Resorts World Casino Hit With $10.5 Million Money Laundering Penalty

Table of Contents

Main Points: Understanding the Resorts World Casino Case

2.1. Details of the Resorts World Casino Money Laundering Violation

H3: The Specific Allegations:

The $10.5 million penalty stemmed from multiple serious breaches of AML regulations. Resorts World Casino allegedly failed to implement adequate "Know Your Customer" (KYC) procedures, leading to insufficient due diligence on high-risk patrons. Furthermore, the casino is accused of failing to properly report suspicious activity, a critical component of effective AML compliance. Inadequate employee training in AML procedures further compounded the issues.

- Insufficient KYC: Reports suggest failures to properly verify the identities of customers depositing large sums of cash, potentially allowing money launderers to utilize the casino for illicit activities.

- Failure to Report Suspicious Activity: Allegations include a failure to report numerous transactions that should have triggered suspicion, according to regulatory guidelines. This failure to file Suspicious Activity Reports (SARs) is a major violation of AML regulations.

- Inadequate AML Training: Lack of comprehensive training for casino staff on AML procedures and red flags contributed to the overall failure in detecting and reporting suspicious activity.

H3: The Regulatory Body's Response:

The New York State Gaming Commission (NYSGC) levied the $10.5 million penalty. Their official statement highlighted the seriousness of Resorts World Casino's violations, emphasizing the potential for casinos to be exploited for money laundering. The investigation spanned several months, analyzing financial records and interviewing staff.

- NYSGC Findings: The NYSGC report detailed specific instances of non-compliance, including documented failures to meet KYC standards and numerous unreported suspicious transactions.

- Investigation Timeline: The investigation involved a thorough review of casino records over a specified period, leading to the official findings and the subsequent penalty.

- Rationale for the Fine: The $10.5 million fine reflects the severity of the violations and serves as a deterrent to other casinos to prioritize robust AML compliance.

H3: Resorts World Casino's Response:

Resorts World Casino has acknowledged the penalty and committed to enhancing its AML compliance program. While they haven’t explicitly admitted guilt, they have pledged to implement significant changes to prevent future violations.

- Official Statement: The casino issued a press release expressing their commitment to strengthening their AML program and cooperating fully with regulatory authorities.

- Corrective Actions: Resorts World has announced investments in new AML technology, enhanced staff training, and revised internal procedures. Specific details regarding these changes are expected to be released in the coming months.

2.2. Implications for Resorts World Casino

H3: Financial Impact:

The $10.5 million fine represents a significant financial blow to Resorts World Casino. This will undoubtedly impact their bottom line, potentially affecting profitability and investor confidence. The penalty could also lead to increased insurance premiums and other financial burdens.

- Stock Price Impact: The announcement of the penalty likely resulted in fluctuations in the casino's stock price, reflecting investor concerns about regulatory risk.

- Profitability and Operations: The fine will directly reduce profits and might necessitate cost-cutting measures to offset the financial loss.

H3: Reputational Damage:

The money laundering penalty has severely damaged Resorts World Casino's reputation. The negative publicity associated with the case could deter potential customers concerned about the casino's commitment to ethical and legal operations.

- Customer Trust: The incident has likely eroded customer trust, impacting patronage and potentially leading to long-term financial consequences.

- Brand Image: The negative publicity associated with the penalty has undoubtedly tarnished the casino’s brand image, requiring significant efforts to rebuild trust.

H3: Operational Changes:

In response to the penalty, Resorts World Casino is implementing substantial operational changes to bolster its AML compliance program. This includes investing in updated technology and training for staff.

- Technology Upgrades: The casino is likely investing in advanced AML software to enhance transaction monitoring and detection of suspicious activity.

- Enhanced Training Programs: Comprehensive and updated training programs will equip staff with the skills and knowledge to identify and report suspicious activity effectively.

2.3. Broader Implications for the Casino Industry and AML Compliance

H3: Increased Scrutiny of Casino AML Programs:

The Resorts World Casino case underscores the increased regulatory scrutiny facing the casino industry regarding AML compliance. Regulators worldwide are taking a more rigorous approach to ensure casinos effectively prevent money laundering.

- Stricter Enforcement: Expect stricter enforcement of AML regulations and more frequent audits of casino compliance programs.

- Heightened Awareness: The incident serves as a stark reminder to all casino operators of the importance of robust AML compliance.

H3: Best Practices for AML Compliance in Casinos:

To avoid similar penalties, casino operators must prioritize robust AML compliance programs. This involves implementing and consistently reviewing several key measures.

- Robust KYC Procedures: Implement stringent KYC procedures that thoroughly verify customer identities and financial backgrounds.

- Effective SAR Systems: Establish efficient systems for reporting suspicious activity, ensuring timely and accurate filing of SARs.

- Ongoing Employee Training: Provide ongoing and comprehensive AML training to all employees, including management and front-line staff.

- Technology Adoption: Invest in advanced technology solutions to improve transaction monitoring and detect suspicious patterns.

Conclusion: Learning from the Resorts World Casino Money Laundering Penalty

The $10.5 million Resorts World Casino money laundering penalty serves as a critical lesson for the entire casino industry. The case highlights the devastating consequences of inadequate AML compliance, impacting not only the financial stability of the casino but also its reputation and future operations. Effective casino money laundering prevention requires a multi-faceted approach, encompassing robust KYC procedures, vigilant suspicious activity reporting, and ongoing employee training. To avoid facing similar money laundering penalties, and to ensure ethical and responsible operations, casino operators must prioritize strengthening their casino AML compliance programs immediately. Don't wait for a costly regulatory intervention; proactively review and enhance your AML strategy today.

