Rolls-Royce 2025 Targets Unchanged: Company Addresses Tariff Concerns

Table of Contents

Rolls-Royce 2025 Targets: A Recap

Rolls-Royce has set bold targets for 2025, aiming for significant growth and market leadership within the ultra-luxury segment. While precise figures haven't been publicly released in their entirety, the company's overall strategy indicates a commitment to substantial expansion. Their strategic objectives include:

- Specific sales target for 2025: While the exact number remains undisclosed, industry analysts predict a significant increase in sales volume compared to current figures, potentially exceeding previous records.

- Planned expansion into new markets: Rolls-Royce plans to expand its presence in rapidly growing luxury car markets, particularly in Asia and the Middle East. This diversification strategy aims to mitigate risks associated with regional economic downturns.

- Investment in new technologies (e.g., electrification): The brand is investing heavily in the development of electric and hybrid powertrains, aligning with global trends towards sustainable luxury transportation. This commitment signals their readiness to adapt to changing consumer preferences and environmental regulations.

- Sustainability goals: Rolls-Royce is committed to reducing its carbon footprint throughout its production and supply chain, reflecting a growing emphasis on environmentally conscious luxury goods.

Impact of Tariffs on the Automotive Industry

Tariffs significantly impact the automotive industry, particularly the luxury segment. High-value vehicles rely on a complex global supply chain, making them especially vulnerable to trade disputes.

- Increased production costs due to tariffs on imported parts: Tariffs on imported components, such as specialized electronics or materials, directly increase manufacturing costs, squeezing profit margins.

- Potential price increases for consumers: These increased costs are often passed on to consumers in the form of higher prices, potentially impacting demand.

- Impact on global supply chains: Disruptions to global supply chains caused by tariffs can lead to production delays and shortages of essential parts, affecting production output.

- Competitive challenges from other luxury brands: Tariffs can disproportionately affect certain manufacturers, giving competitors a relative advantage in the marketplace.

Rolls-Royce's Response to Tariff Concerns

Despite these challenges, Rolls-Royce remains confident in its 2025 targets. The company has stated that it is proactively managing the impact of tariffs through a multi-pronged approach.

- Strategies to mitigate the impact of tariffs: Rolls-Royce is exploring alternative sourcing strategies to reduce reliance on tariff-affected regions and optimizing its supply chain for greater efficiency and cost-effectiveness.

- Confidence in the resilience of the luxury car market: The company highlights the enduring demand for luxury goods, even amidst economic uncertainty, suggesting a belief in the long-term strength of its market segment.

- Focus on long-term growth strategies: Rolls-Royce emphasizes its commitment to long-term growth and strategic investments, indicating a belief that the current challenges are temporary.

- Specific actions taken to address the tariff situation: While specific details remain confidential, the company's statements suggest a proactive approach including negotiations with suppliers and internal cost optimization initiatives.

Diversification and Market Strategies

To further mitigate risk, Rolls-Royce is focusing on diversification strategies:

- Expansion into new geographical markets: Targeting emerging luxury markets reduces reliance on any single region, protecting against localized economic downturns.

- Focus on specific customer segments: Catering to niche customer needs creates resilience against broader economic fluctuations.

- Development of new product lines or models: Introducing new models and variations enhances market reach and appeal.

Financial Outlook and Investor Confidence

While tariffs pose a challenge, Rolls-Royce's proactive measures suggest a positive outlook.

- Projected impact on profitability: While the exact impact remains to be seen, the company's mitigation strategies aim to minimize the negative effects on profitability.

- Analyst reaction to the company's statement: Analysts largely view Rolls-Royce's response favorably, citing its strong brand position and proactive strategies.

- Investor confidence levels: Investor confidence generally remains high, reflecting confidence in the brand's long-term prospects and resilience.

- Stock market performance: The stock market reaction will be a key indicator of the impact of these challenges and the market's perception of the company's response.

Conclusion

Rolls-Royce's unwavering commitment to its 2025 targets demonstrates its confidence in the resilience of the luxury car market and its ability to navigate global economic challenges, including the impact of tariffs. While acknowledging the potential difficulties, the company’s proactive strategies to mitigate risks highlight a robust approach to long-term growth. Their diversification strategy and focus on innovation position them well to overcome these hurdles.

Call to Action: Stay informed about Rolls-Royce's progress towards its ambitious 2025 targets by following our updates on the latest news concerning Rolls-Royce and the automotive industry's response to global trade challenges. Learn more about Rolls-Royce’s 2025 strategy and the company's commitment to overcoming tariff hurdles.

Featured Posts

-

Bbc Income Crisis Unprecedented Challenges And The Future Of Broadcasting

May 03, 2025

Bbc Income Crisis Unprecedented Challenges And The Future Of Broadcasting

May 03, 2025 -

Fortnite Chapter 6 Season 2 Release Time Date Downtime Pre Load And Battle Pass Details

May 03, 2025

Fortnite Chapter 6 Season 2 Release Time Date Downtime Pre Load And Battle Pass Details

May 03, 2025 -

Exclusive Report U S Army To Significantly Expand Drone Operations

May 03, 2025

Exclusive Report U S Army To Significantly Expand Drone Operations

May 03, 2025 -

Stock Market Valuations And Investor Sentiment Bof As Assessment

May 03, 2025

Stock Market Valuations And Investor Sentiment Bof As Assessment

May 03, 2025 -

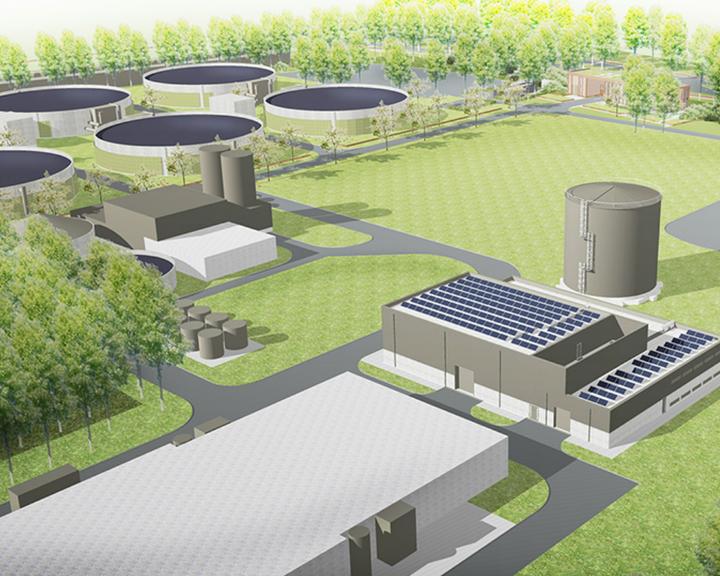

Record Breaking Heat Pump Launched At Utrecht Wastewater Treatment Facility

May 03, 2025

Record Breaking Heat Pump Launched At Utrecht Wastewater Treatment Facility

May 03, 2025