Refinance Federal Student Loans: A Step-by-Step Guide

Table of Contents

Understanding Your Federal Student Loans

Before you even consider refinancing, it's crucial to fully understand your existing federal student loans. This includes knowing the types of loans you have and their current interest rates.

Types of Federal Student Loans

Federal student loans come in various forms, each with its own characteristics. Understanding these differences is vital for making informed refinancing decisions.

- Direct Subsidized Loans: The government pays the interest while you're in school (under certain conditions) and during grace periods.

- Direct Unsubsidized Loans: Interest accrues from the moment the loan is disbursed, even while you're in school.

- Grad PLUS Loans: Loans available to graduate and professional students, often with higher interest rates than undergraduate loans.

- Parent PLUS Loans: Loans available to parents of undergraduate students to help pay for their education.

Knowing the specifics of your Direct Subsidized Loans, Direct Unsubsidized Loans, Grad PLUS Loans, or Parent PLUS Loans will help you compare refinancing offers effectively.

Checking Your Credit Score

Your credit score plays a significant role in determining your eligibility for refinancing and the interest rate you'll receive. A higher credit score usually translates to better loan terms.

- Obtain a free credit report: You can obtain a free credit report annually from AnnualCreditReport.com. This report shows your credit history, including your FICO score.

- Improve your credit score: Strategies to improve your credit score include paying bills on time, keeping credit utilization low, and maintaining a healthy mix of credit accounts.

- Impact of a high credit score: A higher credit score increases your chances of approval and often secures you a lower interest rate, resulting in significant savings over the life of the loan.

Exploring Refinancing Options

Once you understand your loans, you can begin exploring your refinancing options. The two primary avenues are private lenders and federal loan consolidation.

Private Lenders vs. Federal Loan Consolidation

- Private Student Loan Refinancing: Refinancing with a private lender allows you to consolidate multiple federal loans into a single private loan, potentially with a lower interest rate. However, you lose the benefits of federal loan programs, such as income-driven repayment plans and loan forgiveness programs. Keywords: private student loan refinancing, private student loans.

- Federal Student Loan Consolidation: Consolidating your federal loans through the government (a Direct Consolidation Loan) simplifies your payments into a single monthly payment. However, you may not lower your interest rate significantly.

Choosing between private student loan refinancing and federal student loan consolidation depends heavily on your individual circumstances and financial goals.

Understanding Interest Rates and Loan Terms

Understanding the terms associated with refinancing is crucial.

- Annual Percentage Rate (APR): This represents the total cost of borrowing, including the interest rate and any fees.

- Fixed Interest Rate: Your interest rate remains constant throughout the loan term, providing predictable monthly payments.

- Variable Interest Rate: Your interest rate fluctuates based on market conditions, which can lead to unpredictable monthly payments.

- Loan Term: The length of time you have to repay your loan; a shorter term means higher monthly payments but less interest paid overall.

- Origination Fee: A fee charged by the lender for processing your loan application.

Factors influencing interest rates include your credit score, loan amount, and whether you have a co-signer.

The Refinancing Application Process

Refinancing your federal student loans involves several steps.

Comparing Lenders and Rates

Shopping around is key to securing the best possible interest rate. Use online tools to compare student loan refinance lenders and compare student loan rates from multiple lenders before committing to any loan. Finding the best student loan refinance rates requires careful comparison.

Gathering Necessary Documents

Before you apply, gather the necessary documents to streamline the process. These typically include:

- Income verification (pay stubs, tax returns)

- Details of your existing federal student loans

- Proof of identity

Step-by-Step Application Process

The application process typically involves:

- Completing an online application.

- Providing required documentation.

- Undergoing a credit check.

- Loan approval and disbursement.

Post-Refinancing Considerations

Once you've refinanced, there are important factors to consider.

Monitoring Your Loan

Use a student loan payment tracker to stay organized and on top of your payments. Understanding your student loan repayment schedule is crucial.

Potential Tax Implications

Be aware of any potential tax implications of refinancing. While interest on federal student loans is usually not tax deductible after refinancing, consult a tax professional to be certain.

Managing Your Refinance

- Budgeting: Create a budget that incorporates your new monthly student loan payments.

- Financial Advice: Consider seeking professional financial advice to create a comprehensive financial plan.

- Handling Challenges: Have a plan in place in case of unexpected financial difficulties.

Conclusion

Refinancing federal student loans can be a powerful tool for managing your debt and achieving financial goals. By understanding your loan types, comparing lenders, and navigating the application process effectively, you can potentially lower your interest rate and monthly payments. Remember to carefully consider the pros and cons of private refinancing versus federal consolidation, and always monitor your loan and plan for potential changes in your financial situation. Ready to explore the benefits of refinancing federal student loans and potentially lower your monthly payments? Start comparing rates from reputable lenders today! Don't hesitate to explore your federal student loan refinancing options and find the best solution for your needs.