Featured Posts

-

Finding The Best Crypto Casino Sites In Australia For 2025

May 18, 2025

Finding The Best Crypto Casino Sites In Australia For 2025

May 18, 2025 -

Highlights From Snls Jack Black Episode Ego Nwodims Standout Performance

May 18, 2025

Highlights From Snls Jack Black Episode Ego Nwodims Standout Performance

May 18, 2025 -

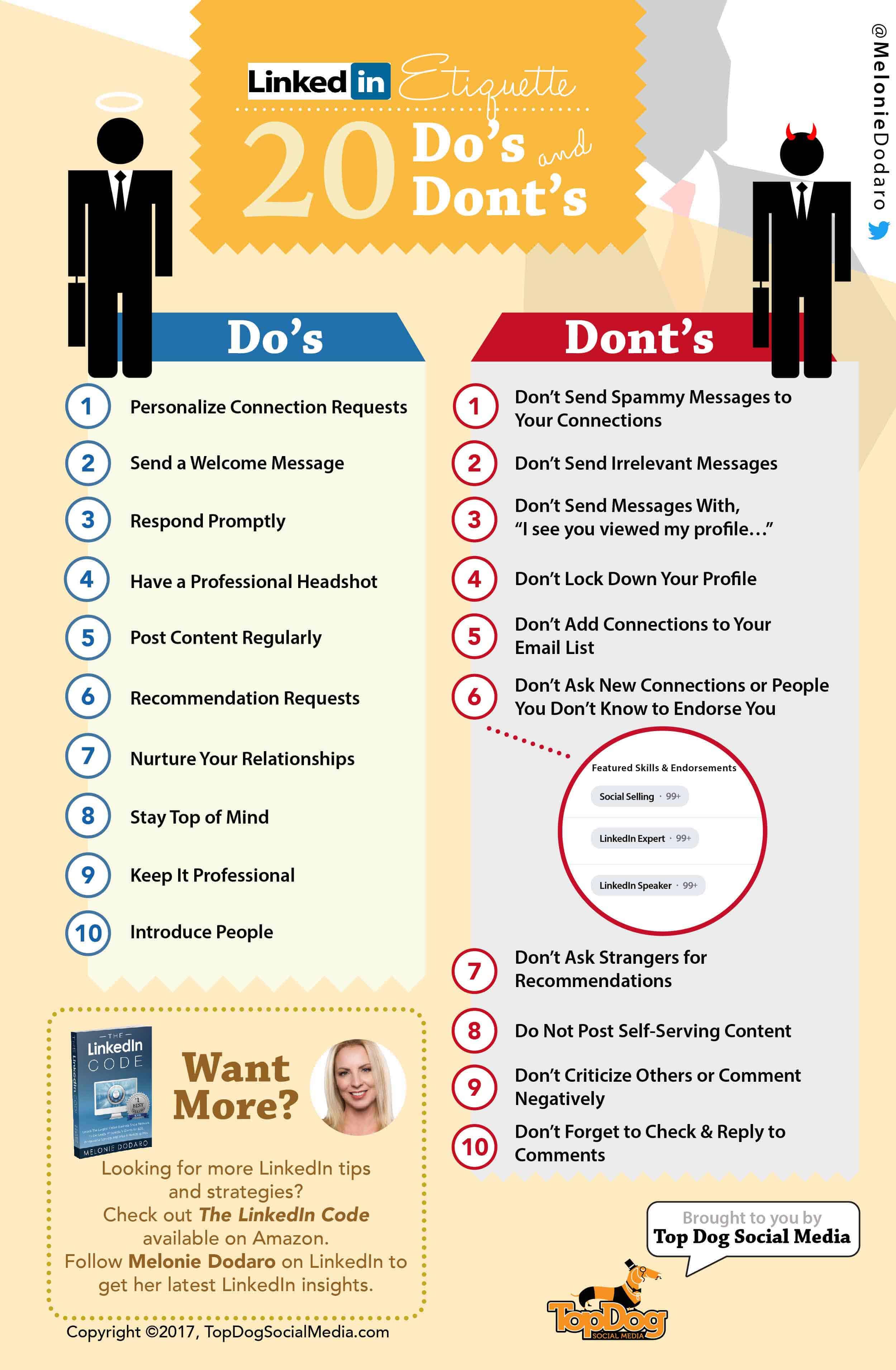

Successfully Navigating The Private Credit Job Market 5 Dos And Don Ts

May 18, 2025

Successfully Navigating The Private Credit Job Market 5 Dos And Don Ts

May 18, 2025 -

Pedro Pascals Latest Role Another Internet Sensation

May 18, 2025

Pedro Pascals Latest Role Another Internet Sensation

May 18, 2025 -

Taylor Swift Announces Reputation Taylors Version Release Date Speculation And Fan Theories

May 18, 2025

Taylor Swift Announces Reputation Taylors Version Release Date Speculation And Fan Theories

May 18, 2025

Latest Posts

-

Investing In Uber Uber Risks And Rewards

May 19, 2025

Investing In Uber Uber Risks And Rewards

May 19, 2025 -

Ubers Future Evaluating The Investment Potential Of Uber Stock

May 19, 2025

Ubers Future Evaluating The Investment Potential Of Uber Stock

May 19, 2025 -

Ride The Future Uber And Waymos Autonomous Vehicles In Austin

May 19, 2025

Ride The Future Uber And Waymos Autonomous Vehicles In Austin

May 19, 2025 -

Self Driving Taxis Arrive In Austin Uber And Waymos Latest Launch

May 19, 2025

Self Driving Taxis Arrive In Austin Uber And Waymos Latest Launch

May 19, 2025 -

Austin Welcomes Robo Taxi Services From Uber And Waymo

May 19, 2025

Austin Welcomes Robo Taxi Services From Uber And Waymo

May 19, 2025