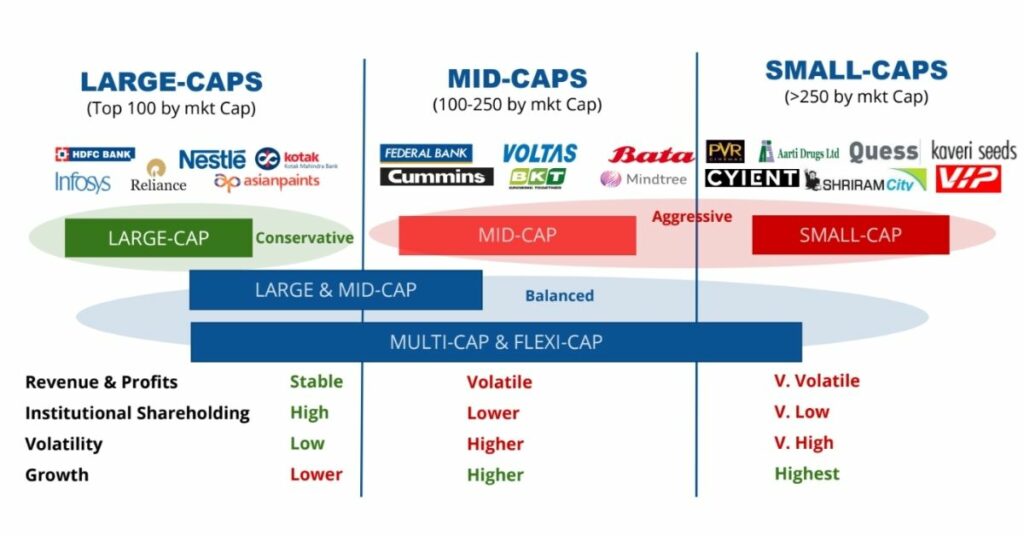

Reliance Earnings Surprise: Impact On India's Large-Cap Market

Table of Contents

Reliance Industries' Q[Quarter] Earnings Breakdown

Revenue and Profitability

Reliance Industries' Q[Quarter] results showcased a mixed bag. The company reported a total revenue of [Insert Revenue Figure], exceeding analyst expectations by [Percentage]%. This exceeded expectations primarily due to robust performance in several key sectors.

- Revenue exceeded expectations by X%, driven by strong performance in the telecom sector. Jio's continued subscriber growth and expansion into new services contributed significantly to this surge.

- Net profit increased/decreased by Y% compared to the previous quarter. This fluctuation can be attributed to [explain reasons, e.g., increased operating costs, one-time gains, etc.].

- EBITDA margins stood at [Percentage]%, reflecting [positive/negative] trends in operational efficiency. This highlights the company's ability to manage costs effectively despite [challenges/opportunities].

Sector-wise Performance Analysis

A granular look at Reliance's diverse business portfolio reveals varying performances across sectors.

- Jio's subscriber growth contributed significantly to overall revenue. The telecom sector continues to be a major driver of Reliance's growth, demonstrating the company's success in the competitive Indian telecom market.

- The retail segment experienced [positive/negative] growth, impacted by [Specific Factor, e.g., increased competition, changing consumer behavior]. This highlights the challenges faced by Reliance Retail in navigating a dynamic market environment.

- The energy sector showed [positive/negative] results influenced by [Specific Factor, e.g., global oil prices, domestic policies]. This underscores the vulnerability of this sector to external macroeconomic factors.

Market Reaction and Impact on Large-Cap Indices

Immediate Market Response

The market reacted swiftly to Reliance's earnings announcement.

- Reliance Industries stock experienced a Z% increase/decrease immediately following the announcement. This volatility reflects the market's assessment of the earnings report and its implications for the company's future prospects.

- Positive/Negative sentiment spilled over to other large-cap stocks, resulting in [Describe the overall market movement]. This demonstrates the interconnectedness of the Indian large-cap market and the significant influence of Reliance Industries.

- Trading volume for Reliance Industries surged/dipped significantly, indicating high investor activity. This heightened activity showcases the considerable interest surrounding Reliance's performance and the market's anticipation of future developments.

Broader Implications for the Large-Cap Sector

Reliance's earnings significantly impacted investor confidence and market sentiment.

- Positive performance boosted investor confidence in the overall market, leading to [positive market effects, e.g., increased investment, higher market indices]. This positive ripple effect highlights Reliance's position as a market leader and its influence on investor psychology.

- Concerns about [Specific Industry, e.g., the retail sector] were amplified due to Reliance's results in that segment. This underscores the importance of diversification and the need for a robust strategy in each sector.

- The overall impact on the large-cap index was [positive/negative], reflecting the market's assessment of the long-term implications of Reliance's earnings. This emphasizes the need for continued monitoring and analysis to fully grasp the evolving market dynamics.

Analyst Opinions and Future Outlook

Expert Predictions

Financial analysts offer varied perspectives on Reliance's future.

- Analyst A predicts continued growth in the telecom sector, citing [reasons for prediction]. This prediction suggests continued optimism regarding Reliance Jio's future prospects.

- Analyst B expresses concerns about [Specific Risk Factor, e.g., increasing competition, regulatory changes], potentially impacting future profitability. This highlights the need to consider potential risks and challenges in the coming quarters.

