Seattle Businesses' Competitive Edge: Accepting Canadian Currency

Table of Contents

The Growing Canadian Market in Seattle

Significant Tourist and Shopper Traffic

Canadians represent a substantial portion of Seattle's tourism and shopping traffic. While precise figures fluctuate yearly, anecdotal evidence and tourism reports consistently highlight the significant number of Canadians visiting the Emerald City for various reasons.

- Tourism Statistics: While specific numbers for Canadian tourists require deeper research into official tourism reports for the state of Washington, it's widely understood that Seattle is a popular destination for Canadians due to its proximity to the border, attractions like Pike Place Market and the Space Needle, and its vibrant culture.

- Shopping Trends: Seattle's unique boutiques, flagship stores, and outlet malls attract Canadian shoppers looking for specific brands, tax advantages (depending on the purchase and province), or simply a different shopping experience.

- Events Attracting Canadian Visitors: Major events like concerts, sporting matches, and festivals draw significant numbers of Canadian attendees, providing a concentrated influx of potential customers.

Untapped Revenue Potential

Businesses that don't accept Canadian currency are missing out on a substantial revenue stream. The inconvenience of currency exchange deters many Canadian shoppers, leading them to choose competitors who offer a more seamless transaction.

- Examples of Lost Sales: Imagine a Canadian tourist wanting to buy a souvenir; if the store only accepts US dollars, they might opt to purchase elsewhere, representing a direct loss for the business.

- Comparative Statistics: While precise figures are difficult to obtain without business-specific data, studies consistently show a significant increase in revenue for businesses that actively cater to cross-border shoppers by accepting their native currency. This demonstrates the untapped potential waiting to be unlocked.

Simplified Payment Processing and Solutions

Choosing the Right Payment Processor

Several payment processing solutions facilitate the acceptance of Canadian dollars, simplifying cross-border transactions. Businesses can choose from various options to suit their specific needs and existing systems.

- List of Popular Payment Processors: Many popular point-of-sale (POS) systems and online payment gateways, such as Square, Shopify Payments, and PayPal, offer the ability to process transactions in multiple currencies, including Canadian dollars. Each has its own features, fees, and integration capabilities.

- Key Features Comparison: Consider factors like currency conversion rates, transaction fees (which vary depending on the processor and plan), and the ease of integration with your existing POS system or online store. Some processors offer real-time conversion, while others may use a daily or fixed exchange rate.

- Mobile Payment App Integration: Many popular mobile payment apps also support multiple currencies, extending convenience to both customers and businesses.

Minimizing Currency Exchange Fees

Accepting Canadian dollars directly eliminates currency exchange fees for both the business and the customer. This creates a win-win situation.

- Comparison of Transaction Fees: Businesses save money on currency conversion fees charged by banks or payment processors. These fees can eat into profit margins, especially on higher-value transactions.

- Highlighting Cost Savings: The elimination of these fees directly impacts profitability and can allow for more competitive pricing strategies. Furthermore, the customer avoids the hassle and potentially unfavorable exchange rates encountered when converting currency themselves.

Enhanced Customer Experience and Brand Loyalty

Improved Customer Satisfaction

Accepting Canadian currency significantly improves the customer experience for Canadian visitors. The convenience and ease of transaction foster a positive impression, encouraging repeat business.

- Positive Customer Testimonials: Businesses that have adopted this practice often report positive feedback from Canadian customers, highlighting the appreciated convenience.

- Examples of Increased Customer Loyalty: Offering a seamless payment experience fosters loyalty, increasing the likelihood of return visits and positive word-of-mouth referrals.

- Improved Brand Reputation: A business that caters to its diverse customer base builds a strong brand reputation for inclusivity and customer-centricity.

Building a Strong Cross-Border Brand

Actively accepting Canadian currency demonstrates a welcoming and inclusive attitude towards Canadian customers, building brand loyalty and encouraging positive word-of-mouth marketing.

- Marketing Strategies to Target Canadian Customers: Highlighting your acceptance of Canadian dollars in marketing materials targeted towards the Canadian market is crucial. This could involve using Canadian-centric imagery or messaging in online ads and promotional materials.

- Examples of Successful Businesses: Research successful businesses in border towns or tourist areas that have leveraged this strategy to attract and retain Canadian customers.

Conclusion

Accepting Canadian currency offers Seattle businesses a significant competitive advantage. By simplifying cross-border payments, businesses can increase revenue, improve customer satisfaction, and build stronger relationships with their Canadian clientele. The untapped potential within the Canadian market is substantial, and embracing this opportunity can lead to significant growth and profitability.

Call to Action: Don't miss out on the significant revenue potential – start accepting Canadian currency today and experience the competitive edge it offers your Seattle business! Explore payment processing solutions that support multiple currencies and unlock the power of this lucrative market. Learn more about optimizing your business for cross-border payments and discover the benefits of accepting Canadian dollars. Contact a payment processing specialist or explore online resources to find the perfect solution for your business needs.

