Ripple's Legal Battle And XRP's Future: Examining The Latest News And ETF Possibilities

Table of Contents

The Ripple-SEC Lawsuit: A Deep Dive

At the heart of the matter is the SEC's lawsuit against Ripple, alleging that the company sold XRP as an unregistered security, violating federal securities laws. The SEC argues that XRP sales constituted investment contracts, promising investors future profits based on Ripple's efforts. Ripple, on the other hand, maintains that XRP is a decentralized digital asset, similar to Bitcoin or Ether, and therefore not subject to SEC regulations.

- SEC's Allegations: The SEC claims Ripple conducted unregistered securities offerings, defrauding investors by not disclosing the risks associated with XRP.

- Ripple's Defense Strategy: Ripple's defense centers on arguing that XRP is a currency and not a security, citing its decentralized nature and widespread usage on various exchanges. They also highlight the significant volume of XRP already in circulation.

- Key Legal Precedents Cited: Both sides have cited various legal precedents, focusing on the Howey Test, which defines what constitutes an investment contract. The interpretation of this test is crucial to the case's outcome.

- Impact of Recent Court Decisions: Recent rulings have provided some clarity but haven't definitively resolved the matter. The ongoing nature of the case keeps the XRP market in a state of flux.

Analyzing the Impact on XRP Price and Market Sentiment

The Ripple-SEC lawsuit has undeniably impacted XRP's price and market sentiment. XRP's price has shown significant correlation with the progress of the legal battle. Positive news tends to drive the price up, while negative developments lead to sharp declines.

- XRP Price Trends: Before the lawsuit, XRP experienced significant price growth. During the legal proceedings, its price fluctuated wildly, often mirroring the sentiment surrounding court decisions and legal filings.

- Investor Sentiment Analysis: Social media sentiment analysis shows a strong connection between online discussions and XRP's trading volume. Positive news leads to increased trading activity, while negative news creates selling pressure.

- Impact on Trading Volume: Major exchanges have seen fluctuations in XRP trading volume that are directly tied to the evolving legal situation.

- Comparison with Other Cryptocurrencies: Other cryptocurrencies have faced similar regulatory scrutiny, highlighting the broader implications of the Ripple case for the entire crypto market.

The Potential for an XRP ETF: Opportunities and Challenges

An Exchange Traded Fund (ETF) would provide a regulated and accessible investment vehicle for XRP, offering investors increased liquidity and potentially boosting adoption. However, the path to XRP ETF approval is fraught with challenges.

- Benefits of an XRP ETF: An XRP ETF would bring greater liquidity and accessibility to a wider range of investors, potentially attracting institutional money.

- Regulatory Requirements: Securing ETF approval requires navigating complex regulatory hurdles, including satisfying the SEC's stringent requirements for listing.

- Impact of the Lawsuit on ETF Approval: A favorable ruling in the Ripple case would significantly increase the likelihood of an XRP ETF. An unfavorable ruling could delay or even prevent approval.

- Comparison with Other Crypto ETFs: The progress of other crypto ETF applications provides a benchmark for the potential timeline and challenges facing an XRP ETF.

Future Outlook: Predicting XRP's Trajectory

Predicting XRP's future is inherently speculative, given the ongoing legal uncertainty. However, we can outline potential scenarios based on different outcomes.

- Bullish Scenarios: A favorable court ruling for Ripple, combined with eventual ETF approval, could lead to significant price appreciation and increased market adoption.

- Bearish Scenarios: An unfavorable ruling could significantly depress XRP's price and dampen investor confidence.

- Neutral Scenarios: A prolonged legal battle with an unclear outcome could maintain the current volatility and uncertainty surrounding XRP.

- Long-Term Prospects: The long-term prospects for XRP depend heavily on the resolution of the legal case and the broader regulatory landscape for cryptocurrencies.

Ripple's Legal Battle and XRP's Future: A Summary and Call to Action

The outcome of Ripple's legal battle will significantly shape XRP's future, influencing its price, market sentiment, and the potential for ETF listings. The uncertainty surrounding the case underscores the volatility inherent in the cryptocurrency market. While the possibility of an XRP ETF presents exciting opportunities, navigating this uncertain landscape requires caution. To stay informed about Ripple's Legal Battle and XRP's Future, subscribe to reputable cryptocurrency news sources, follow key influencers in the space, and always conduct thorough due diligence before making any investment decisions. Remember, understanding the risks associated with XRP, especially given the ongoing legal proceedings, is paramount.

Featured Posts

-

Premiere Naissance De L Annee Une Boulangerie Normande Offre Son Poids En Chocolat

May 02, 2025

Premiere Naissance De L Annee Une Boulangerie Normande Offre Son Poids En Chocolat

May 02, 2025 -

Improving Workboat Safety And Efficiency Through Automation A Tbs Safety And Nebofleet Partnership

May 02, 2025

Improving Workboat Safety And Efficiency Through Automation A Tbs Safety And Nebofleet Partnership

May 02, 2025 -

Negative Reaction To Latest Fortnite Item Shop Update

May 02, 2025

Negative Reaction To Latest Fortnite Item Shop Update

May 02, 2025 -

The Impact Of Michael Sheens 1 Million Charitable Donation

May 02, 2025

The Impact Of Michael Sheens 1 Million Charitable Donation

May 02, 2025 -

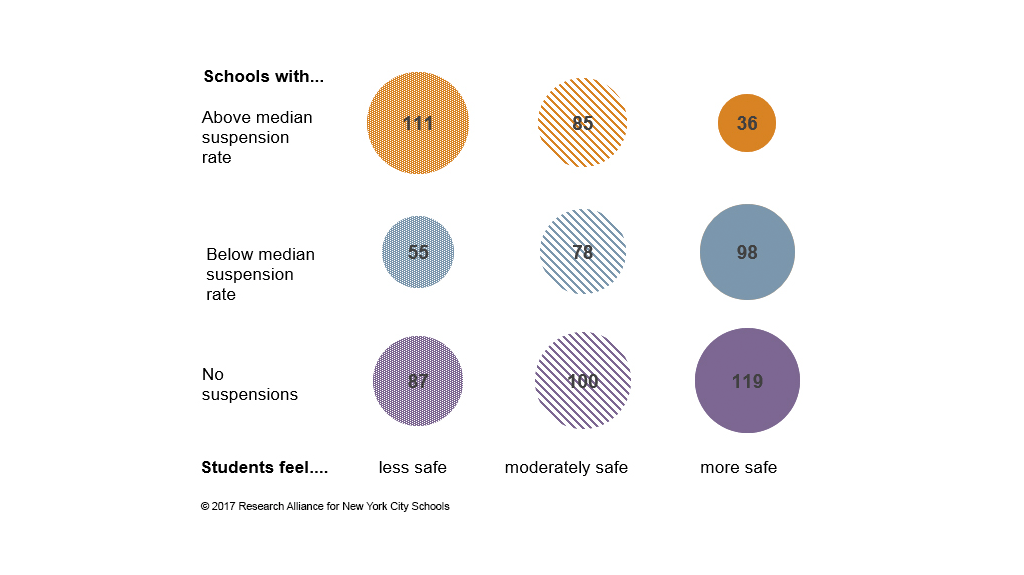

Are School Suspensions Doing More Harm Than Good A Comprehensive Analysis

May 02, 2025

Are School Suspensions Doing More Harm Than Good A Comprehensive Analysis

May 02, 2025