Review Your HMRC Child Benefit Correspondence: Key Information

Table of Contents

Understanding Your Child Benefit Statement

Your Child Benefit statement is a vital document outlining your payments and claim details. Understanding its contents is paramount to ensuring you receive the correct amount. Key details included in your statement are:

- Payment Dates and Amounts: This section clearly shows when you received payments and how much each payment was. Check these carefully against your bank statements to ensure accuracy.

- Confirmation of Claim Details: This verifies the number of children included in your claim and any relevant information about each child. Immediately report any discrepancies.

- Information About Changes to Your Payments: HMRC will inform you of any changes to your payments, such as reductions due to changes in income or family circumstances. Review these changes carefully and contact HMRC if you have any questions.

- Accessing Your Statement Online: You can access your Child Benefit statement and other information conveniently through your HMRC online account. This provides a digital record of your payment history, significantly simplifying management. Logging into your account regularly allows you to easily monitor your payments and identify potential issues swiftly.

Identifying and Responding to HMRC Letters Requesting Information

HMRC may request information from you for various reasons, including changes in your circumstances, such as income changes, or as part of routine verification checks. These letters often have deadlines for responses, so prompt action is critical.

- Understanding the Deadline: Always note the response deadline clearly stated in the letter. Missing this deadline can lead to delays in your payments or other penalties.

- Providing Necessary Documentation: HMRC might request supporting documentation like payslips, bank statements, or proof of address. Ensure you gather and send these documents promptly and accurately.

- Penalties for Non-Response: Failing to respond to HMRC requests for information within the given timeframe can result in financial penalties, so prompt action is essential.

- Contacting HMRC for Assistance: If you encounter difficulties providing the required information, contact HMRC immediately to explain your situation and request an extension or further guidance. They are usually willing to assist those who demonstrate genuine effort and communication.

Recognizing Potential Errors in Your Child Benefit Payments

Errors in Child Benefit payments can happen, resulting in either overpayments or underpayments. Recognizing these errors promptly and taking appropriate action is crucial.

- Identifying Overpayments: If you believe you've received an overpayment, contact HMRC immediately to report it. Failing to do so can lead to demands for repayment, potentially with interest and penalties.

- Identifying Underpayments: If you suspect an underpayment, gather supporting evidence (such as birth certificates, if applicable) and contact HMRC to initiate a review of your claim.

- Reporting Discrepancies: Contact HMRC via phone or their online portal to report any discrepancies. They will investigate and take appropriate action to rectify the situation.

- Appealing HMRC Decisions: If you disagree with HMRC's decision regarding your Child Benefit payment, you have the right to appeal. Follow the appeals process outlined in the correspondence or on the HMRC website.

Keeping Your HMRC Contact Details Up-to-Date

Maintaining accurate contact information with HMRC is paramount to ensure you receive all essential correspondence and avoid delays or missed payments.

- Updating Your Address Online: Use your HMRC online account to update your address promptly whenever you move. This ensures letters reach you without delay.

- Updating Phone Number and Email Address: Keep your contact information up-to-date, including your phone number and email address. Consider registering for email notifications for quicker updates.

- Consequences of Outdated Details: Failure to update your contact details can result in missed correspondence, delays in payments, and complications in resolving any issues.

Conclusion

Regularly reviewing your HMRC Child Benefit correspondence is vital for ensuring accurate payments and avoiding potential penalties. Promptly respond to any requests for information, and immediately address any discrepancies. Keeping your contact details updated is crucial for seamless communication with HMRC. Regularly review your HMRC Child Benefit correspondence to ensure you receive the correct payments and avoid complications. Take action today to update your HMRC online account and ensure your details are current. Don’t delay—check your Child Benefit correspondence now!

Featured Posts

-

Nova Drama Hrvatskog Pisca Patnja Nevinih I Rane Koje Nece Zarasti

May 20, 2025

Nova Drama Hrvatskog Pisca Patnja Nevinih I Rane Koje Nece Zarasti

May 20, 2025 -

K Sepernontas Ta Tampoy I Istoria Tis Marthas Kai Toy Gamoy Tis

May 20, 2025

K Sepernontas Ta Tampoy I Istoria Tis Marthas Kai Toy Gamoy Tis

May 20, 2025 -

Agatha Christies Towards Zero Why Episode 1 Delays The Murder

May 20, 2025

Agatha Christies Towards Zero Why Episode 1 Delays The Murder

May 20, 2025 -

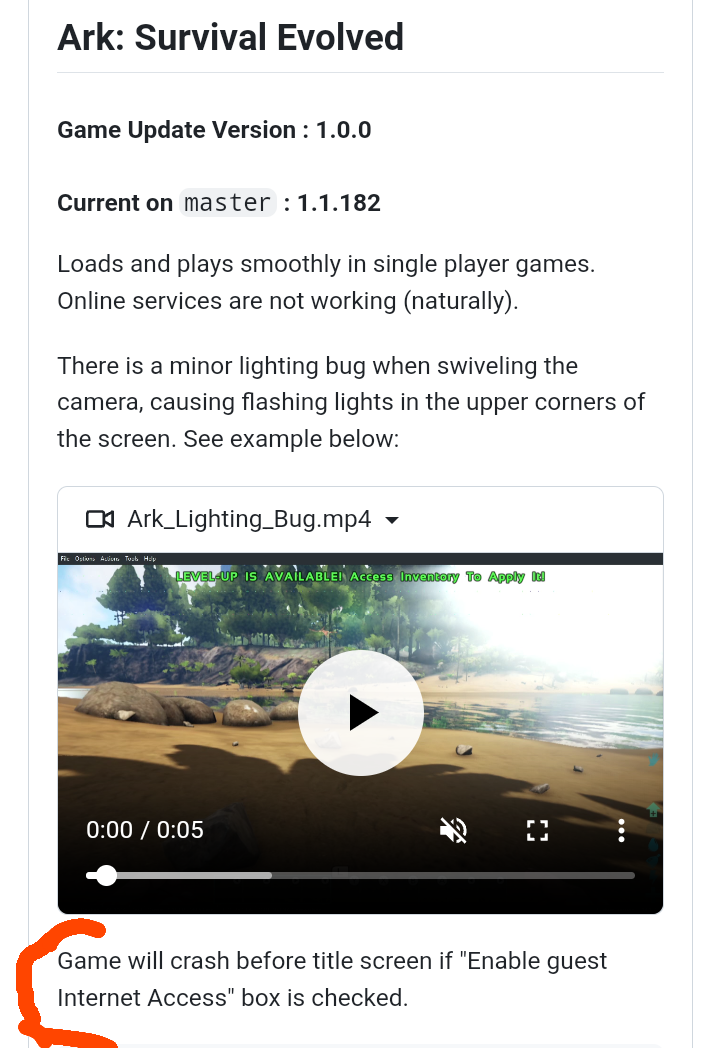

Nintendos Legal Action And The Ryujinx Emulator Shutdown

May 20, 2025

Nintendos Legal Action And The Ryujinx Emulator Shutdown

May 20, 2025 -

Market Reaction Dow Futures And Dollar Slip Following Moodys Downgrade

May 20, 2025

Market Reaction Dow Futures And Dollar Slip Following Moodys Downgrade

May 20, 2025