Successfully Navigating The Private Credit Job Market: 5 Do's & Don'ts

Table of Contents

5 Do's for Success in the Private Credit Job Market

Do 1: Network Strategically within the Private Credit Industry

Networking is paramount in the private credit industry. It's not just about collecting contacts; it's about building genuine relationships.

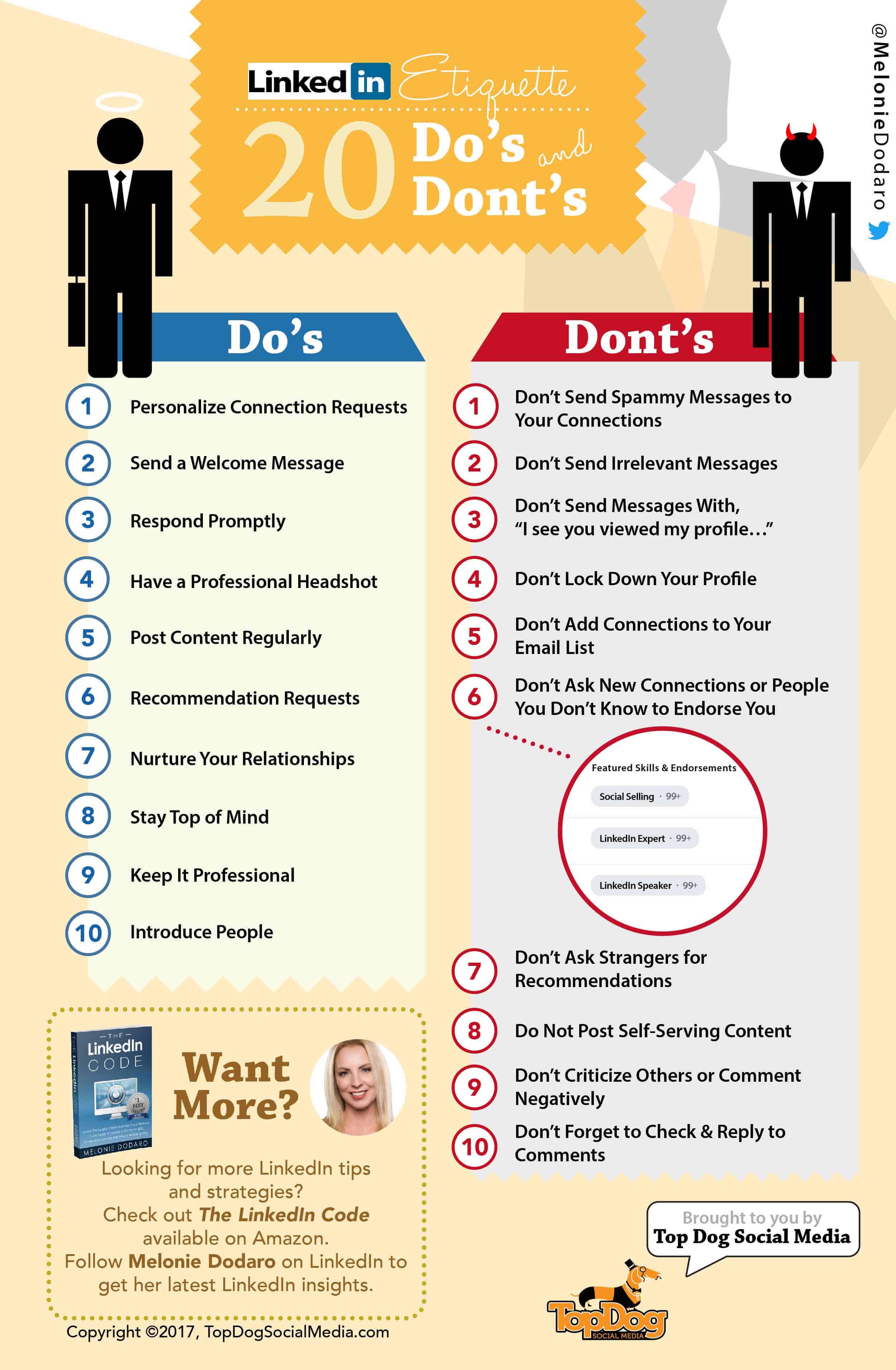

- Leverage LinkedIn: Actively engage with professionals in private credit, join relevant groups, and participate in discussions.

- Attend Industry Events: Conferences like the Private Equity International conference and smaller, specialized workshops offer invaluable networking opportunities. Don't just attend; actively participate and engage in conversations.

- Informational Interviews: Reach out to senior analysts and other professionals for informational interviews. This is a fantastic way to learn about different firms and gain insights into the industry. Don't be afraid to ask targeted questions about their career paths and the private credit landscape.

- Target Specific Firms: Research firms you admire and identify key individuals within those firms. Tailor your outreach to demonstrate your genuine interest in their specific work.

