Rising GPU Prices: Factors And Future Predictions

Table of Contents

The Impact of Cryptocurrency Mining on GPU Prices

Cryptocurrency mining, particularly Ethereum mining until its recent merge to proof-of-stake, has significantly contributed to the surge in GPU prices. The process of mining cryptocurrencies requires immense computational power, making high-end GPUs highly desirable.

- Increased demand from miners outstrips supply: Miners often purchase GPUs in bulk, creating a massive demand that often exceeds the available supply. This artificial scarcity directly impacts prices.

- Miners often purchase high-end GPUs in bulk: The most powerful GPUs are the most efficient for mining, leading to a disproportionate increase in demand for top-tier models.

- The profitability of mining directly impacts GPU purchasing decisions: When cryptocurrency prices are high and mining is lucrative, the demand for GPUs increases dramatically. Conversely, a drop in cryptocurrency prices reduces mining profitability and thus, GPU demand.

- The shift away from proof-of-work consensus mechanisms could impact this factor: The Ethereum merge to proof-of-stake significantly reduced the demand for GPUs in cryptocurrency mining, potentially easing pressure on GPU prices. However, other cryptocurrencies still utilize proof-of-work, maintaining some level of demand.

A study by [insert credible source here, e.g., a market research firm] showed a [insert percentage]% increase in GPU prices correlating directly with major booms in cryptocurrency mining activity.

Global Chip Shortages and Supply Chain Issues

The global semiconductor shortage, a multifaceted problem impacting numerous industries, has significantly constrained GPU production. This shortage stems from a confluence of factors:

- Factory closures and disruptions due to the pandemic and geopolitical factors: The COVID-19 pandemic caused widespread factory closures and supply chain disruptions, severely impacting chip production. Geopolitical instability further exacerbated these issues.

- Increased demand for chips across multiple industries (automotive, consumer electronics): The demand for chips isn't limited to GPUs; the automotive and consumer electronics industries also experienced significant increases in demand, competing for limited resources.

- Limited manufacturing capacity and long lead times for chip production: Building new chip fabrication plants (fabs) is a lengthy and expensive process, limiting the ability to quickly increase production capacity.

- The ongoing impact of trade wars and tariffs on the supply chain: Trade tensions and tariffs have added complexity and increased costs to the global supply chain, further hindering GPU production.

[Insert links to relevant news articles or reports on the global chip shortage here, e.g., from Reuters, Bloomberg, or industry publications.]

Increased Demand from Gamers and Professionals

The demand for GPUs is not solely driven by cryptocurrency mining; the gaming community and professionals also contribute significantly.

- The growth of the gaming industry and the release of high-demand games: The gaming industry continues to grow exponentially, with increasingly demanding games requiring more powerful GPUs. The release of AAA titles often fuels a surge in GPU demand.

- Increased adoption of GPU-accelerated computing in various fields: GPUs are increasingly used in AI research, data science, machine learning, and other computationally intensive fields, driving demand for high-performance models.

- The need for higher-performance GPUs for VR, AR, and AI applications: Emerging technologies like virtual reality (VR), augmented reality (AR), and advanced AI applications require GPUs with significantly higher processing power, boosting demand.

- The impact of new console generations on demand: The release of new gaming consoles often stimulates demand for compatible, high-performance GPUs.

[Insert statistics showcasing the growth of the gaming market and professional applications of GPUs here, e.g., from Newzoo or Statista.]

Inflation and Raw Material Costs

Inflation and rising costs of raw materials play a crucial role in increasing GPU manufacturing costs.

- Rising energy prices impacting manufacturing costs: The energy-intensive process of chip manufacturing is highly sensitive to fluctuations in energy prices.

- Increased costs of essential raw materials for GPU production: The cost of raw materials such as silicon, which is crucial for chip fabrication, has been steadily increasing.

- The impact of global economic instability on pricing: Global economic instability and uncertainty contribute to increased production and transportation costs.

- Transportation costs contributing to higher prices: Shipping costs have increased significantly, adding to the final price of GPUs.

