements: Further negotiations and agreements could lead to broader tariff reductions or adjustments, lessening the need for individual exemptions.

-

Long-term implications for US-China trade relations: The long-term impact will depend on the overall trajectory of the relationship – whether it evolves towards greater cooperation or remains characterized by ongoing tension.

Conclusion

Recent developments in US-China tariff exemptions highlight the complex and ever-evolving nature of trade relations between these two economic giants. The granting, denial, and implications of these exemptions have had a significant impact on various sectors of both economies. Understanding this dynamic landscape is critical for effective business planning and decision-making.

Call to Action: Staying informed about developments in US-China tariff exemptions is crucial for businesses involved in US-China trade. Continue to monitor updates on US-China tariff exemptions and related policies to understand how these changes might affect your business operations. Regularly check official government websites and relevant trade publications for the latest information on US-China tariff exemptions and related policies.

Featured Posts

-

Open Ais Chat Gpt An Ftc Investigation And Its Potential Consequences

Apr 28, 2025

Open Ais Chat Gpt An Ftc Investigation And Its Potential Consequences

Apr 28, 2025 -

Luigi Mangione Supporters Their Hopes And Expectations

Apr 28, 2025

Luigi Mangione Supporters Their Hopes And Expectations

Apr 28, 2025 -

Cassidy Hutchinson Plans Memoir A Look Inside The January 6th Hearings

Apr 28, 2025

Cassidy Hutchinson Plans Memoir A Look Inside The January 6th Hearings

Apr 28, 2025 -

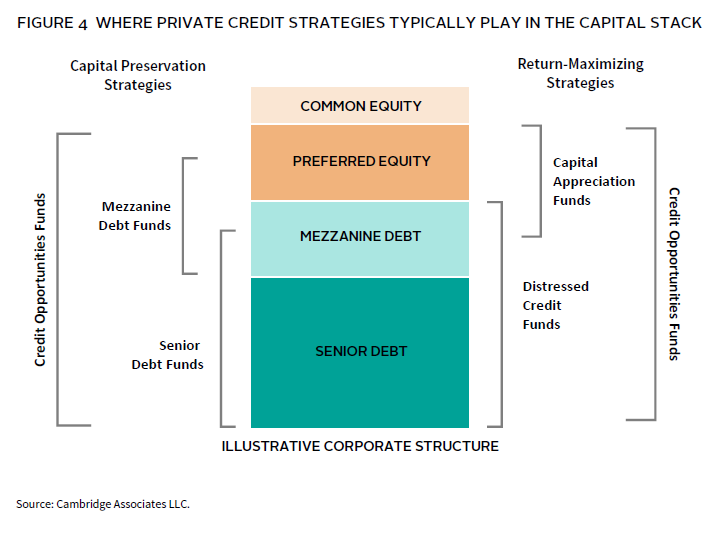

5 Key Actions To Secure A Private Credit Role

Apr 28, 2025

5 Key Actions To Secure A Private Credit Role

Apr 28, 2025 -

Gpu Price Increases Whats Driving The Cost

Apr 28, 2025

Gpu Price Increases Whats Driving The Cost

Apr 28, 2025

Latest Posts

-

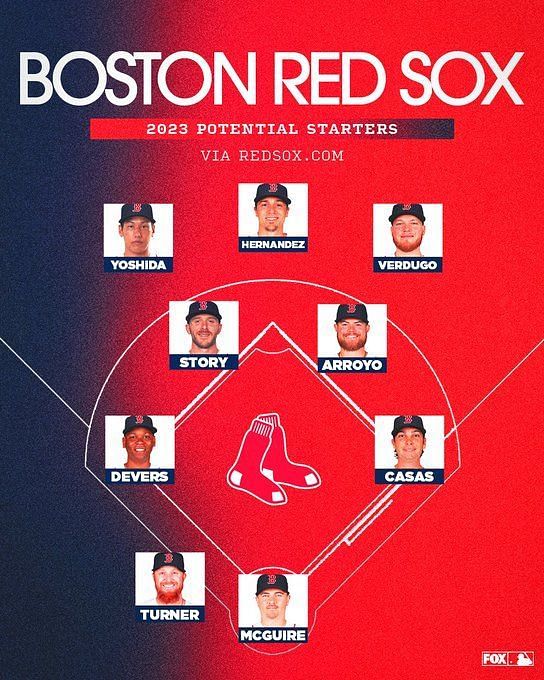

Red Soxs Shifting Lineup Impact Of Outfielders Return And Casas Lowered Spot

Apr 28, 2025

Red Soxs Shifting Lineup Impact Of Outfielders Return And Casas Lowered Spot

Apr 28, 2025 -

Analysis Red Sox Lineup Changes Following Outfielders Return And Casas Demotion

Apr 28, 2025

Analysis Red Sox Lineup Changes Following Outfielders Return And Casas Demotion

Apr 28, 2025 -

Updated Red Sox Lineup Casas Position Change And Outfielders Reinstatement

Apr 28, 2025

Updated Red Sox Lineup Casas Position Change And Outfielders Reinstatement

Apr 28, 2025 -

Red Sox Lineup Outfielder Returns Casas Moves Down In The Order

Apr 28, 2025

Red Sox Lineup Outfielder Returns Casas Moves Down In The Order

Apr 28, 2025 -

Triston Casas Continued Slide Red Sox Lineup Adjustment And Outfielders Return

Apr 28, 2025

Triston Casas Continued Slide Red Sox Lineup Adjustment And Outfielders Return

Apr 28, 2025