Do 2: Tailor Your Resume and Cover Letter to Private Credit Specifics

A generic resume won't cut it in this competitive market. You need to showcase your skills and experience directly relevant to private credit roles.

- Highlight Relevant Skills: Emphasize skills like financial modeling (using software like Excel, Argus, or Bloomberg), credit analysis, deal structuring, and due diligence.

- Quantify Your Accomplishments: Instead of simply stating your responsibilities, quantify your achievements using metrics. For example, "Increased efficiency by 15% through process improvement" or "Secured three direct lending deals totaling $50 million."

- Use Industry Keywords: Incorporate relevant keywords like leveraged loans, direct lending, mezzanine financing, distressed debt, and covenant compliance. Use these terms naturally, not just to stuff keywords.

- Tailor to Each Application: Customize your resume and cover letter for each specific firm and role. Demonstrate that you understand their specific investment strategies and target markets.

Do 3: Master the Art of the Private Credit Interview

Private credit interviews often involve a mix of behavioral, technical, and case study questions.

- Prepare for Behavioral Questions: Practice answering common behavioral interview questions, focusing on situations demonstrating your problem-solving skills, teamwork abilities, and work ethic.

- Technical Proficiency: Demonstrate a strong understanding of financial statements (balance sheets, income statements, cash flow statements), credit analysis techniques, and valuation methodologies. Be prepared to discuss your experience with various credit structures (e.g., senior secured, subordinated debt).

- Case Study Preparation: Many interviews include case studies that assess your analytical and problem-solving skills. Practice solving case studies under timed conditions.

- Research the Firm: Thoroughly research the firm's investment strategy, portfolio companies, and recent deals. Demonstrate your understanding of their business during the interview.

Do 4: Showcase Your Knowledge of Private Credit Market Trends

Demonstrating an understanding of current market conditions is crucial.

- Stay Updated: Follow industry news and publications such as Private Debt Investor, and read research reports from major financial institutions to stay current on interest rate trends, regulatory changes, and market cycles.

- Analyze Trends: Be prepared to discuss current market trends and their potential impact on private credit deals. This shows initiative and strategic thinking.

- Thoughtful Discussion: Engage in informed discussions about the impact of macroeconomic factors (inflation, interest rates, economic growth) on the private credit market.

Do 5: Follow Up Effectively After the Private Credit Interview

Following up is a critical yet often overlooked step.

- Send Thank-You Notes: Send personalized thank-you notes to each interviewer within 24 hours, expressing your gratitude and reiterating your interest.

- Reiterate Key Points: Highlight specific aspects of your conversation that resonated with you and further emphasize your qualifications.

- Follow Up (Strategically): If you haven't heard back within a reasonable timeframe (usually a week or two), a polite follow-up email is acceptable.

5 Don'ts for Job Seekers in the Private Credit Sector

Don't 1: Neglect Networking: Active networking is essential; don't underestimate its power.

Don't 2: Submit a Generic Resume/Cover Letter: Tailor your application materials to each specific opportunity.

Don't 3: Underprepare for Interviews: Thorough preparation is key to success in technical and behavioral questions.

Don't 4: Ignore Industry News: Stay updated on market trends, regulatory changes, and economic developments.

Don't 5: Fail to Follow Up: Professional follow-up demonstrates your interest and initiative.

Your Path to Success in the Private Credit Job Market

Successfully navigating the private credit job market requires a multifaceted approach. By focusing on strategic networking, tailoring your application materials, mastering the interview process, demonstrating your market knowledge, and following up effectively, you’ll significantly increase your chances of securing your dream role. By following these "dos" and avoiding these "don'ts," you'll significantly increase your chances of securing your dream job in the dynamic private credit job market. Start networking and tailoring your application materials today!

