Revealed: How Musk's X Debt Sale Reshapes The Company's Future

Table of Contents

The Financial Implications of X's Debt Sale

The Amount Raised and its Significance

The precise amount of debt raised by X remains partially undisclosed, adding to the intrigue surrounding this significant financial maneuver. However, reports suggest a substantial sum, potentially billions of dollars, a figure that dwarfs X's previous fundraising rounds. Comparing this to X's previous financial performance and fluctuating market valuation is crucial to understanding the scale of this debt. Is it sufficient to cover immediate operational costs and ambitious long-term projects? Only time will tell.

- Debt Terms: The specifics of the debt, including interest rates, maturity dates, and associated fees, are key to understanding its long-term implications. Higher interest rates could significantly burden X's finances.

- Lenders Involved: Identifying the lenders involved provides insight into the confidence the financial community has in X's future prospects. Are these established financial institutions or high-risk lenders?

- Credit Rating Changes: Any downgrades to X's credit rating following the debt sale will signal increased risk and potentially limit future access to capital.

Potential Uses of the Funds

The potential uses of the substantial capital acquired through the debt sale offer several avenues for X's future. Musk's ambitious vision for X as an "everything app" suggests a broad range of applications for these funds.

- Debt Repayment: A portion of the funds could be used to reduce existing debt, improving X's overall financial health and stability.

- Technology Upgrades: Significant investment in infrastructure improvements and technological advancements, including further AI integration, is a strong possibility. This could improve user experience and operational efficiency.

- Content Moderation: Addressing concerns about content moderation and safety on the platform requires resources. The funds could be allocated to improve content moderation tools and policies.

- Marketing and User Acquisition: Expanding user base is crucial for X's success. The funds could fuel marketing campaigns and user acquisition strategies.

- Potential Acquisitions: Musk's track record suggests a penchant for acquisitions. The debt sale could provide funding for strategically aligned acquisitions to bolster X's capabilities.

Impact on X's Financial Health and Stability

The long-term effect of this increased debt load on X's financial health and stability is a significant concern. High debt levels can make a company vulnerable during economic downturns or unexpected events. Key financial metrics will be crucial in assessing this impact.

- Debt-to-Equity Ratio: This ratio will indicate the balance between debt and equity financing. A high ratio suggests higher financial risk.

- Interest Coverage Ratio: This metric shows X's ability to pay interest expenses from operating income. A low ratio signals financial stress.

- Cash Flow: Analyzing X's cash flow will provide a clearer picture of its ability to manage its debt obligations and future investments.

Strategic Implications and Future Direction of X

Musk's Vision for X and the Role of the Debt

Elon Musk has openly discussed his vision for X, envisioning it as a comprehensive platform encompassing various services, transforming it from a social media platform into a sprawling "everything app." The debt sale plays a crucial role in facilitating this ambitious transformation.

- Project X: The funds could accelerate the development and implementation of key initiatives aligning with Musk's vision for an integrated platform.

- Payment Integration: The debt could help X integrate payment systems and other financial services, making it a one-stop shop for users.

- Global Expansion: The capital could fuel efforts to expand X's reach into new international markets.

Impact on Product Development and User Experience

The infusion of capital through the debt sale has the potential to significantly impact X's product offerings and user experience, both positively and negatively.

- New Features: The investment could lead to the development of exciting new features, enhancing user engagement and attracting new users.

- Improved Existing Features: Funds could be allocated towards improving existing features, addressing long-standing user complaints and enhancing platform performance.

- Subscription Service Expansion: Expansion of the platform's subscription service model could be a key avenue to generate additional revenue and secure financial stability.

Competition and Market Position

X's debt sale significantly impacts its competitive standing within the intensely competitive social media and broader technology landscape.

- Competition with Meta and TikTok: The strategic use of the funds will be critical to maintain and expand X's market share in the face of established competitors like Meta (Facebook, Instagram) and TikTok.

- Innovation and Differentiation: Investing in innovative features and services is crucial for X to maintain its competitiveness and differentiate itself from its rivals.

Impact on Investors and the Broader Tech Landscape

Investor Sentiment and Stock Market Reaction

The market's reaction to the X debt sale has been mixed, reflecting uncertainty about the platform's future trajectory.

- Stock Price Fluctuations: The news likely caused significant fluctuations in X's stock price (if applicable), indicating investor sentiment and confidence in the company's future prospects.

- Investor Confidence: The success of X's strategic initiatives, fueled by the debt sale, will be crucial in regaining and maintaining investor confidence.

Wider Implications for the Tech Industry

The X debt sale carries wider implications for the tech industry, impacting funding models and overall financial health.

- Venture Capital Investments: The sale could influence future venture capital investments in the social media and technology sectors.

- IPOs: The success (or failure) of X's strategy will affect the appetite for initial public offerings (IPOs) by similar companies.

Conclusion: Understanding the Long-Term Effects of Musk's X Debt Sale

The X debt sale marks a pivotal moment in the platform's history, impacting its financial standing, strategic direction, and competitive positioning within the tech industry. The long-term implications for X's future trajectory remain uncertain, but the strategic deployment of these funds will be crucial in determining its ultimate success. This high-stakes financial maneuver carries significant risks and rewards, impacting not only X but the broader technological and financial landscape.