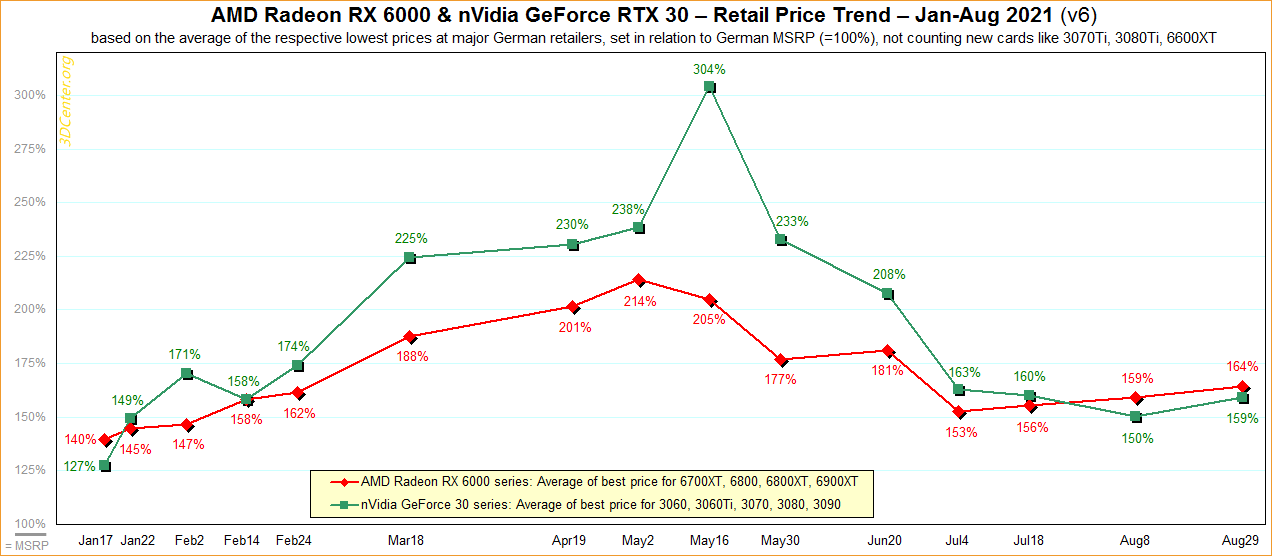

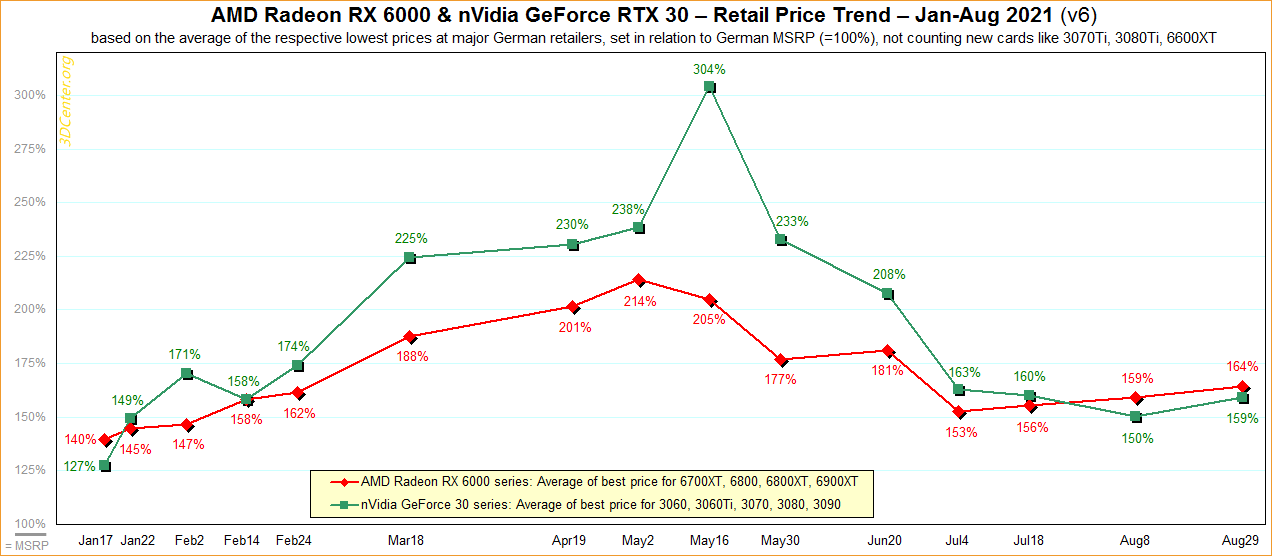

[Include charts or graphs depicting the increase in raw material prices over time here.]