Featured Posts

-

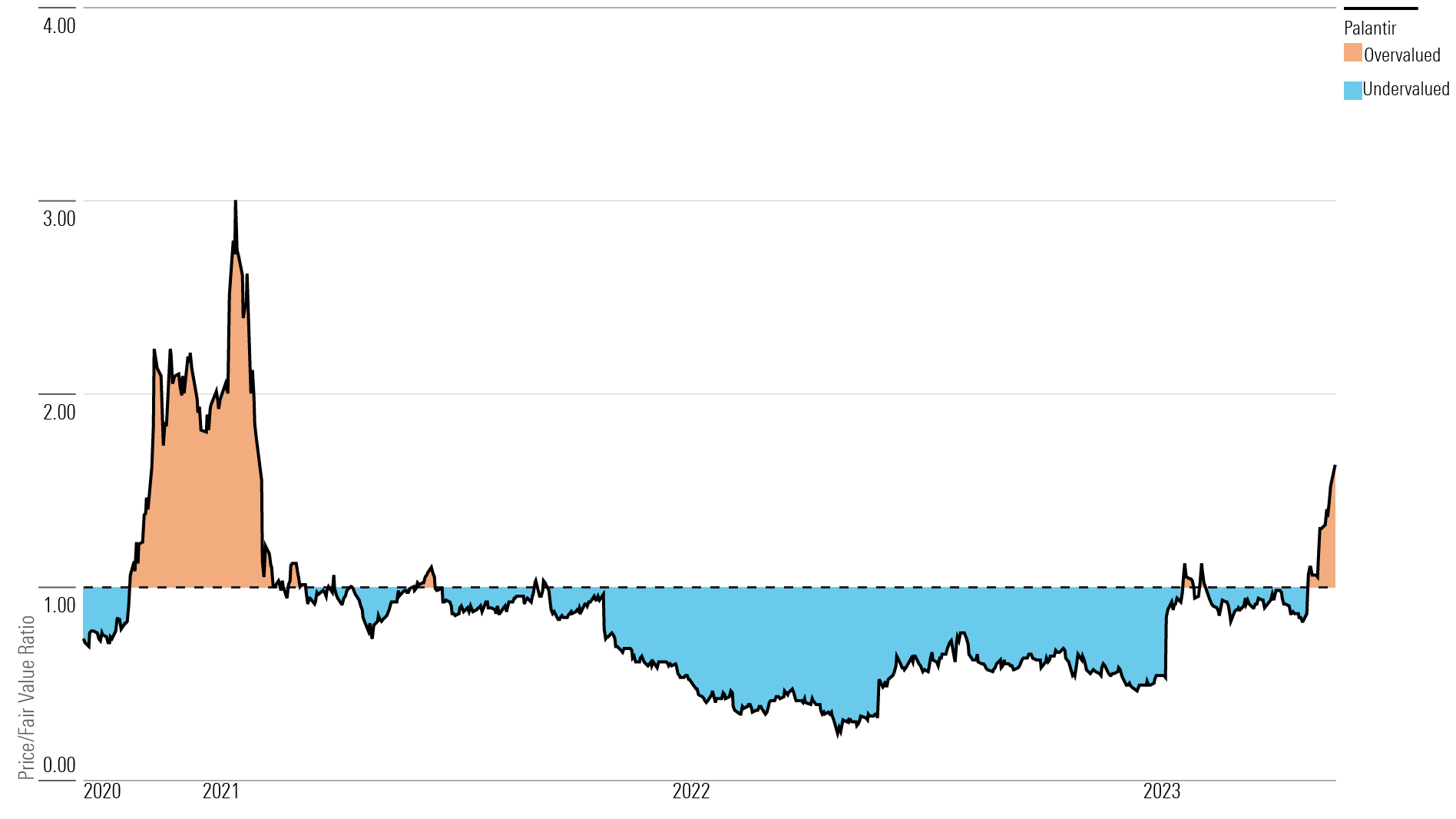

Should You Buy Palantir Stock A Pre May 5th Earnings Review

May 10, 2025

Should You Buy Palantir Stock A Pre May 5th Earnings Review

May 10, 2025 -

Madhyamik Pariksha Result 2025 Check Merit List Online

May 10, 2025

Madhyamik Pariksha Result 2025 Check Merit List Online

May 10, 2025 -

Understanding The Value Of Middle Management Benefits For Companies And Their Workforce

May 10, 2025

Understanding The Value Of Middle Management Benefits For Companies And Their Workforce

May 10, 2025 -

Oilers Vs Sharks Game Tonight Predictions Picks And Betting Odds

May 10, 2025

Oilers Vs Sharks Game Tonight Predictions Picks And Betting Odds

May 10, 2025 -

Gazas Plight A Decade Of Blockade Hunger And Despair

May 10, 2025

Gazas Plight A Decade Of Blockade Hunger And Despair

May 10, 2025