Recent XRP Whale Activity: 20 Million Tokens Acquired

Table of Contents

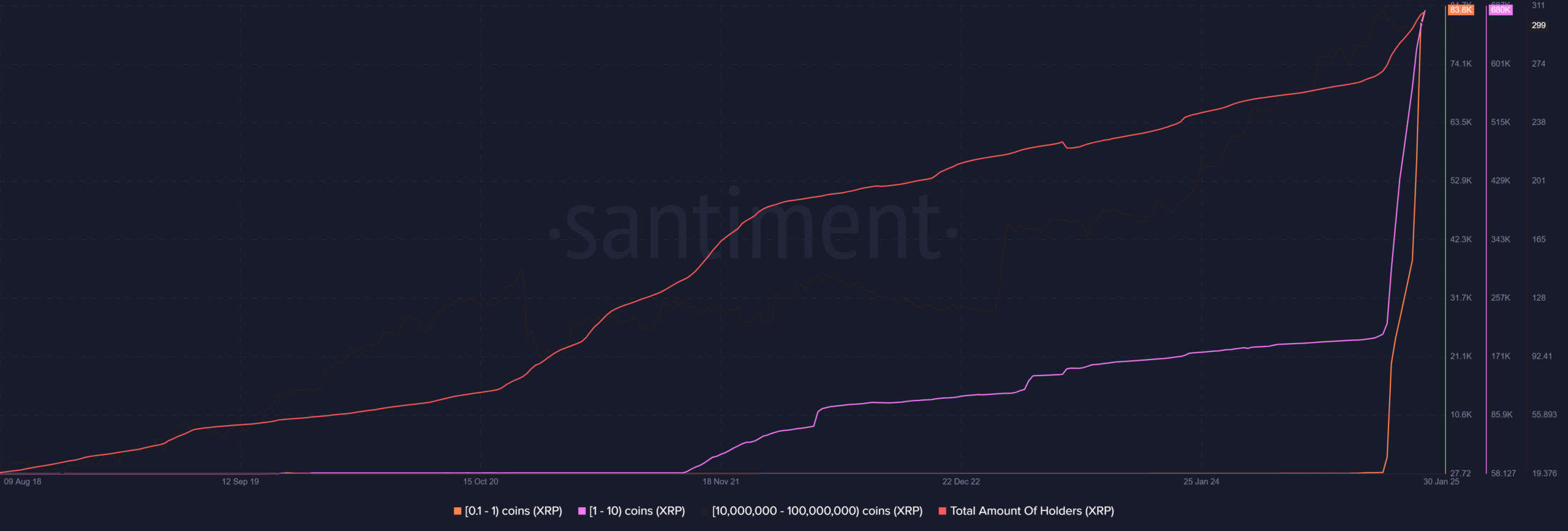

The Significance of the 20 Million XRP Acquisition

The acquisition of 20 million XRP represents a substantial investment, considering XRP's overall market capitalization. While the exact percentage this represents fluctuates with market conditions, such a large purchase undeniably holds significant weight. This type of transaction can significantly impact XRP's price and overall market sentiment.

- Market share implications: A purchase of this magnitude could represent a notable increase in a single entity's XRP holdings, potentially affecting the overall distribution of tokens and market power.

- Trading volume and volatility: The transaction likely contributed to increased trading volume and short-term price volatility. Large buy orders can create upward pressure, attracting more buyers and further influencing the price.

- Comparison to previous transactions: This acquisition can be compared to previous significant XRP whale transactions to gauge its relative importance and potential impact. Analyzing the timing and context of previous large purchases can offer valuable insights.

This purchase could affect both short-term and long-term price predictions. While short-term price movements are often volatile and influenced by various factors, a large buy-in can signal increased confidence in the asset's long-term potential, leading to sustained price increases. Data and charts illustrating price movements following the transaction would provide further context (though unfortunately, such real-time data isn't included in this static article).

Identifying the XRP Whale and Their Potential Motives

Pinpointing the specific whale responsible for this 20 million XRP acquisition is challenging. The decentralized and pseudonymous nature of cryptocurrency transactions makes it difficult to definitively identify individual investors. However, we can explore potential motivations based on available information.

-

Long-term investment strategy: The whale may be a long-term investor, anticipating significant growth in XRP's value over time.

-

Anticipation of positive news: The purchase could be driven by anticipation of positive news, such as a favorable outcome in the ongoing Ripple lawsuit or the announcement of major partnerships or technological advancements.

-

Strategic market manipulation (Disclaimer: This possibility should be considered with extreme caution and skepticism. Market manipulation is illegal and unethical.) Although less likely, a possibility exists that the purchase is a calculated move to influence market sentiment and price.