Future Predictions for GPU Prices

Predicting the future trajectory of GPU prices is challenging, but several factors suggest potential trends:

- Potential easing of supply chain issues in the coming years: While the timeline is uncertain, some experts predict a gradual easing of supply chain constraints in the coming years, potentially leading to increased GPU availability.

- The impact of new GPU architectures and manufacturing processes: Advancements in GPU architecture and manufacturing processes may increase efficiency and reduce production costs.

- The potential for price stabilization or even decreases: A combination of easing supply chain issues and technological advancements could lead to price stabilization or even decreases in the long term.

- Factors that could cause continued price increases: Unforeseen geopolitical events, persistent inflation, and unexpectedly high demand could still cause GPU prices to remain elevated or even increase further.

Based on current market trends and expert opinions, a cautious prediction would be a gradual stabilization of GPU prices over the next few years, with potential for price decreases dependent on resolving supply chain issues and further technological advancements.

Conclusion

This analysis of rising GPU prices reveals a complex interplay of factors, ranging from cryptocurrency mining and global chip shortages to increased demand and inflationary pressures. While some factors may ease in the coming years, others may continue to impact the market. Staying informed about these trends is crucial for making informed decisions about purchasing GPUs. Continue to monitor the GPU market and stay informed about future developments and predictions related to rising GPU prices and related challenges. Understanding these GPU price factors is key to navigating the ever-changing landscape. Keep an eye on future GPU price predictions to optimize your purchasing strategy.

Featured Posts

-

Aaron Judge And Paul Goldschmidt Power Yankees To Series Salvaging Win

Apr 28, 2025

Aaron Judge And Paul Goldschmidt Power Yankees To Series Salvaging Win

Apr 28, 2025 -

Red Sox Vs Blue Jays Updated Lineups And Buehlers Pitching Debut

Apr 28, 2025

Red Sox Vs Blue Jays Updated Lineups And Buehlers Pitching Debut

Apr 28, 2025 -

The Return Of High Gpu Prices A Market Analysis

Apr 28, 2025

The Return Of High Gpu Prices A Market Analysis

Apr 28, 2025 -

Yukon Mine Manager Faces Contempt After Refusal To Answer Questions

Apr 28, 2025

Yukon Mine Manager Faces Contempt After Refusal To Answer Questions

Apr 28, 2025 -

E Bay Faces Legal Action Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025

E Bay Faces Legal Action Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025

Latest Posts

-

Espns Moving Tribute To Departing Anchor Cassidy Hubbarth

Apr 28, 2025

Espns Moving Tribute To Departing Anchor Cassidy Hubbarth

Apr 28, 2025 -

Cassidy Hubbarths Final Espn Broadcast A Touching Tribute

Apr 28, 2025

Cassidy Hubbarths Final Espn Broadcast A Touching Tribute

Apr 28, 2025 -

Emotional Goodbye Espn Bids Farewell To Cassidy Hubbarth

Apr 28, 2025

Emotional Goodbye Espn Bids Farewell To Cassidy Hubbarth

Apr 28, 2025 -

Espn Pays Tribute To Cassidy Hubbarth On Her Last Show

Apr 28, 2025

Espn Pays Tribute To Cassidy Hubbarth On Her Last Show

Apr 28, 2025 -

Exploring Monstrous Beauty Feminist Revisions Of Chinoiserie At The Metropolitan Museum

Apr 28, 2025

Exploring Monstrous Beauty Feminist Revisions Of Chinoiserie At The Metropolitan Museum

Apr 28, 2025