Stay tuned for updates on how this significant debt sale continues to reshape the future of X and the digital world. Follow us for the latest news and analysis on Musk's X and its evolving financial landscape.

Featured Posts

-

Yankees Rout Pirates 12 3 Max Frieds Successful Debut

Apr 28, 2025

Yankees Rout Pirates 12 3 Max Frieds Successful Debut

Apr 28, 2025 -

Fishermans Stew A World Class Chefs Recipe Wins Over Eva Longoria

Apr 28, 2025

Fishermans Stew A World Class Chefs Recipe Wins Over Eva Longoria

Apr 28, 2025 -

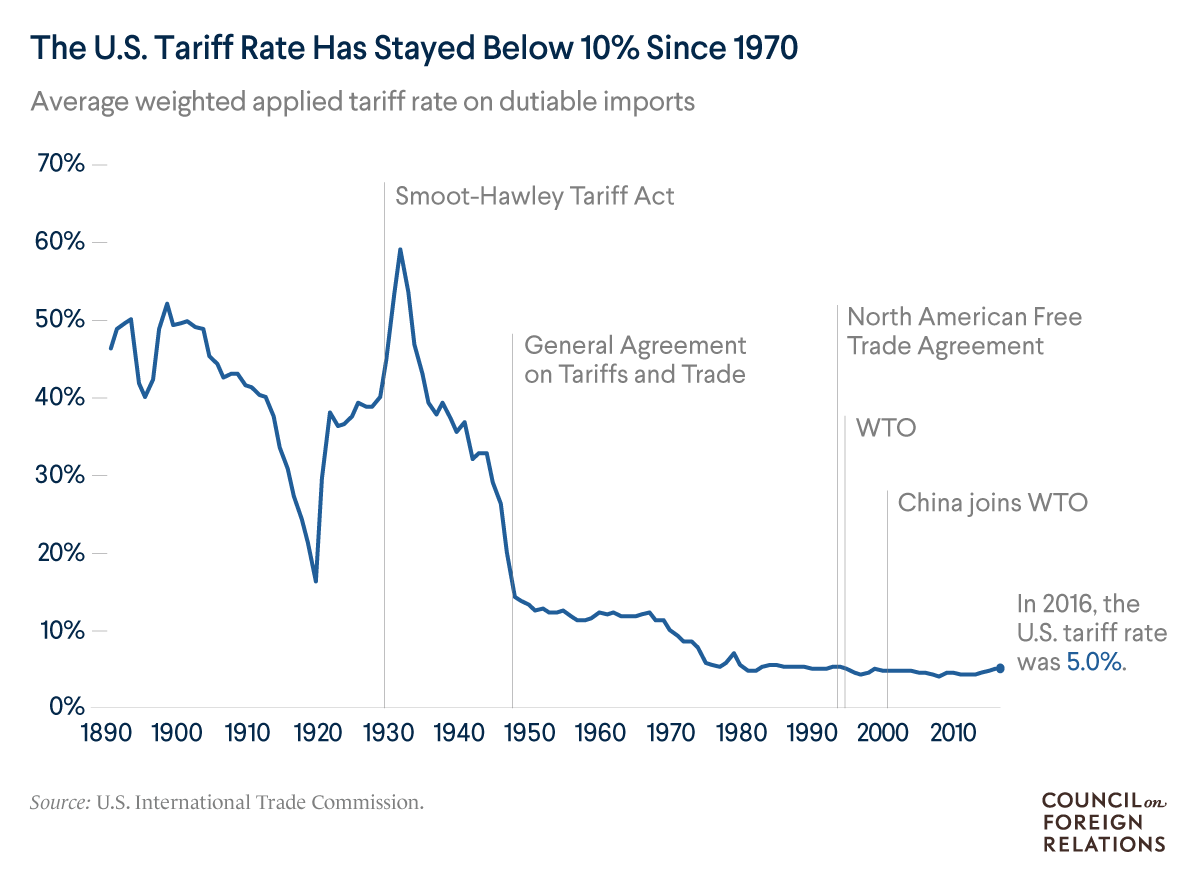

Recent Developments In Us China Trade Relations Tariff Exemptions

Apr 28, 2025

Recent Developments In Us China Trade Relations Tariff Exemptions

Apr 28, 2025 -

Trumps Higher Education Policies Effects On Diverse College Campuses