-

On-chain data analysis: Blockchain analytics tools can be used to analyze transaction patterns, identifying potential links between wallets and attempting to trace the flow of funds.

-

Known large XRP holders: Comparing the transaction details to known large XRP holders can provide clues, though it's crucial to remember the privacy afforded by blockchain anonymity.

-

Limitations of tracking: It's important to acknowledge the inherent limitations of tracking crypto whale activity due to privacy concerns and the complexities of blockchain analysis.

The Ripple Lawsuit and its Influence on XRP Whale Activity

The ongoing Ripple lawsuit against the SEC has significantly impacted XRP's price and market sentiment. The legal uncertainty has created volatility, with price movements often correlating with developments in the case.

- Positive lawsuit outcome: A favorable ruling could significantly boost XRP's price, as it would likely reduce regulatory uncertainty. This large purchase could be interpreted as a bet on such a positive outcome.

- Uncertainty and market reaction: The lawsuit’s uncertainty itself drives market reaction, causing periods of both substantial gains and losses depending on the perceived likelihood of success.

- Volatility around legal decisions: Key legal decisions are likely to cause increased volatility in XRP's price, as investors react to the news.

This significant XRP acquisition might reflect confidence in a positive resolution to the Ripple lawsuit, or it could be a purely opportunistic trade taking advantage of a perceived undervaluation. Further analysis is needed to determine the primary motivating factor.

Analyzing On-Chain Data for Further Insights

Blockchain analysis plays a critical role in understanding this activity. Tools can be used to analyze various metrics:

- Transaction volume: Examining the volume of XRP traded around the time of the acquisition can reveal market activity patterns.

- Exchange inflows/outflows: Tracking XRP movements between exchanges and wallets helps determine if the tokens were acquired from an exchange or another large holder.

- Distribution patterns: Analyzing the distribution of XRP across various wallets can help to understand the overall market dynamics and the potential concentration of holdings.

This data allows for a deeper understanding of whale behavior and its impact on the market, contributing to more informed investment decisions.

Conclusion

The recent acquisition of 20 million XRP tokens by a whale is a significant event with substantial implications for XRP's price and market sentiment. While the whale's identity and exact motives remain uncertain, the sheer scale of the transaction cannot be ignored. Continued analysis of on-chain data and the ongoing Ripple lawsuit will be crucial in evaluating the long-term impact of this XRP whale activity. Stay informed about future developments in XRP whale activity to make sound investment decisions. Monitoring the situation closely is key to understanding this dynamic market event and navigating the complexities of XRP whale activity in the cryptocurrency world.

Featured Posts

-

Choosing The Right Surface Pro 12 Inch Model Deep Dive

May 08, 2025

Choosing The Right Surface Pro 12 Inch Model Deep Dive

May 08, 2025 -

Institutional Ethereum Accumulation Cross X Indicators Point To Potential 4 000 Breakout

May 08, 2025

Institutional Ethereum Accumulation Cross X Indicators Point To Potential 4 000 Breakout

May 08, 2025 -

Ethereums Bullish Momentum Price Strength And Upside Potential

May 08, 2025

Ethereums Bullish Momentum Price Strength And Upside Potential

May 08, 2025 -

Kripto Varlik Piyasasinda Yeni Bir Doenem Spk Nin Getirdigi Duezenlemeler

May 08, 2025

Kripto Varlik Piyasasinda Yeni Bir Doenem Spk Nin Getirdigi Duezenlemeler

May 08, 2025 -

Rogue One Stars Unexpected Opinion On A Fan Favorite Character

May 08, 2025

Rogue One Stars Unexpected Opinion On A Fan Favorite Character

May 08, 2025

Latest Posts

-

Universal Credit Understanding And Reclaiming Hardship Payment Overpayments

May 08, 2025

Universal Credit Understanding And Reclaiming Hardship Payment Overpayments

May 08, 2025 -

Celtics Vs Nets Latest Injury Report And Tatums Playing Status

May 08, 2025

Celtics Vs Nets Latest Injury Report And Tatums Playing Status

May 08, 2025 -

Abc Promo Features Tnt Announcers Hilarious Take On Jayson Tatum

May 08, 2025

Abc Promo Features Tnt Announcers Hilarious Take On Jayson Tatum

May 08, 2025 -

Dwp Universal Credit Claiming Back Overpaid Hardship Payments

May 08, 2025

Dwp Universal Credit Claiming Back Overpaid Hardship Payments

May 08, 2025 -

Is Jayson Tatum Out Tonight Celtics Nets Injury News

May 08, 2025

Is Jayson Tatum Out Tonight Celtics Nets Injury News

May 08, 2025