Institutional Ethereum Accumulation: CrossX Indicators Point To Potential $4,000 Breakout

Table of Contents

Ethereum's price has shown impressive resilience lately, sparking renewed interest from institutional investors. The coveted $4,000 price point, once seemingly distant, is now within striking distance, fueled by what appears to be significant institutional Ethereum accumulation. This article delves into the compelling evidence, focusing on CrossX indicators that suggest a potential $4,000 breakout is on the horizon. We will analyze on-chain data, correlate it with broader market trends, and discuss the technical factors supporting this bullish prediction. Understanding Institutional Ethereum Accumulation and the insights offered by CrossX Indicators is crucial for navigating the current market landscape.

2. Main Points:

H2: CrossX Indicators Suggesting Significant Institutional Buying

H3: On-Chain Data Analysis:

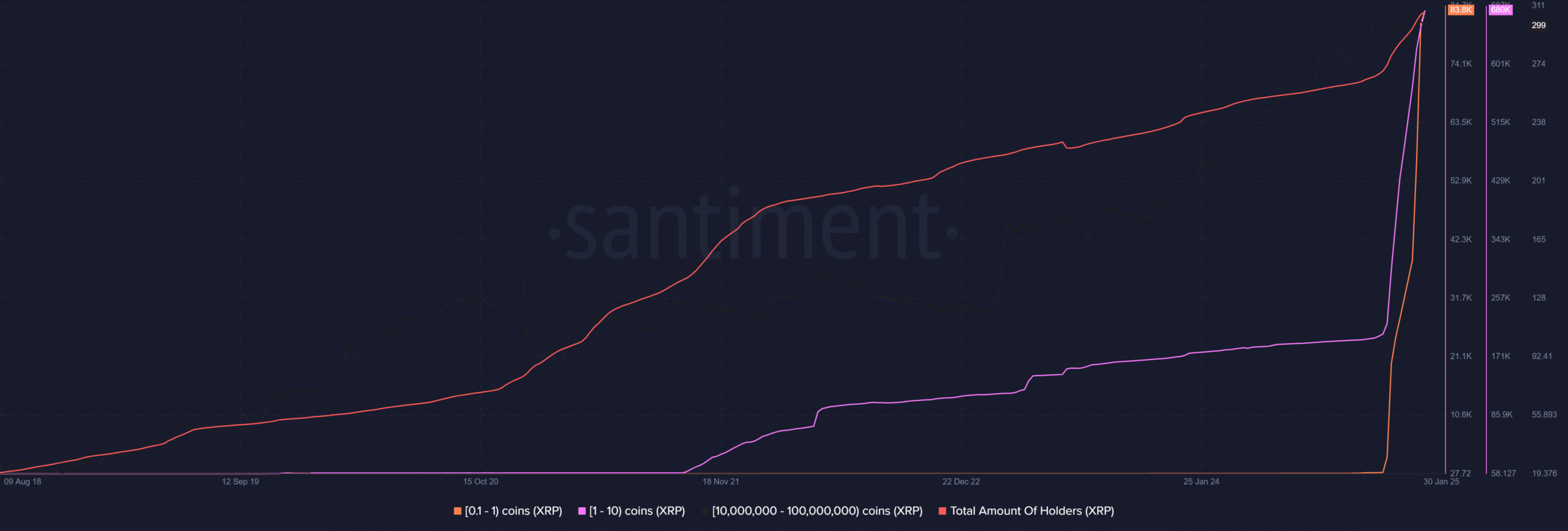

CrossX indicators are a powerful tool for analyzing large-scale cryptocurrency transactions, providing insights into the actions of major players, including institutional investors. These indicators go beyond simple price movements, offering a deeper understanding of on-chain activity. By analyzing data points like large wallet accumulation and exchange outflows, CrossX helps identify significant buying pressure.

- Large Wallet Accumulation: A substantial increase in Ethereum held by large wallets (holding 1,000 ETH or more) has been observed in recent weeks, suggesting institutional accumulation. This is a key CrossX indicator.

- Exchange Outflows: A consistent pattern of Ethereum flowing out of major exchanges points towards a reduction in the available supply for trading, potentially signaling institutional buying for long-term holding.

- Increased Activity on Smart Contract Platforms: Increased activity on decentralized finance (DeFi) platforms, many of which run on Ethereum, further supports the narrative of institutional interest as these platforms require significant amounts of ETH for operation.