Apr 28, 2025

Trumps Higher Education Policies Effects On Diverse College Campuses

Apr 28, 2025 -

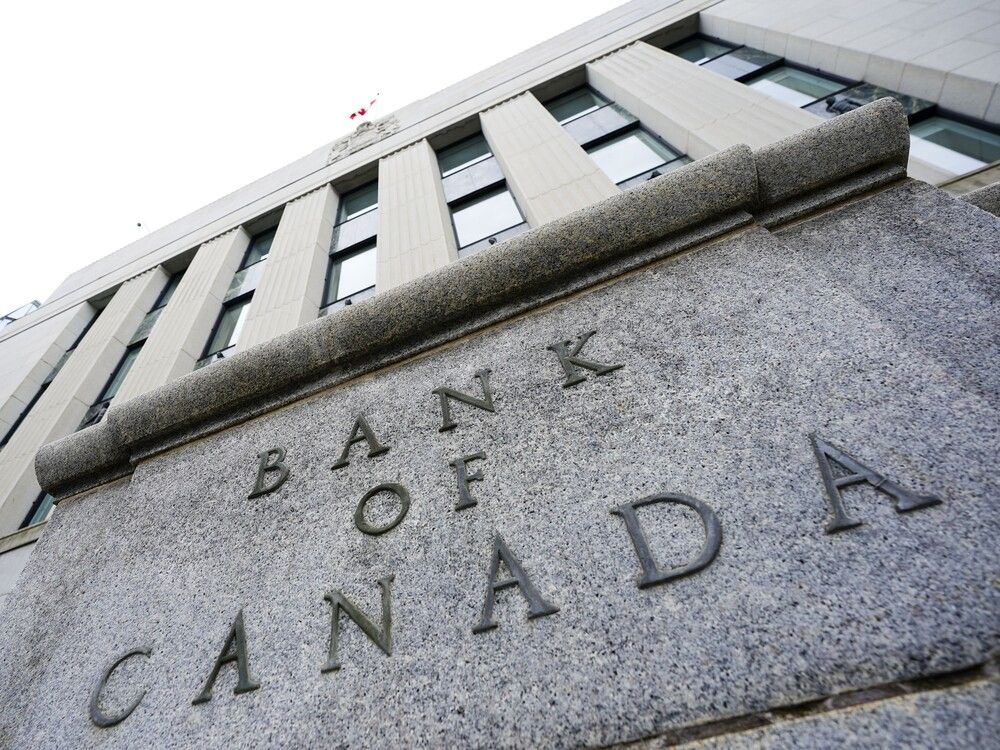

Grim Retail Sales Are Bank Of Canada Rate Cuts On The Horizon

Apr 28, 2025

Grim Retail Sales Are Bank Of Canada Rate Cuts On The Horizon

Apr 28, 2025

Latest Posts

-

75

Apr 28, 2025

75

Apr 28, 2025 -

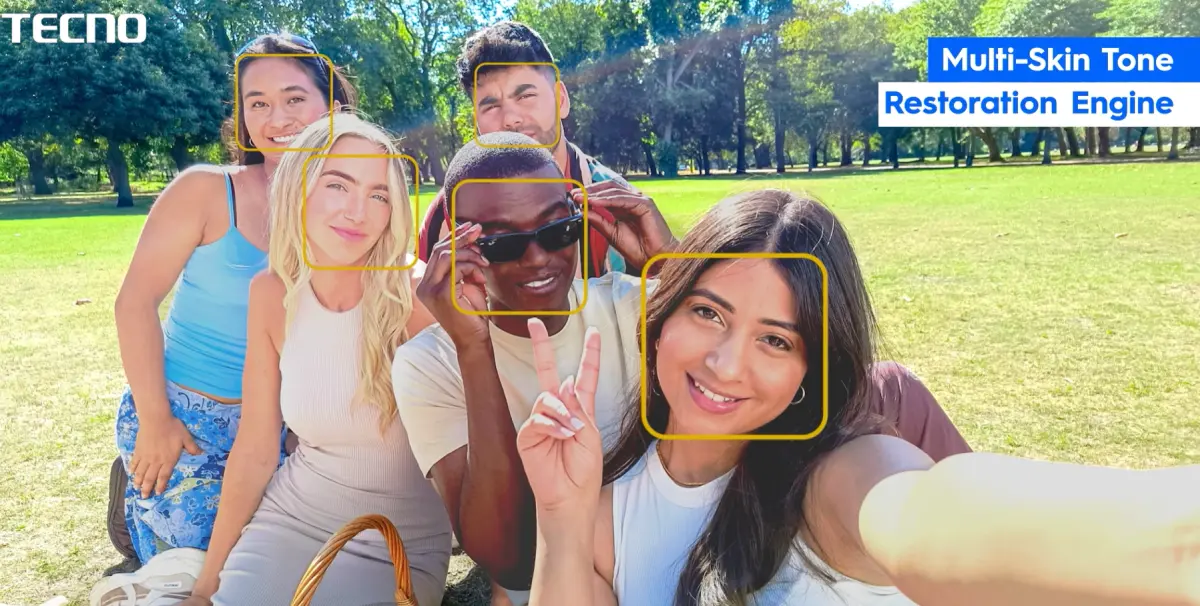

Universal Tone Tecno

Apr 28, 2025

Universal Tone Tecno

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Boston Red Sox Lineup Modifications For Doubleheaders First Game

Apr 28, 2025

Boston Red Sox Lineup Modifications For Doubleheaders First Game

Apr 28, 2025 -

Red Sox Game 1 Lineup Coras Minor Adjustments

Apr 28, 2025

Red Sox Game 1 Lineup Coras Minor Adjustments

Apr 28, 2025