Featured Posts

-

Stream Seattle Mariners Vs Chicago Cubs Spring Training Game Today

May 17, 2025

Stream Seattle Mariners Vs Chicago Cubs Spring Training Game Today

May 17, 2025 -

Angel Reeses Concise Answer To A Caitlin Clark Inquiry

May 17, 2025

Angel Reeses Concise Answer To A Caitlin Clark Inquiry

May 17, 2025 -

Tom Thibodeaus Plea Knicks Need More Resolve After Blowout

May 17, 2025

Tom Thibodeaus Plea Knicks Need More Resolve After Blowout

May 17, 2025 -

Zhevago Posledstviya Ugrozy Prekrascheniya Investitsiy Ferrexpo Dlya Ukrainy

May 17, 2025

Zhevago Posledstviya Ugrozy Prekrascheniya Investitsiy Ferrexpo Dlya Ukrainy

May 17, 2025 -

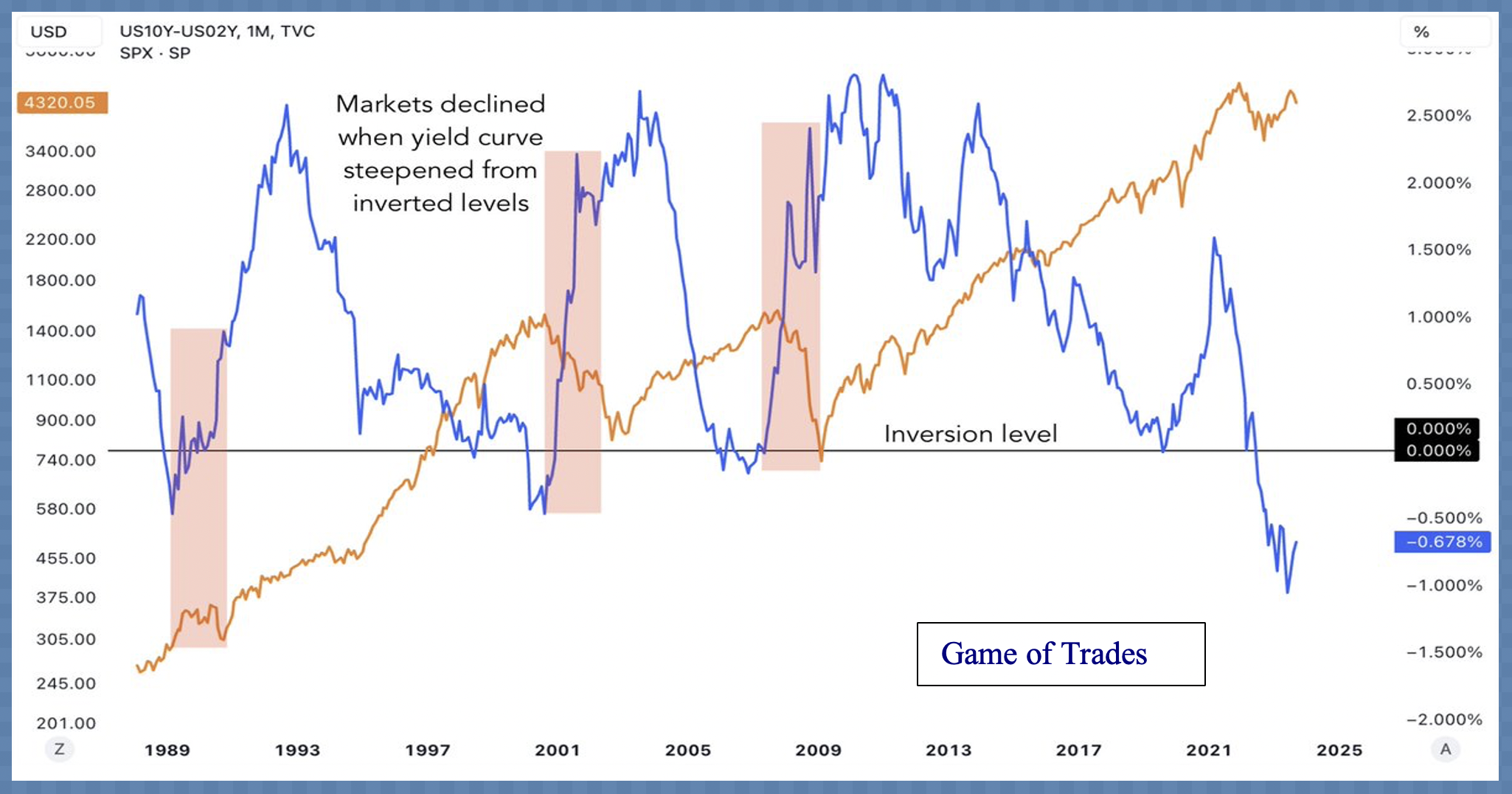

Japans Economy Faces Pressure The Challenge Of A Steepening Bond Yield Curve

May 17, 2025

Japans Economy Faces Pressure The Challenge Of A Steepening Bond Yield Curve

May 17, 2025

Latest Posts

-

7 Bit Casino Best Online Casino Canada For Canadian Players

May 17, 2025

7 Bit Casino Best Online Casino Canada For Canadian Players

May 17, 2025 -

Exploring The Best Crypto Casinos Of 2025 Jackbits Bitcoin Offering

May 17, 2025

Exploring The Best Crypto Casinos Of 2025 Jackbits Bitcoin Offering

May 17, 2025 -

Jackbit Casino Review A Contender For Best Crypto Casino In 2025

May 17, 2025

Jackbit Casino Review A Contender For Best Crypto Casino In 2025

May 17, 2025 -

Jack Bit Casino Review A Top Contender Among Us Bitcoin Casinos

May 17, 2025

Jack Bit Casino Review A Top Contender Among Us Bitcoin Casinos

May 17, 2025 -

Top Crypto Casinos For 2025 Is Jackbit The Best Bitcoin Option

May 17, 2025

Top Crypto Casinos For 2025 Is Jackbit The Best Bitcoin Option

May 17, 2025