[Insert relevant chart visualizing large wallet accumulation and exchange outflows here]. The chart clearly demonstrates the significant increase in Ethereum held by large wallets and the corresponding decrease in exchange reserves, both key indicators of Institutional Ethereum Accumulation.

H3: Correlation with Other Market Indicators:

The CrossX indicators supporting Institutional Ethereum Accumulation aren't isolated phenomena. They align with other positive market signals:

- Positive Bitcoin Correlation: A strengthening Bitcoin price typically boosts the entire cryptocurrency market, including Ethereum. This positive correlation strengthens the case for sustained growth.

- Improving Market Sentiment: A shift towards more bullish sentiment among analysts and investors contributes to increased demand for Ethereum.

- Altcoin Season Potential: The possibility of an altcoin season, where altcoins outperform Bitcoin, further fuels the potential for a significant Ethereum price increase.

H2: The Potential for a $4,000 Ethereum Breakout

H3: Technical Analysis Supporting the Breakout:

Technical analysis corroborates the bullish outlook suggested by CrossX indicators.

- Moving Averages: Key moving averages like the 50-day and 200-day are converging, often a bullish signal indicating a potential upward price trend.

- RSI (Relative Strength Index): The RSI is showing signs of breaking out of oversold territory, suggesting buying pressure is mounting.

- MACD (Moving Average Convergence Divergence): The MACD is exhibiting a bullish crossover, further reinforcing the potential for a price surge.

[Insert relevant chart visualizing technical indicators here]. The converging moving averages, RSI breakout, and bullish MACD crossover strongly suggest an imminent price increase, aligning perfectly with the Institutional Ethereum Accumulation identified through CrossX analysis.

H3: Factors Contributing to Potential Price Increase:

Several fundamental factors could contribute to a $4,000 Ethereum breakout:

- Booming DeFi Ecosystem: The continued growth and expansion of the decentralized finance (DeFi) sector, heavily reliant on Ethereum, increases demand for ETH.

- Ethereum 2.0 Progress: The ongoing development and implementation of Ethereum 2.0, aiming to improve scalability and efficiency, enhances the long-term value proposition of Ethereum.

- Increased Regulatory Clarity: Growing regulatory clarity in various jurisdictions could boost institutional confidence and investment in Ethereum.

H2: Risks and Considerations

While the evidence strongly suggests a potential $4,000 breakout fueled by Institutional Ethereum Accumulation, it's crucial to acknowledge potential risks:

- Macroeconomic Factors: Global economic uncertainty could impact investor sentiment and negatively influence cryptocurrency prices.

- Regulatory Uncertainty: Unforeseen regulatory changes could create volatility in the market.

- Market Volatility: The cryptocurrency market is inherently volatile, and unexpected price drops remain a possibility.

3. Conclusion: Institutional Ethereum Accumulation Poised for a $4,000 Breakout?

The analysis of CrossX indicators reveals significant institutional Ethereum accumulation, a trend corroborated by positive market correlations and supportive technical analysis. The confluence of these factors strongly suggests a potential $4,000 breakout for Ethereum. While macroeconomic factors and regulatory uncertainty pose risks, the bullish indicators outweigh the bearish concerns. Stay informed about the evolving landscape of Institutional Ethereum Accumulation and don't miss the potential $4,000 breakout! Further research into CrossX indicators and their implications for Ethereum's price trajectory is highly recommended.

Featured Posts

-

Section 230 And Banned Chemicals A Judges Ruling On E Bay Listings

May 08, 2025

Section 230 And Banned Chemicals A Judges Ruling On E Bay Listings

May 08, 2025 -

The Arteta Debate Collymores Arsenal Assessment

May 08, 2025

The Arteta Debate Collymores Arsenal Assessment

May 08, 2025 -

Pressure Mounts For Economic Reform Amidst Taiwan Dollars Rise

May 08, 2025

Pressure Mounts For Economic Reform Amidst Taiwan Dollars Rise

May 08, 2025 -

Understanding Ethereums Price A Comprehensive Guide To Market Analysis And Predictions

May 08, 2025

Understanding Ethereums Price A Comprehensive Guide To Market Analysis And Predictions