Featured Posts

-

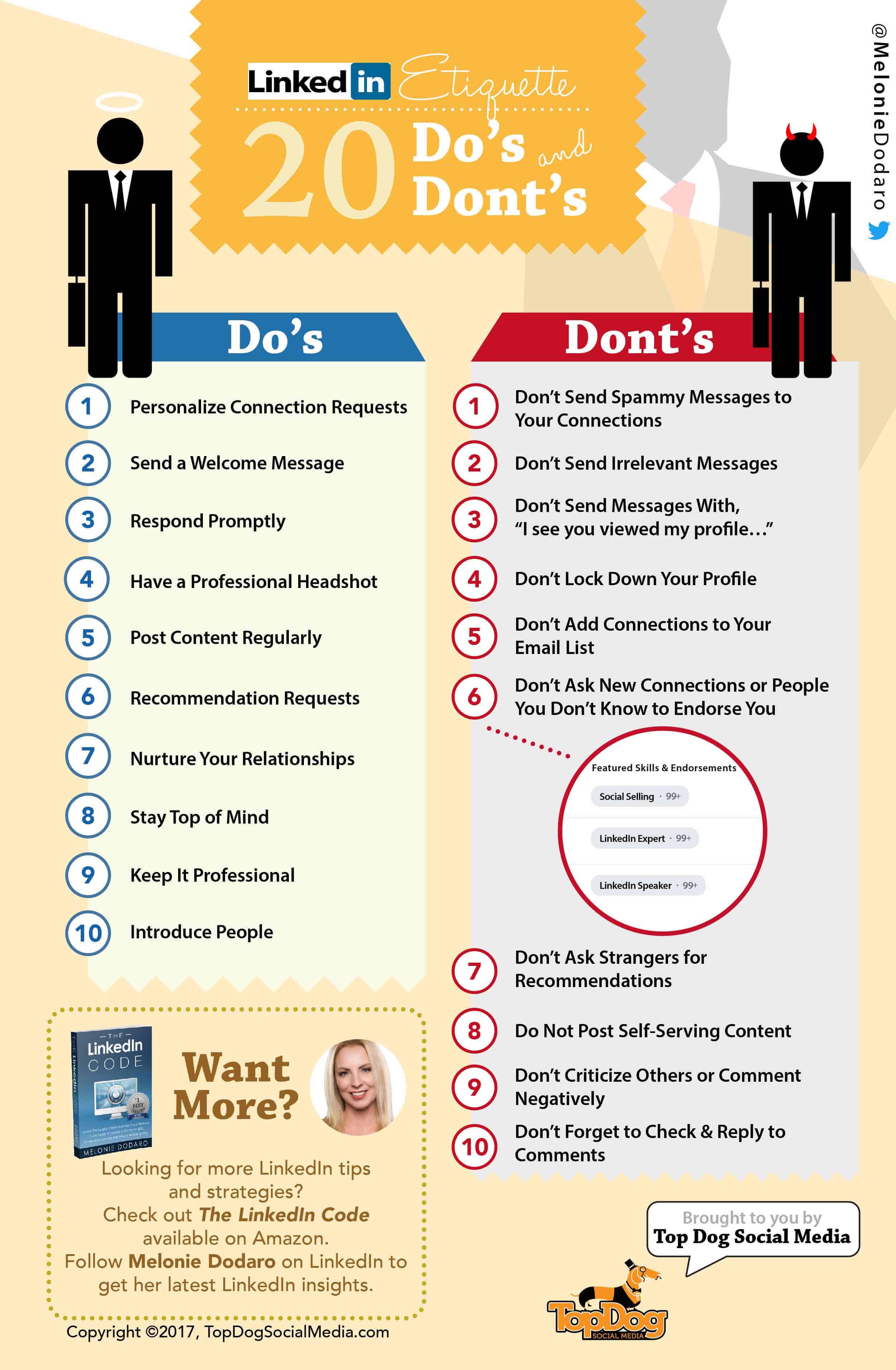

Alex Fine And Pregnant Cassie Ventura At Mob Land Premiere

May 18, 2025

Alex Fine And Pregnant Cassie Ventura At Mob Land Premiere

May 18, 2025 -

Mohawk Council And Grand Chief Face 220 Million Lawsuit From Kahnawake Casino

May 18, 2025

Mohawk Council And Grand Chief Face 220 Million Lawsuit From Kahnawake Casino

May 18, 2025 -

Donald Trumps Taylor Swift Announcement Magas Reaction

May 18, 2025

Donald Trumps Taylor Swift Announcement Magas Reaction

May 18, 2025 -

Uks Eurovision 2025 Entry Controversy And Past Scandals

May 18, 2025

Uks Eurovision 2025 Entry Controversy And Past Scandals

May 18, 2025 -

Il Frontemanne Dei Maneskin Damiano David Si Lancia Da Solista

May 18, 2025

Il Frontemanne Dei Maneskin Damiano David Si Lancia Da Solista

May 18, 2025

Latest Posts

-

Gold Plunges Amidst Trader Profit Booking On Us China Trade Optimism

May 18, 2025

Gold Plunges Amidst Trader Profit Booking On Us China Trade Optimism

May 18, 2025 -

Can Carneys Cabinet Deliver A Critical Assessment By Gary Mar

May 18, 2025

Can Carneys Cabinet Deliver A Critical Assessment By Gary Mar

May 18, 2025 -

Gold Price Drop Profit Taking And Us China Trade Deal Optimism

May 18, 2025

Gold Price Drop Profit Taking And Us China Trade Deal Optimism

May 18, 2025 -

Assessing Carneys Cabinet A Call For Responsible Governance

May 18, 2025

Assessing Carneys Cabinet A Call For Responsible Governance

May 18, 2025 -

Will Canadian Tires Acquisition Of Hudsons Bay Pay Off A Comprehensive Analysis

May 18, 2025

Will Canadian Tires Acquisition Of Hudsons Bay Pay Off A Comprehensive Analysis

May 18, 2025