- Consensus forecasts for the next quarter suggest [predicted growth/decline], reflecting a [positive/negative] outlook on Reliance's future performance. This provides a consolidated view of expert opinion, offering valuable insight for investors.

Long-Term Implications

The long-term impact of these earnings remains to be seen, but several key factors are at play.

- Reliance's market position is expected to remain strong, given its diversified portfolio and significant investments in key sectors. This reinforces Reliance's position as a dominant force within the Indian market.

- The overall health of India's large-cap market will be influenced by the continued performance of Reliance and other key players. This underscores the interconnectedness of the market and the need to monitor other significant companies as well.

- Future government policies and global economic conditions will play a crucial role in shaping the long-term trajectory of Reliance and the broader market. This indicates external factors significantly influencing Reliance's future performance and the overall market.

Conclusion

Reliance Industries' Q[Quarter] earnings announcement delivered a mixed bag of results, significantly impacting India's large-cap market. While some sectors showed robust growth, others faced challenges, leading to a volatile market reaction. Analyst opinions are divided, with some expressing optimism about future growth while others highlight potential risks. To understand the full ramifications of this earnings surprise, it's crucial to monitor Reliance's future performance and the broader economic landscape. Stay updated on the latest developments in Reliance earnings and their impact on India's large-cap market by following reputable financial news sources and consulting with your financial advisor before making any investment decisions related to Reliance Industries or the Indian large-cap market.

Featured Posts

-

Minnesota Governor Defies Us Attorney General On Transgender Athlete Ban

Apr 29, 2025

Minnesota Governor Defies Us Attorney General On Transgender Athlete Ban

Apr 29, 2025 -

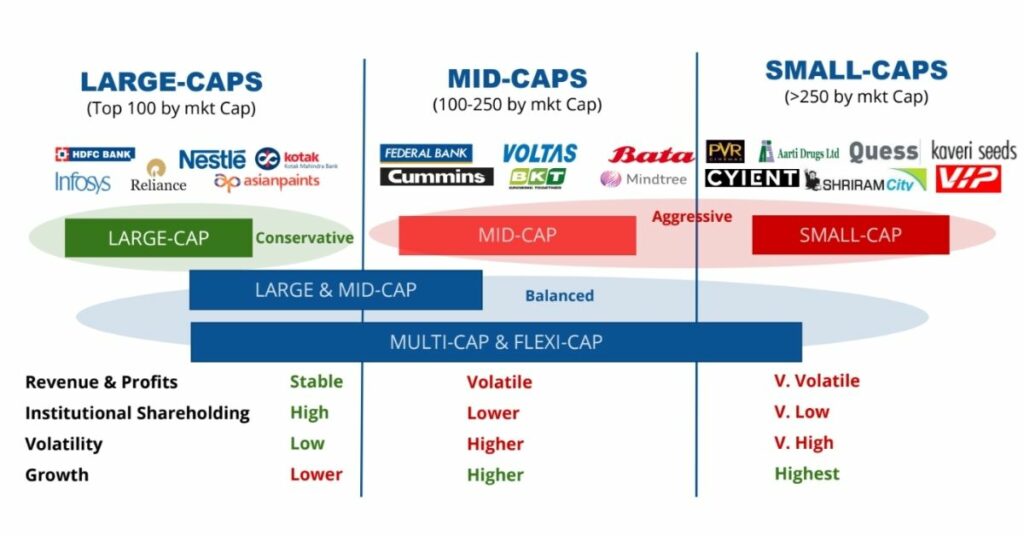

The Future Of Search Perplexitys Ceo On Battling Google In The Ai Browser Race

Apr 29, 2025

The Future Of Search Perplexitys Ceo On Battling Google In The Ai Browser Race

Apr 29, 2025 -

The Changing Face Of X A Look At The Financials Following The Debt Sale

Apr 29, 2025

The Changing Face Of X A Look At The Financials Following The Debt Sale

Apr 29, 2025 -

Analyzing The Economic Fallout Of Trumps China Tariffs Inflation And Supply Chain Disruptions

Apr 29, 2025

Analyzing The Economic Fallout Of Trumps China Tariffs Inflation And Supply Chain Disruptions

Apr 29, 2025 -

Open Ais Chat Gpt Under Ftc Scrutiny A Deep Dive

Apr 29, 2025

Open Ais Chat Gpt Under Ftc Scrutiny A Deep Dive

Apr 29, 2025

Latest Posts

-

Como Alberto Ardila Olivares Garantiza El Gol

Apr 29, 2025

Como Alberto Ardila Olivares Garantiza El Gol

Apr 29, 2025 -

Alberto Ardila Olivares Garantia De Gol Real O Promesa Vacia

Apr 29, 2025

Alberto Ardila Olivares Garantia De Gol Real O Promesa Vacia

Apr 29, 2025 -

Dreaming Of Life In Spain Two Americans Two Different Stories

Apr 29, 2025

Dreaming Of Life In Spain Two Americans Two Different Stories

Apr 29, 2025 -

La Garantia De Gol De Alberto Ardila Olivares Un Analisis

Apr 29, 2025

La Garantia De Gol De Alberto Ardila Olivares Un Analisis

Apr 29, 2025 -

Con Alberto Ardila Olivares La Garantia De Gol Esta Asegurada

Apr 29, 2025

Con Alberto Ardila Olivares La Garantia De Gol Esta Asegurada

Apr 29, 2025