May 08, 2025 -

Greenland A New Geopolitical Battleground Between The Us And China

May 08, 2025

Greenland A New Geopolitical Battleground Between The Us And China

May 08, 2025

Latest Posts

-

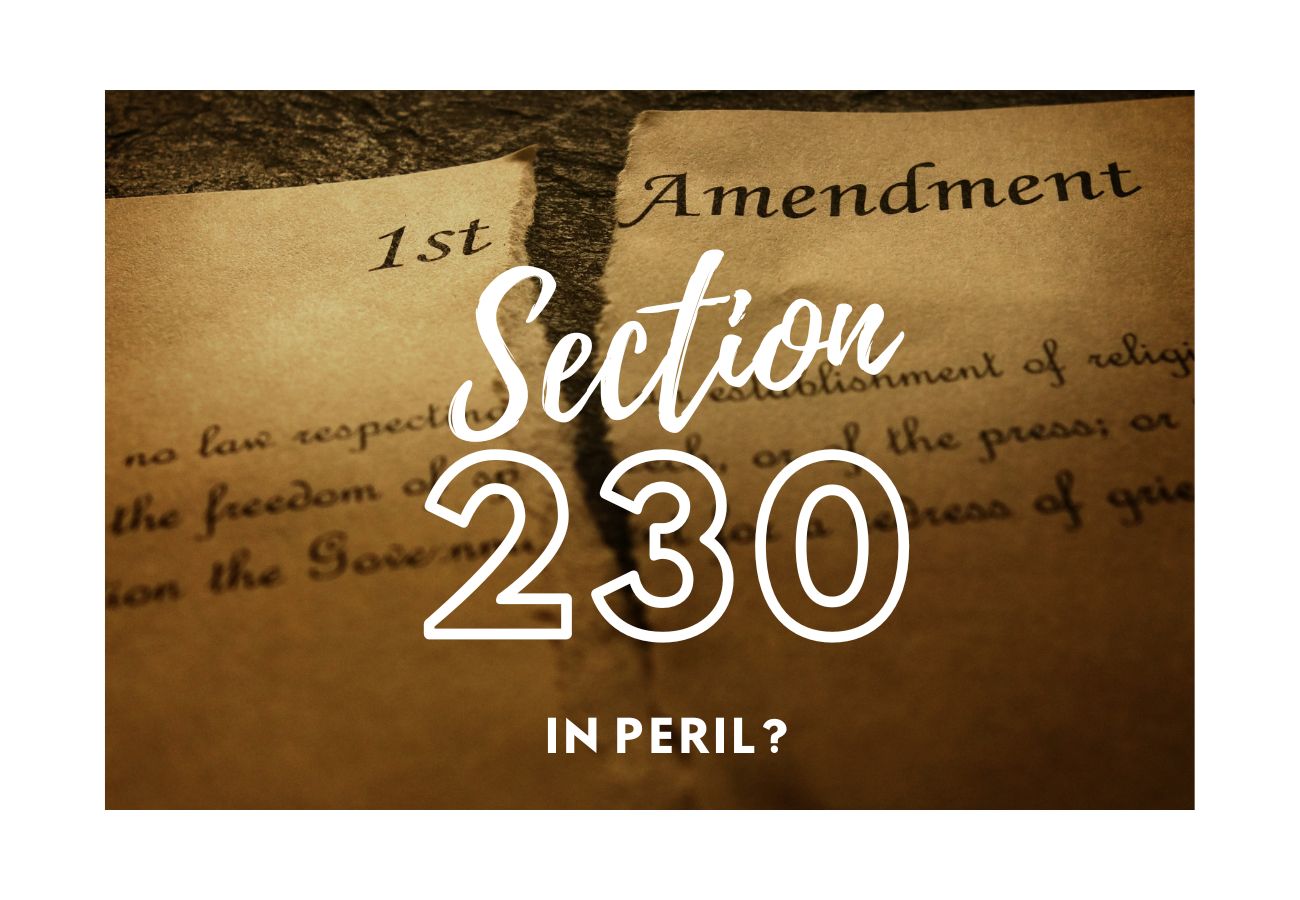

Latest Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 08, 2025

Latest Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 08, 2025 -

Xrps Future The Impact Of Secs Commodity Debate

May 08, 2025

Xrps Future The Impact Of Secs Commodity Debate

May 08, 2025 -

Daily Lotto Friday 18th April 2025 Results

May 08, 2025

Daily Lotto Friday 18th April 2025 Results

May 08, 2025 -

Winning Numbers Daily Lotto Wednesday April 16 2025

May 08, 2025

Winning Numbers Daily Lotto Wednesday April 16 2025

May 08, 2025 -

The Sec And Xrp Navigating The Uncertainty Around Commodity Classification

May 08, 2025

The Sec And Xrp Navigating The Uncertainty Around Commodity Classification

May 08, 2025